How Do Deductions Affect Your Tax Bracket

Tax deductions reduce your taxable income, lowering the amount of income subject to taxes. Generally, deductions lower your tax by your marginal tax rate multiplied by the value of the deduction. For example, if you had a $1,000 tax deduction and are in the 22% marginal tax bracket, youd pay $220 less on your taxes. If you are on the lower edge of a tax bracket, claiming a deduction may get you into a lower one.

What Are Some Other Inflation Adjustments I Should Look Out For

We mentioned earlier that the IRSâs tax brackets apply to your taxable income, which is what you get when you apply certain adjustments and deductions to your revenue.

One other way that the IRS helps guard against bracket creep is by adjusting the values of deductions to keep up with inflation. Here are the main ones you should look out for:

Canada Pension Plan Contributions

If you are 18 years old or older, but younger than 65, you are employed in pensionable employment, and you do not receive a CPP retirement or disability pension, your employer will deduct CPP contributions from your pay.

If you are at least 65 years of age but under 70 and you work while receiving a CPP or QPP retirement pension, your employer will continue to deduct CPP contributions from your pay, unless you elect to stop paying CPP contributions. You cannot elect to stop contributing to the CPP until you are at least 65 years of age. For more information, see Canada Pension Plan contributions for CPP working beneficiaries.

The CPP provides basic benefits when you, a contributor to the plan, become disabled or retires. In the event of your death, the plan provides benefits to your survivors.

Your employer will calculate how much CPP to deduct with approved calculation tools, using the annual CPP contribution rates and maximums.

Your employer remits these deductions to us, along with his or her share of contributions, through payroll remittances.

To get information on the CPP, go to Canada Pension Plan Overview.

Recommended Reading: Can You File Taxes For Unemployment

Federal Income Tax Return Calculator

Estimate how much you’ll owe in federal taxes, using your income, deductions and credits all in just a few steps with our tax calculator.

How we got here

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets:

Single filers

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$157,804.25 plus 37% of the amount over $523,600 |

|

$1,990 plus 12% of the amount over $19,900 |

|

|

$9,328 plus 22% of the amount over $81,050 |

|

|

$29,502 plus 24% of the amount over $172,750 |

|

|

$67,206 plus 32% of the amount over $329,850 |

|

|

$95,686 plus 35% of the amount over $418,850 |

|

|

$168,993.50 plus 37% of the amount over $628,300 |

|

$995 plus 12% of the amount over $9,950 |

|

|

$4,664 plus 22% of the amount over $40,525 |

|

|

$14,751 plus 24% of the amount over $86,375 |

|

|

$33,603 plus 32% of the amount over $164,925 |

|

|

$47,843 plus 35% of the amount over $209,425 |

|

|

$84,496.75 plus 37% of the amount over $314,150 |

Head of household

|

$1,420 plus 12% of the amount over $14,200 |

||

|

$6,220 plus 22% of the amount over $54,200 |

||

|

$13,293 plus 24% of the amount over $86,350 |

||

|

$32,145 plus 32% of the amount over $164,900 |

||

|

$46,385 plus 35% of the amount over $209,400 |

||

|

$523,601 or more |

$156,355 plus 37% of the amount over $523,600 |

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $10,275 he makes then 12% on anything earned from $10,276 to $41,775 then 22% on the rest, up to $80,000 for a total tax bill of $13,214.

Effectively, this filer is paying a tax rate of 16.52% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 12.96% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Don’t Miss: What Do I Do If I Owe Taxes

How Much Tax Will I Get Back

You may or may not get money back after completing and lodging your Australian tax return. Your income tax bracket and rate applicable for the financial year, as well as any tax deductions including those without a receipt plus work-related tax deductions are considered as part of your tax assessment, and whether or not you are eligible for a tax refund.

Roughly three-quarters of Australians are claiming tax deductions worth $37 billion annually, with an average total deduction of $2,576, despite half of all taxpayers claiming less than $674, according to figures reported by the ABC. Australian Bureau of Statistics data shows $552 billion in total taxation revenue was collected in a recent financial year.

Paying Income Tax When You Get Severance Pay As A Salary

In some cases, youll get your severance pay as a salary continuance. This means your regular pay and benefits will continue for a set period after you leave your job. You pay income tax on this type of severance payment like you would on regular employment income.

