Whos Responsible For Independent Contractors Payroll Taxes

The short answer: Not your company. Thats the clear distinction between a contractor and an employee of your company that we mentioned at the beginning of this article. If your company is submitting payroll tax payments to the IRS and state and local governments, that person must be classified as an employee. A freelance worker, on the other hand, is responsible for paying all of their federal and state and local taxes as well as Social Security and Medicare taxes. Since they are self-employed, theyre also required to pay both their portion and the employers portion of those FICA taxes.

Protecting Your Business From Misclassification Penalties

If youre unsure how to classify your employees, you can file a Form SS-8 to the IRS. They will review the nature of the relationship between the employer and the employee and give you an official determination.

This process can take several months to complete, but it may be worth the wait if you want to hire many workers with the same roles and responsibilities. If you need to quickly determine your workers classification, consult with an employment attorney or tax professional before making your final decision.

CO aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

COis committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here.

Tax Deductions For Independent Contractors

Deductions lower your taxable income for the year. Independent contractors claim them as business expenses on their taxes. Depending on the kind of business you own, your deductible expenses might include:

- Advertising costs

- Rent or lease payments

- Equipment purchases

Independent contractors can also claim a deduction for health insurance premiums they pay out of pocket. That includes premiums paid for medical, dental and long-term care insurance. If you pay for your spouses and childrens insurance, you may be able to deduct those costs, as well. The exception to the rule is that you cant deduct premiums for health insurance if you have access to a spouses insurance plan.

As an independent contractor, you can also deduct personal expenses, such as mortgage interest paid, interest paid to student loans and real estate taxes. You can also get a tax break for contributing to a self-employed retirement plan or a traditional IRA. If youre looking for a retirement plan option, consider a SIMPLE IRA, . These plans allow for deductible contributions, with qualified withdrawals taxed at your ordinary income tax rate in retirement.

Read Also: How Does H And R Block Charge

Quarterly Estimated Tax Filing

Your estimated tax payments are due four times per year. You can use Schedule SE to help you calculate how much you owe at each deadline.

The deadlines for making your quarterly estimated tax payments are:

Dont forget that if your state has income taxes, youll also need to make estimated tax payments to your state. Check with your states business resources for deadlines and any required forms.

Risks Of Using A 1099 Employee

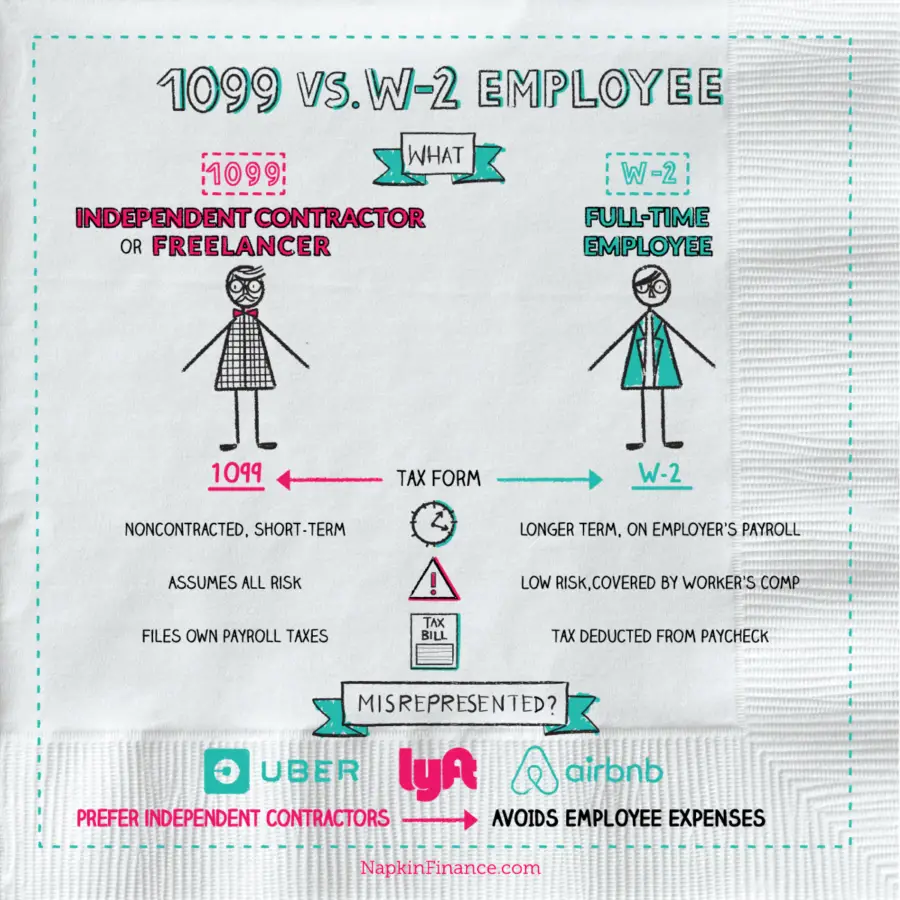

When it comes to independent contractors, employers are not expected to withhold income taxes, pay FICA taxes, and in some cases, pay any premiums for workers comp or unemployment insurance. On the surface, using an independent contractor sounds simpler and more attractive than having a W-2 employee.

