Taxes For Your Nevada Llc

Note: Our tax lesson is not as step-by-step as our forming an LLC in Nevada lesson, due to the uniqueness and variation among businesses. Taxes are not as straightforward as forming an LLC in Nevada , and therefore, the information below is an overview, and not a comprehensive guide. Thank you for your understanding.

Recommendation: We recommend speaking with a few accountants in Nevada to make sure you meet all your federal, state, and local tax obligations. For tips on finding an accountant for your Nevada LLC, please see our how to find an accountant guide.

Taxes are reported and paid on 3 levels:

- Federal

- State

- Local

The location, nature of the business, and how your Nevada LLC is treated for tax purposes will determine which federal, state, and local taxes apply.

Do I Separate Tax Returns For My Business And Personal Taxes

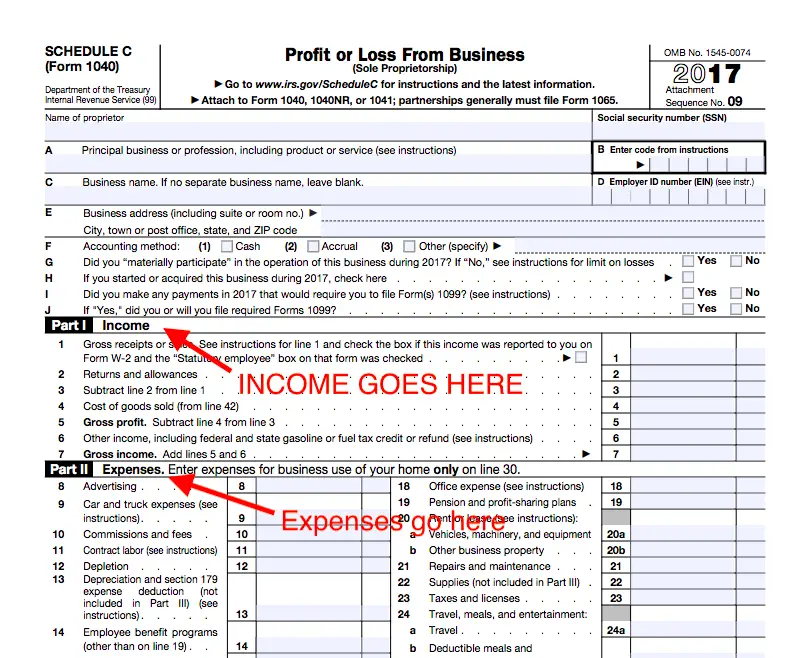

Single member LLCs are not reported separately. All information about your business income and deductions are reported on Schedule C and count towards personal income.

Multi member LLCs are reported separately and file their own tax returns. If the LLC is treated as a partnership, then Form K-1 issued which gives each members share of income and deductions. This amount contributes towards their personal income and is taxed individually. LLCs who file as corporations are taxed at the corporate level.

Business Tax Return Due Dates

Here are the tax return due dates for small business taxes:

- Sole proprietorship and single-member LLC tax returns on Schedule C with the owner’s personal tax return: May 17, 2021

- Partnership tax returns on Form 1065: March 15, 2021

- Multiple-member LLC returns filing partnership returns on Form 1065:March 15, 2021

- S corporation returns on Form 1120 S: March 15, 2021

- Schedule K-1s for partners in partnerships, LLC members, and S corporation shareholders on their personal tax returns: April 15, 2021

- All other corporations with fiscal years ending other than December 31: the 15th day of the fourth month after the end of the fiscal year

Don’t Miss: How To File Taxes Without Income To Get Stimulus Check

Reasons To File A Separate Llc Tax Return

If you need help with understanding why an LLC needs to file a tax return, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Do I File My Personal And Llc Taxes Together

The IRS disregards the LLC entity if only a single member exists. This requires you to report all income and expenses of the LLC on a personal tax return. If you are the sole member of multiple LLCs, you must file a separate Schedule C for each business that generates at least $400 of earnings during the year.

