Unemployment Benefits And Unemployment Fraud

Are the unemployment benefits I received during 2020 taxable in Massachusetts?

While unemployment is generally taxable income for Massachusetts purposes, see additional questions below about a recent law change providing tax relief for certain unemployment income. If you received unemployment benefits or pandemic unemployment benefits during 2020, you should receive a Form 1099-G, Certain Government Payments, showing the amount of unemployment compensation received. This income must be reported on your 2020 Massachusetts Individual Income Tax return whether you are eligible for a deduction or not.

Does Massachusetts allow a deduction for unemployment income?

As a result of a recent state law change, taxpayers with household income not more than 200% of the federal poverty level may deduct up to $10,200 of unemployment benefits from their taxable income on their 2020 and 2021 tax returns for each eligible individual. Federal law allows a deduction of up to $10,200 if the taxpayers federal adjusted gross income is less than $150,000. Since the Massachusetts income threshold is different from the federal income threshold, some taxpayers may be eligible for a deduction on their federal tax return but not on their Massachusetts tax return. Complete the worksheet to find out if you are eligible for a deduction.

If Ive already filed my 2020 income tax return, should I file an amended return to claim the new deduction?

Donât Miss: How To File Taxes Doordash

State Federal And Local Taxes

Tax Filing

- The deadline for filing 2020 state and federal taxes for individuals is now May 17, 2021.

- Both the federal and state extensions do not apply to estimated tax payments due on April 15, 2021.

This extension will provide taxpayers with additional time to prepare and file tax returns during the pandemic. Filing your taxes electronically with direct deposit is the quickest way to receive your refund.

Golden State Stimulus

The state has launched billions of dollars in emergency relief funding for Californians. Small businesses, individuals and other statewide assistance programs are included to bring relief to our communities that have been hurting.

Individuals and families will receive relief through direct $600 payments. This will include those with incomes below $30,000, as well as those unfairly excluded from previous federal stimulus payments. A total of 5.7 million supplemental stimulus payments for low-income Californians.

Small businesses will also receive immediate relief in a four-fold increase in assistance. They may receive grants up to $25,000. $50 million will be allocated for cultural institutions. The relief also includes tax cuts and waiving various fees for small businesses impacted by COVID.

There will be additional statewide assistance that includes restoration of reductions, CalWORKS eligibility expansion, federal care funds, student assistance, food and diaper banks, and housing support for farmworkers.

How To Free File Your Federal And California Income Tax Returns

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.There are 9 references cited in this article, which can be found at the bottom of the page. This article has been viewed 37,120 times.

As tax season comes around, you will need to find an easy and affordable way to file your federal and state income tax returns. Depending on your income, you may be eligible to use free online services that make filing your federal and state income tax returns simple and affordable. Even if your income is too high to use certain services, you may still be able to file your taxes for free by using online forms and online filing.

Recommended Reading: Do You Pay Taxes On Donating Plasma

Unemployment Stimulus Checks And Free Tax Return Prep: What You Need To Know

The COVID-19 pandemic has impacted every aspect of daily life, and taxes are no different. This year’s tax filing season starts Fridayâtwo weeks later than usualâand will bring some changes to the way taxes are filed.

“What’s crazy is the tax code did change, I guess quite a bit this year, but really what happened was our lives changed so much that even the parts of the tax code that didn’t change, we are just experiencing them differently because we are experiencing life differently. We’re working differently,” said Nathan Rigney, principal research tax analyst at H& R Block.

Here’s what you need to know before preparing your taxes.

How To Determine California State Residency As An Expat

California explains residency as the place where you have the closest connections. The state looks at various factors to determine state residency, some of which may surprise you.