Should you hire independent contractors? Of course! If thats what best defines your relationship with the employee and makes the most sense for the job that needs done. Just be care, and consider the risks:

- Worksite injuries. Independent contractors should have their own workers compensation coverage to protect your business from liability.

- Misclassifications. While your 1099 employee may begin as an independent contractor, their relationship to your company can change over time. Review the contractors status every 6 to 12 months to avoid becoming an employer by accident.

- Penalties and fines. Misclassifications put your business at high risk for multiple penalties, fines, and back-taxes.

You May Like: Form 1040 State Tax Refund

Getting Paid As An Independent Contractor

Employees who work for someone else have state, federal, Social Security and Medicare taxes withheld from every paycheck they receive. But if youre an independent contractor, it doesnt work that way.

When your clients send payment for your work, no one takes money out of your paycheck for taxes. Instead, youre responsible for setting aside enough money to pay your taxes when theyre due. Well talk more about how to pay your taxes in a little bit.

Examples: When To Choose A 1099 Vs W2 Employee

As you can see, sometimes it makes more sense to engage the services of an independent contractor than it does to hire an employee. At other times, though, youâll need to hire an employee to get the job done. If youâre still not sure which type of worker you should hire, there might be some alternative solutions at your disposal.

Don’t Miss: How Much Is H& r Block Charge

How To Determine Whether Your Employees Are 1099 Vs W2 Employees

We noted the importance of correctly classifying your employees as 1099 or W2 workers with the IRS. Often, cost and ease are the key determining factors a business owner considers before choosing whether to engage a contractor or hire an employee. To be fair, itâs much easier to pay a contractor than it is to administer payroll and handle other HR functions required of a business with employees.

But any cost and time savings will quickly disappear if the IRS or Department of Labor audit you and find that youve misclassified workers. Because when it comes to 1099 vs. W2, the IRS is stringent: They can can levy back taxes and penalties of more than 40% of the contractors pay. And the DOL could require you to pay wages going back three years.

Admittedly, the line between 1099 and W2 workers can become blurryâbut the IRS provides some guidance about how to correctly classify your workers. The IRS considers three major categories in determining whether workers are employees or independent contractors:

Determine If The Worker Is An Employee Or Independent Contractor

Companies must thoroughly understand the relationship between themselves and their workers are they employees or independent contractors? The answer isnt always cut and dried, which is why the IRS provides specific guidelines for worker classification.

In general, if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done, then the person performing the work is an independent contractor. To determine this degree of control, the IRS considers three common law rules:

Read Also: Otter Tail County Tax Forfeited Land

Estimate How Much Youll Need To Pay

With these two new shifts in your tax obligations, you might be wondering, How do you estimate your income and self-employment tax payments?

If its your first year as a 1099 worker and you dont have a CPA doing your taxes, Chelsea Krause, an accounting expert at business financial site Merchant Maverick, says the IRSSelf-Employed Individuals Tax Center is your home for understanding how much you might have to pay.

The page has a link to the 1040-ES, which is a worksheet that will tell you, based on your income for the past three months, how much you need to pay for the quarter. The worksheet takes about 10-15 minutes to complete.

In the event that youve filed as a 1099 worker the previous year, then Dave Du Val, an Enrolled Agent with TaxAudit.com, says the following percentages are the governments guide for how much you should save:

- 90 percent of what youll owe for the year

- 100 percent of what you paid the previous year

- 110 percent of what you paid the previous year if your income was above $150,000

If possible, make up any shortfall in the taxes you owe by estimated tax payments as soon as you are making more than you expected, Du Val said.

Who Is Responsible For The Independent Contractor’s Federal Payroll Taxes

Independent contractors are responsible for their own federal payroll taxes, also known as self-employment tax. This is a two-part tax, with 12.4% going to Social Security and 2.9% going to Medicare, for a total of 15.3%. Payments are usually filed quarterly using Form 1040-ES, Estimated Tax for Individuals. Freelancers may also have to pay state and local tax, depending on the jurisdiction.

As mentioned previously, however, there are some instances where a service recipient is required to deduct taxes from an independent contractors pay. Backup withholding typically occurs when freelancers provide the wrong TIN or incorrectly report their income on a tax return.

