What Is Sales Tax Everything You Need To Know

As a consumer, you are probably well aware of the concept of sales tax. In most states, sales tax is the reason that a $100 item actually costs you closer to $105 at the register. But once youve gotten your company up and running, youll likely need to address the idea of sales tax from a new perspective.

Many people assume that only large companies or huge retail outlets need to be concerned with sales taxes. Thats simply not the case. Read ahead for the most important aspects of collecting and paying sales taxes.

What is sales tax?

While there is general uniformity between the states when it comes to the collection and payment of sales taxes, there are some substantial differences between the states process of collection. In some states, a majority of sales taxes are taken directly from customers during transactions. In others, your business will be liable for most of the amount collected. However, in a majority of states, the burden will be split between you and your customers.

Despite the differences from state to state, these four steps will generally help you define your sales tax collection process:

Understand the difference between sales and use taxesWith the emergence of the Internet and online ordering, it has become difficult for states to collect sales taxes on many online orders. In order to counteract this, many states have broadened their state use tax to include the storage and use of property to help complement the traditional sales tax.

How Businesses Calculate Sales Tax

The Indeed Editorial Team comprises a diverse and talented team of writers, researchers and subject matter experts equipped with Indeed’s data and insights to deliver useful tips to help guide your career journey.

The cost a customer pays when purchasing goods or services from a business includes both the company’s sales price and the cost of applicable sales taxes. Businesses and their employees need to know what sales tax is, why they must collect it and how to calculate the correct sales tax amount on each purchase.

Thoroughly understanding this information helps ensure they comply with their state and local sales tax rules and regulations. In this article, we discuss how sales tax is calculated, what it is and answer other frequently asked questions employees have about sales tax.

Wrapping Up: How To Calculate Sales Tax

The act of calculating sales tax itself is straightforward. All you need is the formula for sales tax to come up with the correct amount of sales tax to charge. It’s knowing how to correctly charge sales tax in each state is where you can run into confusion. You can decide to sell in your state only, which limits your ability to generate profits and earn an income, or you can start an e-commerce business and take advantage of the hosting service’s built-in sales tax calculators for each state. You spend less time figuring out how to handle sales taxes and spend more time making sales.

Don’t Miss: Are Charitable Contributions Still Tax Deductible

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Register For A State Tax Permit

Once youve figured out where youre considered to have sales tax nexus, you need to register for a sales tax permit in those states.

Its important not to skip this step. You also need to make sure you do this before you actually start collecting sales tax.

Its against the law in most states to collect state sales taxes without a proper permit on file.

Also Check: Are State Income Taxes Deductible

How Is It Calculated

- The way to calculate

Sales tax is a tax that is charged by merchants on the sale of goods and services. The amount of sales tax charges depends on the state in which the purchase is made, as each state has its own set of rates.

In most cases, sales tax is calculated by multiplying the purchase price by the applicable rate. For example, if a product has a sales tax rate of 7%, then the customer would be charged $7 for every $100 they spend. However, there are some exceptions to this rule.

Certain types of products, such as food and clothing, may be subject to a reduced tax rate. Additionally, some states exempt certain items from sales tax altogether. To find out how much sales tax you will be charged on a purchase, it is important to consult the tax rate schedule for your state.

Generally speaking, sales tax is a fairly straightforward concept. However, there are some instances where things can get a little complicated. If you have any questions about how sales tax is calculated, be sure to consult with an accountant or tax specialist.

- Who will collect this tax?

There is a lot of discussion about who will be responsible for collecting sales tax in the new economy. The answer is not yet clear, but there are a few contenders.

Some people believe that online retailers should be responsible for collecting sales tax, since they are the ones who are profiting from the sales. Others believe that the responsibility should fall on the states, since they are losing out on revenue.

What Is A Sales Tax

A sales tax is a consumption tax imposed by the government on the sale of goods and services. A conventional sales tax is levied at the point of sale, collected by the retailer, and passed on to the government. A business is liable for sales taxes in a given jurisdiction if it has a nexus there, which can be a brick-and-mortar location, an employee, an affiliate, or some other presence, depending on the laws in that jurisdiction.

You May Like: How Do Business Tax Write Offs Work

When Do I Begin Charging The New Rate

When the sales and use tax rate changes in your city or county, your business must collect, report, and pay the new rate beginning on and after the effective date. Generally, district tax rates become effective on the first day of the next calendar quarter, at least 110 days after the adoption of the district tax.

What Is The Sales Tax Formula

The formula for sales tax is a simple algebra equation that involves converting a percentage to a decimal, then using the decimal as a multiplier on the cost of the item to get the final sales tax amount.

When written out, the equation looks like this:

- Sales tax rate = Sales tax percent / 100

- Sales tax = List price x Sales tax rate

In the event the tax rate is a percentage, you drop the percentage sign and divide the tax amount by 100 to get the decimal numbers for the tax rate. Or you can move the decimal point two places to the left, which puts a 0 in front of the sales tax percentage. A 10.00% sales tax becomes .010. Multiply the price of the item with the decimal tax number to get the tax amount. Add the sales tax number to the price of the goods for the final price.

