Federal Income Tax Withholding

Employers withhold federal income tax from their workers pay based on current tax rates and Form W-4, Employee Withholding Certificates. When completing this form, employees typically need to provide their filing status and note if they are claiming any dependents, work multiple jobs or have a spouse who also works , or have any other necessary adjustments.

Dont Miss: Where Is My State Refund Ga

Australian Income Tax Calculator

Employment income: Employment income frequency

Enter an income to view the result

The estimated tax on your taxable income is0

| Your income after tax & Medicare levy: |

|---|

| Your marginal tax rate: |

This means for an annual income of you pay:

| No tax on income between $1 $18,200 | $0 |

You May Like: Can You File Missouri State Taxes Online

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

Also Check: How Much Taxes Do I Have To Pay For Doordash

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Employment & Training Investment Assessment

The fifth component of your tax rate is the Employment and Training Investment Assessment . The assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 0.10 percent of wages paid by an employer. Money from the assessment is deposited to the credit of the employment and training investment holding fund. By law, the Replenishment Tax Rate is reduced by the same amount, so there is no increase in your tax rate due to this assessment.

Also Check: Can Home Improvement Be Tax Deductible

How To Increase A Take Home Paycheck

Salary Increase

The easiest way to achieve a salary increase may be to simply ask for a raise, promotion, or bonus. However, this is assuming that a salary increase is deserved. For instance, an employee is in a legitimate position to ask for a raise or bonus if their performance exceeded original expectations, or if the company’s performance has noticeably improved, due in part to the employee’s input. If internal salary increases are not possible, which is common, try searching for another job. In the current job climate, the highest pay increases during a career generally happen while transitioning from one company to another. For more information about or to do calculations involving salary, please visit the Salary Calculator.

Reevaluate Payroll Deductions

Sometimes, it is possible to find avenues to lower the costs of certain expenses such as life, medical, dental, or long-term disability insurance. For instance, someone who is healthy with no major diseases or injuries can reconsider whether the most expensive top-of-the-line health insurance is necessary. In addition, each spouse’s company may have health insurance coverage for the entire family it would be wise to compare the offerings of each health insurance plan and choose the preferred plan.

Open a Flexible Spending Account

Work Overtime

Cash Out PTO

Temporarily Pause 401 Contributions

How Are These Taxes Being Calculated

If you are employed under a U.S.-registered business, the burden is off your shoulder as your employer will make the computation for you and automatically deducts it on your gross pay. However, if you are a self-employed or a freelancer, you need to make the calculations for yourself. You can use this app to compute your federal tax withholding. For state taxes, you may refer directly to your State Department of Revenue to know the imposed individual tax systems.

Don’t Miss: 1040paytax Customer Service

Understanding Your First Paycheck

You get your first job out of college. You can finally breathe a sigh of relief you have post-grad plans! You can confidently answer that nerve-racking question: What are you doing after graduation?

But as soon as you accept that job offer, the train leaves the station pretty quickly! A whole lot of big financial decisions come at you fast like getting an apartment, paying your bills and setting up a budget to make sure your math checks out.

One of the most shocking things is when you get that first paycheck and how small it really is! You knew some taxes would be taken out but most of us are unprepared for how much really comes out.

“A lot of times when people accept their new job offer, they think, ‘Oh my goodness,’ like $40,000 a year is like winning the lottery when you’ve gone from making like $4,000 a year over the summer, you know?” said Sophia Bera, a financial advisor at Gen Y Planning. “And so I think what people don’t realize is, then how little that actually translates to in their net pay.”

Payroll Calculator For Texas

When it comes to computing federal payroll taxes, here’s what you need to know. Check out our step-by-step guide for a more in-depth look at each of the federal payroll tax components.

- Gross Earnings:

-Multiply all of your hourly employees’ hours worked by their pay rate. Don’t forget to include any hours worked overtime!

-Divide each employee’s annual wage by the number of pay periods per year for all salaried employees.

- If your employees contribute to 401, FSA, or other pre-tax withholding, deduct them. Simply deduct their contributions from their gross earnings before paying payroll taxes.

- Subtract the federal income tax, which ranges from 0% to 37%. On the IRS website, you may find detailed withholding information.

- Deduct FICA taxes:

-Withhold 6.2 percent of each employee’s taxable salary for Social Security tax purposes until they have earned a total of $147,000 for the year. You, as an employer, must also pay this tax.

-Withhold 1.45 percent of each employee’s taxable pay for Medicare tax purposes until they earn a total of $200,000 for the year. This tax will be paid by you as well. Withhold a 0.9 percent Additional Medicare Tax from employees earning more than $200,000 per year. The Additional Medicare Tax is solely the responsibility of the employee.

