How To Generate An Electronic Signature For The Coversheet For Title 68doc On Ios

To sign a renew farm tax exemption oklahoma right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your oklahoma farm tax exemption renewal: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is just as productive and powerful as the web app is. Get connected to a smooth web connection and begin executing forms with a fully legitimate electronic signature within a couple of minutes.

Apply For A Oklahoma Tax Id Online

The application process is similar across multiple different methods, but theres one method thats indisputably better: applying online.

Traditional applications, like applying via phone, mail, or fax, do exist, but applying online is easier and more convenient for the vast majority of people. You can access the application in digital format, and answer the questions at your own pace anywhere you have an internet connection. Assuming youve already gathered the important details on your business and founding members, you should be able to complete the online application in mere minutes.

Then, youll need to wait for your application to process- and thats where online applications really shine. When you apply online, youll only need to wait an hour or so for your application to finish processing. After that, youll receive an email with your tax ID, so you can start using it right away.

Other Forms & Helpful Information

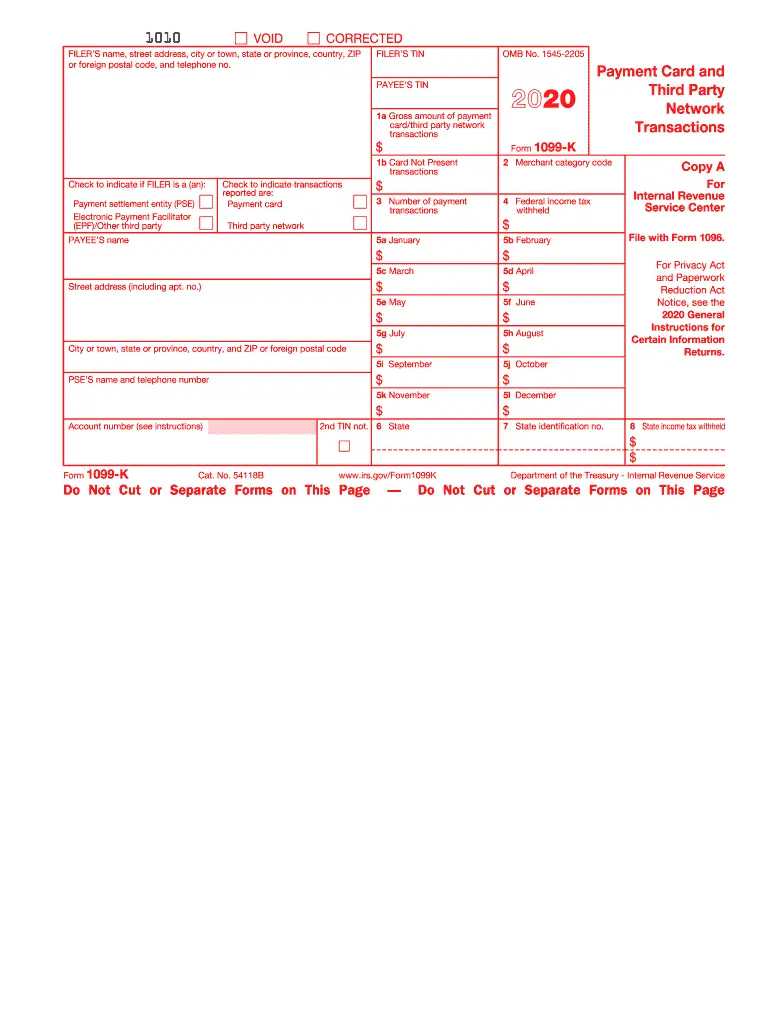

Please note: Forms 1099, 1096, 1098, 5498, and W-2 cannot be filed with forms downloaded from the IRS site. To get copies of these forms you need to call the IRS directly at 1-800-829-3676, purchase them at an office supply store, or order them online at the IRS web site.

Forms for current and past years can be accessed at www.irs.gov/Forms-& -Pubs.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Requesting A Penalty Waiver

The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. Youll also be assessed interest on the balance due at a rate of 1.25% per month. If youre hit with a tax penalty, you can request a penalty waiver to reduce what you owe. To request a penalty waiver, you can contact the Tax Commission at 522-8165.