OdatNurd

Read Also: Where Is My State Refund Ga

Information About Filing A Tax Return For An Llc

- Filing as an LLC allows you more flexibility when determining how business earnings will be taxed by the Internal Revenue Service .

- The choice you make in how your business is taxed determines the tax rules your business will be subject to.

- With an LLC, there are no set rules in place. Per the IRS you are allowed to use tax rules applicable to those used for a sole proprietorship, corporation, or partnership.

- A corporation is considered a separate entity, unlike an LLC, which is considered by the IRS to be a “pass-through entity” the same as a sole proprietorship or partnership.

- As a “pass-through entity,” the profits are passed on to the owners, also referred to as members, of the LLC who will then file the profit figure with their personal taxes.

- While an LLC itself is not charged with the task of paying federal income taxes, there are states that charge the LLC with a tax.

Estimated Tax Due Dates

The IRS wants to be paid at the time income is earned, not at the end of the tax year, so businesses and self-employed taxpayers must make quarterly estimated tax payments during the year. There are four due dates for estimated taxes that you might have to pay during the year:

You can make your payments the next business day if any of these dates fall on a Saturday, Sunday, or legal holiday.

Read Also: Michigan.gov/collectionseservice

How Will My Llc Get Taxed

The flexibility of the LLC structure means there are four separate tax scenarios that your LLC could fall under:

If itâs a single-member LLC and hasnât opted to file as a corporation, it will file its taxes exactly as a sole proprietor would.

If itâs a multi-member LLC and hasnât opted to file as a corporation, it will file its taxes exactly like a partnership.

If it has opted to file its taxes as a C corporation by submitting IRS Form 8832, then it will file its taxes like a C corporation.

If it has opted to file its taxes as an S corporation by submitting IRS Form 2553, then it will file its taxes like an S corporation.

How To File Quarterly Taxes For Llc

If you have an LLC, you need to know how to file quarterly taxes for the LLC. You will need to pay quarterly taxes as well as annual taxes, and it is important that you know when the quarterly taxes are due to prevent additional tax implications, as even underpaying can lead to tax penalties. Quarterly tax payments are due on the following dates:

April 15

September 15

January 15

Since an LLC is a unique business structure that is created by state statute, you will need to be fully aware of what is required of you depending on the state in which you register your LLC. You have many choices when it comes to taxes. You can choose to be taxed as a corporation, sole proprietorship, or a partnership.

With that being said, if you form a single-member LLC, it will be automatically taxed as a sole proprietorship. You can elect to be taxed as a corporation or as a disregarded entity. In order to be treated as a corporation, you will have to file IRS Form 8832 and elect to be taxed as such. If you want to be taxed as a disregarded entity, you can only do so if your LLC doesnt require an Employer Identification Number . Businesses with no employees and no excise tax liability need not obtain an EIN. In this case, the single-member uses his or her own personal social security number on the tax documents.

Read Also: How To Correct State Tax Return

When Are Taxes Due For An Llc

When you set up your limited liability company , one of your responsibilities is paying your business taxes on time. Determining the tax deadlines for your LLC depends on the type of entity you choose for tax purposes: corporation, partnership, or sole proprietor. There are also other factors that determine your deadlines.

Single Owner Llc Income Tax

As stated above, single owners can choose to pay taxes as Sole Proprietorship, where the IRS views them as a disregarded entity. In this scenario, the owner is responsible for Federal, State, Local, and Self-Employment taxes. Filing as an S-Corp gives them the option of leaving some of the profits as Distributions, which avoids the Self-Employment taxes.

Read Also: How Much Does H& r Block Charge To Do Taxes

How Llcs As A Pass

LLCs treated as pass-through businesses â disregarded entities, partnerships, and S corporations â pay tax through their owner or owners.

Let’s say you’re the only owner in an LLC that provides landscaping services. Last year, you had taxable income of $100,000, and you paid yourself $50,000.

As a disregarded entity, you report $100,000 of income to your self-employment tax software. Even though you only paid yourself $50,000, you’re responsible for paying tax on the business’s entire taxable income.