The usual income tax deductions apply, including:

- CPP or QPP contributions

- RPP contributions

Read Also: How Much Federal Income Tax Do I Pay

Determining The Amount Of Taxes You Should Withhold

If you are newly retired, it can be difficult to figure out how much in taxes to withhold from your pension, because your tax rate depends on your household sources of income and deductions.

When you add up all your sources of income and subtract your deductions, you get your taxable income, which determines your tax bracket. You can use this tax bracket to estimate how much to withhold. When you look at a chart of tax rates, you can see that higher amounts of income will be taxed at higher rates.

Tax planning can help you figure out the right amount to withhold. With tax planning, you put together a “pretend” tax return, called a “tax projection.” As you transition into retirement, you might want to work with a CPA, tax professional, or retirement planner to help you with this.

If you prefer to do it yourself, you can plug numbers into an online 1040 tax calculator to get a rough estimate, or you can fill out your federal tax form as if you were filing taxes. Follow the instructions to see where each source of income goes. Calculate the tax you think you will owe. Divide that by your total income. Use the answer to see what percentage to withhold.

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

Read Also: When Will We Get Our Tax Return

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

How To Pay Your 1099 Taxes

If you think you might owe more than $1,000 in federal income taxes, you should be making payments throughout the year â not just when you file your return. These additional payments are referred to as âquarterlyâ or âestimatedâ tax payments. You pay your quarterly taxes on the 15th day following the end of the quarter. For example, letâs say you expect to owe $2,000 in taxes. You would divide that amount by four and make your quarterly tax payments on the following schedule:

| Quarter |

|---|

| $500 |

We havenât gotten into all the nitty-gritty here â like the forms that are involved in the filing process. If youâre interested in more details, check out our blog post on how to pay self-employment taxes step by step.

Also Check: How To Avoid Capital Gains Tax On Cryptocurrency

What Is Most Profitable

You must check how much tax you would pay in each of the two tax schemes.

To calculate how much tax you would pay under the general tax rules, you can use the tax calculator. To find out which deductions youre entitled to, you can use the deduction wizard.

To calculate how much tax you would pay in the PAYE scheme, you can subtract 25 percent from your salary. If youre exempt from paying national insurance contributions in Norway, you should subtract 17 percent from your salary.

Your General Tax Questions Answered

How can I reduce the amount of tax I pay?

You can reduce your taxable income, and therefore reduce the amount of tax you need to pay, by claiming deductions.

Do I need to declare interest on my savings account if its a small amount?

Yes, youll need to declare any interest earned in a savings account.

When do I need to lodge my tax return?

If you’re doing your tax return yourself online, you need to lodge your tax returns by 31 October. Keep in mind that the financial year ends on the 30 June.

Is prize money taxable?

Winnings from lotteries, game shows and raffles arent taxable, but if you regularly receive winnings from game shows it might be.

Is child support taxable?

You usually dont have to declare child support payments, as someone has already paid tax on this.

Are cash birthday presents taxable?

These are not taxable, although if the amount received was a large amount or was earned in a business-style transaction they might be.

Are overseas pensions taxable?

If youre an Australian resident for tax purposes, youll be taxed on your foreign pensions, annuities, capital gains from overseas properties and more. Australia has a system to avoid double taxation in the event that you get taxed in the country where your income comes from. If youre not an Australian resident, you usually wont need to declare earnings from overseas sources.

Read Also: Can I Pay My Irs Tax Bill In Installments

Scenario : Single And Starting Out

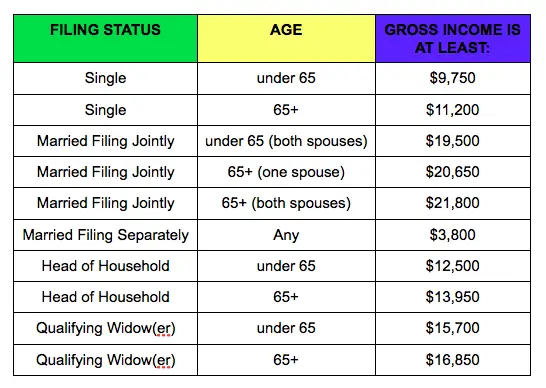

Two factors arguably play the largest role in what your tax liability will be: your filing status and the number of family members you have in your household. In general, the smaller your household is, the more tax you’ll pay for a given income figure.

