What Is The Estate Tax

Estate taxes are levied by the government on the estate of a recently deceased person. It only applies to estates worth a certain amount, which varies based on which municipality is levying the tax. You may have heard the term death tax, but estate tax is the legal term.

This tax is different from the inheritance tax, which is levied on money after is has been passed on to the deceaseds heirs.

Florida Personal Income Tax Laws

Created by FindLaw’s team of legal writers and editors

Personal income tax is a government tax on individuals that varies based on their taxable income. Generally, taxable income is determined by taking a personâs total income and applying deductions. Depending on the circumstances, credits may also be available to individuals. Many states levy a personal income tax in addition to the federal personal income taxes collected by the Internal Revenue Service. Seven states, however, including Florida, do not collect personal income tax. This article provides a basic overview of taxes in Florida.

Estate Tax Unified Credit

Each U.S. citizen may exempt from estate taxation on assets in their taxable estate up to approximately $11,500,000 . The exemption increases with inflation. Recently, the estate tax law was changed so that a decedents estate tax exemption may be applied against lifetime gifts and after death bequests or trust. For married couples, any part of the $11,500,000 credit which is not used by the first spouse to die may be carried over to the surviving spouse. The carried over credit is referred to as the Deceases Spousal Unused Exclusion . Therefore, a married couple may exempt approximately $23 million of assets from federal estate taxation when their assets are passed to their children and other heirs. Very few Florida residents are concerned about estate tax liability because few people are worth more than $23 million.

To take advantage of the DSUE the law requires the surviving spouse to file a federal estate tax return, Form 706, upon the death of the first spouse and properly elect DSUE on the Form 706. Preparing a Form 706 is complicated even for smaller estates and families should expect to pay legal and accounting fees.

In all cases where estate tax is due, a Form 706, Estate Tax Return must be filed within nine months after the decedents death, although an extension of an additional six months is generally granted upon the filing of an application for extension.

Don’t Miss: Buying Tax Liens In California

The Florida Property Tax

The Florida constitution reserves all revenue from property taxes for local governmentsthe state itself doesn’t use any of this money. Property taxes are based on the “just value” or market value of properties as they’re assessed by a local appraiser as of Jan. 1 of each year.

Increases in value are limited to 3% of the previous year’s assessment or the Consumer Price Index , whichever is less. This limitation is known as the “Save Our Homes” cap.

Taxes are based on millage rates set by local governments, with 10 mills being equal to 1%. The millage rate is multiplied by the value of the property to determine the dollar amount of the tax. County, city, and school districts are permitted to levy taxes at up to 10 mills each.

Special districts, such as water management, can levy additional taxes, usually at under 2 mills.

