Do You Need A Cpa After You Have Calculated Your Crypto Taxes

Crypto taxation is not that complicated. After youve compiled your crypto activities, your next step is to list your trades on the resource provided by your countrys revenue authorities . After this, you need to transfer your total gains to your 1040 Schedule D form .

Luckily, all the crypto tax resources listed in this guide make the entire process simple.

Example : Capital Gain Or Loss

Tim found a deal on a living room set at an online vendor that accepts Bitcoin. Tim acquired $3,500 worth of Bitcoin to buy the furniture with. By the time he bought the furniture and converted his remaining Bitcoin back into dollars, the value of Tims Bitcoin had increased by $500. The gain realized by Tim was on account of capital, so Tim has to report a $500 capital gain on his income tax return. However, only 50% of that capital gain is taxable.

Tax On Lost Or Stolen Crypto

The CRA has not released specific guidance stating whether you can claim lost or stolen crypto as a capital loss.

But, they do allow taxpayers to deduct capital losses due to theft of other capital property. As crypto is considered to be capital property under Canadian law – you may be able to make a claim for a capital loss for stolen crypto. Find out more in our lost & stolen crypto Canada guide.

Also Check: How Long Do You Need To Keep Tax Records

Trading Cryptocurrency For Another Type Of Cryptocurrency

Generally, when you dispose of one type of cryptocurrency to acquire another cryptocurrency, the barter transaction rules apply. You have to convert the value of the cryptocurrency you received into Canadian dollars. This transaction is considered a disposition and you have to report it on your income tax return. Report the resulting gain or loss as either business income or a capital gain .

What Kind Of Records Might Hmrc Ask For

As far as crypto record keeping is concerned, HMRC correctly states that many exchanges do not keep detailed information about crypto transactions and the onus of maintaining these transactions accurately rests with the taxpayer. These details include:

- the type of crypto asset

- date of the transaction

- whether the crypto assets were bought or sold

- the number of units involved

- value of the transaction in pound sterling

- cumulative total of the investment units held

- bank statements and wallet addresses, as these might be needed for an enquiry or review

You should ensure you download reports regularly from your exchanges as they can lose your data or just delete it permanently after a certain period of data. Again, using tax software like Koinly can help you maintain such a ledger.

Recommended Reading: How To Pay Your Property Taxes Online

What Is The Canadian Tax Year

The Canadian tax year runs from the 1st of January to the 31st of December every year, with tax returns due by the 30th April every year.

The information on this website is for general information only. It should not be taken as constituting professional advice from Koinly. Koinly is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances. Koinly is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website.

The Ultimate Crypto Tax Guide For Canadians In 2022

If we could all agree on one thing, this is it: the world of decentralized finance, mostly known as DeFi, and all the vocabulary associated with it can be confusing. Whether you love it or hate it, it doesnt stop everyone from talking about cryptocurrency exchanges, Web3, non-fungible tokens , crypto wallets, and all other things that seem out of this world.

So even if you are clueless about all of these but have decided to delve into investing in cryptocurrency or NFTs, or you seem to understand how it works, chances are, you dont have a grasp on how to file taxes on your crypto transactions in Canada. Many people find cryptocurrency tax to be a confusing subject, so you are not alone. This guide will help you understand how to file your crypto tax in Canada.

Read Also: Where Is My State Tax Refund

Superficial Tax Loss Rule

Given the simple example above, you might think it is smart to ârealizeâ a capital loss when the price of Bitcoin dumps, and immediately buy it back to realize a capital loss in this tax year. This tactic is known as âtax loss harvestingâ, and to circumvent this the CRA introduced the superficial tax loss rule. If you buy the cryptocurrency in a 30 day window either side of the sell transaction, that sell transaction is ignored and the original cost basis is reapplied.

How To Calculate Your Cryptocurrency Taxes Canada

Calculating your crypto taxes so you can accurately report them to the CRA can take hours – if not days if you trade at volume! You can do it all manually, or you can use a crypto tax app like Koinly to save you hours.

To calculate your crypto taxes manually, follow these steps:

If you have a higher net capital loss than your net capital gain, remember you can carry capital losses forward to future tax years to offset against future gains.

