How Much Should A Single Person Pay In Federal Taxes

Instead, you pay 10 percent on everything up to $9,700, then 12 percent on the excess up to $39,475, 22 percent on taxable income between $39,475 and $84,200, 24 percent on the amount over $84,200 up to $160,725, 32 percent on the amount over $160,725 up to $204,100, 35 percent on the amount over $204,100 up to

An Example Of How Canadas Federal Income Tax Brackets Work

If your taxable income is less than the $48,535 threshold you pay 15 percent federal tax on all of it. For example, if your taxable income is $30,000, the CRA requires you to pay $4,500 in federal income tax.

However, if your income is $200,000, you face several tax rates. This example shows how much federal tax you will pay on your 2020 taxable income. You need to make a separate calculation for your provincial tax due.

- The first tax bracket $0 to $48,535 is taxed at 15%, plus

- The next tax bracket over $48,535 to $97,069 is taxed at 20.5%, plus

- The following tax bracket over $97,069 to $150,473 is taxed at 26%, plus

- At this point, $150,473 of your income has been taxed. The final bracket on your remaining $49,527 is taxed at 29%.

- If you earn more than $214,368 in taxable income in 2020, the portion over $214,368 is taxed at the federal rate of 33%. This is called the top tax bracket and a common misconception is if your taxable income is in this top bracket, you will be taxed at 33% on your entire income.

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

Also Check: 1040paytax Customer Service

Us Tax Bracket Questions

Want to understand how the changes to the tax brackets affect you? Or learn how you may be able to lower your taxable income? The knowledgeable tax pros at H& R Block can help.

This year, most people will get a Form 1095 to report details about their health insurance. Learn more about Forms 1095-A, B and C at H& R Block.

If You Have More Than One Source Of Income

You pay income tax on all the money you earn each year. If you have another source of income, you may owe more income tax than what your employer deducts from your severance pay.

If you have more than one source of income, try to set aside enough money to pay for any extra income tax you might have to pay if you get a severance payment.

Also Check: Is Plasma Donation Money Taxable

Avoiding The Early Withdrawal Penalty

There are some hardship exceptions to penalty charges for withdrawing money from a traditional IRA or the investment-earnings portion of a Roth IRA before you reach age 59½. Common exceptions for you or your heirs include:

- Qualified education expenses

- Disability of the IRA owner

- Death of the IRA owner

- An Internal Revenue Service levy on the plan

- Unreimbursed medical expenses

- A call to duty of a military reservist

IRS exceptions are a little different for IRAs and 401 plans they even vary a little for different types of IRAs.

You also escape the tax penalty if you make an IRA deposit and change your mind by the extended due date of that year’s tax return. You can withdraw the money without owing the penalty. Of course, that cash will then be added to the year’s taxable income.

The other time you risk a tax penalty for early withdrawal is when you roll over the money from one IRA into another qualified IRA. The safest way to accomplish this is to work with your IRA trustee to arrange a trustee-to-trustee transfer, also called a direct transfer. If you make a mistake trying to roll over the money without the help of a trustee, you could end up owing taxes.

You should not mix Roth IRA funds with the other types of IRAs. If you do, the Roth IRA funds will become taxable.

Some states also levy early withdrawal penalties.