Multi-owner LLCs treated as a partnership pay tax similarly.

Four brothers agree to be equal members at LLC registration. The business has $500,000 in taxable income, and each got paid $75,000.

Taxed as a partnership, each brother reports one-quarter of business profits on his Form 1040. Each brother enters $125,000 of income on his Form 1040. Their $75,000 draws are irrelevant because they pay tax according to business earnings.

S corporations are taxed the same way in both examples, but the calculation of taxable income changes.

Can A Single Member Llc File A Partnership Tax Return

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation. … However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

cjs

You May Like: 1040paytax.com Official Site

How Do Llcs Pay Taxes

How an LLC pays taxes depends on the number of members and how it asks the IRS to treat it for income tax purposes. The IRS treats LLCs as disregarded entities, partnerships or corporations for these purposes. The IRS usually classifies single-member LLCs as disregarded entities. The LLC itself doesn’t pay taxes. But members of an LLC taxed this way have to pay taxes as a sole proprietor does. LLC members should report LLC income using Schedule C and file it with Form 1040. The IRS tends to classify domestic LLCs with at least two people as partnerships. Again, the LLC itself doesn’t pay taxes. But members of these LLCs pay taxes as partners do. These LLCs must report partnership income on IRS Form 1065. They should also provide a copy of Schedule K-1 with the individual share of income to each LLC member. Members should also report the earnings data from 1065 on Schedule E and file it with Form 1040. An LLC can file Form 8832 to elect for the IRS to treat it as a corporation. The LLC pays taxes as a corporation does. The LLC should then report the corporate income on Form 1120. S corporations should report corporate income on Form 1120S. S corporation members should report their income share on Schedule-K1 of Form 1120S.

Tax Flexibility Of An Llc

An important feature of an LLC is that the Internal Revenue Service allows business owners to choose the way their business will be taxed. They can choose to be taxed as a sole proprietor, a partnership, an S corporation or a C corporation. You choose how youll be taxed by filing IRS Form 8832.

There are some limitations on the aforementioned choices. An LLC with multiple owners cant choose to be taxed as a sole proprietor, for instance. The IRS will automatically tax an LLC as a partnership if it has more than one owner. You can learn more about rules for taxing LLCs from the IRS backgrounder on Form 3402, covering taxation of LLCs.

Don’t Miss: Www Aztaxes Net

Can Corporate Taxation Cut Your Llc Tax Bill

If you regularly need to keep a substantial amount of profits in your LLC , you might benefit from electing corporate taxation. Any LLC can be treated like a corporation for tax purposes by filing IRS Form 8832 and checking the corporate tax treatment box on the form.

After making this election, profits kept in the LLC are taxed at the separate income tax rates that apply to corporations the owners dont pay personal income taxes on profits left in the company. Because the corporate income tax rates for the first $75,000 of corporate taxable income are lower than the individual income tax rates that apply to most LLC owners, this can save you and your co-owners money in overall taxes.

For example, if your retail outfit needs to stock up on expensive inventory at the beginning of each year, you might decide to leave $50,000 in your business at years end. With the regular pass-through taxation of an LLC, these retained profits would likely be taxed at your individual tax rate, which is probably over 27%. But with corporate taxation, that $50,000 is taxed at the lower 15% corporate rate.

Once you elect corporate taxation, however, you cant switch back to pass-through taxation for five years, and if you do switch back, there could be negative tax consequences. In other words, you should treat the decision to elect corporate taxation as seriously as you would the decision to convert your LLC to a corporation.

Llc Taxes For Us Citizens Or Residents As Owners

For Americans, there is no tax haven for LLCs. Still, an LLC offers an easy option to formalize business operations and create partnerships.

As mentioned earlier, the IRS does not treat an LLC as a separate tax entity. Instead, all its income is passed through to the members of the LLC, who must declare it and pay personal income tax.

A single owner of an LLC would include the profit and loss from the LLC on Schedule C of his or her Form 1040. With two or more partners, each owner reports the allocated portion of the profits on their personal tax return.