Recommended Reading: When Do I File Business Taxes

Personal Income Tax Rates

Taxable income from employment falls under Box 1 and is taxed according to progressive tax rates. Box 1 also includes income from home ownership, periodic receipts and payments, and benefits relating to income provisions.

For 2022, the personal income tax rates for Box 1 vary from 9.42% to 49.50%.

| Taxable income band |

|---|

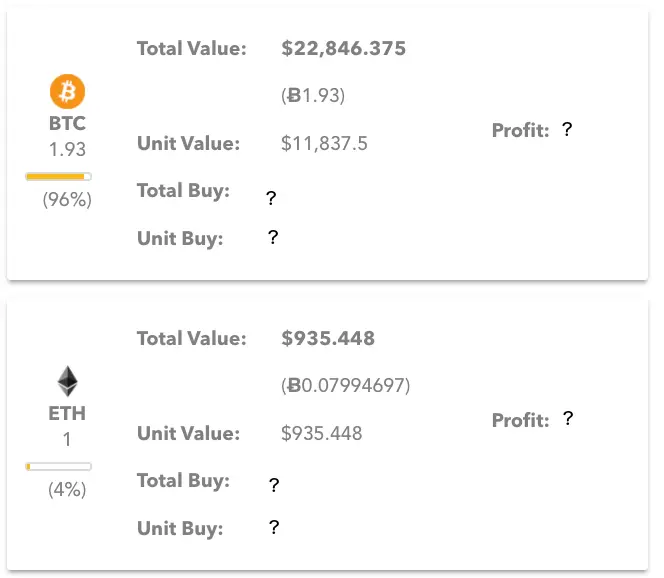

How To Use A Crypto Tax App Like Koinly

Don’t get stuck in the busywork. Don’t get it wrong. Don’t rely on your accountant to know where to look. Use Koinly to generate your HMRC crypto tax report. Here’s how easy it is:

It only takes a minute!

2. Select your base country and currency.

In this instance, the United Kingdom and Great British Pounds.

3. Select your accounting method.

Koinly supports the UK Share Pooling Cost Basis Method. This is the only cost basis method allowed in the UK, so you shouldn’t change it.

4. Connect Koinly to your wallets, exchanges or blockchains.

Koinly integrates with more than 700 crypto exchanges, wallets and blockchains. If you can’t find yours, let us know – we’re always adding more.

5. Let Koinly crunch the numbers. Make a coffee.

Koinly will calculate your cost basis for each crypto asset like ETH, ADA and Bitcoin and taxes them accordingly. Koinly will calculate each capital gain or loss from your disposals, as well as your crypto income and expenses.

6. Ta-da! Your data is collected and your full tax report is generated!

Head to the tax reports page in Koinly and check out your tax summary. This includes your net capital gains, other gains, income, costs, expenses and any gifts, donations or lost crypto.

7. To download your crypto tax report, upgrade to a paid plan from £39 per year.

8. Send your report to your accountant, or complete your Self Assessment Tax Return yourself.

Read Also: How Much Is Income Tax In California

Selling Or Swapping Coins From An Airdrop

Crypto you received from an airdrop will be treated the same as any other crypto when you later spend, swap, gift or sell it. So you’ll pay Capital Gains Tax when you dispose of this crypto.

Itâs important to note that because CRA uses the adjusted cost basis method, you’ll pay Capital Gains Tax on the entire proceeds as all of your proceeds will be seen as profit. Your cost basis is zero, so your entire proceeds are considered a capital gain.

Crypto Capital Gains Tax Uk

Because HMRC see crypto as a capital asset, when you dispose of a capital asset – you’ll pay Capital Gains Tax. Disposals of crypto include:

- Selling crypto for GBP or another fiat currency.

- Trading crypto for crypto, including stablecoins.

- Spending crypto on goods and services.

- Gifting crypto – unless it’s to your spouse or civil partner.

So anytime you sell, trade, spend or gift crypto in the UK – you’ll pay Capital Gains Tax as a result.