Do States With No Income Tax Outperform Other States

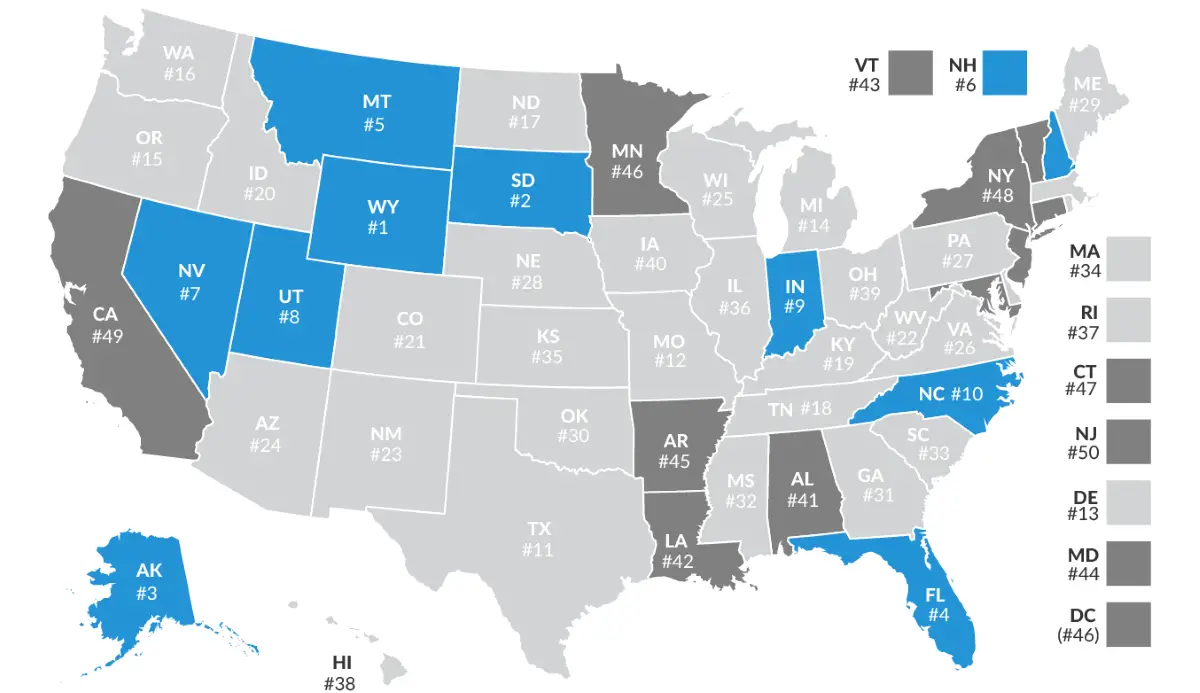

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

You May Like: Cook County Assessor Deadlines

The Place Is The Lowest Property Tax In Florida

Total, property taxes in Florida arent notably excessive, making the state a lovely choice for anybody who desires to personal a home however doesnt wish to be overwhelmed when its time to pay their property taxes. Total, the Sunshine States efficient fee of 0.83 % is under the nationwide common of 1.07 %. Nonetheless, charges contained in the state can fluctuate from one county to the subsequent, inflicting some Floridians to pay excess of others when their property tax payments come due. In case you are questioning, The place is the bottom property tax in Florida? right heres what you should know.

How An Excise Tax Works

Excise taxes are primarily for businesses. Consumers may or may not see the cost of excise taxes directly. Many excise taxes are paid by merchants who then pass the tax on to consumers through higher prices. Merchants pay excise taxes to wholesalers and consider excise taxes in product pricing which increases the retail price overall. There are some excise taxes however that are paid directly by a consumer including property taxes and excise taxes on certain retirement account activities.

Federal, state, and local governments have the authority to institute excise taxes. While income tax is the primary revenue generator for federal and state governments, excise tax revenue also makes up a small portion of total revenue.

Excise taxes are primarily a business tax, separate from other taxes a business must pay, like income taxes. Businesses charging and receiving excise taxes are required to file Form 720 Federal Excise Tax Return on a quarterly basis and include quarterly payments. Business collectors of excise taxes must also maintain their obligations for passing on excise taxes to state and local governments as required. Merchants may be allowed deductions or credits on their annual income tax returns related to excise tax payments.

Don’t Miss: Efstatus Taxactcom

Elements Influencing The Efficient Tax Fee

As talked about above, the efficient tax fee elements in credit, exemptions, and related cost-reducing choices which may be obtainable to residents. One of the vital extensively used ones is the homestead exemption, permitting owner-occupiers to not owe taxes on the primary $25,000 or a propertys worth and an extra $25,000 from non-school-related taxation.

There are additionally property tax discount packages for army members and veterans, people age 65 and over, and sure different teams. Nonetheless, even that solely scratches the floor. Consequently, many individuals solely pay taxes on a portion of their propertys worth in the event that they occupy the house.

Do you assume that property tax variations considerably affect your funds? Would you deliberately seek out the bottom property taxes in Florida or just select the town or residence that greatest meets your wants? Share your ideas within the feedback under.

