More Money On The Way

Customers of a variety of companies, including Jackson Hewitt, H& R Block and TurboTax, had warned about trouble last week.

Many customers had taken out refund advances or agreed to have their tax preparation fees taken out of their tax refunds. The bank accounts were set up by tax preparation firms and later closed as part of that process. But their stimulus money wasn’t getting to them now.

“By law, the financial institution must return the payment to the IRS they cannot hold and issue the payment to an individual when the account is no longer active,” the IRS said earlier as news broke about the glitch.

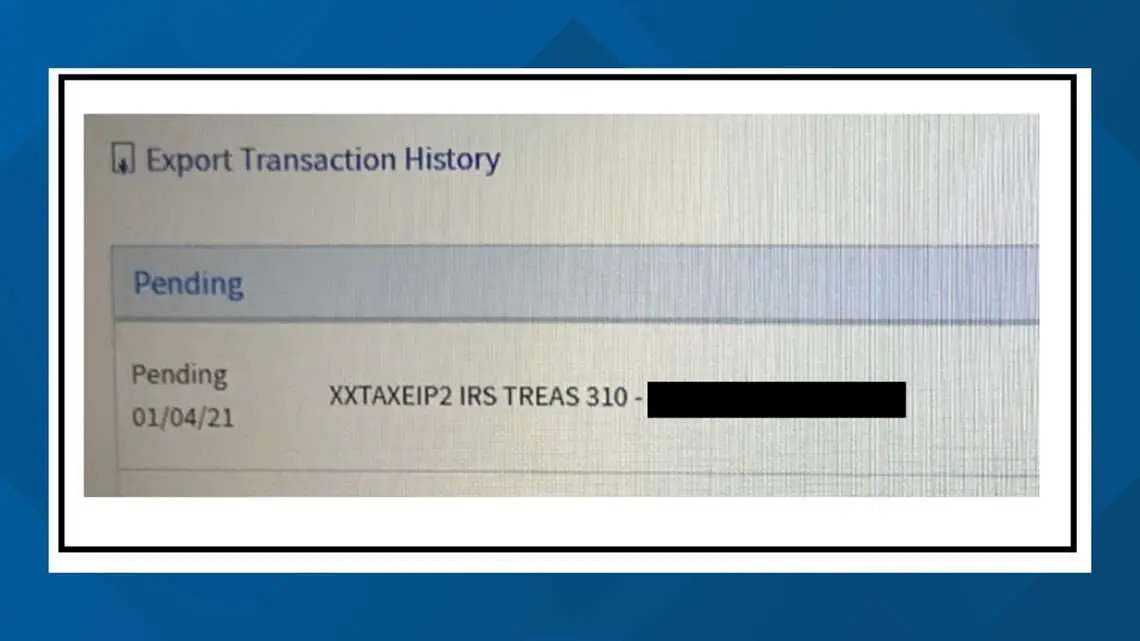

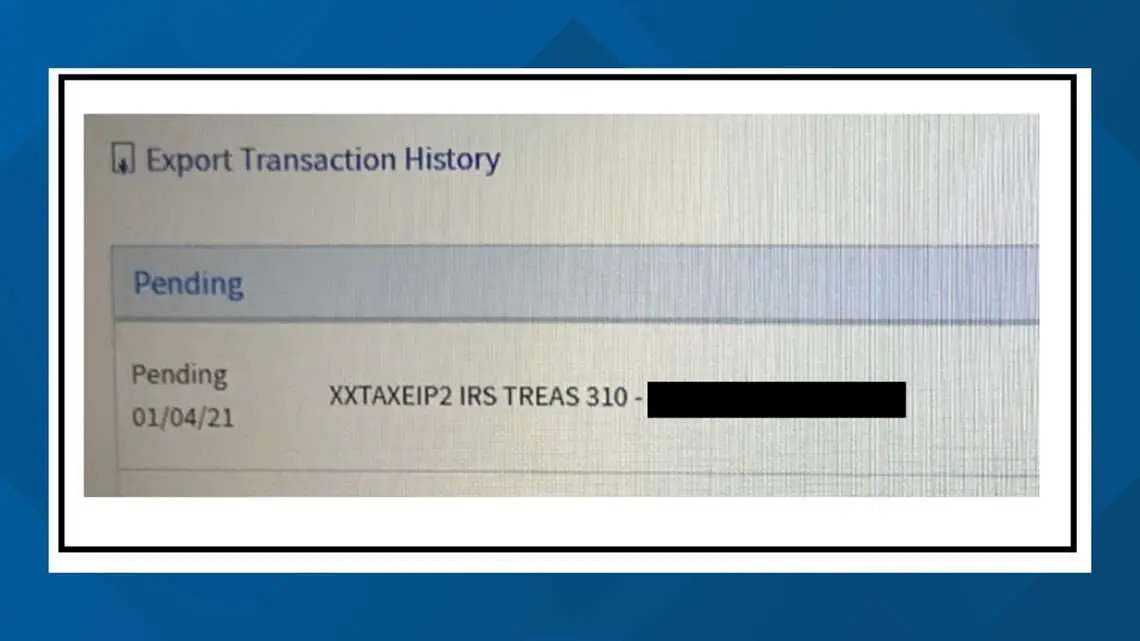

I reported about this problem early on Jan. 5 as readers complained to me about seeing wrong bank accounts show up when they researched an IRS online tool called “Get My Payment.”

The IRS issued a statement on Jan. 10 that noted that the agency is taking “additional steps to get the second Economic Impact Payments to more eligible taxpayers.”

“Following extensive work and discussions with our industry partners,” the IRS said, “the IRS will reissue payments for taxpayers who did not receive the second Economic Impact Payment in instances where the bank account identified in our records has been closed.”

How Can I Find Out If My Third Stimulus Payment Will Arrive As An Eip Card

If you got an EIP card last time, does that mean you’ll get your money the same way with the third stimulus check? Not necessarily. With the second round, the IRS sent double the number of EIP cards. The Treasury says if you didn’t receive your payment via direct deposit by March 24, you should watch the mail carefully in the coming weeks for a paper check or a prepaid debit card.

One new wrinkle this time around: The third round’s checks are going out during tax season. The IRS is using your most recent tax return it has on file, which could be your 2019 or 2020 return, to determine your payment.

Q: Why Couldnt You Distribute The Payments Yourself

A: The payments were deposited to closed accounts in error by the IRS. Unfortunately, by law banks are required to return payments to closed accounts. This process also typically facilitates getting the payments sent by check and delivered to the taxpayers faster. However, after realizing the volume of erroneously deposited payments and subsequent returns, the IRS indicated they would not be able to process checks while getting their systems ready for tax season. When this was announced, many in the industry found this to be an unacceptable solution and worked closely with the IRS to come up with a more acceptable solution, which is in place now. Our mission is to get everyone their money as fast as possible. Those funds will now be reissued by the IRS directly to the recipient beginning by the end of January. We expect recipients to begin receiving funds in their account or by check beginning February 1.