You May Like: Csl Plasma Taxes

What Is A Paycheck

A paycheck is how businesses compensate employees for their work. The most common delivery schedules are bi-weekly and semi-monthly, though this varies based on employer preferences and applicable state laws and regulations. Business-specific requirements, such as collective bargaining agreements covering union employees, may also dictate paycheck frequency.

Paycheck And Salary Calculators

A paycheck calculator lets you know how much money will be in every check that you receive from your employer, and they are available online for free.

Salary calculators can help you determine how much you could be earning, and how much a job offer is worth and how far your paycheck will go in a specific location, based on the cost of living in that area.

Also Check: Federal Tax Return Irs

Additional Tx Payroll Tax Resources:

If youre still looking to fill your brain with more juicy payroll tax facts, here are some additional resources and contact information for those who know Texas payroll like the back of their hand:

The Texas Comptroller of Public Accounts: All the phone numbers you may need.

Employer and Tax Information directly from the Secretary of State himself, and a phone number for good measure: 463-5555

LET’S DO THIS

Exploring Limitations On Tax Withholdings

Taxes and deductions from your paycheck fall into two categories voluntary and involuntary. Mandatory withholdings from your earnings are required by the federal, state or local agencies. These generally include any applicable state or federal income taxes, in addition to child support or other similar orders. Texans should see no state or local income taxes deducted from their payroll. The rate at which youre taxed federally, however, depends on several factors.

The Federal Insurance Contributions Act, otherwise known as FICA, is a mandatory federal payroll tax that employees can expect to be deducted from each paycheck. FICA taxes go towards providing benefits for current Social Security and Medicare recipients. Any excess goes into Social Security trusts to be used for future retirees and beneficiaries of benefits. Currently, the amount of Social Security taxes withheld from your payroll is 6.2 percent of your gross wages up to a certain amount for 2018, only wages up to $128,400 are subject to Social Security tax. Medicare is taxed at 1.45 percent of your gross wages. Both the employer and the employee make contributions to FICA if you’re self-employed, you pay double the FICA.

You can use an online pay calculator, including a paycheck calculator for Texas specifically, to determine your tax obligations and what your net take home pay will be.

Don’t Miss: Taxes Taken Out Of Paycheck Mn

Who Pays Texas Income Tax

Most states impose a tax on your earnings if you live or work within the state that is similar to that imposed by the federal government. States that have income taxes often base them on a percentage of your income that can either vary based on your income level or be imposed at a flat rate. Texas is one of a select group of states that dont impose an income tax on individuals, but it does levy taxes on business income.

Everything Deducted From Your Paycheck Explained

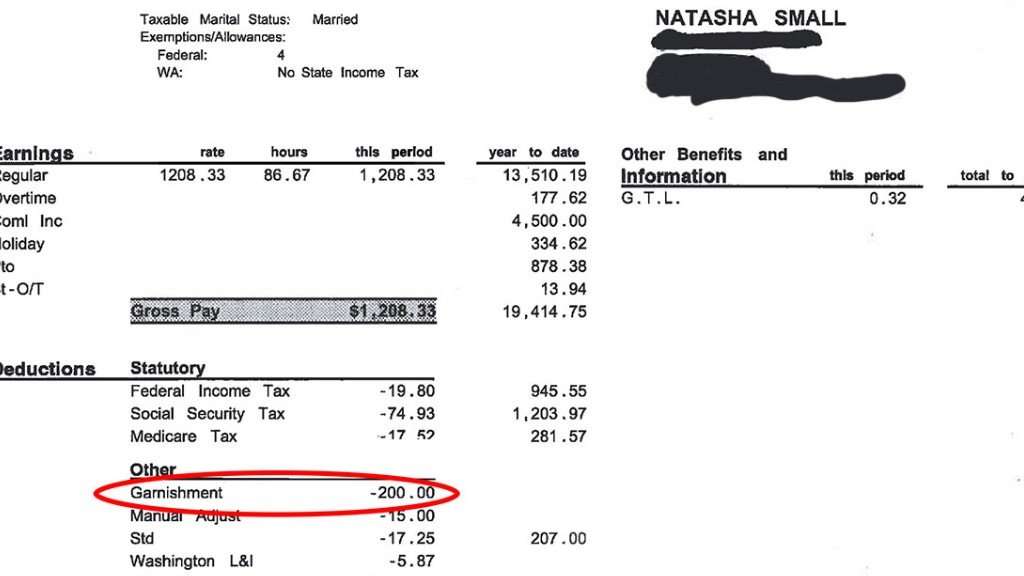

Congratulations, youve earned your first paycheck! Youre probably excited, as you should beyou put in work, and have some cash in the bank to show for it. But if youre like many newly employed people out there, you might also be a little bit confused after running the numbers and noticing that your take-home pay isnt exactly as much as you thought it would be.