Learn Extra:

Should you take pleasure in studying our weblog posts and wish to strive your hand at running a blog, we have now excellent news for you you are able to do precisely that on Saving Recommendation. Simply click on right here to get began. Try these useful instruments that can assist you save extra. For investing recommendation, go to The Motley Idiot.

The Solution To Your Driving Woes

DoNotPay provides invaluable help to future and current drivers. By helping you ace that drivers license test, scheduling a DMV appointment the easy way, or contesting parking tickets, our app saves you money and time.

If you need to file a car warranty or an insurance claim, we will help you deal with the necessary paperwork within minutes. Trying to get out of a car wash membership? DoNotPay can cancel it in an instant.

Our platform works above ground as well. You can use DoNotPay to secure refunds from airline companies or compensation for delayed and canceled flights.

Also Check: Www.1040paytax.com Official Site

Types Of Taxes In Florida

Unlike many other states, Florida also does not impose inheritance taxes, gift taxes, or taxes on intangible personal property. Since states require a steady flow of revenue to pay for public goods such as education and infrastructure, Florida makes up for the lack of income tax through relatively high property , sales, and corporate taxes. Florida imposes the following taxes within the state:

- Sales Tax: The state sales tax is 6 percent. It is calculated for each retail sale and admission charge and certain other services at the time of purchase or use. Counties may also impose a sales surtax on top of the six percent tax. Those county taxes can range from a quarter percent to two and a half percent.

- Use Tax: A use tax is a tax on property that is bought out of state and brought into Florida within six months of purchase. The use tax is also assessed at six percent of the purchase price. Certain property is exempt from this tax, however.

- Property Tax: If you own property in Florida, the county assessor will appraise the value of your property annually to determine the amount of property tax you owe. This tax is collected each year by the county tax collector unless exceptions apply.

- Corporate Tax: Most corporations, banks, and other business must pay a state corporate tax. The corporate tax is similar to a personal income tax for individuals and is based on federal taxable income after making applicable adjustments.

- Convention development tax

What You Need To Know About Relocating To Florida

The combination of warm weather and no personal income tax makes Florida a desirable place to relocate. Connie Eckerle of Smolin outlines what you need to keep in mind to make a clean break from your current domicileand its taxes.

White sand beaches and tax incentives have people turning to the Sunshine State. And not just the traditional retireesremote workers nowhere near retirement are also considering making the move. Because if you have to socially distance yourself, you might as well have balmy winters to keep you company, right?

But why Florida?

As appealing as warm afternoons on the beach sound with winter here, there are things to consider when it comes to relocating to Florida. What do you need to know before buying a plane ticket?

Don’t Miss: How To Appeal Property Taxes Cook County

Are Services Taxable In Florida

The state of Florida imposes a tax rate of 6% plus any local discretionary sales tax rate. It is commonly known that tangible personal property is taxable in Florida. Tangible personal property is defined as personal property that may be seen, weighed, measured, touched, or is in any manner perceptible to the senses. What is not commonly known is that some services are also taxable in Florida. The four specific types of taxable services subject to sales tax in Florida are:

- Nonresidential Cleaning Services

- Commercial/Residential Burglary and Security Services

- Detective Services

In addition to the four specific types of taxable services in Florida, there are some things people typically consider services that are also subject to Florida sales tax. The most common type of these additional services are repair services on tangible personal property. If any tangible personal property is transferred to the customer when making the repair, then the whole price charged to the customer is subject to Florida sales tax. This is known as the one drop of oil rule.

Interior Designers are surprised to learn their interior design fees are subject to sales tax if tangible personal property is sold as part of the contract. For company that manages real property rentals, commercial or residential, the management company is responsible for making sure the tax is collected and remitted as much as the tenant and landlord.

ADDITIONAL RESOURCES

How Does Property Tax Work

The amount owners owe in property tax is determined by multiplying the property tax rate by the current market value of the lands in question. Most taxing authorities will recalculate the tax rate annually. Almost all property taxes are levied on real property, which is legally defined and classified by the state apparatus. Real property includes the land, structures, or other fixed buildings.

