How To Calculate Fica Payroll Tax

Social Security withholding

To calculate Social Security withholding, multiply your employeeâs gross pay for the current pay period by the current Social Security tax rate .

This is the amount you will deduct from your employeeâs paycheck and remit along with your payroll taxes.

Example Social Security withholding calculation:

$5,000 x .062 = $310

Medicare withholding

To calculate Medicare withholding, multiply your employeeâs gross pay by the current Medicare tax rate .

Example Medicare withholding calculation:

$5,000 x .0145 = $72.50 (Medicare tax to be deducted from employeeâs paycheck

Employer matching

As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

But Wait What About Withholdings

Whenever you find yourself asking, âhow do I pay taxes for my employees,â youâll be dealing with tax withholdings. Itâs important to note that when beginning to figure out employeesâ taxes, paycheck withholdings are different than the money you deduct from employees for payroll tax.

Payroll FICA taxes are employee and employer-paid taxes. In other words, half will be paid by you as the employer, and the other half will be paid by the employee.

Withholdings, on the other hand, are an employeeâs income tax. Employees are solely responsible for paying it. However, as the employer, youâre the one withholding it each paycheck. This amount will be determined by an employeeâs W-4 form, and you will submit it to the IRS.

How To Calculate Self

Are you a solopreneur with no employees? Alas, you still have to pay FICA taxes, including matching the employer contribution . Currently, the self-employed FICA tax rate is 15.3% of your net income. And like any other employee, you’ll also pay state and federal income taxes. Make sure to calculate and remit those taxes quarterly to avoid any unpleasant surprises come tax season.

Recommended Reading: Www.1040paytax.com

How To Calculate Payroll Taxes For Your Small Business

If you have employees, youre responsible for accurately calculating and paying payroll taxes. Check out our guide to get started.

We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

Of all the taxes business owners must pay, payroll taxes can be the most vexing. If you think paying your employees is confusing, just wait until you have to calculate payroll taxes.

While you can find plenty of payroll services eager to take this task off your hands, even if you do turn payroll over to payroll software or a service provider, you should still know how to calculate payroll taxes.

