What Are Gas Taxes

Taxes are levied on gasoline, diesel and gasohol, which is a mix of ethanol and unleaded gas, at the federal and state levels.

The federal gas tax is 18.4 cents per gallon on gasoline and 24.4 cents per gallon on diesel fuel. On top of that, states have their own gas taxes. State gas taxes vary, but cost an average of 26.2 cents per gallon on gasoline and 26.7 cents per gallon on diesel. The highest state gas taxes are in California and Pennsylvania , and the lowest is in Alaska , according to the American Petroleum Institute.

The cost of crude oil aside, the taxes are the main factor in determining gas price at the pump, adding more to the price of a gallon of gas than refining costs, retail markup and transportation expenses, USA TODAY previously reported.

Gas prices color midterms:Biden considers addressing record high gas prices as midterm elections loom

What does the federal gas tax pay for?

Most of the money collected from the federal gas tax goes toward highway infrastructure, via the Highway Trust Fund, which pays for most federal spending on highways and mass transit.

The Highway Trust Fund was projected to be insolvent, or unable to pay the debts it owes, by 2022. But in November, a bipartisan infrastructure bill signed into law. The bill included an $118 billion revenue transfer to the fund, extending its near-term solvency through 2027, according to the Committee for a Responsible Federal Budget.

What Is The Fuel Tax Credit Scheme

The fuel tax credit scheme is an almost A$6 billion subsidy each year to industry. The fuel tax credit scheme rebates excise tax to those businesses that consume diesel on non-public roads. Some claim that this is fair since they dont use public roads but this assumes that this schemes purpose is to pay for roads.

What Does Gas Tax Pay For

In general, drivers benefit from the services that their gas tax dollars pay for, like road construction, maintenance, and repair.

- Gas taxes are largely used to fund infrastructure maintenance and new projects, but the amount of state and local road spending covered by gas taxes, tolls, user fees, and user taxes varies widely among states. It ranges from only 6.9 percent in Alaska to 71 percent in Hawaii.

Don’t Miss: How To Calculate Annual Income After Taxes

Who’s Against A Gas Tax Holiday

However, there are plenty of critics of the measure, including in Biden’s own party.

Larry Summers, former Treasury secretary in the Clinton administration and an economic adviser for President Barack Obama, this week called it “a gimmick” that doesn’t solve the underlying issues causing the price spike.

Some economists say the end of the holiday could increase inflation and deplete transportation funds, for a low pay-off, while environmentalists argue the gas tax undermines the effort to move toward clean energy.

Plus, Biden’s proposal has to pass Congress with at least 60 votes to avoid a Republican filibuster.

Biden will make his case for a gas tax holiday during a 2 p.m. ET speech Wednesday.

Contributing: Joey Garrison

How Will Ruc Address The Funding Problem

RUC charges drivers for what they use versus the gas tax, which currently charges more for less fuel-efficient vehicles and charges nothing for alternative-fuel vehicles.

Under a road usage charge, all types of vehicles pay an equal amount for the same miles traveledwhich captures revenue not currently being collected under the gas tax.

Read Also: How To File Taxes Separately While Married

How Much Money Would The Government Lose From The Gas Tax Holiday

The federal government would lose about $10 billion after the gas tax holiday. The amount is minuscule considering the fact that the U.S. government spent $6.82 trillion in 2021. Also, the gas tax holiday would hardly move the needle for gas buyers. With U.S. average gas prices just below $5 per gallon, prices would fall by just about 5 percent if gas buyers get the full benefit.

In absolute terms, it would mean a few dollars of savings every month for the average household. Biden admitted that it relief wont be much but consumers would appreciate every little respite amid multi-decade high inflation.

Gas tax holiday is remarkable for many reasons. One of them is that, for years, there was growing consensus that gas tax needed to be raised to fund infrastructure. Of course, that was before the massive infra bill.