Also Check: Have My Taxes Been Accepted

Q: What If I Have Already Completed The Tax Return Requesting The Recovery Rebate Credit For My Impacted Customer

A: The IRS did direct taxpayers that did not get their EIP2 to file for a credit. That would have delayed those payments for many until the end of February and that was unacceptable to us as well as many others in the industry. It is one of the reasons we pushed to have the IRS process the payments as soon as possible. While this has been a fast-moving issue, the IRS is now going to process these payments so there is no need to file for a credit for these customers. To help you, we will be providing a report for you that gives you a list of impacted customers. If your customer is on the list, they will be receiving their EIP2 proceeds directly from the IRS, and the request for a Recovery Rebate Credit should be modified or removed.

Stimulus Payments To Some People Who Used Tax Preparation Services Getting Bounced Back

The Internal Revenue Service sent out the first wave of stimulus checks to Americans on Saturday, the agency said.

MOBILE, Ala. The stimulus money is flowing, but some Gulf Coast residents are getting disappointing surprises the money is bouncing back.

For many, the reason for the rejected direct deposits has to do with the way they filed their tax returns. When people pay tax preparation services, they sometimes defer payment until their refunds arrive. When that happens, the tax preparers generally use banks to set up temporary accounts to handle the transactions.

In a typical case, when the Internal Revenue Service sends the refund, it gets deposited into one of those temporary account. Money for preparers fees to prepare the tax return plus the fee for any advance the taxpayer took on a portion of the funds get deducted. The balance of the refund then either goes to the clients bank account or to the client in the form of a physical check.

The system generally works well for tax refunds. But it has caused agita when it comes to the economy stimulus payments authorized by Congress last month. The IRS has been using the bank account and routing number included on those tax forms to determine where to send the stimulus money.

That is the bank account that the IRS is showing, said Callie Duffie, who owns Whiddens Tax Service in Grove Hill.

That will be a bad situation because it will put me off five, eight weeks, Its very frustrating.

You May Like: How Can I Make Payments For My Taxes

How To Convert An Rrsp To An Rrif

You are permitted to convert the holdings in your RRSP to an RRIF at any time. The only requirement is that the RRSP must be converted to an RRIF by the end of the calendar year in which you reach the age of 71.

