Will I Lose Out If I Didnt Sign Up In Time To Get A Payment On July 15

No. Everyone will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.

Penalties That Otherwise Apply

Without the program, a plan sponsor faces many potential late filing penalties, including:

- $250 per day, up to $150,000 for each late Form 5500 or 5500-EZ, plus interest ) as amended by section 403 of the Setting Every Community Up for Retirement Enhancement Act of 2019 .

- $1,000 for each late actuarial report

Statute Of Limitations For Refunds

The statute of limitations for refunds is three years from the original filing deadline for the return. For example, the filing deadline for individual returns for the tax year 2019 was July 15, 2020 after being extended from the usual April date due to the coronavirus. Three years from that date is July 15, 2023. Taxpayers have until that date to file an original return for tax year 2019 to claim a refund from the IRS.

The refund “expires” if the return is filed outside this three-year time limit. The IRS can’t reissue the refund back to the taxpayer, nor can it apply the refund to an outstanding balance on another year. It can’t apply the refund as an estimated payment to a future tax year. The money simply disappears.

Recommended Reading: Www Michigan Gov Collectionseservice

Notices Of Dissolution And Final Tax Returns

Every registered Canadian business must file a dissolution notice at the time of closing. Sole proprietorships and partnerships file a Dissolution or Change of Proprietorship form with the provincial Corporate Registry office. Corporations file an Application for Dissolution with the provincial Corporate Registry office, and must also file a final corporate tax return along with a copy of the corporate articles of dissolution with the CRA.

If a corporation fails to complete these filings, the CRA will require corporate filings in one or more subsequent tax years, even though there is no income to declare. As well, any future CRA tax debt may be added to the corporation and if not dealt with, could result in the CRA raising Directors Liability against the directors, or the raising of a s.160 / s.325 non-arms length assessment to re-capture any dividends paid out while money was owing to the CRA.

References: Sheryne Mecklai, CPA, CA Manning Elliott LLP Vancouver, B.C.

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

The Longer You Wait The More Serious The Consequences

Once the IRS determines you should have filed a return and didnt, youll start hearing from them. Youll likely receive a notification letter from the IRS stating you will be penalized for not filing a return.

The IRS may also create a return for you. For example, if your employer reported wages, the IRS may create a tax return showing those wages. The catch? The IRS doesnt know about any deductions or other tax benefits you may deserve. They typically only know about your income, and unless you straighten things out, you could end up paying a lot more in taxes than you should.

If the IRS doesnt hear from you once youve been contacted, things can get more serious. Your bank may send you a notice indicating your money has been seized by the IRS. The agency may also put a lien against your property or garnish your wages. And, during all this time, interest and penalties are piling up, meaning the IRS can take more of your money.

Read Also: Amended Tax Return Online Free

How Do I File My Taxes Online

CNET has rounded up the best tax software, featuring vendors such as TurboTax, H& R Block and TaxSlayer. These companies can make the tax filing process much easier, from reporting your taxable or self-employed income to setting up direct deposit to going through your itemized deductions.

That noted, the IRS provides a list of free online tax prep software offered by many of those same providers. You can use this service if you meet certain criteria and have a relatively simple tax situation. Requirements include: You make less than $72,000 annually, you don’t itemize deductions and you don’t own a business. This will likely be helpful for people who do not typically have to file taxes but need to do so this year to claim missing stimulus money.

If you want to itemize deductions or have a more complex financial situation — you run a business, have investments or generate rental income — you’ll have to pay for a higher tier of service, which can run a couple hundred dollars. Still, for most people, even the most deluxe online package is far less expensive than hiring an authorized tax pro. And if you prefer to keep it old-school, the IRS’ online tax forms handle some but not all of the calculations for you and still allow you to e-file or print and mail.

A number of online tax software providers will help you file for free.

How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund, and there’s also a mobile app, IRS2Go. You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

Read more: What’s your 2020 tax return status? How to track it and your refund money with the IRS

Read Also: How To Report Ppp Loan Forgiveness On Tax Return

Determine If The Irs Filed A Substitute Return

Just because you didnât file your return doesnât mean the IRS wonât file one for you. The IRS may file a Substitution for Return or SFR on your behalf. Donât think of this as a complementary tax filing service. The IRS wonât give you any of the exemptions or deductions that rightfully belong to you.

Once an SFR is filed, you will be sent a notice to accept the tax liability as filed in this alternate return. If you donât respond, the IRS will issue a notice of deficiency. At this point, the tax is considered owed by you and the IRS can begin the collection process. To encourage payment, a levy can be placed on your wages or bank accounts. A federal tax lien may also be placed against your real property.