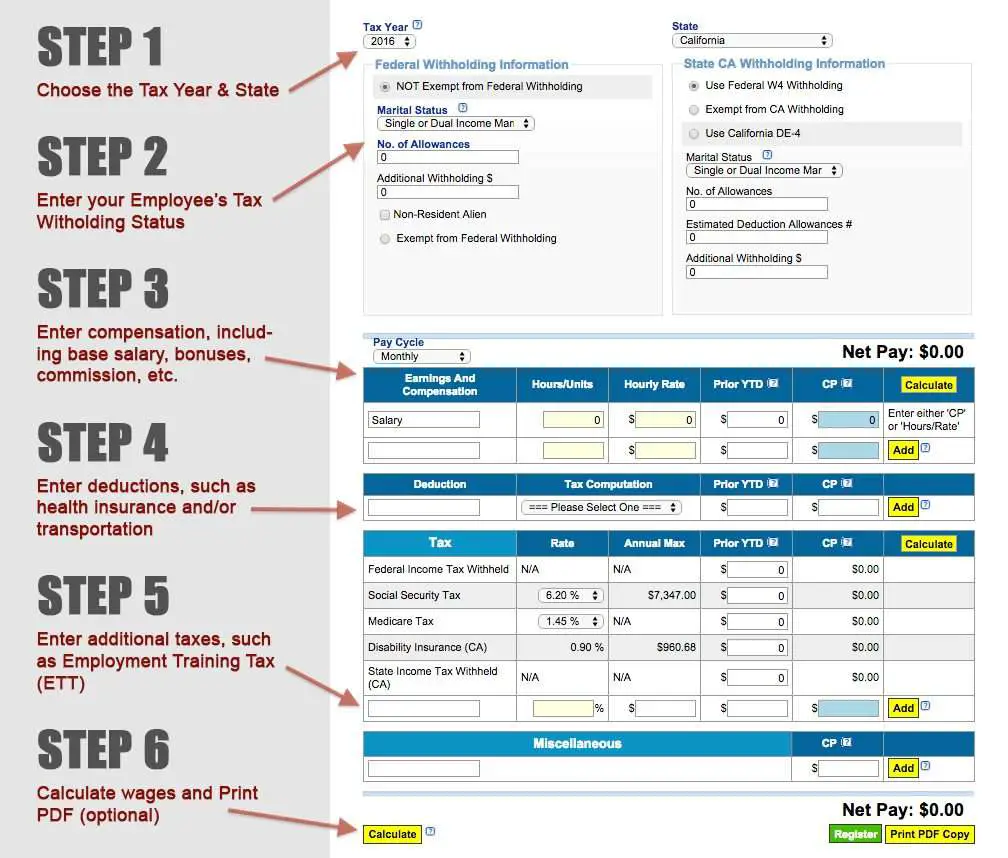

Input Any Additional Pay The Employee Receives

If the employee is salaried, you will only see two fields: bonus and commission. Fill in those amounts, if applicable.

If the employee is hourly, you should see four fields: overtime worked, bonus, commission, and salary. This is your opportunity to add in any additional pay they should receive this pay period. If the employee earned overtime, input in the number of overtime hours they worked. One thing to keep in mind for California employees is that this calculator does not account for double-time pay. The tool calculates overtime pay using time and a half.

Also Check: Irs Employee Search

How To Calculate Payroll: The Basics

Before calculating payroll, you need to know how much and how often you pay your employees.

For hourly employees, multiply the total hourly rate by the number of hours worked for the pay period. If the employee works overtime and is nonexempt, multiply the hourly rate by 1.5 to get the overtime rate. Then, multiply the overtime rate by the number of hours the employee worked over 40 in the week. Add the employees total regular wages and overtime together .

If your employee is salaried, determine their annual wages and divide it by the number of pay periods in the year . The amount is the employees gross wages for the pay period. For example, if an employee makes $40,000 annually and is paid biweekly, divide their annual wages by 26 to get their total gross pay for the period .

Generally, there are a few taxes you need to calculate to process payroll correctly, including:

- State income tax , if applicable

- Local income tax, if applicable

In some states , you may need to calculate state unemployment taxes for your employees. Additionally, some states have state-specific taxes employees and/or employers may need to pay .

Additional Medicare Tax Withholding

The employee tax rate for additional Medicare taxis an employee only tax that begins when wagespaid to an employee exceed a certain amount.

Both the tax rate and the wage threshold are detailedin IRS Publication 15.

As an employer you are responsiblefor withholding additional Medicare tax when an employeemeets this threshold,but you do not have an employer matching share to pay.

Read Also: Doordash Payable Account

Think Out Of The Box: Outsource Your Payroll Tax

The above is the most comprehensive way to understand how to calculate the payroll taxes under each Act. Having said that, if you are still finding payroll to be a hard nut to crack, you can always outsource this function to a payroll management service provider. Monily has helped thousands of businesses over the years manage their payrolls conveniently and has guided them on how to calculate the payroll taxes. Our accounting experts and financial advisors do the nitpicky and pesky calculations for all startups, small and medium-sized businesses. What may appear complex to you is a breeze for our payroll experts.

Schedule a free consultation today and let our experts handle this daunting function of payroll tax calculation for you.

What Are Payroll Taxes

Payroll taxes are taxes based on salaries, wages, commissions and tips an employee makes. They are withheld from their paychecks by their employer, who then pays them to the government. Payroll taxes are used to fund social insurance programs like Social Security and Medicare and show up as FICA and MedFICA on pay stubs.

Its important not to confuse federal payroll taxes with federal and state income taxes, even though both are taken out of an employees pay. The difference between these two taxes is that payroll taxes fund specific social programs, while income taxes go to the U.S. Treasurys general funds. Additionally, every worker pays a flat payroll tax rate, while income taxes vary based on an employees earnings.

Recommended Reading: Efstatus/taxact

How To Calculate Federal Income Tax Withholding Using The Wage Bracket Method

In IRS Publication 15-A, find the tables marked âWage Bracket Percentage Method Tables.â Use the table corresponding to your employeeâs pay period.

Check form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim.

Find the employeeâs gross wage for the pay period in columns A and B. The wage should be over the amount found in column A but under the amount found in column B.

Subtract the amount found in Column C.

Multiply the result by the percentage found in Column D.

Check form W-4 to determine if the employee requests additional tax withheld from each paycheck. If they do, add that amount to the final number.

The end result is the amount you should withhold from the employeeâs paycheck for that pay period.