If you want to make sure the state of California no longer considers you a resident, you should be careful to read their list of residency factors:

- Amount of time you spend in California versus amount of time you spend outside California

- Location of your spouse/RDP and children

- Location of your principal residence

- State that issued your drivers license

- State where your vehicles are registered

- State in which you maintain your professional licenses

- State in which you are registered to vote

- Location of the banks where you maintain accounts

- The origination point of your financial transactions

- Location of your medical professionals and other healthcare providers , accountants, and attorneys

- Location of your social ties, such as your place of worship, professional associations, or social and country clubs of which you are a member

- Location of your real estate property and investments

- Permanence of your work assignments in California

Recommended Reading: Efstatus.taxact 2013

How Can I Get Free Tax Return Prep Assistance

Several free tax preparation programs exist that can assist those who are eligible. This year, some will offer COVID-friendly filing options, including contactless drop-off, virtual, and online filing. These are just a few:

Volunteer Income Tax Assistance and Tax Counseling for the Elderly

For more than 50 years, the IRS’s VITA program has offered free tax return preparation assistance to those who make $57,000 or less, persons with disabilities, and limited English-speaking taxpayers. The TCE program focuses on helping those who are 60 years of age and older and specializes in pensions and retirement-related issues that affect the elderly.

Note that while the IRS manages the program, IRS-certified volunteers are the ones who help people with tax returns. To find the nearest location and check whether an appointment is required, visit their website.

Did you know that you donât need to pay someone to help you file your taxes if you earn less than $57,000 a year?The IRS provides free, safe and trustworthy tax prep right in our community! Find a location near you at .

â L.A. County Center for Financial Empowerment

Free Tax Prep L.A.

On January 27, Mayor Eric Garcetti launched the Free Tax Prep L.A. 2021 campaign to make working-class families aware that they may qualify to get their taxes prepared for free. Those who made less than $57,000 in 2020 are eligible.

OC Free Tax Prep

What If I Suspect Unemployment Fraud

If you received a 1099-G form showing unemployment benefits were dispersed to you, but you didn’t receive the money, Rigney suggests reaching out to the Employment Development Department for a corrected form.

“You don’t know when they’ll be able to issue that, and you’re going to have to go through some effort to get the corrected 1099-G,” he said, adding you should still file taxes.

The IRS has said filers should not include the fraudulent income in their federal return, Rigney said. As for the state return, he said they’re still waiting on guidance.

Read Also: Is Doordash Contract Work

Who Is Considered Resident Or Nonresident For Federal Tax Purposes

Generally, most international students & scholars who are on F, J, M or Q visas are considered nonresidents for tax purposes. International students on J-1 & F-1 visas are automatically considered nonresident for their first five calendar years in the US, whilst Scholars/Researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the US. If youve been in the US for longer than the five or two year periods, the IRS Substantial Presence Test will determine your tax residency.

How Much Should You Get Paid For Unused Sick Or Vacation Days

Federal law doesn’t provide guidelines for paid vacation or sick leave.

President Barack Obama did sign an executive order that made it mandatory for contractors who work with the federal government to provide their employees with up to seven days of paid sick leave annually.

However, the executive order does not give any direction on how much an employer should pay a terminated employee for vacation or sick leave.

Below we’ve listed the states that do and don’t pay for unused sick or vacation days, as per HR software provider Paycor.

Alabama: Not addressed by state law

Alaska: Not addressed by state law

Arizona: An employers policy or employee contract governs whether earned, unused vacation is paid on separation.

Arkansas: An employers policy or employee contract governs whether earned, unused vacation is paid on separation.

California: Employees cannot be deprived of earned, unused vacation time, no matter the reason for separation unless a willful agreement has been met by both parties.

Colorado: Upon employment separation, all vacation pay must be accurately paid and delivered to the appropriate parties.

Connecticut: An employers policy or employee contract governs whether earned, unused vacation is paid on separation.

Delaware: An employers policy or employee contract governs whether earned, unused vacation is paid on separation.

If they do, the value of the accrued time must be paid within 30 days of separation.

Florida: Not addressed by state law

Recommended Reading: Are Raffles Tax Deductible

Business Taxes Are Not An Allowable Use Of Ppp Funds

The latest round of coronavirus relief also gives business owners more flexibility with how they spend PPP funds. Newly covered costs include protective equipment, property damage and business software.