Don’t worry – you won’t pay tax on the entire proceeds when you make a disposal. You’ll only pay tax on crypto gains, so whenever you’ve made a profit.

In addition to this, HMRC has finally released some guidance on DeFi transactions – in particular lending and staking – but it hasn’t really clarified too much. The guidance now states that DeFi transactions may be subject to Income Tax or Capital Gains Tax depending on the “nature of the transaction” and whether that transaction has the nature of capital or the nature of income. In essence, a capital transaction happens when you dispose of your crypto, regardless of whether you have the right to claim that crypto back or not, this could include:

- Adding/removing your crypto in a liquidity pool – if the DeFi protocol can benefit from your liquidity.

- Staking your crypto through a DeFi protocol – though the return from staking may be chargeable under Income Tax.

Also Check: How To Calculate Your Tax Return

Which Crypto Exchanges Report To Hmrc

But what about your specific UK crypto exchange? Does Binance report to HMRC? What about Coinbase and HMRC?

HMRC stated back in 2019 that they requested customer data crypto from exchanges that do business in the UK including Coinbase, eToro and CEX.

These are the only crypto exchanges they’ve named so far. But before you breathe a sigh of relief, just because HMRC haven’t named the crypto exchange you use doesn’t mean they haven’t contacted them. HMRC is cracking down on crypto – so it is safe to assume HMRC will have contacted all the major crypto exchanges doing business in the UK, such as Binance, Kraken, KuCoin, Gemini, CoinJar, Crypto.com, Bittrex and Gate.io.

You might recall that in 2020, Coinbase handed over data on UK customers who transacted more than £5,000 worth of cryptocurrency between 2017 and 2019.

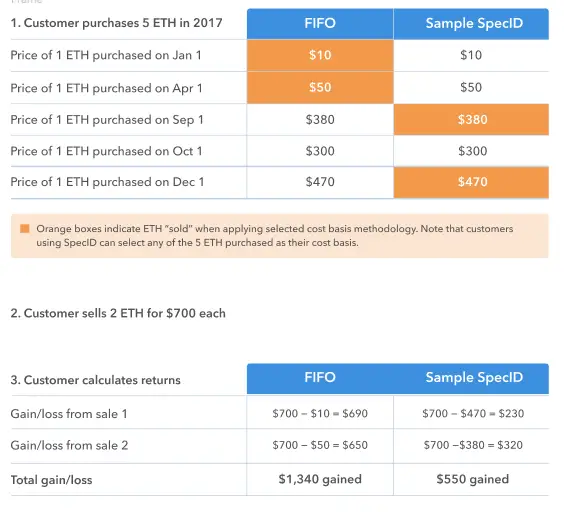

What Is Specific Identification

Taxpayers can also elect to use Specific Identification. Specific Identification allows a taxpayer to select which particular cryptocurrency unit is being disposed of in a transaction. This allows a taxpayer to optimize the tax calculation in order to minimize any gains or obtain losses.

In the example above, the taxpayer is able to identify theyre disposing of assets acquired on July 1 and September 1. Using Specific Identification would result in a $2,000 net capital loss as opposed to a $7,000 net capital gain under FIFO as shown above. Here, its preferable to use Specific Identification to dispose of assets with the highest cost basis first, an approach known as highest in first out .

Read Also: How Much Does Employer Pay In Taxes For Employee

What Is Capital Gains Tax

Were glad you asked!

Capital Gains Tax is the tax you owe on profits. You pay it when you sell an asset . For the 2022/23 tax year, you pay CGT at the following rates:

- 10% for your entire capital gain if your overall annual income is below £50,270

- 20% for your entire capital gain if your overall annual income is above the £50,270 threshold

When it comes to crypto, you can earn up to £12,300 tax-free per tax year before you have to pay Capital Gains Tax.

