Can You Transfer Your Refund

Yes, you can ask the CRA to transfer your refund to your instalment account by:

- Selecting this option when filing electronically

- Attaching a note to your paper return

The CRA will transfer your full refund to your instalment account and consider this payment to be received on the date the CRA assesses your return.

Why Would My Tax Refund Come In The Mail

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If that’s not the reason, you may be getting multiple refund checks, and the IRS can only direct deposit up to three refunds to one account. Additional refunds must be mailed. Also, your bank may reject the deposit and this would be the IRS’ next best way to refund your money quickly.

It’s also important to note that for refunds, direct deposit isn’t always automatic. Some are noticing that like the stimulus checks, the first few payments for the child tax credit were mailed. Just in case, parents should sign in to the IRS portal to check that the agency has their correct banking information. If not, parents can add it for the next payment.

For more information about your money, here’s the latest on federal unemployment benefits and how the child tax credit could affect your taxes in 2022.

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive confirmation for file their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

Recommended Reading: Where’s My Tax Refund Ga

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: How Much H And R Block Charge For Taxes

When Will I Get The Refund

Unemployment tax refunds started landing in bank accounts in May and will run through the summer, as the IRS processes the returns.

The first phase included the simplest returns, made by single taxpayers who didn’t claim for children or any refundable tax credits.

More complicated ones may take longer to process.

In mid-July, the IRS issued 4million refunds, of which those by direct deposit landed in bank accounts from July 14.

Meanwhile, households who receive the cash refund by paper check could expect this from July 16.

Another batch of payments were then sent out at the end of July, with direct deposits on July 28 and paper checks on July 30.

The IRS didn’t announce any payouts for August and is yet to reveal the upcoming refund schedule too.

How To Get The Refund

If you are owed money and you’ve filed a tax return, the IRS will send you the money or use it to pay off other owed taxes automatically.

You typically don’t need to file an amended return in order to get this potential refund.

Instead, the IRS will adjust the tax return you’ve already submitted.

However, if you haven’t yet filed your tax return, you should report this reduction in unemployment income on your Form 1040.

The deadline to file your federal tax return was on May 17.

You May Like: Www Aztaxes Net

Wheres My State Tax Refund New Jersey

New Jerseys Division of Taxation allows taxpayers to check the status of refunds through its Online Refund Status Service. You will need to enter your SSN and the amount of your refund.

You can also check the status of a refund using the automated phone inquiry system. The automated system can tell you if and when the state will issue your refund. It cannot give you information on amended returns. The number is 1-800-323-4400 or 609-826-4400. Both options are available 24 hours a day, seven days a week.

In general, electronic tax returns take at least four weeks to process. Paper returns take significantly longer at a minimum of 12 weeks. If you send a paper return via certified mail, it could take 15 weeks or more to process.

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Also Check: Michigan Gov Collectionseservice

Wheres My State Tax Refund Kentucky

Check the status of your Kentucky tax refund by visiting the revenue departments Wheres My Refund? page.

If you e-filed and opted for direct deposit, you can expect your refund in two to three weeks. Getting a refund as a paper check will take three to four weeks. If you filed a paper return, youre refund will take significantly longer to arrive. The state says it could take eight to 12 weeks.

The Wheres My Refund Page only allows you to check the current years tax return. The status of previous tax returns are available if you call 502-564-4581 and speak to an examiner. It may take more than 20 weeks to process prior year tax returns.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: Where’s My Tax Refund Ga

What About Speeding Up Your Tax Rebate

Hey, your destiny is in the all-powerful hands of HMRC, so thereâs only so much you can do to speed up your tax refund. However, here are a few ideas:

- Make sure youâve got all the appropriate information gathered up in one place, and ensure you know your national insurance number, so HMRC doesnât need to pester you for everything they need.

- Donât submit your tax refund application when theyâre mega-busy. That means avoiding self-assessment deadline periods in January and July.

- If your tax refund is a small amount â usually under £1,000 â things should be quite quick. But be prepared for extra checks on larger claims, which will add to your wait.

How Do I Find Out About My Refund Status

If HMRC owes you any tax through a rebate or refund, youâll receive a letter called a P800 from the governmentâs income-tax department. This will tell you your refund amount.

But donât start hopping from foot to foot if one drops through your letterbox. P800 letters can also indicate that youâve not paid enough tax.

Your P800 will arrive after the relevant tax year has ended in April. Youâll usually receive it around September.

Your P800 will tell you all about claiming online through the GOV.UK website. If youâre able to claim online, the income-tax refund will appear in your bank account within about five days.

