Georgia Median Household Income

| 2011 | $46,007 |

If you file in Georgia as a single person, you will get taxed 1% of your taxable income under $750. If you earn more than that, then youll be taxed 2% on income between $750 and $2,250. The marginal rate rises to 3% on income between $2,250 and $3,750 4% on income between $3,750 and $5,250 5% on income up to $7,000 and, finally, 5.75% on all income above $7,000.

For married couples who file jointly, the tax rates are the same, but the income brackets are higher, at 1% on your first $1,000 and at 5.75% if your combined income is over $10,000.

Michigan Median Household Income

| 2011 | $45,981 |

Michigan collects a state income tax, and in some cities there is a local income tax too. As with federal taxes, your employer withholds money from each of your paychecks to put toward your Michigan income taxes. You must claim withholding exemptions for Michigan income taxes by filing Form MI-W4. The W-4 form is not a substitute for the MI-W4, so you need to submit both forms to your employer. Though the most recent version of the W-4 removes the use of allowances, you may still be able to claim allowances and exemptions on the state level with the MI-W4.

Whether youre a Michigan resident or not, if you work in Michigan your employer is required to withhold Michigan taxes from your paychecks. That rule also applies if you live in Michigan but your employer is located outside of the state. In some cases, your employer may not remove Michigan taxes if you live in a state that has a separate, reciprocal agreement with Michigan.

If you live in one of the 24 Michigan cities with a local income tax, your employer will withhold money for those taxes. Michigan city taxes apply whether you live or work in the city. However, the tax for non-residents is half the rate for residents in all cities. The most common rate is 1% for residents and 0.5% for non-residents. Detroit has the highest city rate at 2.4% for residents and 1.2% for non-residents.

How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. In this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

Recommended Reading: How To Find Property Tax Records

Five: Calculate Federal Income Tax Withholding Amount

To calculate federal income tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15-T: Employer’s Tax Guide. Make sure you have the table for the correct year.

The 2022 income tax brackets are as follows:

- 37% for incomes over $578,125

- 35% for incomes over $231,250

- 32% for incomes over $182,100

- 24% for incomes over $95,375

- 22% for incomes over $44,725

- 12% for incomes over $11,000

You must withhold FICA taxes from employee paychecks.

How To Calculate Taxes Taken Out Of A Paycheck

Calculations, however, are just one piece of the larger paycheck picture.

Don’t Miss: How Do I Know If I Owe Irs Taxes

Calculate Your Paycheck In 6 Steps

There are six main steps to work out your income tax liability or refunds. First, you need to determine your filing status to understand your tax bracket.

Step 1 Filing status

There are 4 main filing statuses:

- Head of Household

Your marital status and whether you have any dependent will determine your filing status.

For example, if you are single and have a child, then you should file as Head of Household.If you are married but preferred to file separately from your partner , then you will file as Married, Filing Separately.

Refer to IRS to understand more.

Step 2 Adjusted gross income

The second step is to figure out your adjusted gross income.

The formula is:Net income Adjustments = Adjusted gross income

Income means money received for pretty much any reason such as wage, rental income, side hustle, unemployment benefits, etc. You just need to add them up to determine your annual income. If youre paid hourly, you will need to multiple it with your total annual hours.

Adjustments are also known as above-the-line deductions or pre-tax deductions.There are 2 types of deductions: above-the-line & post-tax .

Some of the adjustments are:

- Student loan interest

- Moving expenses for a job

- College tuition and fees

For the complete breakdown of the various type of above-the-line deductions or adjustments, refer to this article from thebalance.com.

Step 3 Taxable income

Now you need to figure out your taxable income.

Some of the deductions you can itemize are:

How The $1120 A Day After Tax In Australia Is Calculated

First, we need to know your tax-free allowances to calculate $1,120 a day after tax in Australia. The applicable tax-free allowances for you are:

- $18,200 as standard Personal Allowance .

The total Personal Allowance sum you are entitled to equals $18,200 a year.

Next, we need to calculate Medicare the Medicare sum to pay for a day equals $21.

Then we need to calculate taxes. Based on Australian tax brackets, after deducting tax-free allowances, the tax sum to pay for a day equals $391.44.

Lastly, we need to subtract the tax and Medicare from the gross $1,120 salary, which would be $707.29 daily salary.

Recommended Reading: How Much Is 8 Sales Tax

How To Calculate Payroll And Income Tax Deductions

As an employer, you have a responsibility to handle every step of your business payroll. One of the more notable steps is handling the tax deductions that are withheld from every employees gross wages. To help, weve put together some pointers on how you can calculate the various deductions found on each paycheck.

Federal Income Tax : 2019 Or Prior

Federal Income Tax is calculated using the information from an employees completed W-4, their taxable wages, and their pay frequency. Based on Publication 15-T , Federal Income Tax Withholding Methods, you can use either the Wage Bracket Method or the Percentage Method to calculate FIT.

We will use the Percentage Method in our example, looking at tables found in the 2022 IRS Publication 15-T PDF file. You can open the file to follow our calculations below.