Business taxes arent part of that expanded list. So if you use your PPP loan to pay your business taxes, that amount wont be forgiven.

Where Do I Mail My California Amended Tax Return

4.6/5amended returnmailTaxCATaxCAanswer here

Mail your federal return to the Internal Revenue Service Center listed for the state that you live in. *Please Note: There is no street address. The zip code indicated in the chart below is exclusive to the corresponding IRS processing center. The zip code will identify it as going to the IRS.

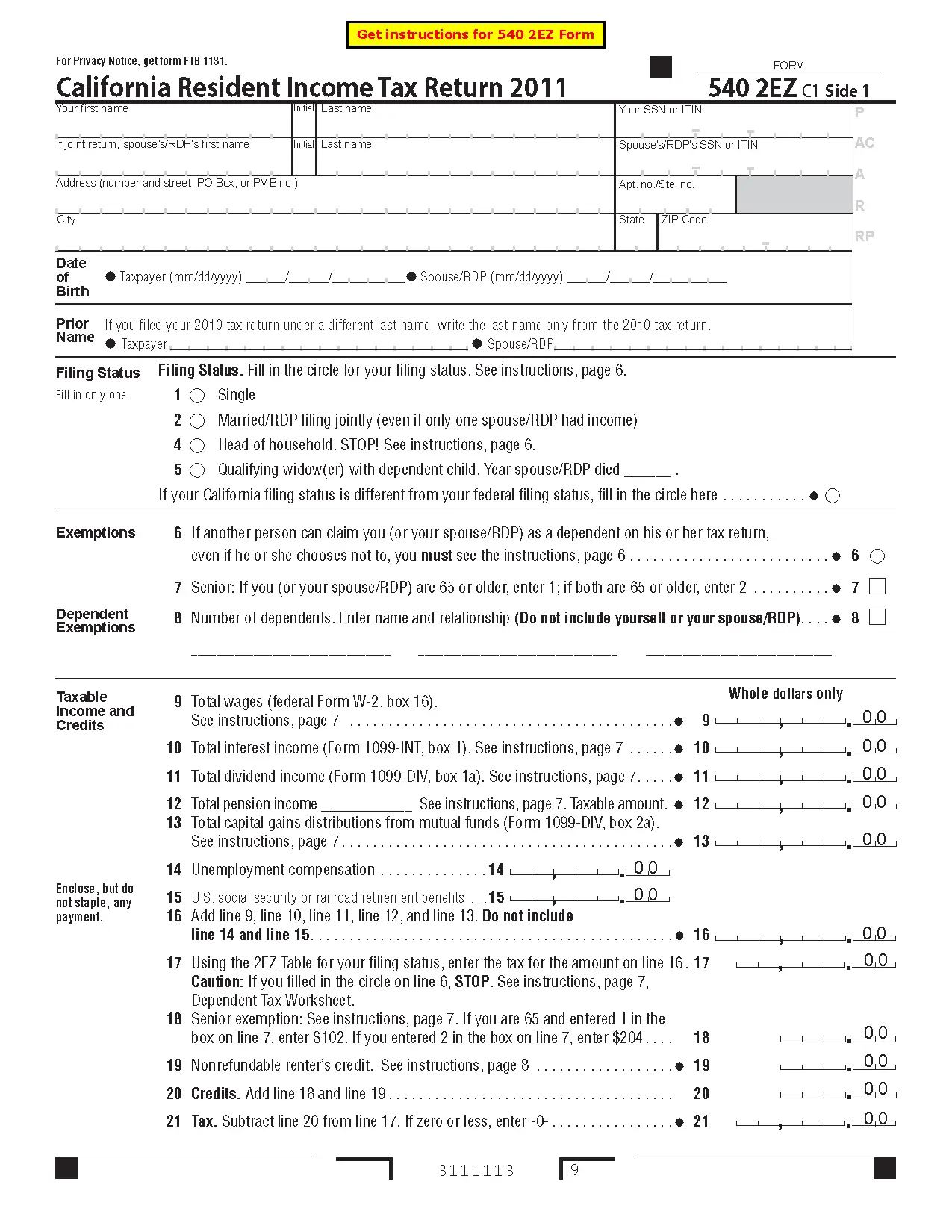

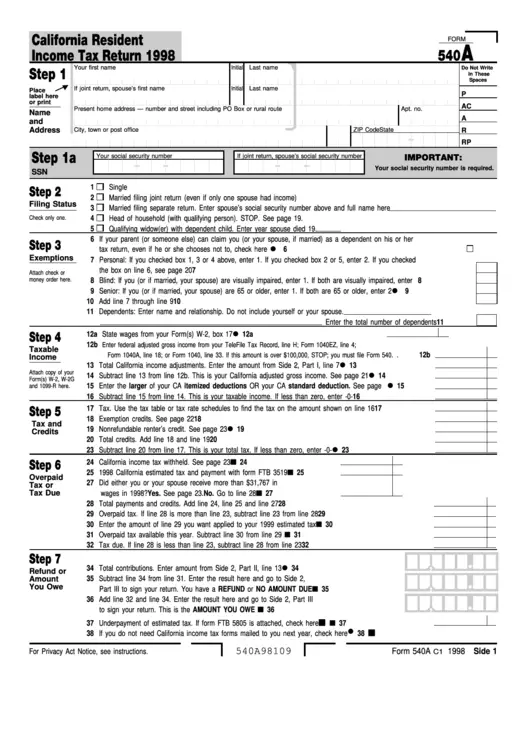

One may also ask, how do I file an amended California tax return? Need to change or amend an accepted California State Income Tax Return for the current or previous Tax Year? Simply complete Form 540 or Form 540NR and Schedule X .

Considering this, where do you mail your California state tax return?

You can complete and mail these forms to the Franchise Tax Board, PO Box 942840, Sacramento, CA 94240-0001, if no balance is due or you’re owed a refund. If you’re filing with a payment, mail it to PO Box 942867, Sacramento, CA 94267-0001.

What do I mail with 1040x?

When mailing my 1040X amended return, do I need to mail my original 1040 with it?

Recommended Reading: Efstatus Taxact Com Login

What Is The Mailing Address To Send My Federal Tax Return Refund In California

Where you mail your Federal tax return will depend on the type of Form 1040 filed and whether you are expecting a refund or if you owe federal taxes. Here is an IRS.gov link where California tax filers can verify the appropriate mailing address .

Ppp Loan Forgiveness Is Included As Book Income