Whats up with that? Upon further examining your paystub at your first job, youll notice a few line items categorized as deductions.Deductions are all of the things that were taken out of your gross pay, leaving you with your net pay, or take-home pay. While there are some deductions you cant really control, others are part of your employee benefits package, so you can adjust them according to what works for you and your budget.

Its OK to be a bit baffled on your first payday. Weve all been there before. To help clear up the confusion, we broke down typical paycheck deductions, where your earnings are going, and how much control you have over it.

Also Check: Efstatus.taxact 2013

What Are Employment Taxes

Employment taxes are federal and state taxes levied on taxable wages paid to employees. Income tax withholding based on information submitted on Form W-4 by employees. Employees are the only ones who pay this tax.

Employers and employees both pay a portion of this, which is made up of Social Security and Medicare taxes. The Social Security element is known as Old Age, Survivors, and Disability Insurance, or OASDI, and it pays benefits to retirees, spouses, and former spouses, as well as dependent children in some situations and disabled people under the age of retirement.

The Medicare part entitles those 65 and older access free Part A Medicare coverage, as well as coverage through Parts B, C, and D for a additional fee.

Federal unemployment tax , which is paid entirely by employers state unemployment tax, which is paid entirely by employers, with the exception of a few states that require some employee contributions.

Federal Top Income Tax Rate

| Year | |

|---|---|

| 2011 | 35.00% |

When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It’s important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn’t. Additionally, it removes the option to claim personal and/or dependency exemptions. Instead, filers are required to enter annual dollar amounts for things such as total annual taxable wages, non-wage income and itemized and other deductions. The new version also includes a five-step process for indicating additional income, entering dollar amounts, claiming dependents and entering personal information.

One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return.

You May Like: How To Find Employers Ein

You’ll Get More House For Less Money In Texas Compared To California

The average home value in California is $618,016, according to Zillow. In Texas? It’s $222,507.

Oof.

The difference in cost per square foot is also amazing. The median listing price in California is $324 per square foot. In Texas, it’s just $129.

In other words, they can double the house and still save money.

Of course, these are state-wide numbers. Savings will vary depending on your local market and the market of the potential clients you target. The savings for someone who moves from Sacramento to Austin are very different than the savings a San Franciscan can expect from their move to Dallas.

Do a little homework on target markets to avoid setting unrealistic expectations.

Employee And Employer Taxes

If you pay employees, there are some slightly different tax implications. Speak to your accountant to get clear guidance for your unique situation.

Employer Payroll Tax Withholding

All employers are required to withhold federal taxes from their employees wages. Youll withhold 7.65 percent of their taxable wages, and your employees will also be responsible for 7.65 percent, adding up to the current federal tax rate of 15.3 percent. Speak to your accountant for more information.

Recommended Reading: Will A Roth Ira Reduce My Taxes

Dont Forget To Keep Records

Its worth your time to create a system with which you can save relevant employee information and documentation. For example, youd likely want to have employee information on their earnings available if they quit or are fired. Your payroll records should include details such as:

- Full name and Social Security number of employee

- Address and ZIP code

- Total hours worked each day by employee

- Type of pay

Learn how long to keep payroll records and exactly which ones to keep.

How Your Texas Paycheck Works

Your hourly wage or annual salary can’t give a perfect indication of how much you’ll see in your paychecks each year because your employer also withholds taxes from your pay. You and your employer will each contribute 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. These taxes together are called FICA taxes.

No matter which state you call home, you have to pay FICA taxes. Income you earn that’s in excess of $200,000 , $250,000 or $125,000 is also subject to a 0.9% Medicare surtax. Your employer will not match this surtax, though.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The same is true if you contribute to retirement accounts, like a 401, or a medical expense account, such as a health savings account . These accounts take pre-tax money so they also reduce your taxable income.

Your marital status, pay frequency, wages and more all contribute to the size of your paycheck. If you think too much or too little money is being withheld from your paycheck, you can file a fresh W-4 with your employer at any time during the year. When you do this, be sure to indicate how much extra income you want withheld so as to avoid a tax bill come April each year.

Read Also: Do Doordash Drivers Have To Pay Taxes