General Tax Return Information

Due Date – Individual Returns – E-filed returns are due April 20. Paper filed returns are due April 15.

Extensions – Oklahoma allows an automatic six month extension if no additional tax is due and if a federal extension has been timely filed. A copy of the federal extension must be provided with your Oklahoma return. If the federal return is not extended or an Oklahoma liability is owed, an extension of time to file the Oklahoma return can be granted on Form 504-I. 90% of the tax liability must be paid by the original due date of the return to avoid penalty charges for late payment. Interest will be charged from the original due date of the return.

Extension requests cannot be e-filed. To access Form 504-I, from the main menu of the Oklahoma return select Oklahoma Extension of Time To File.

Drivers License/Government Issued Photo Identification: Oklahoma does not require this information to file the tax return. Providing the information will help confirm the taxpayer’s identity and can prevent unnecessary delays in tax return processing. To enter Identification Information, from the main menu of the Oklahoma return select Personal Information > Driver’s License Information.

Don’t Miss: Where’s My Tax Refund Ga

How Do You Register For A Sales Tax Permit

You can register online. Visit the Tax Commission’s Online Business Registration System website. When you register online, expect the agency to take at least five day s to process your application for a sales tax permit.

If you want to get your permit more quickly, you can apply in person. You’ll go to the Tax Commission office in Oklahoma City or Tulsa.

Your sales tax permit will be issued on a probationary basis. This probation lasts for six months. Once your probationary period is over, the permit will automatically renew for a period of 30 months. If your business remains in good standing, you can renew your permit every three years from the date it was first issued.

If you’re unsure which agencies you’ll have to register with, you should contact the Tax Commission to get the information. Following are some of the potential agencies:

- State Department of Labor

Get Your Oklahoma Sales Tax Permit Online

You can easily acquire your Oklahoma Sales Tax Permit online using the Oklahoma Taxpayer Access Point website. If you have quetions about the online permit application process, you can contact the Oklahoma Tax Commission via the sales tax permit hotline 521-3160 or by checking the permit info website .

You May Like: Csl Plasma Taxable

Documents Required To File Your Taxes

Form W-2

- Shows your earned wages and deductions from your earned wages

- Usually sent out the week of February 1 by OU Human Resources

Form 1042-S

- Students who claim tax treaty exemptions or who received a scholarship in excess of their estimated annual cost will receive this form

- Usually sent out end of February or beginning of March by OU Human Resources

How To Make An Esignature For The Coversheet For Title 68doc From Your Smart Phone

Get renew farm tax exemption oklahoma signed right from your smartphone using these six tips:

The whole procedure can take a few moments. As a result, you can download the signed oklahoma farm tax exemption renewal to your device or share it with other parties involved with a link or by email. Due to its universal nature, signNow works on any gadget and any operating system. Use our eSignature solution and leave behind the old times with affordability, efficiency and security.

Also Check: How To Get A Pin To File Taxes

How Do I Get An Oklahoma State Tax Id Number

If you need an Oklahoma state tax ID number, the easiest and fastest way to get one is by applying online. When you use this method, youll be able to answer questions about your company quickly, and in a medium you can access virtually anywhere. As long as you have the right information about your company on standby , you should be able to finish the application in short order. When complete, youll need to wait for the application to process- which could take a few days to a few weeks.

This is still favorable to applying for your Oklahoma state tax ID number in any other method, where the application process is less convenient, and could take additional weeks of time to finish processing.

How Do I Track My Oklahoma Tax Refund

To track the status of your Oklahoma 511 income tax refund online, visit the Oklahoma Tax Commission website and use their Refund Status Search service. Oklahoma Tax Commission states that you could receive your refund in a couple of weeks if you e-file compared to several more weeks longer if filing on paper. Filing your income tax return online and selecting the direct deposit option if even faster.