Using Worksheet 1 on page 5, we will determine how much federal income tax to withhold per pay period.

Step 1. Adjust the employees wage amount

1a) This is the same as gross wages: $2,083.33.

1b) Our employee is paid semi-monthly or 24 times per year.

1c) This should equal your employees annual salary: $2,083.33 x 24 = $50,000

Because we are using the 2019 W-4 form, we now skip to step 1j:

1j) Our employee has claimed 2 allowances

1k) $4,300 x 2 = $8,600

1l) $50,000 $8,600 = $41,400

To continue, you will need to refer to the tax tables on page 10:

Step 2: Figure the tentative withholding amount

2a) This amount is from line 1l, $41,400

2b) We are referring to the table labeled Single or Married Filing Separately on the left . Our employees adjusted annual wage amount is greater than $13,900 and less than $44,475. So, we would enter an amount of $13,900 .

2c) The amount in column C is $995.

2d) The percentage from column D is 12%.

2e) $41,400 $13,900 = $27,500

2f) $27,500 x 12% = $3,300

4a) $0

You May Like: How Much Taxes Does Illinois Take Out Of Paycheck

Total Up Your Tax Withholding

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Ugh, we know. Its been years since youve looked at your paystub, and you dont even remember how to log in to your payroll system. But this will be worth it!

Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

How Your Paycheck Works: Income Tax Withholding

When you start a new job or get a raise, youll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Thats because your employer withholds taxes from each paycheck, lowering your overall pay. Because of the numerous taxes withheld and the differing rates, it can be tough to figure out how much youll take home. Thats where our paycheck calculator comes in.

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It’s your employer’s responsibility to withhold this money based on the information you provide in your Form W-4. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage.

If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U.S. employer have federal income taxes withheld from their paychecks, but some people are exempt. To be exempt, you must meet both of the following criteria:

Recommended Reading: How Much Do I Owe In Taxes 2020

Calculating Your Tax Rate

Your tax rate in retirement will depend on the total amount of your taxable income and your deductions. List each type of income and how much will be taxable to estimate your tax rate. Add that up, then reduce that number by your expected deductions for the year.

For example, suppose that you’re married and filing a joint return with your spouse. You have $20,000 in Social Security income and $25,000 a year in pension income, and you expect to withdraw $15,000 from your IRA. You estimate that you’ll have $5,000 per year in long-term capital gains income from mutual fund distributions.

Your total income, not including capital gains and before Social Security benefits, is $40,000 . Your total income is $45,000 when you add in capital gains.

At $45,000, you’ll be taxed on up to 85% of your Social Security benefits. This doesn’t mean 85% exactly, because it’s a formula, so it may be less. Based on all of this information, you’ll pay taxes on $15,350 of your Social Security benefits. That means your income will be $60,350 .

Making Payments To The Irs

Just because youve calculated payroll and paid your employees doesnt mean your job is done. You also need to send the taxes you withheld to the respective taxing authority. For FIT and FICA, that is the IRS. For state and local income taxes, that is your states withholding tax agency.

Be sure to send both the taxes you withheld from your employees paycheck as well as the taxes that you as the employer are responsible for.

The timing of when you send the federal taxes depends on how much you pay employees, how frequently you pay them, and your lookback period . The IRS Form 941, Employers Quarterly Federal Tax Return, provides details on how, when, and where to pay FIT and FICA.

The deadline to file Form 941 is the last day of the month following the end of a calendar quarter. For example, for the quarter ending on March 31st, Form 941 is due on April 30th. There are significant penalties for not filing this form, so dont forget!

For state tax filings, you should contact your states withholding tax agency for filing requirements for state and local income tax rates. Each state is different.

Don’t Miss: How To Report Stock Sales On Tax Return

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Lets Review Our Example Using The 2019 W

- Our employee earns $50,000 a year, or $2,083.33 of gross pay per semi-monthly pay period.

- Our employees federal income tax withholding is $178.96 using the old W-4.

- Social Security tax is $129.17, and Medicare tax is $30.21. The total combined FICA tax is $159.38.

- Since our employee lives in Florida, there is no state income tax withholding.

- There were no deductions or expense reimbursements.

- Thus, our employees net pay is $1,744.18.

Recommended Reading: How To Calculate Crypto Taxes

Take Care Of Deductions

In addition to withholding for payroll taxes, calculating your employees paycheck also means taking out any applicable deductions.

There are voluntary pre and post-tax deductions like health insurance premiums, 401 plans, or health savings account contributions. Some employees also have involuntary deductions that may need to be considered for items like child support or wage garnishments .

Be careful here, because pre-tax deductions like 401 are taken out of gross income in Step 1, which means that the tax withholding calculation in Step 2 will be lower. Post-tax deductions are taken out after Step 2. Pre-tax deductions will save the employee more taxes.

Texas Median Household Income

| 2010 | $48,615 |

Payroll taxes in Texas are relatively simple because there are no state or local income taxes. Texas is a good place to be self-employed or own a business because the tax withholding won’t as much of a headache. And if you live in a state with an income tax but you work in Texas, you’ll be sitting pretty compared to your neighbors who work in a state where their wages are taxed at the state level. If you’re considering moving to the Lone Star State, our Texas mortgage guide has information about rates, getting a mortgage in Texas and details about each county.

