International Fuel Tax Agreement

An IFTA registration is required for any motor carrier domiciled in Georgia who will operate on an Interstate basis and meets the following qualified definitions:

- Vehicles used, designed, or maintained for transportation of persons or property

- Having two axles and a gross vehicle weight or registered gross weight exceeding 26,000 pounds

- Having three or more axles regardless of weight

- Is used in combination, when the weight of such combination exceeds 26,000 pounds gross vehicle, or registered gross vehicle weight

“Qualified Motor Vehicle” does not include recreational vehicles. This registration requires an annual renewal with the issuance of a new permit and decals.

Register for an IFTA number.

Understanding The Tax Identification Number

A tax identification number is a unique set of numbers that identifies individuals, corporations, and other entities such as nonprofit organizations . Each person or entity must apply for a TIN. Once approved, the assigning agency assigns the applicant a special number.

The TIN, which is also called a taxpayer identification number, is mandatory for anyone filing annual tax returns with the IRS, which the agency uses to track taxpayers. Filers must include the number of tax-related documents and when claiming benefits or services from the government.

TINs are also required for other purposes:

- For credit: Banks and other lenders require Social Security numbers on applications for credit. This information is then relayed to the to ensure the right person is filling out the application. The also use TINsnotably SSNsto report and track an individual’s .

- For employment: Employers require an SSN from anyone applying for employment. This is to ensure that the individual is authorized to work in the United States. Employers verify the numbers with the issuing agency.

- For state agencies: Businesses also require state identification numbers for tax purposes in order to file with their state tax agencies. State taxing authorities issue the I.D. number directly to the filer.

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

Also Check: Reverse Tax Id Lookup

How To Find My Ein Number

Theres a lot to focus on when starting your own business. How will you get customers? Are you going to employ people to help you get started? How are you going to market your business? In the excitement its easy to lose track of things, like an Employee Identification Number.

An Employer Identification Number is like a Social Security Number for your business. Its also known as a Federal Employer Identification Number and Federal Tax Identification Number . The nine-digit number is assigned by the IRS. Its useful on several different levels. Below well walk you through how an EIN works and how to look up your EIN.

How Do You Get A Sales Tax Id Number

If youre going to sell taxable goods and services in the state of Oklahoma, youll need to register for sales taxes. You may have heard people refer to a sales tax ID number thats required for this, but this phrase actually refers to your Oklahoma state tax ID number.

Applying for an Oklahoma state tax ID number is a way of registering your business with the state of Oklahoma, and its necessary if youre going to legally account for your sales taxes. Its also important to have if you plan on hiring employees in the state of Oklahoma, or if youre going to owe excise taxes.

The process for getting an Oklahoma state tax ID number is similar to the one you followed when getting your federal tax ID. Youll need to answer several questions about your business, including many of the same points of information, and wait for the application to process. Applying online is far faster than any other method, though the processing times for state tax ID numbers are longer you may be waiting a few days to a few weeks to get it.

Also Check: Reverse Ein Lookup

Still Cant Find Your Ein Number Dont Give Up

If you still cant find your EIN, dont lose hope. It might be listed in documents buried deep in your filing cabinet or other space you use for storing documents. Take the time to sort through all paperwork related to your business and your EIN might turn up sooner than you think.

If your business has applied for anything, find any copies of those applications and take a close look. A business bank account statement or even your businesss online account profile might have your EIN number.

Daily Limitation Of An Employer Identification Number

Effective May 21, 2012, to ensure fair and equitable treatment for all taxpayers, the Internal Revenue Service will limit Employer Identification Number issuance to one per responsible party per day. This limitation is applicable to all requests for EINs whether online or by fax or mail. We apologize for any inconvenience this may cause.

Recommended Reading: Efstatus.taxact

Reach Out To The Irs For Assistance

You can find your EIN by contacting the IRS on a weekday between 7 AM and 7 PM to speak to a customer service representative.

This approach is ideal for those have recently changed their EIN, as the IRS has all the latest information, updated with regularity. So dont resort to outdated documents in search of your EIN number, as those old documents may list an EIN number that is no longer applicable to the business.