Dan Primack

What Does The Federal Gas Tax Pay For Biden Seeks Waiver

Over the weekend, U.S. President Joe Biden said that he was considering a federal gas tax holiday as well as gas rebate cards. Now, he has formally asked Congress to suspend the federal gas tax for three months. What does the federal gas tax pay for and how would the federal government meet the deficit?

The Biden administration has been under fire amid the multi-decade high inflation in the country, which hit 8.6 percent in May. Higher gas prices are among the main reasons for spiraling inflation. The administration has taken steps like releasing oil from strategic reserves and calling upon energy companies to pump more oil, in order to lower gas prices for U.S. consumers.

Don’t Miss: Are You Taxed On Cryptocurrency Gains

Examining The Percentage Of State Gas Tax Revenue That Is Allocated For Expenses Unrelated To Roads Including Money Shifted To Law Enforcement Education Tourism Environmental Programs And More

Oregon introduced the first gas tax in 1919 and within a decade each state adopted the motor fuel tax as a method of funding roads. Gas taxes used to fund roads and highways represent the users-pay/users-benefit principle of responsible taxation, whereby those bearing the cost of the taxhighway usersobtain the benefits of a well-maintained road network.

Many states today, however, divert portions of their state gas tax revenue to the state general fund and other non-highway uses, such as these:

- The largest and most common diversions, found in 20 states, are those to transit and active transportation . New York and New Jersey, for example, allocate over a third of their respective motor fuel tax revenue to transit.

- Ten states divert a portion of their gas tax revenue to law enforcement and safety services, marking the second most common diversion.

- Though less frequent, diversions to education tend to be substantial, accounting for 25.9% and 24.7% of gas tax revenue in Michigan and Texas respectively.

- Other states divert gas tax revenue to tourism, environmental programs and administrative costs. In total, 22 states divert over 1% of their gas tax revenue.

This policy brief catalogs state gas tax diversions of the 25 states that employ that practice and outlines potential policies that will strengthen the users-pay/users-benefit model of transportation funding.

View And Maintain Your Information

Tax and Revenue Administration is no longer processing phone or email requests for basic account information.

Account owners or their representatives can access most of the information related to their account in Tax and Revenue Administration Client Self-Service portal. TRA Client Self-Service is a secure online system for authorized Tax and Revenue Administration clients to conveniently conduct business with TRA. You can do the following tasks in TRACS:

- file a return / claim

- confirm receipt and completion of submitted returns

- view status of prior assessments, financial details and notices of assessment and reassessment

- access financial information and view account period balances

- update address and contact information

- delegate account access to other employees or authorized individuals

- check installment balances

Recommended Reading: What To Take To Get Taxes Done

What State Has The Highest Gas Tax 2021

California has the highest tax rate on gasoline in the United States. As of January 2021, the gas tax in California amounted to 63 U.S. cents per gallon, compared with a total gas price of 3.38 U.S. dollars per gallon. Meanwhile, Alaska has the lowest gas tax out of all U.S. states, at 14 U.S. cents that same month.

Will The Federal Gas Tax Increase

The short answer? Maybe.

When the federal gas tax was last increased, in August 1993, the average gallon of gasoline cost $1.06 and the first Jurassic Park movie had just hatched in theaters.

While the federal gasoline tax hasnt changed in over 25 years, construction and infrastructure-maintenance costs have greatly increased. State and local officials have estimated the cost of the nations infrastructure needs at $2 trillion.

While the Highway Trust Fund raised $41 billion in 2018, it still hasnt been enough to cover projects in recent years, forcing Congress to transfer money from other sources to cover the shortfall. The HTF may become insolvent by 2021 if nothing is done to patch the gap, according to the Congressional Budget Office.

Fuel efficiency, which has steadily improved since 1975, has contributed to the shortfall.

Adding hybrid and electric cars further reduces gas tax revenues because they either use very little or no gasoline. As a response, some states have started charging a special registration fee for select vehicles to recoup some of the lost gas tax revenue.

The Trump administration has fielded the idea of increasing the federal gas tax, gaining both support and opposition in Washington from Republicans and Democrats. But its still unclear whether an increase will become a reality.