Be aware, though, that payroll taxes arent the only relevant taxes in a household budget. In part to make up for its lack of a state or local income tax, sales and property taxes in Texas tend to be high. So your big Texas paycheck may take a hit when your property taxes come due.

Also Check: Is The Tax Assessment The Value Of The Property

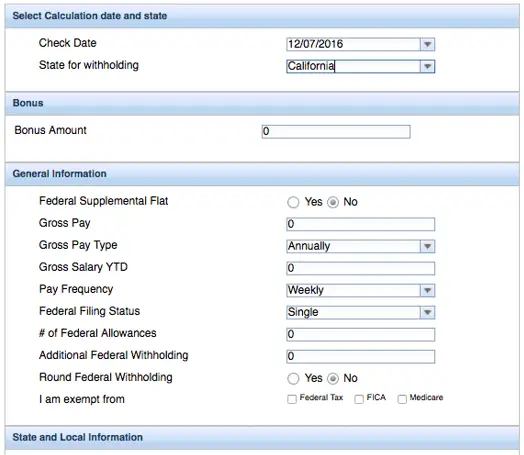

Why Is My Bonus Considered A Supplemental Wage

If youre receiving your first bonus, youre probably wondering why the IRS taxes them. The IRS views them as a supplemental wage, alongside back pay, overtime, severance pay and commission. While everyone would prefer if the IRS allowed bonuses to be tax-free, thats not the case. So, expect to pay taxes on them, but at a different rate than your regular income.

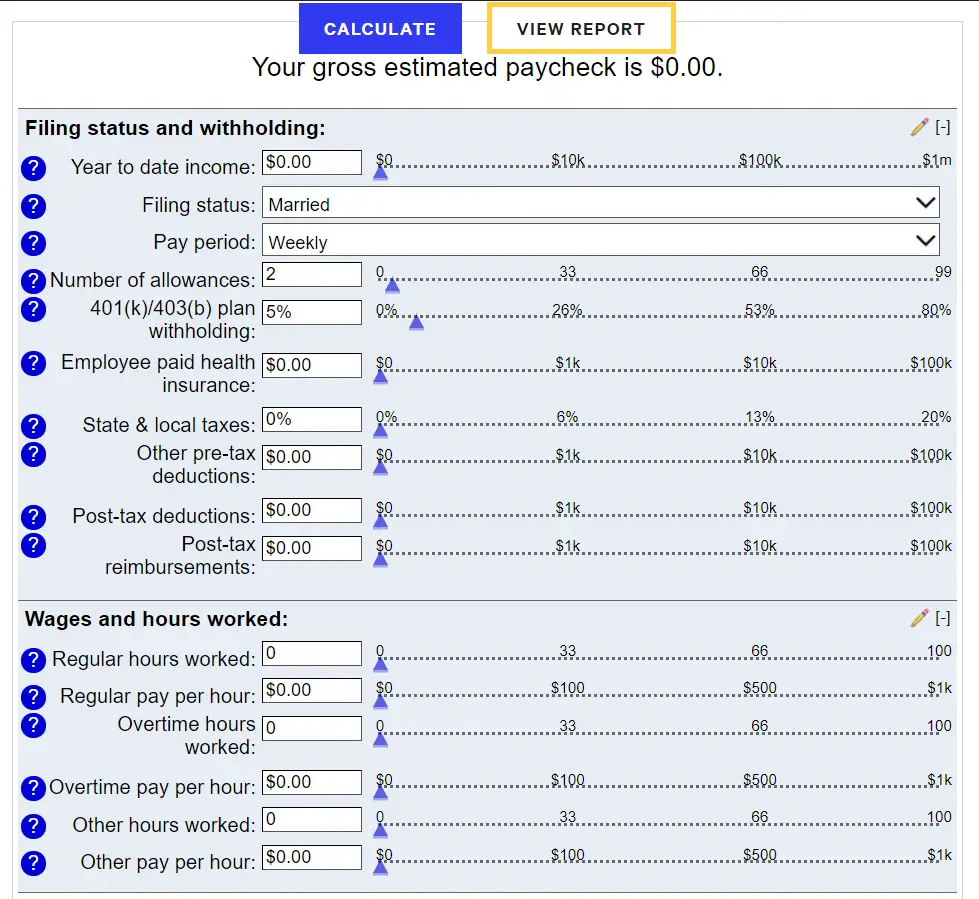

Calculating Employee Payroll Taxes In 5 Steps

Once your employees are set up , youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheld. And, if necessary, making deductions for things like health insurance, retirement benefits, or garnishments, as well as adding back expense reimbursements.

In technical terms, this is called going from gross pay to net pay.

If youre trying to figure out a specific step, feel free to skip to the one youre looking for:

- Step 1: Figure out gross pay

- Step 2: Calculate employee tax withholdings

You May Like: Can You File 2 Years Of Taxes At Once