The only caveat for this option is that the person who contacts the IRS for the EIN number must be authorized to request such information. The individual who requests the EIN number from the IRS should be a partner in the business, the sole proprietor of the business, a corporate officer or another authorized party.

If you get stuck on hold or cant get through to the IRS, try calling in the middle of the week instead of Monday or Tuesday. Like most organizations, the IRS is inundated with calls at the start of the week.

What If I Need My Business To Be Federally Incorporated

If you intend to incorporate your business federally, the Business Number is supplied by Innovation, Science and Economic Development Canada when your incorporation is approved. To apply for federal incorporation you can visit Corporations Canada and be sure to learn the difference between federal and provincial incorporation beforehand. After receiving the Business Number from ISED, you can apply for any of the above-mentioned tax ID program accounts through the CRA.

You May Like: 1040paytax.com Official Site

Electronic Data Gathering Analysis And Retrieval System

Using the Electronic Data Gathering, Analysis, and Retrieval System is the easiest way to search for a federal tax ID number.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free.

The EDGAR database includes several forms that may contain a business’s EIN, including the 8-K, 10-K, and 10-Q forms.

Before you start your EDGAR search, you should keep in mind that searching just the first few letters of a business’s name will provide you better results, as many businesses are not listed under their full names.

What Is A Taxpayer Identification Number

The reason why some may find the prospect of finding out their taxpayer identification number daunting could be because there are three main types of abbreviations which refer to the taxpayer identification number, and you may not know which one you need. These three abbreviations are: TIN, ITIN, and EIN. The TIN stands for taxpayer identification number which is an umbrella term for what we are talking about. If you are US citizen who pays tax, you will have been issued a TIN which is identical to your social security number . What is your SSN? You can request a replacement SSN card at the SSAs website to find out your social security number.

However, if you are an employer, you may also be wondering what your EIN is. Youll need to file for an Employer Identification Number or EIN. This number is issued to individuals and legal entities, depending on a business legal structure. The IRS issues this number to various business structures, including sole proprietors, partnerships, and corporations . You can get more information on employer identifications numbers in this PDF file from the IRS: IRS Publication 1635, Understanding Your EIN. Note that you will need an EIN in addition to your SSN one functions as your individual number, the other as your number as an employer.

To sum up, there are a few different types of TIN depending on your status:

$1 Domain Names

Don’t Miss: Doordash Tax Percentage

Finding An Individual Tax Id

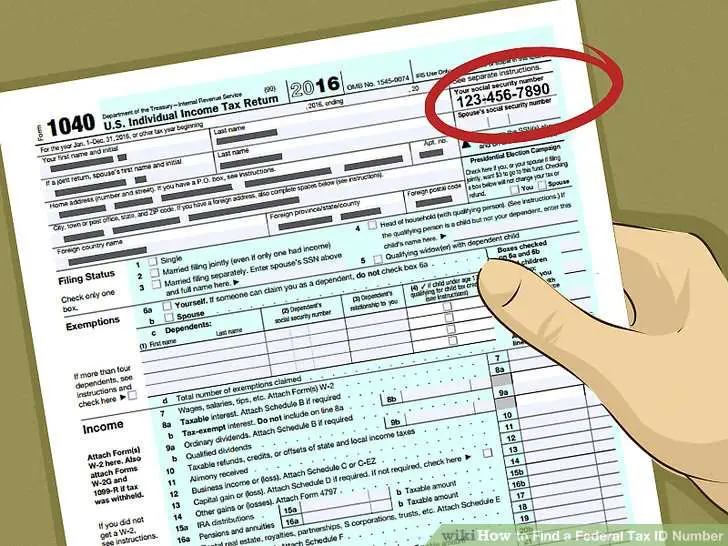

Though there are pros and cons to doing it, if you have a Social Security number, you can use that as your tax ID, even in business. If you work for someone else as an employee, you get a W-2 no later than Jan. 31 of each year, and the SSN is there at the top. If you need a copy of a form from a previous year, you can get it from the employer who issued it. Employers must keep these for at least four years after you leave the company. Your tax return, like the 1040, the 1040A, or the 1040EZ lists your SSN at the top of the first page.