Ultimately, property owners are subject to the rates determined by the municipal government. A municipality will hire a tax assessor who assesses the local property. In some areas, the tax assessor may be an elected official. The assessor will assign property taxes to owners based on current fair market values. This value becomes the assessed value for the home.

The payment schedule of property taxes varies by locality. In almost all local property tax codes, there are mechanisms by which the owner can discuss their tax rate with the assessor or formally contest the rate. When property taxes are left unpaid, the taxing authority may assign a lien against the property. Buyers should always complete a full review of outstanding liens before purchasing any property.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

What Are All Those Taxes And Fees On Your Florida Electricity Bill

We recently got an email from one of our clients in Florida. What are all these taxes and fees on my electricity bill? he asked. We get this question all the time from clients in Florida and across the country. Heres a rundown of the taxes and fees you might find on your Florida electricity bill.

Taxes on Your Florida Electricity BillYour electricity bill includes a gross receipts tax that may include up to four other different taxes, paid to state or local governments. You may pay a franchise fee, utility/municipal tax, Florida sales tax, and discretionary sales surtax, too. These taxes vary by area and are not controlled by your utility company. The company collects these taxes and distributes them to the proper government entities. Gross Receipts Tax: paid to the State of Florida approximately 2.56% of your bill. Franchise Fee: paid to municipalities and/or counties in exchange for the government not creating an electric utility of its own that would compete with your utility company. Utility/Municipal Tax: paid to municipality or county based on your electricity usage. Florida Sales Tax: paid to the State of Florida 7% of the amount of electricity you purchase. Discretionary Sales Surtax: paid to your county.

Have questions about specific taxes and fees on your electricity bill or other utility bill? Speak with the experts at SM Engineering today. Well explain your bill and scour it for potential savings. Schedule your no-obligation bill audit today.

Excise Taxes On Retirement Accounts

Excise taxes are also charged on some retirement account activities. Many people are familiar with these taxes as penalties. A 6% excise tax is applied to excess individual retirement account contributions that are not corrected by the applicable deadline. A 10% excise tax penalty applies to distributions from certain IRAs and other qualified plans when an investor makes withdrawals before age 59.5.

Also, a 50% excise tax penalty is charged when investors do not take the mandatory required minimum distributions from certain retirement accounts. Required minimum distributions are mandatory after age 72 for traditional IRA accounts and several other tax-deferred retirement savings plans.

Also Check: Is Past Year Tax Legit

Income Tax Percentage In Florida

The above table provides you with a broad range of different Florida State income tax rate scenarios. The income tax rates in the table are based on a single taxpayer claiming one personal exemption.

The Florida income tax rates in the table reflect almost a worst-case scenario for a US taxpayer because those that are married and have dependents can typically take advantage of other deductions, which would effectively make the federal income tax you pay, less than what you see in the table.

Again, you must always consult a professional when it comes to calculating your Florida tax liability, since other factors may affect the amount of income tax you pay on your earnings in Florida. The income tax percentage in Florida is 0% as noted on the table, but you are still responsible for paying Social Security and Medicare , totaling 7.65%.

You are also responsible for paying Federal Income Tax regardless of whether you reside in Florida with its favorable 0% income tax rate. To see all the US income tax rates by state have a look at our page that includes a table with all the rates and links to specific income tax rates in each US state.

Florida Communication Services Tax

In addition to the above taxes, Florida also collects a special communication services tax on all phone, internet and television services. The total tax rate is 7.44%, but service providers are only allowed to directly bill consumers for 5.07% of that. For the remaining 2.37%, consumers must report and pay the tax independently.

For satellite-based services like DirecTV, the rate is even higher at 11.44%. So if you are a big spender on high-speed internet, multiple phone lines and the top-of-the-line cable TV packages, expect a slightly higher price-tag when it comes time to pay up.

Don’t Miss: Efstatus.taxact.com.