The Percentage Method is much more complicatedânot recommended if youâre doing this alone. If you want to learn more about the Percentage Method, you can read all about both methods in IRS Publication 15-A.

Once youâve figured out how much income tax to withhold from your employeesâ paychecks, your next step is to figure out how much FICA to withhold , and how much youâll be required to pay on their behalf.

How To Calculate The Withholding Amount

The amount of taxes that will need to be withheld from an employee’s paycheck will vary from employee to employee. Factors that can influence withheld taxes include:

- Whether the payroll period is biweekly, weekly, semi-monthly, or monthly.

- The relationship status of the employee.

- How many tax exemptions the employee has claimed.

- The employee’s gross pay during the current pay period.

- How many withholding allowances are being used.

- Any other amount that your employee has requested to be withheld.

Read Also: How Much Should I Set Aside For Taxes Doordash

Formula To Calculate Annual Taxable Income

A = Projected annual taxable income= + B1 HD F1If the result is negative, A = $0.

S1 = This is a set of two numbers: the number of total pay periods divided by the applicable number of the current pay period, as in the chart below. Also, see the information under Special situations.

Table 5.1 S1 Examples| 24/24 | 12/12 |

I = Gross pay for the pay period. This includes overtime earned and paid in the same pay period, pension income, qualified pension income, and taxable benefits, plus IYTD, but does not include amounts in factor B.

F = Payroll deductions for the pay period for employee contributions to a registered pension plan for current and past services, a registered retirement savings plan , or a retirement compensation arrangement plus FYTD.

Note

For full details, see the description under Option 1.

F2 = Alimony or maintenance payments required by a legal document dated before May 1, 1997, to be deducted at source from the employees salary for the pay period plus F2YTD. The legal document could be a garnishment or a similar order of a court or competent tribunal.

Note

For full details, see the description under Option 1.

U1 = Union dues for the pay period, plus U1YTD.

B1 = Year-to-date non-periodic payments such as bonuses, retroactive pay increases, vacation pay when vacation is not taken, and accumulated overtime. Since tax on a current non-periodic payment is calculated separately, do not include the current non-periodic payment in calculating A.

Note

Why Is It Important To Have Accurate Paychecks

Having accurate paychecks isnt just important for employees. Its an essential part of operating your business legally. Fail to pay employees fairly under federal, state, or local laws, and you may find yourself facing thousands of dollars in fines. Underpaying employee overtime is one of the most common labor law violations businesses commit. If you live in California, New York, or Texas, where local laws go beyond federal requirements, youll want to be especially diligent.

Read Also: Is Donating Plasma Taxable

Calculate Your Monthly Payroll Tax

The 2021 Payroll Tax annual reconciliation is now available. To assist customers with the impact of COVID-19, the due date for lodgement and payment of the 2021 annual reconciliation has been extended to 14 January 2022. Customers will also have the option of deferring payments for the monthly return periods July to December until 14 January 2022 and enter into a new Support Payment Arrangement.

After lodging the 2021 annual reconciliation, customers have the option to pay their outstanding liability in full or enter into a Support Payment Arrangement which can also include any monthly liabilities for the July to December 2021 return periods.

Customers are now able to establish a Support Payment Arrangement for a period of up to 12 months. This option will only be available until 28 February 2022.

Our online calculator helps you work out your actual monthly tax liability or provides the option to enter an estimate tax liability for the months of July to May each financial year.

If you have an annual tax payable amount less than $150,000 for the previous financial year, you can use the estimate calculation method to estimate your liability.

When you have determined your monthly tax payable, make the payment by the due date or let us know if its a nil liability.

Your monthly payment or nil return is due seven days after the end of each month, or the next business day if the seventh day is on a weekend or public holiday.

You Can Outsource Payroll Tax

Payroll tax is complex. The calculations are nitpicky and penalties are steep. Even paying payroll taxes just a day late comes with a 2% penalty on the amount due, with that penalty rising as high as 15% for past due payroll taxes.

We highly recommend outsourcing your payroll to a company like Gusto. Theyâll take the headache out of everything from paying your employees the right amount at the right time, to handling pesky withholding calculations and payroll taxes.

When it comes time to record payroll costs on your books, Bench can take care of that for you. Learn more about how we are saving small business owners hours of admin every month.