To track the status of your Oklahoma income tax refund for 2020 you will need the following information:

- Last seven digits of Social Security Number or ITIN

- Amount of refund requested

- Zip code

The requested information must match what was submitted on your 2020 Oklahoma Form 511. The Oklahoma Tax Commission refund lookup service can only be used to query the current income tax year 2020. Contact the Oklahoma Tax Commission service center by phone or mail if you are having trouble using the service or need to discuss a prior year income tax return.

To contact the Oklahoma Tax Commission service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2020 Oklahoma Form 511 instructions to obtain the proper phone number and mailing address.

You May Like: How Can I Make Payments For My Taxes

How Much Sales Tax Is Charged

The sales tax rate that is charged varies depending on the address of the business if the purchase is made in the store. When shipping in-state, the sales tax is based on the address of the purchaser.

In addition to the statewide tax, there are additional sales taxes that may be added by cities, towns, counties, and municipalities. To find sales tax rates, see the sales tax rate locator from the Oklahoma Tax Commission.

How Is Unemployment Compensation Taxed

You may be among the millions of people who received or are receiving unemployment compensation due to the coronavirus pandemic. By law, these benefits are taxable, and must be reported on your federal income tax return.

If you get unemployment compensation, you should receive a Form 1099-G showing the amount you were paid and any federal income tax you elected to have withheld. You may request one from the Oklahoma Employment Security Commission if you do not receive one by mail.

Federal law allows individuals to choose a flat 10% withholding from these benefits to cover part or all your federal income tax liability. If you did not choose voluntary withholding, or make quarterly estimated tax payments, you may get an unexpected tax bill.