For those who have a birthday in December, that means the calendar year ends on 12/31. Even if your birthday is on December 31st, you must convert the RRSP to an RRIF before the year expires.

You have the option to convert the RRIF to an annuity or take a lump-sum payment if you prefer.

For those who decide to convert to an RRIF, your payments are not required to begin until next calendar year.

That means you can convert the RRSP to an RRIF in January of 2018, then take your first scheduled payments as late as December 2019. The rule is that your first scheduled withdrawal is not required to begin until the calendar year which follows the year the RRSP account was converted to an RRSP.

I Was Supposed To Get An Eip Card For The First Or Second Stimulus Check But I Never Got It What Can I Do

If your first or second stimulus check never arrived, you’ll have to claim it as a Recovery Rebate Credit when you file your 2020 tax return, now through the May 17 deadline. You’ll have to file your taxes to claim any missing stimulus money, even if you’re part of the group of nonfilers who typically don’t have to do so. In some cases — like if you received a confirmation letter from the IRS that it sent your money, but your EIP card never arrived — you may have to report the missing funds or any errors to the IRS.

Also Check: Where’s My Refund Ga State Taxes

Information Required To Start Direct Deposit

There are 5 pieces of information that are required to initiate the prenote process to begin a Direct Deposit.

- The bank account number of the employee must be provided.

- The routing number for the financial institution is needed.

- Employees must choose which type of account they have .

- The name and address of the financial institution is necessary, even if there arent different branches.

- The name of the account holder listed on the account is required as well.

If an employee and a spouse share the bank account where the Direct Deposit is being requested, both names may be required by the financial institution for the prenote to be moved to completed status.

For this reason, many employers request a voided or canceled check as part of the documentation to begin a Direct Deposit. Because a valid check often contains all of the information listed in the bullet points above, there are fewer errors or missing pieces of data that would slow down the process.

From an employee standpoint, it is important to remember that the routing number and account number of your account is sensitive information. These should only be provided in circumstances where you absolutely trust your employer.

What Is A Direct Deposit

Direct Deposit is an electronic payment. It occurs when money is electronically transferred from an employers account to an employee account which has been authorized through a prenote. Most transfers are completed using an automated clearing house, or ACH network. This allows the payments to be coordinated among several different financial institutions simultaneously when payday arrives.

If you receive your paycheck through a Direct Deposit, then your account balance will increase automatically when that payment arrives. Youre not required to deposit the funds into your account physically or accept the payment.

The opposite occurs with the employer. Once the payment is initiated, the balance in the company account will automatically decrease without a requirement to accept the transaction.

Several billion ACH payments are initiated each year around the world as part of the Direct Deposit process. Some branches of government, especially in the United States, have even started to use the prenote vs Direct Deposit process to pay entitlements, benefits, or structured payments, like Social Security.

You May Like: How To Buy Tax Lien Properties In California

Tips And Tricks For Successful Printing

*Amount may vary. Not representative of actual tax refund/direct deposit.

- If you have not already, make sure to destroy all remaining check stock from previous years and only use the new check stock we are sending you

- Test which way paper goes into your printer by writing an arrow on it and printing a document to avoid putting the check stock in the wrong way Make sure to load your check stock into the printer before printing a check

- If you do not see a check authorization, try logging out and logging back in

- Make sure check sequence is correct and numbers match before printing

- When you start a new packet of checks, update your check range in the system

- Best practice is to print checks the night before funding. You will be sent a check print notification around 6pm the night before funding. Otherwise, wait an hour after printing before giving it to your client

- Inform your client that checks are only valid for 90 days. If it has been more than 90 days, give EPS a call at

Millions Of Stimulus Debit Cards Will Be Mailed Out Starting This Week

The Treasury Department announced Thursday that approximately 8 million second stimulus payments will be mailed out starting this week in the form of prepaid debit cards.

The debit cards, called Economic Impact Payment cards, are issued by MetaBank, N.A., and will arrive in a white envelope that “prominently displays the U.S. Department of the Treasury seal.”

The cards themselves will have “Visa” on the front and MetaBank on the back. The envelope will also include instructions for activating the cards. Many people reportedly threw the cards away during the first round of stimulus checks because they were not expecting them.

Millions of paper checks are also being delivered, and the IRS is still depositing payments via direct deposit. The agency has until Jan. 15 to deliver all of the payments after that, eligible taxpayers who have not received their payment will need to claim it on their 2020 tax returns.

Cards sent out the first time will not be “reloaded.” Taxpayers will either receive a new card, a paper check or direct deposit.

The Treasury also noted that some people who received a paper check last time may get a debit card for their second payment, and vice versa. It did not provide a reason for this change.