Don’t Miss: How Can I Estimate My Tax Refund

Who Collects Sales Tax

In general, you’re responsible for collecting sales tax as the vendor or retailer and remitting it to your state’s department of revenue. In the event you’re selling at a physical location in another state, you have to collect sales taxes for that state and remit them to that state’s department of revenue. Always check state rules and regulations prior to collecting and remitting sales tax prior to making your first sale in order to be in compliance.

If you’re selling online through a major website, you usually don’t have to do anything towards the collection of sales taxes. The sites are designed to charge sales tax according to the state the buyer lives in on your behalf.

It’s good practice to look at the sales tax collection requirements for your home state and any state you plan to sell in, especially when you’re starting a business.

When Do You Need To Calculate Sales Tax

Maybe youre getting ready to make a big purchase and you want to calculate exactly how much youll be paying out of pocket.

But the most common reason youd need to calculate sales tax is because you are a retailer making a sale. You have obligations to your customers and to the state to charge the right amount of sales tax every time. And in that case, TaxJar has your back!

You May Like: Does Idaho Have Sales Tax

Local Sales And Use Tax Frequently Asked Questions

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. You will be required to collect both state and local sales and use taxes. For information about the tax rate for a specific area, see Local Sales and Use Tax Rates on our sales and use tax web page.

For information on collecting and reporting local sales and use tax, see 94-105, Local Sales and Use Tax Collection A Guide for Sellers. For a list of local tax rates, see Texas Sales and Use Tax Rates. We also provide tax rate cards for all combined tax rates.

Sales and use taxes are collected at the same rate. See Purchases/Use Tax for additional information.

As a seller, you are responsible for collecting and remitting the correct amount to the Comptrollers office. If you do not, you can owe any additional tax and may be assessed additional penalties and interest.

What Are Sales Tax Holidays

Sales tax holidays are short-term periods in which consumers are exempt from paying sales taxes. These holidays usually exist to provide additional savings that encourage consumers to make purchases for back-to-school shopping or hurricane preparedness during a specific time. The length of a sales tax holiday also varies, but it is often a day, weekend or one week.

Not every state has a sales tax holiday. States that have a sales tax holiday usually identify specific items and a maximum sales price for each item that qualifies for the sales tax exemption.

Recommended Reading: What Is Deadline To File Taxes 2021

Use The Sales Tax Formula To Find The Sales Tax Amount And The Final Sales Amount The Customer Owes

Once you know the combined sales tax rate for the area your business is in and the total taxable sales price for the customer’s purchase, you can calculate the amount of sales tax the customer owes. The sales tax formula is:

x = Sales tax amount

After you find the sales tax amount, add it to the total taxable and non-taxable sales price to calculate the final sales amount. Be sure to add the total non-taxable sales price back in at this point. The final sales amount formula is:

+ + = Final sales amount

The resulting sum is the total amount the customer owes your business for their purchase.

Do Businesses Need To Charge Sales Tax

Since sales tax is determined by state , whether or not you as a business owner need to be charging it depends mainly on where you live.

But its essential that all business owners know the law and follow it to the letter.

That said, every business owner should thoroughly research sales tax law where they live and learn how to calculate sales tax correctly.

Heres a look at how to determine which of your goods and services need to be taxed if you dont happen to live in one of the few states that dont charge sales tax at all.

Read Also: How Much Tax Do You Pay On Lottery Winnings

How To Find Sales Tax Before And After The Purchase

Sales tax is a tax levied on the sale of retail goods and services. Sometimes, a sales tax is already factored into the price of the product, and you wont need to calculate any additional fees when trying to determine the full price. Most of the time, though, the list price of an item is pre-tax, and if you want to figure out how much youll be charged once you bring that item to the check-out line, youll need to know how to find sales tax.

Luckily, calculating the final price of an item with sales tax included isnt hard at all. The only thing you need to know is basic arithmetic, and what the sales tax of your specific state or region happens to be. We cant help you with the second part, but we can offer a basic arithmetic course if you need some extra guidance.