However, some US states tax LLCs directly. Also, note that an LLC may elect to be taxed as a corporation. In many cases, American taxpayers will also be required to pay self-employment tax in addition to income tax.

To limit this self-employment tax liability and also offer the option to contribute more to a retirement plan, US taxpayers should consider an S Corp. We explore more of these advantages in this comparison of LLC and S Corp. Contact us to learn more about our services and pricing.

Talk To An Expert

Don’t Miss: How Much Does H & R Block Charge For Taxes

Relief For Missed S Corporation Elections

If a corporation misses the deadline for elections that are S Corporation related, the IRS has made provisions for relief in Rev. Proc. 2013-30. This provision includes electing to be considered as an S Corporation according to Sec. 1362, and as a corporation according to Regs. Sec. 301.7701-3, which enables it to be treated as an S Corporation.

Filing Taxes As A Partnership

If your LLC has more than one member, you can be taxed as either a partnership or a corporation. Make the election using Entity Classification Election . To file taxes as a partnership, you must complete Return of Partnership Income and file it with the IRS. You also need to complete Schedule K-1 for each member and provide a copy to them. The partnership itself does not pay taxes. Instead, each partner reports their share of the profit and loss from the business on their own personal taxes. The K-1 sets out that partner’s profit and loss to be reported.

You May Like: How Much Does H& r Block Charge To Do Taxes

Does An Llc Need A Separate Tax Return

Related

A limited liability company, also known as an LLC, is a flexible entity that allows the owners, called members, to select the form of business that best suits their needs. An LLC offers limited personal liability against the debts and actions of the company, similar to a corporation. All 50 states and the District of Columbia authorize the formation of an LLC. Most states charge an annual fee to register and do business as an LLC.

Except in the case of a single-member LLC, an LLC must file separate federal and state tax returns as a C corporation, an S corporation or a partnership. A federal election of which type of tax return to file, Form 8832, is generally accepted by the states. Whether you’re filing taxes for a small business with no income or a lot of income, take a look at different forms of corporations and their tax filing requirements.

Potential Risk Of Llcs For Foreigners

Be aware that applying this approach to Amazon selling uses a rather aggressive reading of the US tax code and does not come without risks.

To date, we are not aware of any court ruling against this interpretation of the tax code. However, as with any aggressive approach to tax planning, there is always the possibility that the IRS eventually rejects it.

A more cautious approach would be to set up a US C corporation. While it is not tax-free, it can still be quite tax-efficient. A C Corp must pay tax on the net income after all expenses. Since those expenses include the management fee that the owner pays to themselves, the actual taxable income could be rather small. And because the service is performed by a non-US person outside the US, a lower US tax rate, often zero, applies.

When you are just starting out, a tax-free LLC might be a good choice. For more cautious entrepreneurs or those with an established successful business, we recommend considering the C corp instead to mitigate any risk. Discuss your options with an experienced tax accountant.

Read Also: Www.1040paytax.com

How S Corporations Are Taxed

In an S Corporation, the taxes flow through it to the individuals who own it and the income or losses are reported on their tax forms. The taxes are reported in the same way that a partnership does. On the tax Form 1120S, the details of the businesss finances are reported, including:

- Income

- Losses

- Tax credits

A Schedule K-1 must also be submitted to all shareholders, which shows the portion of money received that were reported on the 1120S. Each shareholder reports their share on a Schedule E when they file their 1040 taxes. Owners of an S Corporation can benefit from this format, more than would be possible by using the C organization format for their LLC. In a regular LLC, owners who are partners are not considered employees.

When an owner who actively participates in the business performs services for an LLC that is taxed as an S Corporation, it is necessary to be treated as an employee for tax purposes and as an owner. Average pay or salary must be given for those tasks performed, and the same benefits need to be given that other employees receive. The dual status of an owner is how greater tax benefits are given. The salary given for services performed is taxable, and must be reported on 1040 taxes. Social Security and Medicare Taxes will also have to be taken out of this income, as well as any Federal and state taxes that apply.