How Is Crypto Tax Basis Calculated

Cost basis = Purchase price + Purchase fees. Let’s put these to work in a simple example: Say you originally bought your crypto for $10,000 . Even though you only hold $9,965 worth of crypto after fees, your total cost basis is what you paid to acquire that crypto…. read more

9 Different Ways to Legally Avoid Taxes on Cryptocurrency

Recommended Reading: How Do I File My City Taxes

How To Use Our Australian Crypto Tax Calculator

Our crypto tax calculator estimates how much CGT you would have to pay when you sell or swap your cryptocurrency asset. To use this calculator youll need to provide a few details about your crypto asset. These have been explained below:

- Sold price This is the total value in AUD you disposed of the asset for, e.g. you sold Bitcoin for $15,000, or you swapped Bitcoin for ETH that had a value of $15,000

- Cost basis This is the value you originally paid for the crypto you are disposing of and is your total investment to acquire the asset in AUD including any fees or other costs e.g. you originally bought the Bitcoin for $5,000, or you originally swapped ETH with a value of $5,000 for the Bitcoin

- Taxable income This is your total taxable income for the year in which you sold the crypto asset and includes your salary and other income you may earn. This allows us to determine the tax rate to be applied to your crypto capital gains

- Length of Ownership If you held the crypto asset for longer than 12-months, you are eligible for a 50% CGT discount this means that only 50% of the capital gain is included in your assessable income

When you have entered the above details, click the Calculate button to get estimates for the CGT youll need to pay on your cryptocurrency asset disposal.

What Is A Tax Loss Carryforward

The difference between capital gains and losses is called net capital gain or loss.

If you have a net capital loss, you can deduct that loss on your tax returnup to $3,000 per year.

If your net capital losses exceed $3,000, the portion over $3,000 is a capital-loss carryforward and can be included in your capital gain calculation for the following tax year.

For example, if you had a net capital loss of $5,000 for tax year 1, you would deduct $3,000 of that amount on your tax return for tax year 1.

The remaining $2,000 would be carried forward and used to calculate your net capital gain or loss for tax year 2.

If you also had a loss in tax year 2, then the $2,000 carryforward could be used in tax year 3 along with any carryforward from tax year 2.

Also Check: Can I Still Do My Taxes

Capital Gains Uk Tax Free Allowance

HMRC are pretty generous when it comes to capital gains and give every UK taxpayer a Capital Gains Tax Allowance of £12,300 a year.We’ll explain this in more depth later, but this means you’ll only pay Capital Gains Tax on any capital gains over your £12,300 allowance.

However, in the latest budget, the government announced that this allowance would be cut in the 2023-2024 tax year, and again in the 2024-2025 tax year. So from April 2023, the allowance will now be £6,000. From April 2024, this will halve again to £3,000. Of course, this may change with chancellors, but it may be in your interests to make the most of the current £12,300 allowance ahead of the cuts.

Let’s look at how much Capital Gains Tax you’ll pay on your crypto.

What Crypto Transactions Are Taxable

If youre just starting out, you dont have to report your taxes if youre simply buying, holding, or transferring it from one wallet to another. Youre only entitled to report your taxes to the IRS if in case you sell your crypto.

If youre doing your crypto taxes for the first time, here are some of the questions you should ask as a bitcoin tax payer.

Read Also: How To Find Out If You Owe Back Taxes

How Much Tax Do You Pay On Cryptocurrencies

Taxes on cryptocurrencies are considered as either capital gains tax or as income tax in Canada. While many countries including the US have special tax rates for capital gains, this is not the case in Canada. Instead, any earnings considered to be capital gains are taxed at the same rate as your federal income tax and provincial income tax rate. The good news, however, is that you pay only tax on half of your total capital gains!

Lets break down the different tax rates to better understand how much tax you must actually pay.

Selling Or Trading Staking Rewards

You will also pay Capital Gains Tax when you later dispose of the tokens earned from staking if you sell, swap, spend or gift them. The base cost will be the FMV on the date you received the tokens. Meanwhile, the disposition price will be the FMV on the day you sell, swap, spend or gift the tokens.

Read Also: When Will I Get My Child Tax Credit

How Much Crypto Do You Need To Report

This IRS worksheet can help you do the math. Investors who sold or exchanged their crypto at a loss for example, buying bitcoin at $60,000 and selling it at $30,000 can use their losses to lower their taxable income by a maximum of $3,000. Any additional losses can be carried over to future years…. see details