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

You May Like: Do I Need 1095 C To File Taxes

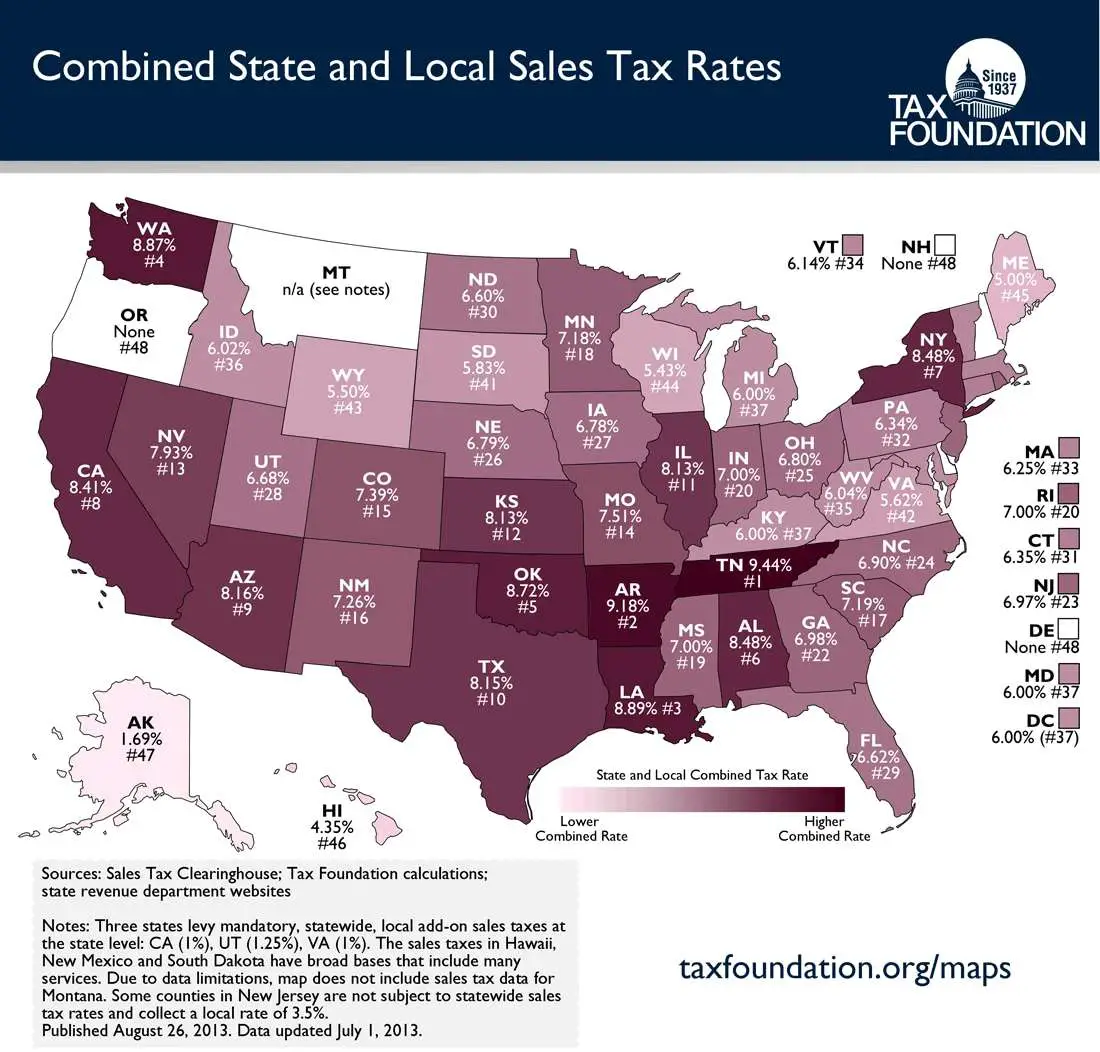

Sales Tax Rates Are A Combination Of Multiple Taxes

The reason the sales tax rates in and around cities like Atlanta vary is because the total sales tax rate is made up of smaller rates. Each state sets a statewide sales tax rate. Then counties, cities, special taxing districts, and other local areas are allowed to add on more sales tax.

Letâs look at the sales tax rate in the city of Atlanta as an example. The Georgia state sales tax rate is 4%. Atlanta is in Fulton County, which sets a sales tax rate at 3%. And then the city of Atlanta sets an additional sales tax rate of 1.9%. Add those three different taxes up, and you get the Atlanta total sales tax rate of 8.9%.

| Taxing Jurisdiction |

|---|

What Happens If I Dont Collect Sales Tax

You still have to pay the tax thatâs due on your sales, even if you didnât collect it from your customers at the point of sale. That means paying out of pocket. In addition, there could potentially be penalties or fines for failing to collect the tax properly.

With a tax automation tool like Quaderno, sales tax is collected for you automatically on every sale. You never have to worry about calculating tax correctly or keeping the right records. Weâll track your tax liabilities and give you clear reports for filing season. See what itâs like with a free trial!

Read Also: Who Has Free Tax Filing

Sales Tax Calculation Formulas

- Sales tax rate = sales tax percent / 100

- Sales tax = list price * sales tax rate

- Total price including tax = list price + sales tax, or

- Total price including tax = list price + , or

- Total price including tax = list price *

If you need to calculate state sales tax, use tax and local sales tax see theState and Local Sales Tax Calculator.

How To Calculate Sales Tax On Almost Anything You Buy

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- It’s not hard to calculate sales tax.

- However, it’s much more complicated to figure out the exact tax rate, since it varies by state and by purchase amount.

When you buy something in the US, you almost always pay more than the sticker price.

That’s because of sales tax, which can vary by state or city but is generally about 4% to 8% of the item’s retail price, imposed when you check out of brick and mortar stores, online retailers, and restaurants.

Sales tax in the US is determined at the state level. There are five states that do not impose a sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. The remaining 45 states and Washington DC all have a sales tax, which varies depending on the product and service for sale.

If you’re shopping in most US states and you want to know how much you’ll be paying in total before you check out, here are steps you can take to calculate the sales tax.

Also Check: When Do I Need To File My Taxes By