If you don’t have a Social Security number, but you have filed taxes in the past, you may have used an Individual Tax Identification Number on the forms in the space where the SSN usually goes. That number is valid if used in 2013 or later unless the IRS has notified you that you need to renew. If you do need to renew, use form W-7 to ask for a new ITIN. That process takes about seven weeks. If you have a valid ITIN, but you cannot find it, call 1-800-908-9982 from within the United States for help.

If you lose your Social Security card, you can apply for a new one online if you have a driver’s license or another form of state identification. You can also fill out a paper form and turn it in to the local Social Security Administration office you’ll need to take your birth certificate and a photo ID.

How To Get A Tax Id Number For Your Business

If you need to learn how to get a tax ID number, there are several options. You can apply online through the Internal Revenue Service directly or a third-party service, or fax an application using Form SS-4. International applicants can apply by phone, but if you prefer to mail in an application, that is a slower alternative.

Also Check: Tsc-ind Ct

How To Find Another Company’s Ein

Usually, small business owners need to locate their own company’s tax ID number, but businesses sometimes need to look up another company’s EIN. For example, you can use an EIN to verify a new supplier or client’s information. Also, in industries like insurance, you might need other companies’ EINs during your daily course of business.

Use one of the following options to find another business’s federal tax ID number:

Does My Business Need An Ein

Businesses of all types are allowed to apply for an EIN. However, the IRS requires certain businesses to have one. If you answer yes to any of the following, you’ll need an EIN:

- Does your business have employees?

- Does your business file employment or excise taxes?

- Is your business taxed as a partnership or corporation?

- Does your business withhold taxes on non-wage income paid to a nonresident alien?

- Do you have a Keogh plan?

Even if your business is a sole proprietorship or LLC with no employees, its still beneficial to get an EIN. It makes it easier to keep your personal and business taxes separate, and it may be required to open a business bank account or apply for business licenses. If you don’t have an EIN, you’ll need to use your personal SSN for various tax documents.

Keep in mind that those with an SSN, an individual tax identification number , or an existing EIN may apply for an EIN.

You May Like: How To Find Employers Ein

Anyone Who Engages In Business In New Mexico Must Register With The Taxation And Revenue Department

Engaging in business means carrying on or causing to be carried on any activity with the purpose of direct or indirect benefit. For a person who lacks physical presence in this state, including a marketplace provider, engaging in business means having, in the previous calendar year, total taxable gross receipts from sales, leases and licenses of tangible personal property, sales of licenses and sales of services and licenses for use of real property sourced to this state pursuant to Section 7-1-14 NMSA 1978, of at least one hundred thousand dollars .

After registering you will receive a New Mexico Business Tax Identification Number. You will receive individual state tax ID numbers for the following accounts if they apply to your business:

- Compensating Tax

- Interstate Telecommunication Gross Receipts Tax

- Leased Vehicle Gross Receipts Tax and Surcharge

- Non-wage Withholding Tax

- Wage Withholding Tax

Each Business Tax Identification Number is used to report and pay tax collected on the above programs from business conducted in New Mexico.

Is Employee Identification Number Needed

In most cases, small businesses are not required to have an Employee Identification Number. If, for example, somebody is running their business as a sole proprietorship and they have no other employees, they’re most likely not going to need an EIN. If, however, the business in question has more than one employee or they have chosen to structure themselves as either a corporation or a partnership, they’re going to need to apply for an Employee Identification Number.

Some other things that might trigger the need for an Employee Identification Number might include:

- Filing a tobacco tax return

- Filing a firearms tax return

- Setting a Keogh plan up through the business in question

If you’re a business owner and you’re not sure if you need to file for an EIN, it is probably in your best interest to contact an attorney with knowledge and experience in this area to examine your specific situation and help you determine if this is something you’ll need to do. It’s not a good idea to proceed without knowing for sure whether or not you’re going to need an EIN.