You May Like: Notice Of Tax Return Change Revised Balance

Where Can I Get Oklahoma Tax Forms

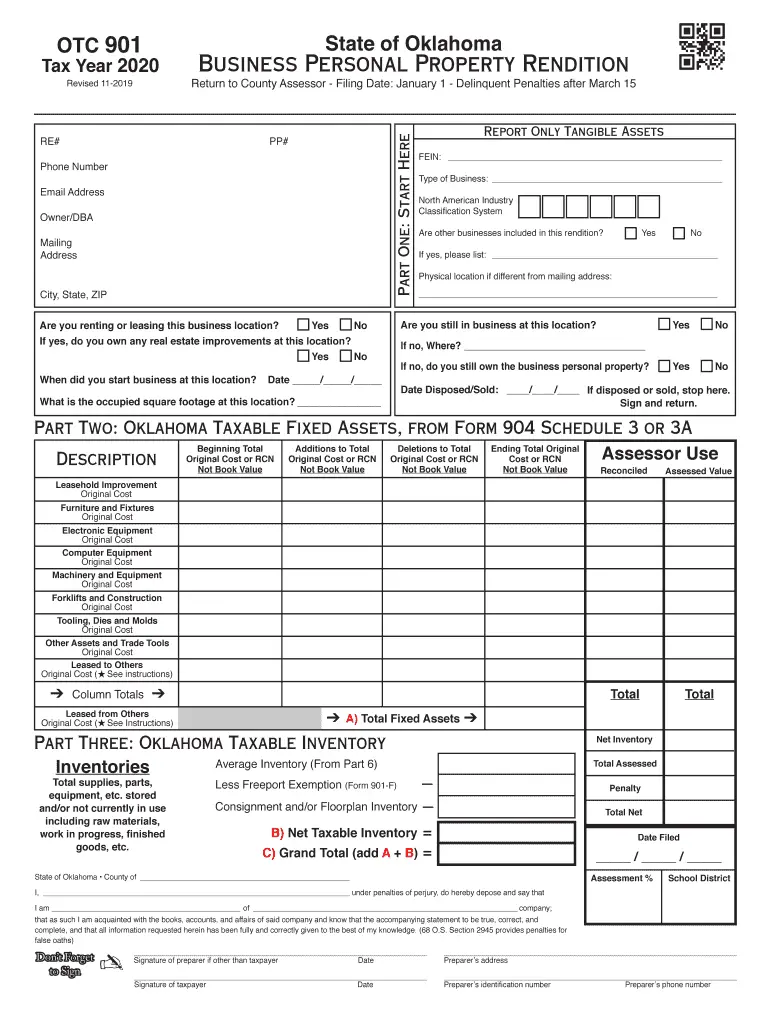

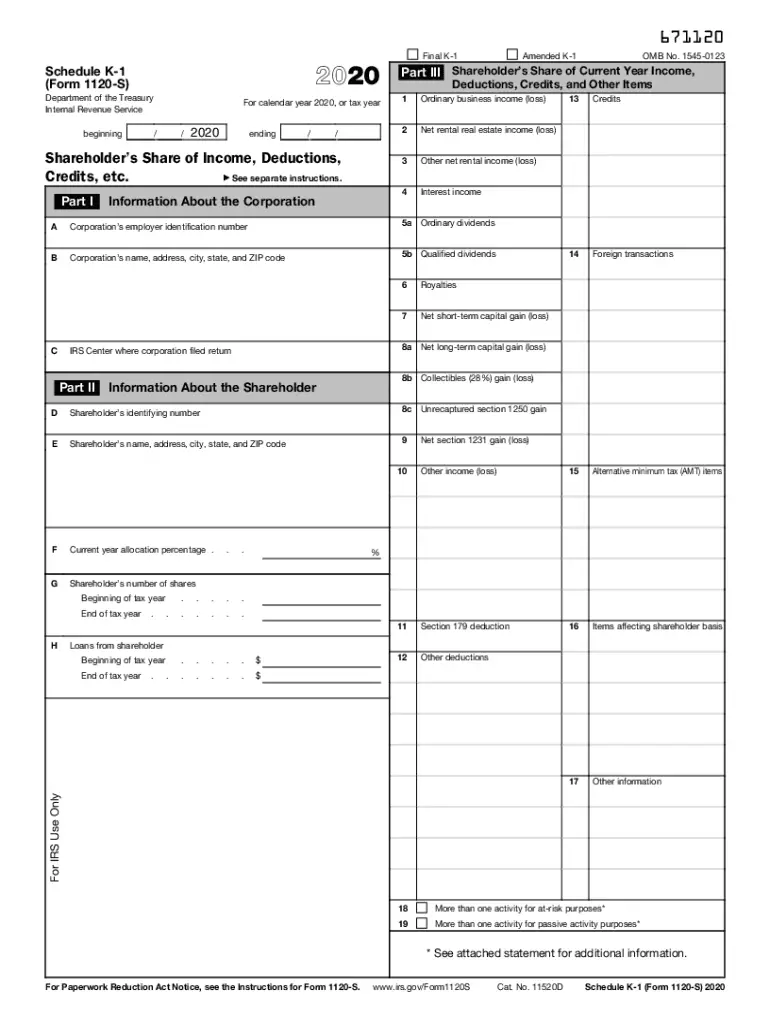

Printable Oklahoma tax forms for 2020 are available for download below on this page. These are the official PDF files published by the Oklahoma Tax Commission, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2020 Oklahoma tax forms.

To get started, download the forms and instructions files you need to prepare your 2020 Oklahoma income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2020 Oklahoma tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all Oklahoma state tax forms at 100%, actual size, without any scaling.

| Oklahoma Annualized Income Installment Method |

Who Needs An Oklahoma Sales Tax Permit

You must register for a sales tax permit if your business sells or rents tangible retail goods or provides any of the following taxable services in Oklahoma: “printing and advertising , transportation and auto parking, admissions, lodging and meals, telephone service and the furnishings of other public utilities, such as electricity and natural gas, with the exception of water.You are responsible for collecting both Oklahoma state and local sales taxes from the purchaser and remitting these taxes to the Oklahoma Tax Commission.

Businesses with a taxable presence within Oklahoma are considered to have sales tax nexus within the state. For more details on what constitutes a taxable presence, see sales tax nexus in Oklahoma.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

How To Get An Oklahoma Sales Tax Permit:

You can register a new business and obtain your sales tax permit through the Oklahoma Tax Commission’s Online Business Registration System, a part of OkTAP web portal. If you need your permit faster than the five-day waiting period, you must apply in person at the Tulsa or Oklahoma City Tax Commission offices.If you have any questions concerning Oklahoma business licensing or registration requirements, please contact the Taxpayer Assistance Division at 521-3160.