Read Also: Www Aztaxes Net

Other Deductions That Reduce Gross Pay

Employers are allowed to provide benefits to their employees that are funded by pre-tax payroll deductions, including:

- Retirement plan contributions. This can include a 401 plan.

- 403 plan contributions for nonprofit or government employees.

- Flexible spending account contributions, a voluntary program that provides reimbursement for medical expenses.

- Health savings account contributions, which are similar to flexible spending accounts. The difference is that the money in the account does not roll over between fiscal years.

If you need help with determining how to calculate payroll taxes, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

State And Local Income Tax Withholding

As an employer, you are required to withhold both local and state income taxes from your employee’s gross wages. If your business is located in a state with no income tax, such as Florida, you will not have to withhold these taxes.

Calculating the withholding amount for state income taxes follows the same process as federal income taxes.

Read Also: Appeal Cook County Taxes

Employees Cpp Basic Exemption For Various Pay Periods

Table 6.1 Employees CPP basic exemption for various pay periods| Pay period |

|---|

* Round the resulting amount in to the nearest $0.01.

Note

When an employee changes province of employment during the year but stays with the same employer, the maximum premium for the year is based on the province where the first $60,300 of insurable earnings is paid.

Example:

An employee makes $30,000 of insurable earnings in Ontario, changes their province of employment to Quebec, and makes an extra $40,000 with the same employer. The employees maximum premium is calculated as follows:

In Ontario: $30,000 × 1.58% = $474.00In Quebec: $30,300 × 1.20% = $363.60Totals: $60,300 = $837.60

QPIP premiums and maximum insurable earnings will be updated on the following link of the Revenu Quebec QPIP premium website once the information is available. The rate of 0.0494 remains unchanged for 2022.

Federal Unemployment Tax Act

Let’s talk about the Federal Unemployment Tax Actor FUTA.

FUTA directs the states and the federal governmentto make and to run the unemployment taxprogram which provides unemployment payments to workerswho have lost their jobs.

The various states create the actual employmentinsurance systems and the federal governmentapproves the state laws and pays the administrativecost of the state programs.

Because this is a joint program between the stateand federal governments,you are first subject to the state tax.

Then this tax becomes a credit against the federal tax.

In your state you may even be exempt from the taxbut you still have to pay the federal tax.

Conversely, you may not owe FUTA tax but you stillneed to pay the state.

Unlike other payroll taxes this tax is the soleresponsibility of the employer.

It is not deducted from the employee’s paycheck.

You are an employer for FUTA tax purposes and must fileand pay the tax if, in the current yearor last year, you paid wages of $1,500or more in any calendar quarter to employees or had oneor more employees at any time in each of the 20 or more weeks.

The 20 weeks do not have to be full or consecutive weeks.

Count all regular temporary and part-time employees,including employees on vacation or sick leave.

Not all employee wages are subject to FUTA tax.

There are exceptions for certain employers as wellas certain types of employees.

Don’t Miss: Doordash Tax Deduction

How To Calculate Payroll Taxes

Weve reviewed some of the base rates for payroll taxes already, but lets lay them all out so you have an idea of how to calculate payroll taxes for your organization. Some of these funds you will withhold from employees paychecks while others you will pay as an employer. Here are the taxes you should factor in per employee:

- 6.2 percent of the employees wages for social security that your org pays

- 6.2 percent withheld from the employees paycheck for social security

- 1.45 percent of the employees wages for Medicare that your org pays

- 1.45 percent withheld from the employees paycheck for Medicare

- 6 percent of the first $7,000 of an employees wages for the year for FUTA

- Your states tax rate for state unemployment

- Withheld amount as designated by the employees W-4 form

Fortunately, you dont have to memorize all these rates yourself. There are numerous payroll tax calculators online, and the best payroll software providers can help you sort through all the rules and regulations as well.

Calculate Employee Gross Pay

Before you can calculate taxes, youll need to calculate employee payroll.

In our example, lets say that Aaron currently works in New Mexico. Hes a salaried employee, earns $60,000, and is paid semi-monthly, which means hes paid 24 times a year. Aarons gross pay each pay period is the same, $2,500, which is calculated by dividing his annual salary by 24:

$60,000 ÷ 24 = $$2,500

Now that we know Aarons gross pay for the period, we can calculate his payroll taxes.

Read Also: Tax Deductions Doordash