You May Like: Wheres My Refund Ga State

Other Ways To Determine A Business’s Ein

In addition to the free methods listed above, there are other, fee-based ways to find a business’s EIN:

- Purchase a business credit report. You can buy a business’s credit report from a credit report company. The company’s EIN should be included in the information in the credit report.

- Use a paid legal database. Legal search companies maintain databases of companies that typically include companies’ contact and tax information.

- Search a fee-based EIN database. There are a number of paid EIN search databases you can use to obtain a company’s EIN information, for a fee.

Depending on whether the company whose EIN you’re looking for is a publicly traded company, a nonprofit company, or a private company, there are a number of ways to determine its EIN. As long as you have a legitimate reason for obtaining this information, the process is usually not difficult and may involve nothing more than picking up the phone and contacting the company directly.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

Ready to start your LLC?

Oklahoma Tax Id Number Application

Home » Apply Online » Oklahoma Tax ID Number Application

The type of organization you have is not going to differentiate how you apply for a Tax ID Number in Oklahoma. What will matter, though, is whether you fill out the proper forms, do it in the correct order, and provide the right information. The Oklahoma Tax ID Application Manual was created to assist in the online application process for any Limited Liability Company or other type of business to obtain a Tax ID Number in Oklahoma. It provides advice that is written by professionals, with new organizations top of mind.

Read Also: Taxes On Plasma Donation

What Is An Ein And How Can I Get One

An EIN serves as a unique identifier for your company and is largely used for tax purposes. The IRS requires any registered business that has employees or is a corporation or partnership to have one. Your EIN serves as the primary ID of a business to the government. It’s also commonly referred to as a “tax identification number ,” “95 number” or “federal tax ID.” It is often used for the following reasons:

- Business taxes

- Obtaining a business license

- Various business legal documents

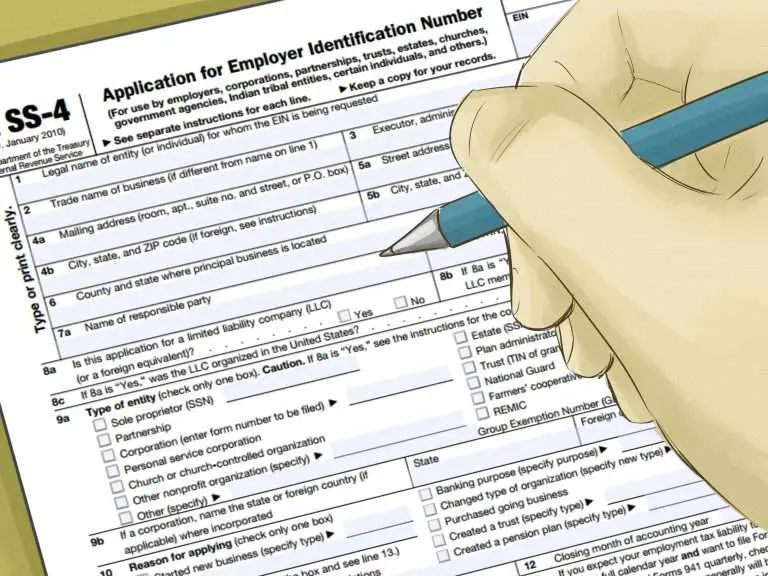

Applying for an EIN is easy it can be done online within minutes on the IRS website through form SS-4.

We recommend that businesses apply for an EIN as soon as possible because its crucial for basic business functions. You don’t need an EIN if you are the only employee, but if you’re looking to quickly scale your business, having an EIN early on is only beneficial.

Completing on online SS-4 is fastest, but you also have these options if youre based in a U.S. state or D.C.:

- Fax: 641-6935

- Mail: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999

If you’re an international applicant and don’t have a legal residence in the U.S., you can apply for an EIN via one of these methods:

- Telephone: 941-1099

- Fax: 215-1627 if within the U.S., or 707-9471 if outside the U.S.

- Mail: Send your SS-4 form to: Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999