You May Like: How To Amend Tax Return Online

Less Money To Fix Roads

Theodore J. Kury, Director of Energy Studies, Public Utility Research Center, University of Florida

Federal highway maintenance is primarily paid for with gas tax revenues that flow into the Highway Trust Fund. The federal levy of 18.4 cents per gallon, unchanged for almost 30 years, is a major component of these revenues, along with taxes on diesel fuel, gasohol, methanol, liquefied gases and compressed natural gas.

The federal government collects roughly $37 billion to $38 billion per year in revenues from the gas tax. These revenues have remained fairly consistent over the past five years, even through the heart of the pandemic. Other highway-related fines and fees also go into the Highway Trust Fund, but their magnitude is comparatively small.

In 2020, the latest year for which numbers are available, the federal government spent roughly $46 billion on highway projects. This figure does not include the subsidies that the federal government extends to state and local governments to reduce the cost of borrowing for highway projects.

But if the government collected $38 billion in gas taxes, where did the other $8 billion come from? Since most politicians strongly resist raising gas taxes, even to pay for much-needed repairs, the government has turned to less transparent alternatives.

Ultimately, taxpayers pay for everything that the government does. Policymakers simply decide how and when that will happen.

Every Time You Top Off Your Vehicle At The Pump Youre Paying Federal And State Gas Taxes That Are Included In The Price Of Every Gallon Of Gasoline

The federal tax, at 18.4 cents per gallon, is meant to help the federal government pay to build and fix things like highways and bridges. Every state adds its own tax to every gallon sold in the state, too.

However, the federal gas tax has been stuck in neutral since 1993, which is the last time the tax was increased. Heres what you need to know about the federal gas tax and whether it may increase in the near future.

Also Check: How Much Earned Income To File Taxes

Magnitude Of The Funding Problem

With increased vehicle fuel efficiency resulting in less gas tax revenues, increased population and VMT creating more wear and tear on the roads, and declining purchasing power with the value of the dollar worth half of what it was in 1991, CDOT is facing a $25 billion funding gap over the next 25 years.

How Is Transit Funded

Many Agencies Provide a Variety of Transit Services. For the purposes of this page, transit services includes bus, rail, paratransit, vanpool, and ferries. Transit services are provided by over 200 operators in California, including cities, counties, independent special districts, transportation planning agencies, private nonprofit organizations, universities, and tribes.

Transit Funding Comes From Variety of Sources. Transit operators that receive federal funds are required to regularly report their financial information to the federal government, which publishes a national report each federal reporting year . In total, transit services in California were funded at $12 billion in FRY 2018. As shown in Figure 1, this funding came from various sources, including local, federal, and state taxes, as well as from passenger fares and fees.

One-Fifth of Funding Comes From Fares and Fees. Users of transit services pay providers fares to use their services and operators generate additional revenues from users through auxiliary fees, such as for park and ride services, concessions, and advertising. However, these fares and fees only make up a small share of total revenues for transit.

Read Also: Do You Have To Withhold Taxes For Nanny

Where Do My Gas Tax Dollars Go

As a driver, youre supposed to directly benefit from the gas taxes you pay. Federal gas tax revenue is pumped into a Highway Trust Fund. The HTF funds federal and state infrastructure projects for roads, bridges and public transportation systems. State gas taxes go into state-managed funds, and each state decides how to use them.

What Is Motor Fuel Tax Revenue Used For

In 2019, revenues from the transportation fund were over $44 billion.

Depending on the jurisdiction, some of the revenue from gasoline and diesel taxes can only be used for transportation related programs like improving infrastructure. Other jurisdictions allow the revenues to be added to the general fund which is used for a variety of programs.

Meanwhile revenues from aviation fuel and jet fuel taxes mainly fund airport and Air Traffic Control operations by the Federal Aviation Administration .