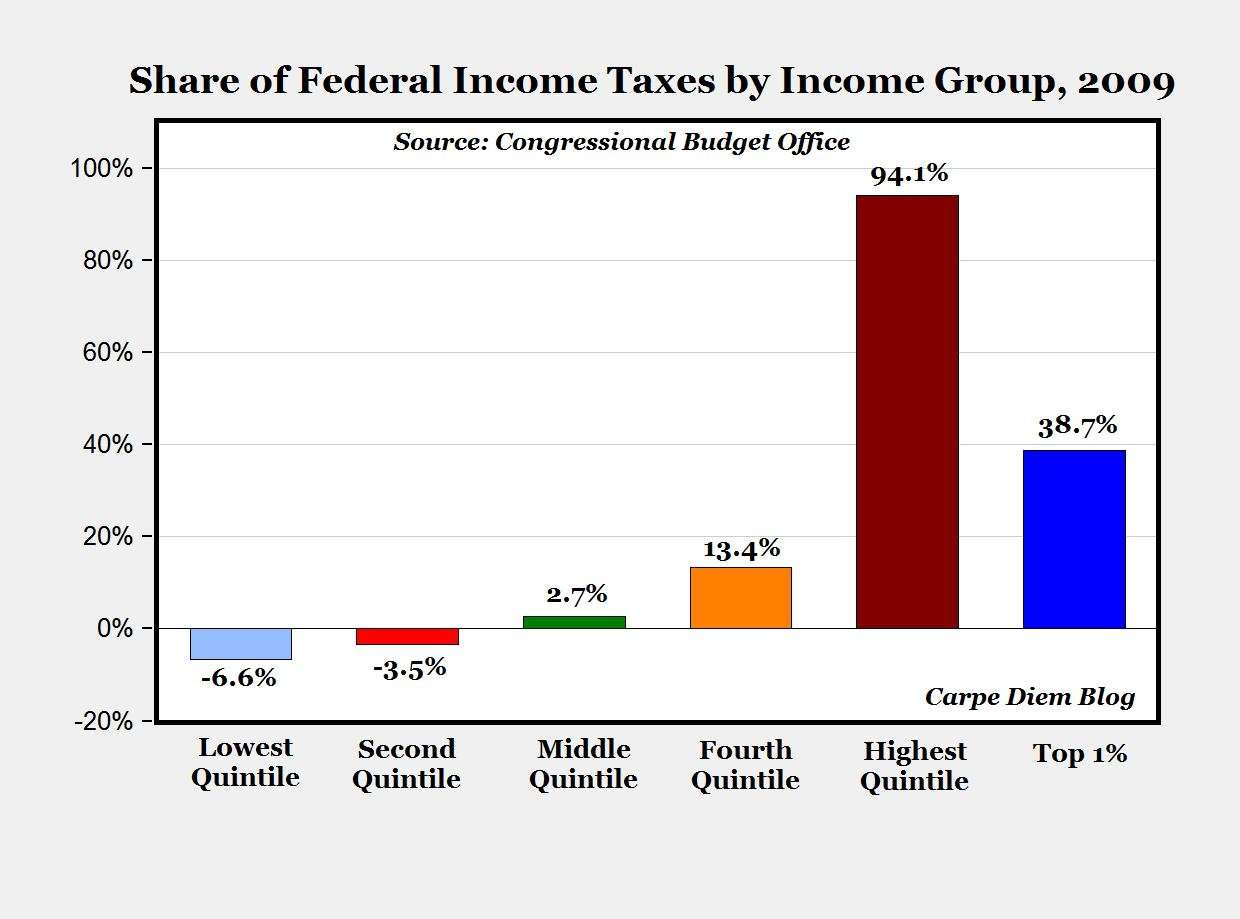

Effective Income Tax Rates

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income. Only the first $118,500 of someone’s income is subject to social insurance taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.

| Effective federal tax rates and average incomes for 2010 |

|---|

| Quintile |

You May Like: Do You Pay Taxes On Plasma Donations

Which Provincial Or Territorial Tax Table Should You Use

Before you decide which tax table to use, you have to determine your employee’s province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located.

To withhold payroll deductions, use the tax table for that province or territory of employment.

If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee’s salary.

For more information and examples, go to Chapter 1, “General Information” in Guide T4001, Employers’ Guide Payroll Deductions and Remittances.

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

Don’t Miss: Tax Preparation License

How Much Does The Average Small Business Pay In Taxes

Small businesses of all types pay an average tax rate of approximately 19.8 percent, according to the Small Business Administration.

Small businesses with one owner pay a 13.3 percent tax rate on average and ones with more than one owner pay 23.6 percent on average. Small business corporations pay an average of 26.9 percent.

Corporations have a higher tax rate on average because they earn more income. This is easy to understand when you consider that over 18 percent of small S corporations earn at least $100,000 net per year while almost 60 percent of small businesses with one owner earn less than $10,000 net.

What Are The Tax Brackets

U.S. income tax rates are divided into seven segments commonly known as tax brackets. All taxpayers pay increasing rates as their income rises through these segments. If youre trying to determine your marginal tax rate or your highest federal tax bracket, youll need to know two things:

- your filing status. That means whether you file as single, married or as head of household.

- your taxable income. Your taxable income does not equal your wages rather its the total of your ordinary income sources minus any adjustments and deductions. Need help determining this number? Find out how to calculate your taxable income.

Don’t Miss: How Much Tax For Doordash

How Youll Be Paid

Your employer will pay your severance pay in one of the following ways:

- as a lump-sum payment

- as a salary continuance, that is, where your regular pay and benefits continue for a limited time after you lose your job

- as deferred payments, that is, where your severance pay is paid to you over several years

In some cases, your employer will let you choose how you get paid.

How your employer pays your severance pay may affect Employment Insurance benefit payments.

Do You Have To Pay Income Tax After Age 80

Seniors dont have to file a return until their income exceeds $13,600. Married filers who are both over 65 do not need to file a joint return unless their income exceeds $26,600. If your sole or primary income source is Social Security or a pension, this may mean you do not have to file a return at all.