Alternatively, if youâre in no rush, you can wait about 45 days and youâll receive your refund as a cheque in the post. But see below for a more detailed breakdown of time limits.

What if you donât have a P800 but believe youâre due an income-tax refund? No problem. You can use the government’s income-tax calculator to figure out how much should be dropping into your bank account.

Don’t Miss: Tax Lien Investing California

I See An Irs Treas 310 Transaction On My Bank Statement What Is It

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Wheres My State Tax Refund Vermont

Visit Vermonts Refund Status page and click on Check the Status of Your Return. You will find it toward the bottom left. That link will take you to form that requires your ID number, last name, zip code and the exact amount of your refund. The Vermont Department of Taxation may withhold some refunds until it receives W-2 withholding reports from employers.

Also Check: How Much Does H& r Block Charge To Do Taxes

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

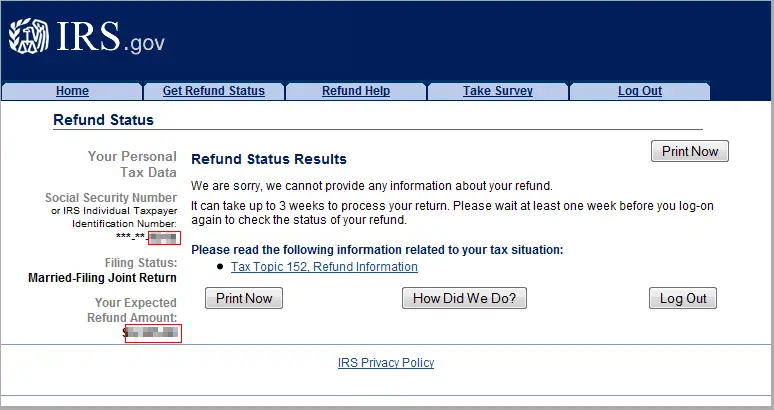

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

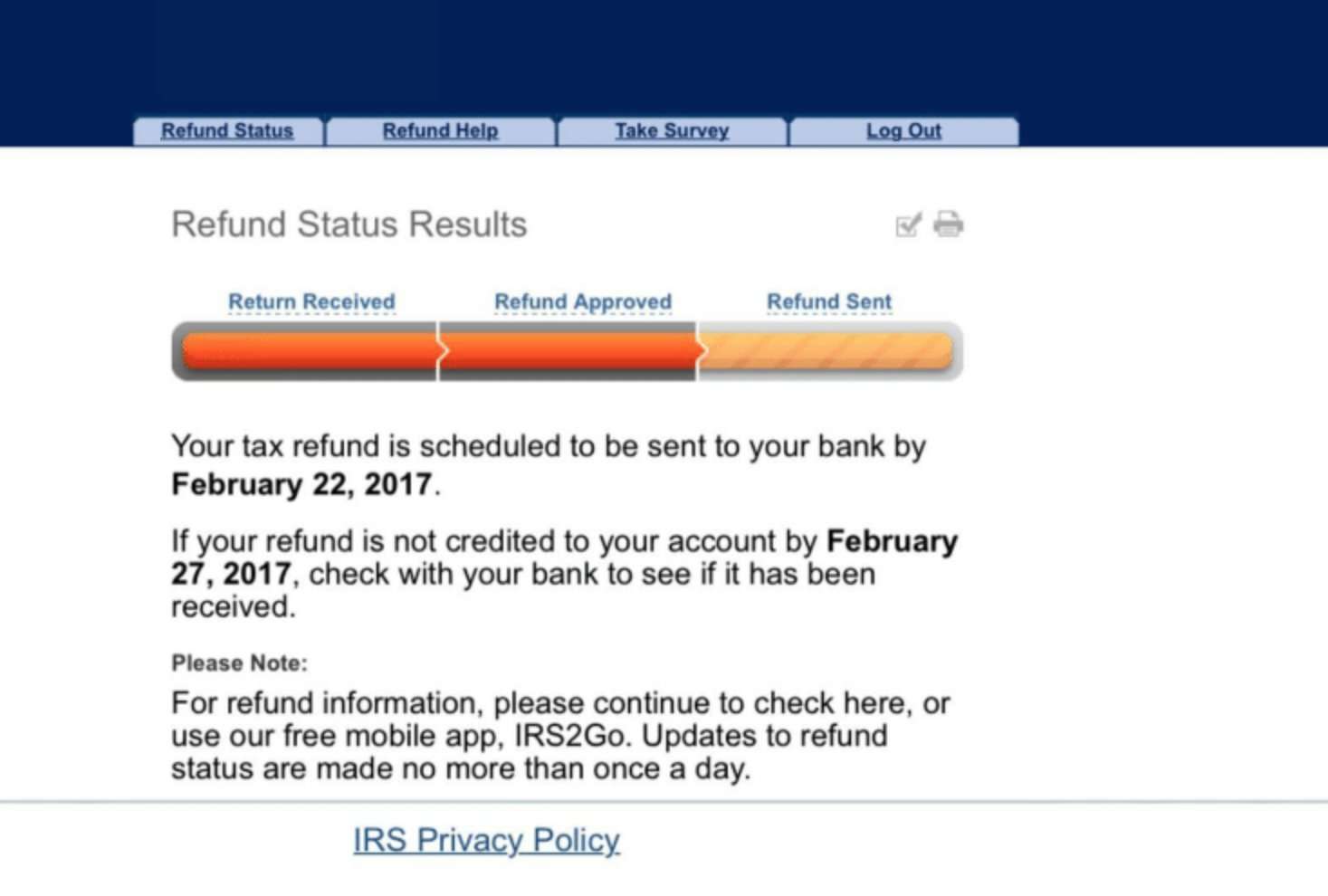

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

Tax Refund Status Faqs

The IRS usually sends out refunds within three weeks, but sometimes it can take a bit longer. For example, the IRS may have a question about your return. Here are other common reasons for a delayed tax refund and what you can do.

At H& R Block, you can always count on us to help you get your max refund year after year. You can increase your paycheck withholdings to get a bigger refund at tax time. Our W-4 calculator can help.

The IRS usually sends out most refunds within three weeks, but sometimes it can take a bit longer if the return needs additional review.

The IRS’ refund tracker updates once every 24 hours, typically overnight. That means you don’t need to check your status more than once a day.

Your status messages might include refund received, refund approved, and refund sent. Find out what these e-file status messages mean and what to expect next.

Having your refund direct deposited on your H& R Block Emerald Prepaid Mastercard® Go to disclaimer for more details110 allows you to access the money quicker than by mail. H& R Block’s bank will add your money to your card as soon as the IRS approves your refund.

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Don’t Miss: Www Michigan Gov Collectionseservice

I Received An Irs ‘math Error’ Notice What Is It