As an example, take a single person making $50,000 per year. We’ll assume that this person has no children or other dependents and has insufficient itemized deductions to justify not taking the standard deduction. To keep things simple, we’ll also assume that all of this person’s income comes from a regular job with an employer.

In this case, gross income of $50,000 will be reduced by a standard deduction of $6,350 and a single personal exemption of $4,050. That makes taxable income equal to $39,600. That’s just barely enough to push the taxpayer into the 25% tax bracket, and the tax will be $5,638.50. Notice that even though the marginal tax rate is 25%, the effective tax rate over the entire $50,000 in income is just over 11%.

Tax Rates And Tax Brackets

Depending on the amount of income you earn, you will fall within one of five federal tax brackets, and one of the five Ontario tax brackets. Each tax bracket is taxed at a different rate. The system is based on what is called graduated tax rates. This means that if your income increases so that you enter a new tax bracket, only the amount of your income that falls in the higher tax bracket gets taxed at the higher rate. Tax brackets are set by both the federal government and by each province.

Don’t Miss: What To Claim On Taxes

What Is A Personal Allowance

Everyone, including students, has something called a Personal Allowance. This is the amount of money youre allowed to earn each tax year before you start paying Income Tax.

For the 2022/23 tax year, the Personal Allowance is £12,570. If you earn less than this, you usually wont have to pay any income tax.

Your Personal Allowance might be bigger if you claim Marriage Allowance or Blind Persons Allowance. Or it might be smaller if youre a high earner or if you owe tax from a previous tax year.

Check the most up-to-date Personal Allowance figures on the GOV.UK website

What Is The Tax

The tax-free threshold is an amount of money you can earn each financial year without needing to pay tax. According to the Australian Taxation Office the taxfree threshold is $18,200. This means if youre an Australian resident for tax purposes, the first $18,200 of your income each financial year is tax-free and you only pay tax if you earn above this amount.

Don’t Miss: How Much Do You Need To Donate For Tax Deduction

Paying Taxes As A 1099 Worker

As a 1099 earner, youâll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%. Normally, the 15.3% rate is split half-and-half between employers and employees. But since independent contractors donât have separate employers, theyâre on the hook for the full amount. If youâd like more details on why things work this way, check out our beginnerâs guide to self-employment tax.

But for now, think of self-employment tax as those double-pop popsicles. It can be split between two people, but it comes in a single package. Thereâs no way to avoid paying for both sticks even if itâs just you.

Luckily, only your net earnings are subject to self employment taxes. Thatâs your gross income minus your business write-offs.

Estimate Your Income Tax For The Current Year

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year .

This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans.

If youre self-employed, the self-employed ready reckoner tool can help you budget for your tax bill.

You may be able to claim a refund if youve paid too much tax.

You May Like: What Can Be Itemized On Taxes

How Do I Pay Vat

If youre buying goods and services, VAT is usually added into the price before you pay so you dont have to do anything extra. It may be possible to claim back the VAT youve spent if the goods or services youre buying are for your work or business.

If youre self-employed and are selling the goods or services, you add the VAT yourself. You must register for VAT with HMRC if your business VAT taxable turnover is more than £85,000.

- Find out more:self-employed VAT return

General Conclusions About Taxes For Typical American Taxpayers

These two examples won’t fit your situation perfectly, but they illustrate some basic rules that govern taxes for those with incomes of about this size. Married couples get larger standard deductions, and families with children get added personal exemptions and other benefits like child tax credits. The tax brackets that cover joint filers impose much lower taxes than the brackets for single filers. In most cases, however, those making $50,000 will pay only a small percentage of their overall income in taxes.

Obviously, other factors can also apply. The more of your $50,000 comes from tax-favored investment income like long-term capital gains or dividend income, the lower your taxes will be, because the tax rates on those types of income are lower. Some taxpayers will also qualify for credits and deductions other than those listed here.

For the most part, households with incomes of around $50,000 can expect to pay effective tax rates of around 10% or less. That’s good news for those who have to count every dollar in order to make ends meet, and it’s important to take advantage of key tax provisions designed to make the tax system as kind as possible to typical Americans and their families.

The Motley Fool has a disclosure policy.

Also Check: How Do Tax Right Offs Work