If an SFR was filed, you donât have to accept the outcome. You can go back and refile those years and include any available deductions. Chances are you can decrease the tax owed, as well as the interest and penalties.

Do I Have To File My Taxes Every Year

Another example of a frequently asked question is this: What happens if you dont file your taxes annually?

As a guide, we noted for you these 3 factors in determining whether or not you are required to file:

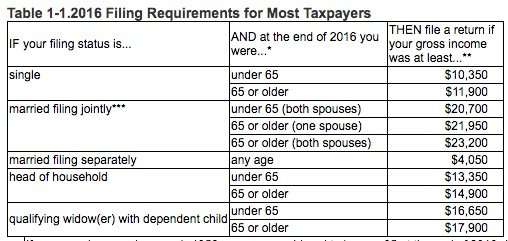

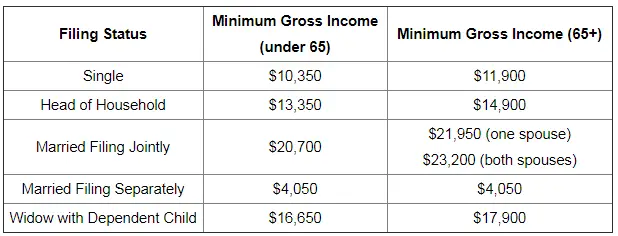

Age Your tax threshold will depend on your age at the end of the year.

Taxpayers who are 65 years old and above have slightly higher tax thresholds. This will depend on their income.

But, if you turned 65 on New Years Day, then you are considered to be 65 at the end of the previous year.

Annual gross income thresholds per filing status Also, as a general rule, if your gross income for the year exceeds the threshold, then you are required to pay taxes.

This is also according to your filing status, which could be any of the following: a. Single c. Married couples filing jointly d. Married couples filing separately e. Qualifying widow/widower with a dependent child

Income Thresholds younger than 65 years old

For single taxpayers younger than 65 years old, the threshold is $10,400. If you are the head of a household, the threshold is $13,400.

And lastly, widows or widowers with dependent children have a threshold of $16,750.

Income Thresholds 65 years old and older

Single taxpayers 65 years old or older have a threshold of $11,950. If you are the head of the household, then the threshold is $14,950.

On the other hand, married couples who are filing jointly have a shared threshold of $23,300. Couples filing separately have an individual threshold of $4,050.

Read Also: How Can I Make Payments For My Taxes

How Far Back Can You File Taxes In Canada

Here is what you need to know about filing prior year tax returns, including how to file back taxes, and how far back you can file taxes in Canada. Farber Tax can help you get your tax situation in order and avoid costly CRA penalties and interest.

Fill out the web form or call us to get started.

Book A Free Confidential Consultation

Home » Everything You Need To Know About Late Tax Filing » How Far Back Can You File Taxes in Canada?

Can I Use The Non

Yes. If you havent filed taxes in a while and have not yet received the Economic Impact Payments that you were eligible for, you can use the Non-filer Sign-up Tool to apply for them whether or not you are also applying for Child Tax Credit payments. See I havent filed taxes in a while. How can I receive this benefit? to see if the Non-Filer Sign-up Tool is for you.

Recommended Reading: Have My Taxes Been Accepted

Stop Late Filing And Payment Penalties And Interest

Filing a tax return on time is key to avoid penalties, even if you can’t pay the balance you owe. If you don’t pay your balance, you may have to pay an additional 5% of the unpaid tax you were required to report for each month your tax return is late, up to five months. Minimum penalty limits also apply.

The IRS assesses another penalty for a failure to pay your taxes owed. If you do file on time, but you can’t pay what you owe in full by the due date, you’ll be fined an additional 0.5% of the amount of the tax not paid on time for each month or part of a month you are late. These fees will accrue until your balance is paid in full or the penalty reaches 25%, whichever comes first.

The IRS also charges interest on overdue taxes. Unlike penalties, interest does not stop accruing after a particular period goes by.

Can You Go To Jail For Not Filing A Tax Return

If a taxpayer doesnt file his or her tax return to purposely evade taxes, then he or she can go to prison.

The IRS will prosecute a taxpayer if there is evidence that he or she committed tax fraud. It can pursue tax fraud charges for up to 6 years after the date of the unfiled return.