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Read next:

Recommended Reading: Where To Do Your Taxes

What Does The Gas Tax Pay For

The revenues from the federal gas tax fund the Highway Trust Fund, which then pays for different infrastructure projects, including interstate projects. The Biden administration has put a lot of emphasis on the countrys aging infrastructure and last year it finally got the $1 trillion infrastructure bill passed.

States are set to receive billions of dollars from the federal government for spending on roads and bridges. With the federal gas tax holiday, it remains to be seen if the funding for these projects falls.

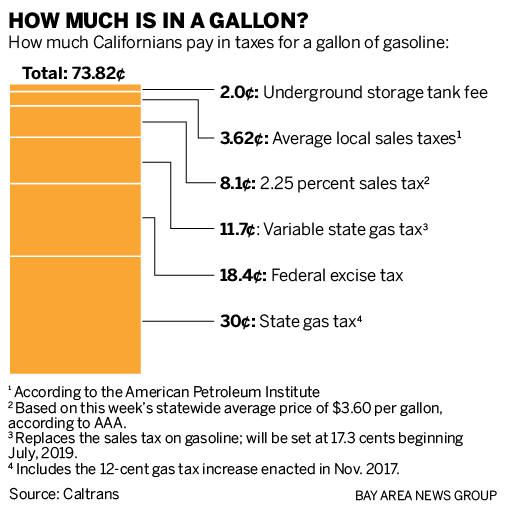

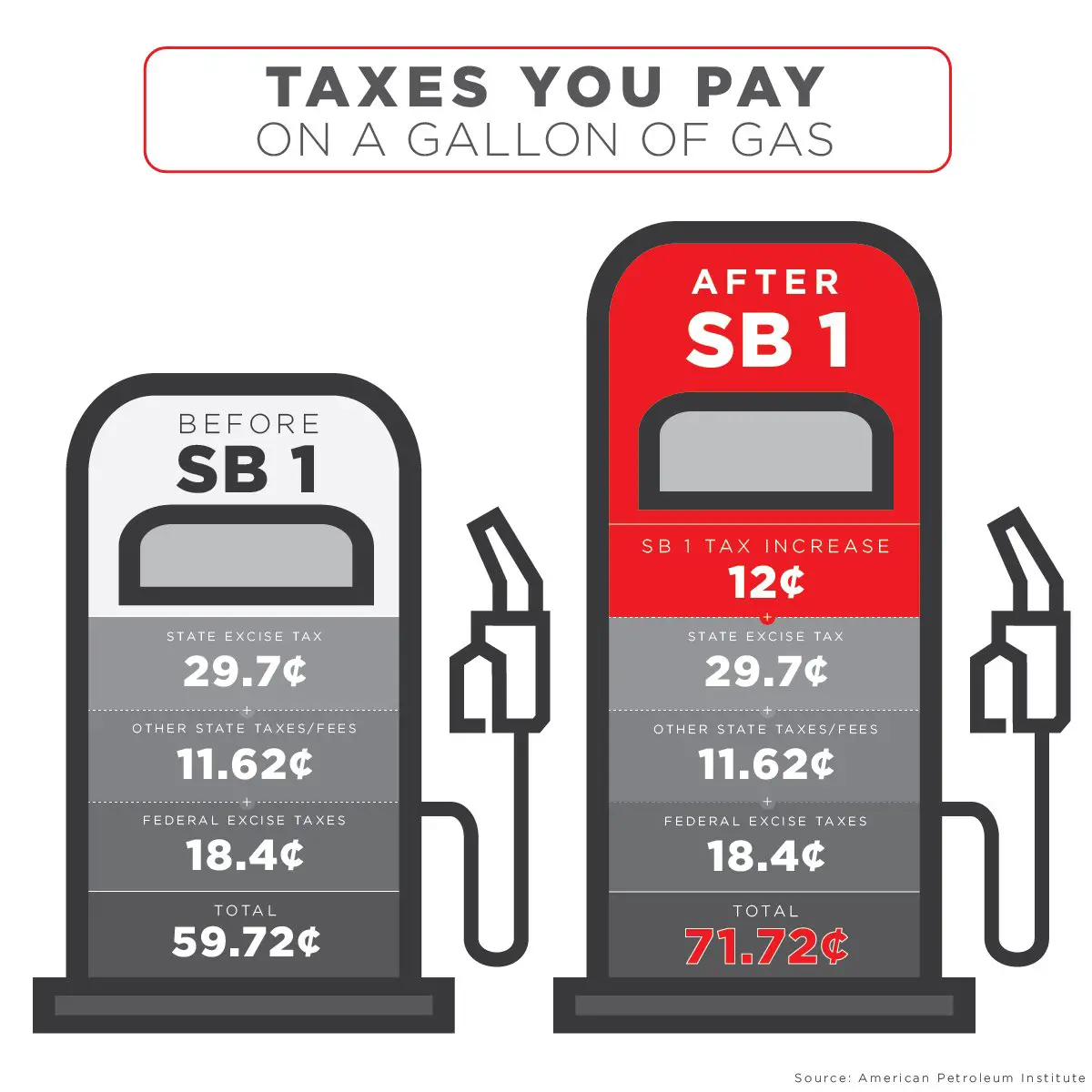

What Taxes Apply To Gasoline In California

Several Different Taxes Affect Gasoline Prices. Many people refer to the gas tax when talking about transportation taxes and fees. Typically, people mean the state excise tax on gasoline because this is the primary source of state funding for highways and roads. However, federal excise taxes and state and local sales taxes also apply to gasoline in California. The figure below shows how much a driver pays for each tax when purchasing a gallon of gasoline costing $5.33 . In this example, the taxes make up about 18 percent of the price, with the state excise tax accounting for over half of all the taxes paid.

As shown in the figure, the specific taxes on gasoline include:

Storage Fees and Other State Policies and Programs Also Affect Gasoline Prices. In addition to the taxes described above, the state levies a fee of 2 cents per gallon on owners of underground storage tanks that contain petroleum. The state also has other programs and regulations that affect gasoline prices. For instance, the states cap-and-trade program affects gasoline prices because it requires fuel suppliers to purchase permits that cover the greenhouse gases emitted when the fuel is burned. We estimate that this currently adds 21 cents per gallon to the price of gasoline. The state also has a low carbon fuel standard program that requires suppliers of high carbon fuels to purchase credits from suppliers of low carbon fuels . We estimate that this currently adds 12 cents per gallon to gasoline prices.