UltraTax CS reports this amount:

- On the Schedule M-1 as income on books not on return.

- For an S Corporation, the amount is treated as other exempt income.

- On Schedule K, line 16b

- On Schedule K-1, Box 16B

- On the Shareholders Basis Worksheet, Page 1, Line 7.

As of 2/18/21, the IRS has not provided guidance on the tax consequence of the PPP loan forgiveness and the S Corporation Schedule M-2. UltraTax CS reports the PPP loan forgiveness as an increase to the Other Adjustments Account by default. If you want, you can enter code O for OOA or A for AAA in the PPP loan forgiveness / Schedule M-2 code drop-down field in Screen Ms to report the PPP loan forgiveness as an increase to the Accumulated Adjustments Account.

Donât Miss: Can Property Taxes Be Deducted From Income Tax

Don’t Miss: 1040paytax.com Official Site

How To Avoid Paying California Taxes As An American Living Abroad

To avoid paying taxes in California after moving overseas, youll need to prove that you are no longer a resident.

Remember, the burden of proof is on you. Your tax records should include evidence that you severed enough of your strongest California ties on this list to prove you are a non-resident of California.

If you have not severed all your California ties, be prepared to defend your position. They may want to use any of your California connections to require you to file a return as a California resident, subjecting you to California tax on your worldwide income.

Refunds In Progress For Affected 2020 Minnesota Returns

We have started the process of adjusting 2020 Minnesota tax returns affected by law changes to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness. For details, read our .