Also Check: Do You Have To Report Plasma Donations On Taxes

How To Include A 1099

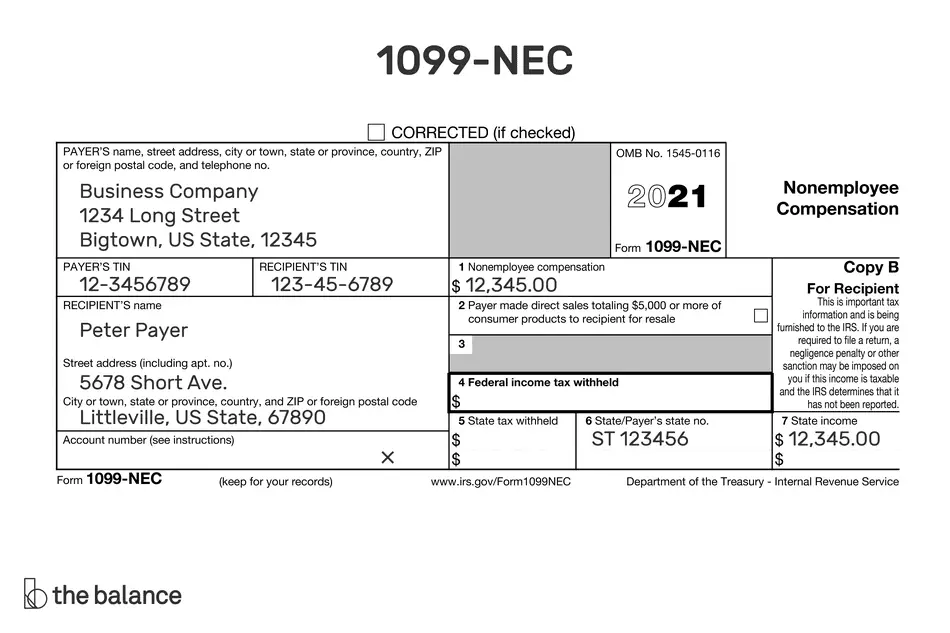

The Balance / Britney Wilson

You received a Form 1099-NEC from someone who paid you for the work you did as an independent contractor. Now what? Two big questions here:

You must report the income on your personal tax return and you must pay both income tax and self-employment tax on this income.

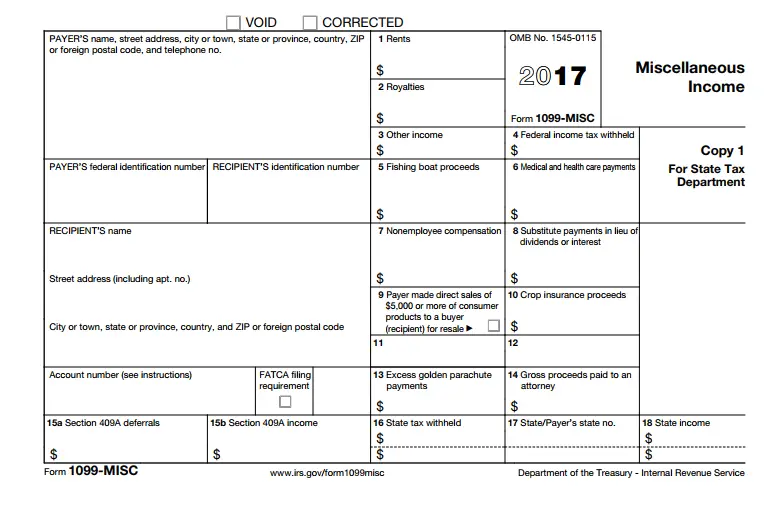

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

Including 1099 Income On Your Tax Return

How you report 1099-MISC income on your income tax return depends on the type of business you own. If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule CProfit or Loss From Business. When you complete Schedule C, you report all business income and expenses. Reporting business expensessuch as fees paid to professionals, purchases of business supplies or equipment, and business office expensesreduce the net income from your business.

The net income from your Schedule C is reported on Line 3 of Schedule 1 of your personal income tax return along with all other sources of income, including income as an employee and investment income. Your personal income taxes are determined by your total adjusted gross income.

If your business is a partnership, multiple-member LLC, or corporation, your 1099 income is reported as part of your business income tax return.

Don’t Miss: Where’s My Refund Ga State Taxes

How To Pay Estimated Taxes Online

You also pay your estimated taxes online through the IRS website. The IRS receives your payment almost immediately when you pay online. Plus, you dont have to worry about your payment getting lost in the mail. The system provides a confirmation number for all payments so you have proof if you run into any problems. Best of all, you can easily make payments from the comfort of your own home. No stamps required!

To learn more about paying estimated taxes online, check out our detailed blog post on the topic.

