Court Permanently Bars Louisiana Woman From Working As Tax Preparercontinue Reading

|

BATON ROUGE A state court has permanently barred a Metairie woman from working as a tax preparer in Louisiana. Judge Shayna Beevers Morvant, of the 24th Judicial District Court in Jefferson Parish, signed the order barring Brischea Bowman Johnson from preparing, filing, or assisting with the preparation or filing of any Louisiana state tax returns but her own. Johnson was arrested in 2020 after a joint investigation between the Louisiana Department of Revenue Criminal Investigations Division and the state Attorney Generals office determined that she had submitted false tax returns for several of her clients, including fraudulent claims for deductions for charitable contributions and business expenses. After Johnson pled guilty to filing false public records, litigators with the Department of Revenue brought a civil case against her to bar her from working as a tax preparer in Louisiana. Johnson is the seventh person barred from working as a tax preparer in the state since Act 526 of the 2018 Regular Session of the Louisiana Legislature authorized the Department of Revenue to file lawsuits against preparers who commit fraud. |

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Read Also: What Does It Mean To Grieve Taxes

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Where’s My Income Tax Refund 2019 Chart Shows Expected Refund Dates

With the government shutdown over and the IRS back in business, it’s time to do your taxes. If you’re one of the millions of Americans who can’t wait to get your hands on your refund, we can tell you how soon you will probably get that refund.

The tax reform law officially kicked in on January 1, 2018, but the taxes you file from January through April 15, 2019 will be the first time most Americans see the actual impact of the tax reform law. See the chart below for an estimated date.

Read Also: Plasma Donation Taxable Income

The Irs Workload Is Up By Close To 20 Percent Despite Budget Cuts

Because of efforts led by Republicans primarily during the Obama administration, the IRSs budget has been cut by roughly 20 percent, when adjusted for inflation, from its level in 2010. That has corresponded with a roughly 17 percent cut in the size of the agencys staff. Treasury officials also reported Monday that the IRS has the smallest number of auditors since World War II.

But the agencys budget cuts have come as its responsibilities have multiplied. The taxpayer advocate reports that the IRS helped roughly 19 percent more individual taxpayers in the same period in which its budget fell by 20 percent.

This imbalance has left the IRS without enough resources to meet taxpayer needs, let alone to invest in additional personnel and technology, the report states.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