Weâll begin adjusting more than 540,000 Individual Income Tax returns and issuing refunds on September 13 to taxpayers affected by the UI changes. Weâre also adjusting and issuing refunds on more than 2,000 business tax returns affected by the PPP changes.

These tax law changes were enacted July 1, 2021, along with other retroactive provisions affecting tax years 2017 to 2020. We have updated 2020 Minnesota tax forms and instructions we continue to review those for tax years 2017, 2018, and 2019.

Note: When filing or amending a Minnesota return, be sure to use the most current forms or update your tax software.

You May Like: Payable Doordash 1099

The California Standard Deduction

The California standard deduction is markedly less than what’s offered by the IRS. As of the 2020 tax yearthe return you’d file in 2021the state-level standard deductions are:

- $4,601 for single taxpayers, as well as married and registered domestic partner taxpayers who file separate returns

- $9,202 for married and RDP taxpayers who file jointly, as well as heads of household and qualifying widows

The 2020 standard deductions at the federal level are $12,400 for single taxpayers and married taxpayers filing separately, $18,650 for heads of household, and $24,800 for married taxpayers filing joint returns and qualifying widows.

Assistance With Filing Your Return

-

Volunteer Income Tax Assistance and Tax Counseling for the Elderly – Search by city or county for best results.

-

Tax Aid provides free high-quality tax return preparation for Bay Area families.

-

Earn it! Keep it! Save it! List of Bay Area counties that offer tax help, courtesy of the United Way.

- Free Tax Help: File your taxes for free online and by phone.

-

If you believe a federal tax issue cannot be resolved online or over the phone, call the Taxpayer Assistance Center at 1-844-545-5640.Or find a TAC near you. Assistance at the TAC requires an appointment.

You May Like: Protest Property Taxes In Harris County

Expenses Deducted Under A Forgiven Ppp Loan

For N.C. income tax purposes, any expenses paid using the proceeds of the forgiven PPP loan that are otherwise deductible at the federal level are not deductible when calculating N.C. taxable income. Taxpayers must make a North Carolina addition for the amount of expenses deducted on the federal return if the expenses were paid with proceeds from a PPP loan, the loan is subsequently forgiven, and the income associated with the PPP loan forgiveness is excluded from federal gross income.

A taxpayer that received a covered loan guaranteed under the PPP and paid or incurred certain otherwise deductible expenses listed in section 1106 of the CARES Act may not deduct those expenses for N.C. income tax purposes in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year.

Also Check: Do Nonprofits Pay Payroll Taxes

Deductibility Of Business Expenses Funded By Ppp Loans

Editor: Kevin D. Anderson, CPA, J.D.

Paycheck Protection Program loans are eligible for forgiveness if the business uses the funds to pay for eligible items such as payroll, certain employee health care costs, interest on mortgage obligations, rent, and utility expenditures. Provided the applicable requirements are met, a borrower of a PPP loan can apply to the lender for all or a portion of the loan to be forgiven. One important issue is whether expenses paid for with PPP loans can be deducted as business expenses. This item traces the history of IRS guidance and, ultimately, congressional legislation on that topic.

IRS position on deductibility

When the PPP was created by the Coronavirus Aid, Relief, and Economic Security Act, P.L. 116-136, it appeared Congressâs intent was that any amount of a PPP loan that was forgiven would not be considered cancellation-of-debt income to the borrower ). However, because this section of the CARES Act is an âoff-Codeâ provision, Sec. 61 and Sec. 108 are not applicable as they relate to taxation of the forgiveness. As a result, the IRS took the position that otherwise deductible expenses that were paid with loan proceeds that were ultimately forgiven should be nondeductible, despite Congressâs apparent intent.

Congress intervenes

Observation

EditorNotes

Kevin D. Anderson, CPA, J.D., is a managing director, National Tax Office, with BDO USA LLP in Washington, D.C.

Donât Miss: How To Keep Receipts For Taxes

Also Check: Irs Forgot Ein