You can find out more information on the EIP Card website.

You May Like: How To Appeal Property Taxes Cook County

Irs Statement Update On Economic Impact Payments

The IRS continues to take additional steps to get the second Economic Impact Payments to more eligible taxpayers. In addition to redirecting payments to the proper account in recent days to a larger group of people , the IRS and tax industry partners worked over the weekend to help a smaller set of impacted taxpayers.

- Reissuance of Certain Economic Impact Payments – Following extensive work and discussions with our industry partners, the IRS will reissue payments for taxpayers who did not receive the second Economic Impact Payment because the temporary bank accounts identified in our records were closed.

- Taxpayers Impacted – This impacts some taxpayers when tax preparation providers were unable to deliver funds to people as a result of IRS guidance, and they are now waiting for the IRS to re-process payments related to these accounts.

- Payment Directly from the Government to be Received Soon – Payments will be issued directly from the government later this month , within weeks of the law being enacted. For people in this group, payments may be issued either as a paper check or as a direct deposit.

- No Action Required by Taxpayers to Receive these Payments – Taxpayers do not need to take any action or call the payments will be made automatically.

The IRS regrets the inconvenience and greatly appreciates the assistance of our tax industry partners in helping accelerate a resolution of this issue.

How To Finalize The Conversion

To convert your RRSP to an RRIF, you must notify the holder of the account about your intentions. Then you must decide on what type of payment you will eventually take from the account.

If you decide to take the lump-sum payment to clear out the account, then the conversion to an RRIF will close out the account. This option should only be considered if you have a large financial obligation to meet. Keeping your money in a tax-deferred state will help fund more of your retirement in most situations.

For further questions, ask the financial institution holding your account or speak with a qualified financial professional.

Also Check: Do You Have To Pay Taxes On Plasma Donations

Treasury Issues Millions Of Second Economic Impact Payments By Debit Card

IR-2021-06, January 7, 2021

WASHINGTON Starting this week, the Treasury Department and the Internal Revenue Service are sending approximately 8 million second Economic Impact Payments by prepaid debit card.

These EIP Cards follow the millions of payments already made by direct deposit and the ongoing mailing of paper checks that are delivering the second round of Economic Impact Payments as rapidly as possible.

If Get My Payment on IRS.gov shows a date that your payment was mailed, watch your mail for either a paper check or debit card. To speed delivery of the payments to reach as many people as soon as possible the Treasury’s Bureau of Fiscal Service is sending payments out by prepaid debit card.

IRS and Treasury urge eligible people who don’t receive a direct deposit to watch their mail carefully during this period. The prepaid debit card, called the Economic Impact Payment card, is sponsored by the Bureau of the Fiscal Service and is issued by Treasury’s financial agent, MetaBank®, N.A. The IRS does not determine who receives a prepaid debit card.

Taxpayers should note that the form of payment for the second mailed EIP may be different than the first mailed EIP. Some people who received a paper check last time might receive a prepaid debit card this time, and some people who received a prepaid debit card last time may receive a paper check.

More information about these cards is available at EIPcard.com.

Is There Anything I Can Do If I Lose My Eip Card Or It Gets Destroyed

If you’ve lost or destroyed your EIP card, you can request a free replacement through MetaBank Customer Service. The replacement fee will be waived the first time.

You don’t need to know your card number to request a replacement. Just call 800-240-8100, and choose the second option from the main menu, according to the IRS website.

You May Like: How Much Will A Roth Ira Reduce My Taxes

How And When Will Tax Prep Customers Get Their Direct Deposit Corrected

EPS Financial, a division of Metabank, posted the following statement on their website, saying the money sent to them by mistake would be sent back to the IRS. Those funds would then be redistributed back to the customer who should have received it directly. WOAI reported this process would take 7 to 10 days.

EPS statement:

The IRS will be issuing Economic Impact payments directly to individuals and not to temporary accounts for bank products.

If the IRS inadvertently sent your EIP payment to the temporary bank account at EPS, this payment has been returned to the IRS to be distributed directly to you.

Neither your tax preparer nor EPS have access to this payment or any information regarding it. Neither your tax preparer nor EPS can update your disbursement information.

All questions regarding your EIP need to be directed to the IRS.”

If I Got An Eip Card In The Past Will I Get More Money On That Card Now

If the IRS sent a previous stimulus check as an EIP card and plans to send you another payment the same way, you’ll receive a brand-new prepaid card with the calculated total for your third stimulus check. The IRS won’t add money to any previous card you may have, the agency said.

You can use the IRS tracking tool online to see if your stimulus check will arrive in the form of an EIP card.

Don’t Miss: Is Plasma Donation Taxable Income