As examples, a taxpayer who does any of the following can be charged with tax fraud: a. Declares false tax exemptions or deductions b. Attempts to bribe anyone with kickbacks from avoiding tax payments c. Submits false or altered documents to the IRS d. Not reporting or misreporting income statement to the IRS e. Joins an organized crime to purposely evade taxes f. Fails to withhold taxes for employees g. Steals someones identity or Social Security Number h. Spreads fraudulent IRS e-mails i. Evades taxes through an exempt organization j. Other suspicious activities

What happens if you dont file your tax return due to fraud? The IRS will impose criminal charges with penalties depending on your state.

The IRS highly encourages everyone to report anyone who engages in any of the aforementioned activities.

But, you may also ask what happens if you dont file your taxes because of an honest mistake? This means that if you did not file because you simply didnt have the money to pay, you wont necessarily go to jail.

Always remember that if you only committed honest mistakes, then you dont have to worry. The IRS may offer you a payment extension or a payment plan.

Recommended Reading: How To Buy Tax Lien Properties In California

Failure To File Taxes

If you fail to file your tax returns on time you could be charged with a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes. Penalties can be as high as five years in prison and $250,000 in fines. However, the government has a time limit to file criminal charges against you. If the IRS wants to pursue tax evasion or related charges, it must do this within six years from the date the unfiled return was due. Non-filers who voluntarily file their missing returns are rarely charged.

People may get behind on their taxes unintentionally. Perhaps there was a death in the family, or you suffered a serious illness. Whatever the reason, once you havenât filed for several years, it can be tempting to continue letting it go. However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.

Affordable Care Act Premium Credit Claim

If you got health care coverage as required by the Affordable Care Act, also known as ACA or Obamacare, you might need to file a return.

This is the case if you qualified for federal help in buying your health care coverage through the health insurance marketplace or exchange. If advance payments of the ACA premium tax credit were made for you, your spouse, or a dependent who obtained such marketplace medical coverage, that amount must be reported by filing a Form 1040 tax return and Form 8962, Premium Tax Credit.

This will ensure that you got the appropriate tax credit in advance. If you received too much premium help, youll have to repay it when you file your return. If you did not get enough, you can collect the extra when you file.

Recommended Reading: Buying Tax Liens California

Can Get I More Of The Child Tax Credit In A Lump Sum When I File My 2021 Taxes Instead Of Getting Half Of It In Advance Monthly Payments

Yes, you can opt out of monthly payments for any reason. To opt-out of the monthly payments, or unenroll, you can go to the IRS Child Tax Credit Update Portal. If you do choose not to receive any more monthly payments, youll get any remaining Child Tax Credit as a lump sum next year when you file your tax return.

How To File Late Tax Returns In Canada

Wondering how far back you can file taxes in Canada? Looking for information on how to file your tax returns late? We can help. Our team is made up of experienced ex-CRA, accounting, and legal professionals who understand CRA processes and know how to resolve tax situations.

If you want to file previous year returns, there are options available to you. One option is the CRAs Voluntary Disclosure Program . This program is designed as a second chance to correct prior year returns or to file returns that have not been filed.

In order to file your back taxes through the VDP, certain conditions must apply:

- You must be making a voluntary disclosure

- To qualify for the VDP, you must disclose information to the CRA before it contacts you for the information. This means that, if the CRA has already contacted you about previous year returns, or if the agency has taken compliance actions against you for not filing your taxes, you cannot use the VDP.

- A penalty must apply

- The VDP only applies if you owe money on previous returns. If you do not owe money, you should still file previous year taxes, but you do not need to use the Voluntary Disclosure Program to do so.

- The information must be at least a year overdue

- The VDP only applies to returns that are more than a year late. If your return should have been filed in the last year, you cannot submit it using the VDP.

Recommended Reading: Do I Need W2 To File Taxes

Do I Need To File Even If Im Not Required To By Filing Status Age And Income Level

In some cases, yesyou will still need to le a tax return if any of the following apply:

- You owe any taxes, such as alternative minimum tax, taxes on a retirement plan distribution, household employment taxes, and Social Security and Medicare taxes that were not withheld from income.

- You received a distribution from a health savings account, Archer MSA, or Medicare Advantage MSA.

- You had at least $400 in self-employment income.

- You earned $108.28 or more from a church or qualified church-controlled organization that is exempt from employer Social Security and Medicare taxes.

- You received an advance payment of the Premium Tax Credit for health insurance bought from a health insurance marketplace. You should receive Form 1095-A with the amount of the advance payments.

- Advance payments of the health coverage tax credit were made for you, your spouse or a dependent. You should receive Form 1099-H with the amount of the advance payments. Note: For tax year 2020, any excess amount of advance premium tax credit payments received doesnt have to be repaid, according to the American Rescue Plan .

- You were required to file Form 965 for a triggering event or Form 965-A for an elected installment payment.