Millions of Americans have received confusing “math-error notices” from the IRS this year — letters saying they owe more taxes. Once they get the notice, they have a 60-day window to respond before it goes to the agency’s collection unit.

From the start of the year to August, the IRS sent more than 11 million of these notices. According to the Taxpayer Advocate Service, “Many math error notices are vague and do not adequately explain the urgency the situation demands.” Additionally, sometimes the notices “don’t even specify the exact error that was corrected, but rather provide a series of possible errors that may have been addressed by the IRS.”

The majority of the errors this year are related to stimulus payments, according to the Wall Street Journal. They could also be related to a tax adjustment for a variety of issues detected by the IRS during processing. They can result in tax due, or a change in the amount of the refund — either more or less. If you disagree with the amount, you can try contacting the IRS to review your account with a representative.

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

Don’t Miss: How To Buy Tax Lien Properties In California

Are You Entitled To Receive Interest On Your Refund

Yes, the Canada Revenue Agency will pay you compound daily interest on your tax refund. The CRA will start paying refund interest on the latest of the following 3 dates:

- the date of the overpayment

- the 120th day after the end of the tax year if the return for the year is filed on time

- the 30th day after the date the return was filed if it is filed late

Can You Transfer Your Refund To Another Person

No, you cannot ask the CRA to transfer your refund to pay another persons amount owing. This includes your spouse or common-law partner.

Residents of Quebec can transfer their Revenu Quebec refunds to their spouse. For more detailed information on how to proceed, please review the following link from Revenu Quebec: REFUND TRANSFERRED TO YOUR SPOUSE

You May Like: How Does H And R Block Charge

How To Change A Return

COVID-19: Expect the normal timeframe for processing adjustment requests submitted by paper to be 10-12 weeks in most cases.

You can request a change to your tax return by amending specific line of your return. Do not file another return for that year, unless the return you want to amend was a 152 factual assessment.

Wait until you receive your notice of assessment before asking for changes.

Generally you can only request a change to a return for a tax year ending in any of the 10 previous calendar years. For example, a request made in 2021 must relate to the 2011 or a later tax year to be considered.