You May Like: Taxes For Doordash

Oklahoma Income Tax Form Addresses

Oklahoma has multiple mailing addresses for different tax forms and other forms of correspondence. Make sure you send your completed tax forms to the correct address – some forms may have a different mailing address specified in the form instructions.

Here are two of the most important Oklahoma Tax Commission mailing addresses for tax returns and general correspondence:

Estimated Income Tax ReturnsOklahoma Tax CommissionIncome Tax ReturnsOklahoma Tax Commission

Disclaimer: While we do our best to keep this list of Oklahoma income tax forms up to date and complete, we cannot be held liable for errors or omissions. Is a form on this page missing or out-of-date? Please let us know so we can fix it!

How To Make An Electronic Signature For Signing The Coversheet For Title 68doc In Gmail

Below are five simple steps to get your renew farm tax exemption oklahoma eSigned without leaving your Gmail account:

The sigNow extension was developed to help busy people like you to reduce the stress of putting your signature on forms. Begin putting your signature on oklahoma farm tax exemption renewal using our solution and join the millions of happy users whove previously experienced the key benefits of in-mail signing.

Also Check: How Can I Make Payments For My Taxes

What Is An Oklahoma State Tax Id Number

Your Oklahoma state tax ID number is a unique ID number provided to your business when you register with the state of Oklahoma. As alluded to in the preceding section, its occasionally called a sales tax ID, and in rare cases, may be called an Oklahoma state EIN.

Contrast this with your federal tax ID number, also called an employer identification number . Like the Oklahoma state tax ID, this functions as a unique identifier for your business, but this one is given to you when you register your business with the federal government. Youll need an EIN if youre going to hire employees , or if your business has multiple members, such as if youre running a partnership, an LLC with multiple members, or a corporation. Its also important to have for when youre applying for business bank accounts, business credit, or licenses and permits.

Your state tax ID number is reserved for use with state-level matters, like sales taxes, excise taxes, and hiring employees in the state.

Who Needs A Sales Tax Permit In Oklahoma

Your business must first register with the state Tax Commission to ensure proper management of the state sales tax. When you register to collect sales tax, you’re acknowledging your legal responsibility to collect, file, and remit sales tax to the state. Just about all businesses are required to have a state sales tax number.

You must collect sales tax if you sell products online and the items are shipped within the same state. Your buyer must pay sales tax on the item. You’ll pay sales tax on a quarterly or monthly basis. How often you pay depends on how much revenue you’ve earned and the type of business you run.

If you ship items within the state, those items are taxable. If you ship items out of state, they’re usually not subject to sales tax. This changes if your yearly revenues are more than $4 million.

If you sell tangible personal property in the state, you must register for a sales tax permit if you have sales tax nexus. Nexus, as defined in tax terms, is a business’ connection to a state. The term nexus doesn’t refer only to a company’s physical presence, although most businesses will have a physical connection in the state, like inventory or a warehouse. If the state considers your business to have nexus in Oklahoma, you’re legally obligated to collect, file, and pay sales tax.

If you need more help understanding nexus, which can be a complicated topic, you might want to consult with a qualified tax professional.

Recommended Reading: Pastyeartax Reviews

Residency Status Information For Oklahoma Returns

Residents: An Oklahoma resident is a person domiciled in Oklahoma for the entire tax year.

Part-year resident: A part-year resident is an individual whose domicile was in Oklahoma for a period of less than 12 months during the tax year. In other words, a part-year resident is an individual who move into or out of the Oklahoma during the year.

Nonresidents: A nonresident is an individual whose domicile was not in Oklahoma for any portion of the tax year.

Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? Visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

From retirement account contributions to self-employment expenses, learn more about the five most common tax deductions with the experts at H& R Block.

Don’t Miss: How Much Time To File Taxes