Also Check: How Do You Report Plasma Donations On Taxes

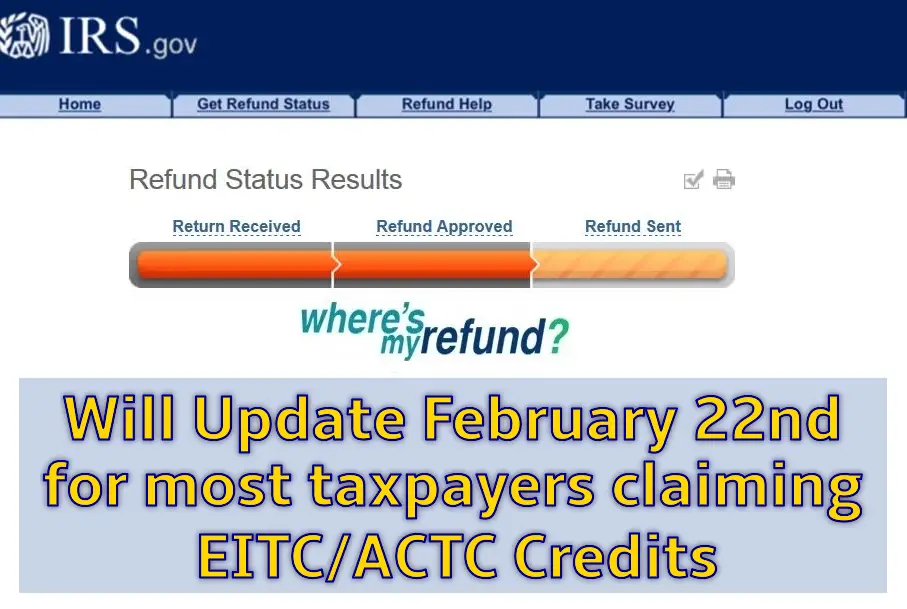

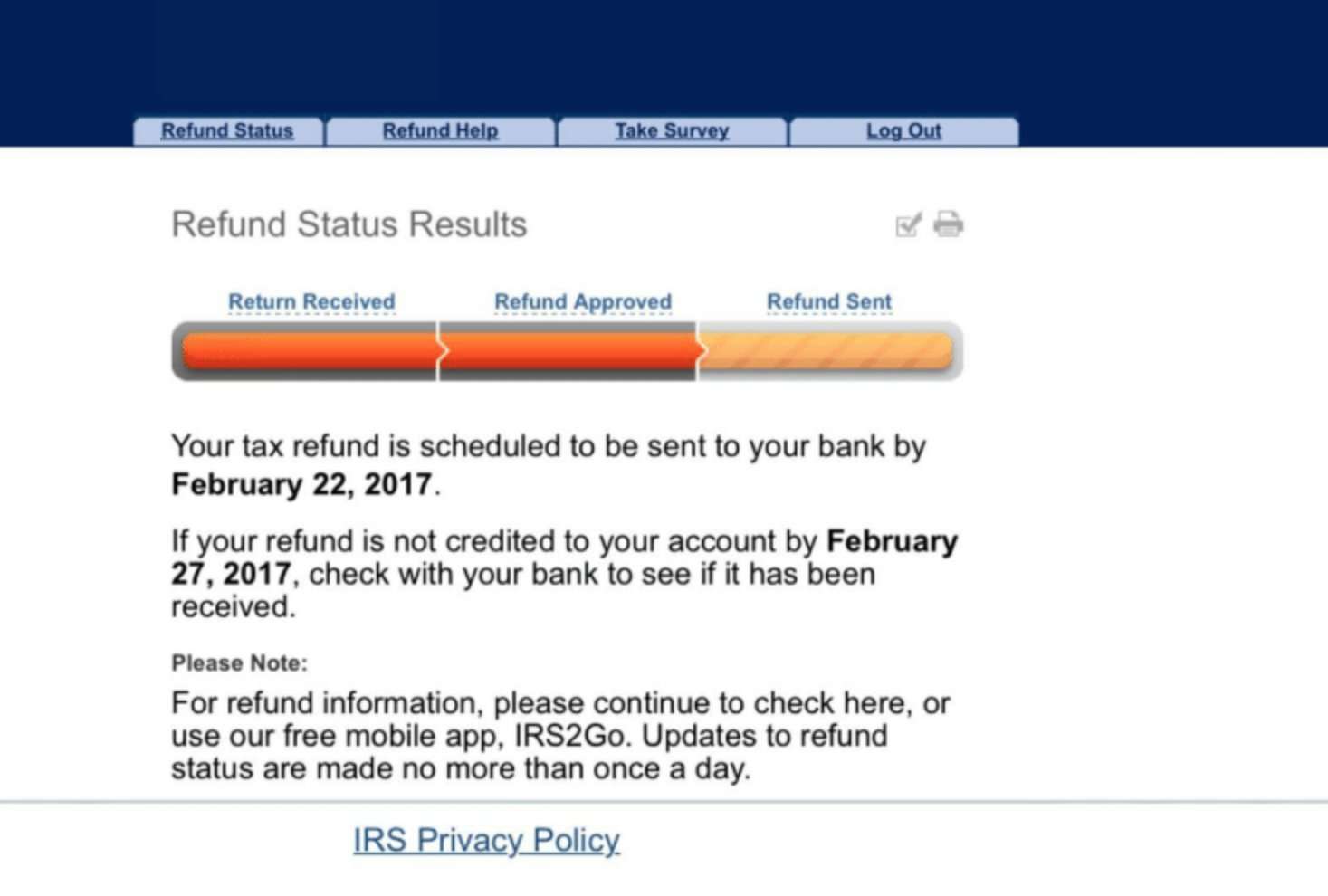

How Do I Use The Where’s My Refund Tool To Check The Status Of My Tax Refund

To check the status of your 2020 income tax refund using the IRS tracker tools, you’ll need to give some information: your Social Security number or Individual Taxpayer Identification Number, filing status — single, married or head of household — and your refund amount in whole dollars . Also, make sure it’s been at least 24 hours before you start tracking your refund.

Using the IRS tool Where’s My Refund, go to the Get Refund Status page, enter your SSN or ITIN, filing status and exact refund amount, then press Submit. If you entered your information correctly, you’ll be taken to a page that shows your refund status. If not, you may be asked to verify your personal tax data and try again. If all the information looks correct, you’ll need to enter the date you filed your taxes, along with whether you filed electronically or on paper.

The IRS also has a mobile app called IRS2Go that checks your tax refund status — it’s available in English and Spanish. You’ll be able to see if your return has been received, approved and sent. In order to log in, you’ll need some information — your Social Security number, filing status and expected refund amount. The IRS updates the data in this tool overnight, so if you don’t see a status change after 24 hours or more, check back the following day. Once your return and refund are approved, you’ll receive a personalized date by which to expect your money.