Read Also: Protest Taxes Harris County

How To Figure Out Your Tax Bracket

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket. Each bracket has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket is the highest tax ratewhich applies to the top portion of your income.

For example, if you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. However, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase:

- The first $10,275 is taxed at 10%: $1,027.50.

- The next $31,500 is taxed at 12%: $3,780.

- The last $33,225 is taxed at 22% $7,309.50

- The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 .

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

Read Also: Is Donating Plasma Taxable Income

Income Tax In The United States

| This article is part of a series on |

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed , but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

In the United States, the term “payroll tax” usually refers to FICA taxes that are paid to fund Social Security and Medicare, while “income tax” refers to taxes that are paid into state and federal general funds.

Most business expenses are deductible. Individuals may also deduct a personal allowance and certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains are taxable, and capital losses reduce taxable income to the extent of gains . Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

The Bottom Line: As Your Income Grows You May Face A Higher Marginal Tax Rate

How much you pay in federal income taxes each year is based on your taxable income, tax bracket and the marginal tax rate attached to your bracket. You can exert some control over how much you pay in taxes each year by taking advantage of tax credits and deductions. And owning a home is one source of deductions, including mortgage interest and property taxes.

If you are interested in reducing your yearly tax bill, learn more about tax deductions for first-time homeowners.

Read Also: Wheres My Refund Ga.state

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans

Abstract: We estimate the average Federal individual income tax rate paid by Americas 400 wealthiest families, using a relatively comprehensive measure of their income that includes income from unsold stock. We do so using publicly available statistics from the IRS Statistics of Income Division, the Survey of Consumer Finances, and Forbes magazine. In our primary analysis, we estimate an average Federal individual income tax rate of 8.2 percent for the period 2010-2018. We also present sensitivity analyses that yield estimates in the 6-12 percent range. The Presidents proposals mitigate two key contributors to the low estimated rate: preferential tax rates on capital gains and dividend income, and wealthy families ability to avoid paying income tax on capital gains through a provision known as stepped-up basis.

How the wealthy enjoy low income tax: preferred rates on an incomplete measure of income

The wealthy pay low income tax rates, year after year, for two primary reasons. First, much of their income is taxed at preferred rates. In particular, income from dividends and from stock sales is taxed at a maximum of 20 percent , which is much lower than the maximum 37 percent ordinary rate that applies to other income.

Analyzing a more comprehensive measure of income

Preferred tax rates on income from stock sales and from dividends feature prominently in commonly cited tax rates as well as in our analysis.

Primary estimate and sensitivity

Method

Technical Appendix

How To Calculate How Much Youll Owe If Youre Self

Lets talk specifics here. You may think that you have to pay tax on every dollar your business earns, but thats actually not the case. Youre only required to pay income tax on your business earnings after business expenses. Moreover, you can lower your average tax rate and thus your tax bill even more by taking advantage of other personal tax deductions and tax credits, such as claiming some of your RRSP contributions as deductions.

For example:

Lets say youre a self-employed web designer in Ontario and you earned $100,000 in business revenue. Business revenue is the total amount of income your business generated by selling goods and/or services. Business revenue does not include any sales tax collected .

You spent $30,000 on business expenses and operating costs.

That leaves you with $70,000 in business earnings after expenses. Using this free tax calculator, youll find that your average tax rate would be 26.66%, and you should set aside $18,662 to pay your federal and provincial taxes and your CPP premiums.

Now, lets say you also contributed $10,000 to your RRSP which you claim as a tax deduction.

As you can see, your RRSP deduction lowered your average tax rate to 22.42%, thus decreasing your tax bill to only $15,697.

Read Also: Appeal Cook County Taxes

Whats The Difference Between Federal Taxable And Adjusted Gross Income

Adjusted gross income is your gross income minus above-the-line adjustments . These can include certain business expenses, contributions to health savings accounts, educator expenses, student loan interest and other adjustments. After youve calculated your AGI on your Form 1040, you then deduct your standard deduction or itemized deductions, and any qualified business income, to arrive at your taxable income. Thats the amount of income youll have to pay taxes on.

How Do I Calculate Estimated Taxes For My Business

Lots of business owners get caught with tax surprises at startup or when they begin to make a profit. The surprise comes because they don’t realize they must pay estimated taxes on their business income.

Learn how to do a quick general calculation to find out how much you might have to pay in estimated taxes and when you are required to file.

If your business is in Texas or another area where FEMA issued a disaster declaration due to winter storms in 2021, the IRS has extended the filing and payment deadlines for estimated taxes April 15, 2021, to June 15, 2021.

You May Like: Plasma Donation Taxable