Managing Your Workers With Square Payroll

When you decide to hire people, one of the first things you do is set up systems to manage how to pay them. Whether you have only employees , only independent contractors , or a mix of the two, Square Payroll can make processing payroll easy.

Square Payroll simplifies your operations and helps you save time with fully integrated timecards, workers comp, sick leave, and PTO for your employees. It also lets you pay both employees and contractors with direct deposit. And it takes care of payroll tax calculations and creation of your W-2s and 1099-MISCs.

Square Payroll

Recommended Reading: Tax Lien Investing California

What Is A 1099 Form

A 1099 form is an information filing form that proves some other entity besides your employer paid you money. There are many different types of 1099 forms. For example, you may get one if your bank paid you interest or you earned income as a contract or freelance worker. Generally, the entity that paid you is responsible for sending a copy of your 1099 form to you in the mail.

Wow This Sounds Like A Scam Does This Happen A Lot

Payroll fraud or independent contractor misclassification is surprisingly common. It is particularly rampant in the janitorial, home care, trucking, and delivery sectors. Workers have filed major lawsuits against companies alleging that they should be treated as employees. Recent cases in the news include lawsuits by Uber drivers, port truck drivers, , and home cleaners. These workers are often owed thousands of dollars in overtime pay and other wages and benefits.

Also Check: Www.myillinoistax

Setbacks Of Being A 1099 Worker

Many workers are often tempted by the 1099 employment option because they are told that they will get a bigger check. They are enticed by the higher pay without obtaining a full understanding of what their employment status will mean long-term. In the short run that’s absolutely true, however eventually independent contractors will actually owe higher taxes than employees. This is because not only will income tax be taken out, but self-employment tax as well. 1099 workers are also expected to pay twice as much for social security and medicare taxes.

Contractors will never enjoy some of the benefits that employees have the ability to take advantage of. These include sick days, vacation hours, health and dental insurance, worker’s comp, retirement, pension and unemployment benefits nor are they covered by an employer’s liability insurance. 1099 workers are not eligible for overtime pay.

Do You Want A 1099 Or A W

Asked another way, independent contractor or employee? It seems like such a simple question. As we approach year-end, companies and workers everywhere may not think about it but they should.

If youre an employee, taxes have to be taken out. That means youll receive an IRS Form W-2 in January. In contrast, if youre an independent contractor, youll get full pay with no deductions. Of course, you are liable for your own taxes. Come January, assuming your total pay was $600 or more, youll receive an IRS Form 1099.

But is it that simple? What if youre the employer not the recipient? This is one of the more momentous decisions in the tax world. In fact, it goes well beyond taxes and covers workers compensation, unemployment insurance, state and federal wage and hour laws, pension laws, nondiscrimination laws and more.

Its hard to think of a more pivotal issue. Yet this decision is made thousands of times a day all over America. Sometimes it is done without much thought. Some employers ask 1099 or W-2? as if they were asking how you take your coffee.

If youre the worker, you may be tempted to say 1099, figuring youll get a bigger check that way. You will in the short run, but youll actually owe higher taxes. As an independent contractor, you not only owe income tax, but self-employment tax too. On the first $113,700 of income, thats a whopping 15.3% rate. Beyond $113,700, the rate drops to 2.9%.

Also Check: Where Is My State Refund Ga

Develop A Bulletproof Savings Plan

Tax experts across the board emphasized the importance of responsible saving so that youve got enough cash stored up to meet your tax obligations each quarter and at the end of the year.

Krause says many freelancers and private contractors entrap themselves in a pay with the next check type of mentality.

As a 1099 contractor, it can be easy to see your whole check as usable money and to convince yourself you’ll put more into your tax savings next check, Krause said. Doing this is incredibly difficult to recover from and is a very slippery slope.

She and Mastio suggest opening a separate savings account into which you can deposit money youll use for your tax payments.

Make it a priority and build it into your monthly budgeting. If it has been a problem in the past, simply open up a separate bank account and transfer 25-30 percent of each months earnings to this account and use that account to make your quarterly tax payments, Mastio said. You may end up over-estimating your payments, but at least you avoid the headache and panic of setting aside too little.

Vs W2 Employee: Which Is Better For Your Business

Now that we know the difference between an independent contractor and a W2 employee, itâs time to answer the question youâve probably been asking yourself: â1099 or W2 which is better for my employee and for my business?â Many small business owners choose to work with independent contractors because of the perceived cost savings. Employment taxes, workers compensation insurance, overhead costs like office space and break-room suppliesâtheyâre all necessary expenses when you hire W2 employees, and they can quickly erode a businessâs bottom line. In addition to the costs, though, youâll also need to weigh the W2 vs. 1099 pros and cons.

Recommended Reading: How To File Missouri State Taxes For Free