You can check on your refund through the IRS2Go mobile app.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

You May Like: How To Find Employers Ein

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Recommended Reading: 1040paytax.com

Are You Entitled To Receive Interest On Your Refund

Yes, the Canada Revenue Agency will pay you compound daily interest on your tax refund. The CRA will start paying refund interest on the latest of the following 3 dates:

- the date of the overpayment

- the 120th day after the end of the tax year if the return for the year is filed on time

- the 30th day after the date the return was filed if it is filed late

Louisiana State Income Tax Filing Begins Jan 24 2022continue Reading

BATON ROUGE The Louisiana Department of Revenue will begin accepting 2021 state individual income tax returns on Jan. 24, 2022. The date coincides with the date the IRS begins accepting 2021 federal income tax returns.

On Jan. 24, taxpayers can begin filing their state income tax returns electronically through Louisiana File Online, the states free web portal for individual tax filers. Louisiana File Online allows taxpayers to:

· File returns and pay taxes electronically

· Check the status of individual income tax refunds

· Amend current and prior-year tax returns

· Request a filing extension

Taxpayers may also submit their returns using commercially available tax preparation software, or with printed state returns available on the LDR website at www.revenue.louisiana.gov/Forms.

For returns submitted electronically, taxpayers due refunds can expect them within 45 days of the filing date. For paper returns, the refund processing time is 14 weeks.

Taxpayers can minimize delays in receiving their refunds by updating their contact information with LDR. If you have moved or changed your name since your last tax filing, update your contact information at www.revenue.louisiana.gov/AddressChange.

The deadline for filing 2021 Louisiana Individual income tax returns is Monday, May 16, 2022.

State income tax changes for 2022 and beyond

Act 395 of the 2021 Regular Session of the Louisiana Legislature made the following changes to Louisianas individual income tax rates:

|

Tax Bracket |

Recommended Reading: 1099 Nec Doordash

How To Track Your Federal Tax Refund If It Hasn’t Arrived Yet

If you just filed recently, you should know your federal tax refund check could take up to 120 days to arrive. Here’s what else we found.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

Whether you’ve already filed your taxes or you’re planning to do so by the final due date — that’s Oct. 15 if you file a tax extension — you’ll need to know how to track your refund. Be aware that the IRS is still facing a backlog of unprocessed individual returns, 2020 returns with errors and amended returns that require corrections or special handling. And while refunds typically take around 21 days to process, the IRS says delays could be up to 120 days.

The tax agency is also juggling stimulus checks, child tax credit payment problems and refunds for tax overpayment on unemployment benefits. The money could give families some financial relief but an overdue tax refund could also be a big help. If you don’t file your 2020 tax return soon, you’ll likely owe late fees or more interest — and you could be missing out on your tax refund, stimulus checks or child tax credit payments, which you may only be eligible for with your 2020 tax return.

Wheres My State Tax Refund Wisconsin

Wisconsins Department of Revenue has an online tool, called Refund 123, that allows you to see the status of your tax refund. To use the tool, enter your SSN, the tax year and the amount of your return in whole dollars.

Refunds for taxpayers who filed electronically are typically issued within three weeks. Paper returns will take longer to process. The states fraud and error safeguards may also delay the processing of your return up to 12 weeks.

Read Also: Doordash Tax Percentage

I See An Irs Treas 310 Transaction On My Bank Statement What Is It

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed for the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of an electronic payment . This would also apply to those receiving an automatic adjustment on their tax return or a refund due to March legislation on tax-free unemployment benefits. You may also see TAX REF in the description field for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that means the money is for a monthly advance payment for the enhanced child tax credit.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Why Havent You Received Your Refund

The CRA may keep some or all of your refund if you:

- owe or are about to owe a balance

- have a garnishment order under the Family Orders and Agreements Enforcement Assistance Act

- have certain other outstanding federal, provincial, or territorial government debts, such as student loans, employment insurance and social assistance benefit overpayments, immigration loans, and training allowance overpayments

- have any outstanding GST/HST returns from a sole proprietorship or partnership

- have a refund of $2 or less

Don’t Miss: Wheres My Refund Ga.state

What Edition Of Turbotax Is Right For Me

Answer a few simple questions on our product recommender and we can help guide you to the right edition that will reflect your individual circumstances.

You can always start your return in TurboTax Free, and if you feel the need for additional assistance, you can upgrade to any of our paid editions or get live help from an expert with our Assist & Review or Full Service. But dont worry, while using the online version of the software when you choose to upgrade, your information is instantly carried over so you can pick up right where you left off.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Recommended Reading: Pastyeartax

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

Recommended Reading: How To Protest Property Tax Harris County

What Can Cause A Delay In My Michigan Refund

A number of things can cause a delay in your Michigan refund, including the following:

- If the department needs to verify information reported on your return or request additional information, the process will take longer.

- Math errors in your return or other adjustments.

- You used more than one form type to complete your return.

- Your return was missing information or incomplete.