You May Like: How Do Charity Tax Deductions Work

What Is The Meaning Of A Gas Tax Holiday

The gas tax holiday would suspend the tax of 18 cents per gallon of gas and 24 cents per diesel that consumers normally pay at the pump for three months. The federal gas taxes paid by drivers goes towards the Highway Trust Fund, which the administration has said will not be negatively affected by the tax suspension as the deficit is at a low wherein the country can afford the tax holiday.

You May Like: Navy Federal Richmond Hill Ga

Whats At Stake For Biden

A lot. Gas prices and inflation more broadly are among the biggest political liabilities for Democrats heading into Novembers midterm elections.

Biden and his administration have repeatedly blamed Russian President Vladimir Putin and his war on Ukraine for rising gas and energy prices, though experts also cite other factors including high demand, clogged supply chains, rising housing costs and Covid-19 stimulus efforts as reasons behind the surging prices.

A CNN poll published last month found that the economy remains a notably weak spot for the President.

Only 23% rate economic conditions as even somewhat good, down from 37% in December and 54% in April 2021. The last time public perception of the economy was this poor in CNNs polling was November 2011, when 18% called economic conditions good.

Americans also said by nearly 4 to 1 that they were more likely to hear bad news than good news about the economy.

If that doesnt change, Democrats aspirations for November could soon be running on empty.

CNNs Kevin Liptak, Daniella Diaz, Sarah Fortinsky and Lauren Fox contributed to this report.

Read Also: How To Fill Out Tax Forms For Work