How To Know If Your Social Security Is Taxable

Retired couple taking a happy selfie in tropical sea excursion with life vests and snorkel masks – … Boat trip snorkeling in exotic scenarios on active elderly and senior travel concept around world. They are not worried about what they do or don’t know about Social Security Taxation.

Getty

Youve worked hard for decades, and now you want to enjoy your golden years. If planned to have a nice standard of living in retirement, you are likely going to get hit with income taxes. The more retirement income you have, the more taxes you likely pay, just the way it is. The myth that Social Security is not taxed is just that, a myth.

An estimated 60% of retirees will owe no federal income taxes on their Social Security Benefits. Which is likely where many people come to believe Social Security benefits are tax-free. They are not. This just means that a majority of retirees are living on what could be described as low income.

The good news is that Social Security income is not taxed quite as heavily as other forms of retirement income. Regardless of how much you make in retirement, at least 15% of your Social Security benefits will come to you tax-free.

How Is The Social Security Tax Used

Income taxes you pay are deposited into the general fund of the United States. They can be used for any purpose, but Social Security taxes are different.

These taxes are paid into special trust funds that should only be used to pay current and future Social Security retirement benefits, as well as disability benefits and benefits for widows and widowers. Today’s workers contribute their percentage, which in turn is paid to today’s beneficiariesthose workers who have retired and who are now collecting Social Security benefits. When today’s workers retire, they’ll tap into the benefits being paid by tomorrow’s workers.

Consulting With A Social Security Attorney

Conducting research and applying for Social Security on your own can be lengthy, stressful, and confusing. It is also vital that applications are completed correctly, as any mistakes could lessen your chance of qualifying.

Social Security attorneys have expansive knowledge of the SSDI process that can help you avoid the common mistakes many applicants make. They can also present your case as favorably as possible to give you the best shot at receiving disability insurance. If you are thinking of filing for SSDI, consider speaking with a Social Security attorney beforehand to discuss your options.

Don’t Miss: Pastyeartax Reviews

Just Started Collecting Social Security Here’s How To Know Whether You’ll Owe Taxes On It

Roughly 1 in every 2 older adults will pay federal income taxes on a portion of their Social Security benefits for the 2020 tax year.

To be sure, this usually happens only if you have other substantial income in addition to your Social Security benefits, such as wages, self-employment, interest, dividends and other taxable income that must be reported on your tax return, according to Uncle Sam.

The Social Security Act Defines Disability Very Strictly

Eligibility rules for Social Securityâs disability program differ from those of private plans or other government agencies. Social Security doesnât provide temporary or partial disability benefits, like workersâ compensation or veteransâ benefits do.

To receive disability benefits, a person must meet the definition of disability under the Social Security Act . A person is disabled under the Act if they canât work due to a severe medical condition that has lasted, or is expected to last, at least one year or result in death. The personâs medical condition must prevent them from doing work that they did in the past, and it must prevent them from adjusting to other work.

Because the Act defines disability so strictly, Social Security disability beneficiaries are among the most severely impaired in the country. In fact, Social Security disability beneficiaries are more than three times as likely to die in a year as other people the same age. Among those who start receiving disability benefits at the age of 55, 1-in-6 men and 1-in-8 women die within five years of the onset of their disabilities.

You May Like: Reserve Retirement Pay Calculator

You May Like: How To Buy Tax Liens In California

What Benefits Does Social Security Disability Insurance Offer

The amount you receive from Social Security Disability Insurance depends on your average lifetime earnings before your disability began. Generally, the more you earned over a longer period, the more you’ll benefit. The Social Security Administration calculates your disability benefit based on the amount of your Social Security “covered earnings.” Generally, these are your past earnings that have been subject to Social Security tax.

You need to take your covered earnings and average them over the 35-year period representing your top earning years. The IRS sees this as your average indexed monthly earnings . The Social Security Administration then applies a formula to your AIME to calculate your primary insurance amount . This serves as the base figure for the Social Security Administration to calculate your Social Security Disability Insurance benefit amount.

To understand your entire covered earnings history, the Social Security Administration provides access to your annual Social Security Statement. If you receive other disability benefits from private insurers, this will not impact your Social Security Disability Insurance benefits.

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

You May Like: When Do You Do Tax Returns

Special Rules For Disabled Widow

If you are a disabled widow, the date you begin to receive benefits depends on whichever of the following happens last:

- 12 months before the date you applied

- five months after the date of onset of your disability

- the month your spouse died, or

- the month you turn 50.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

You May Like: How To Get Tax Preparer License

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

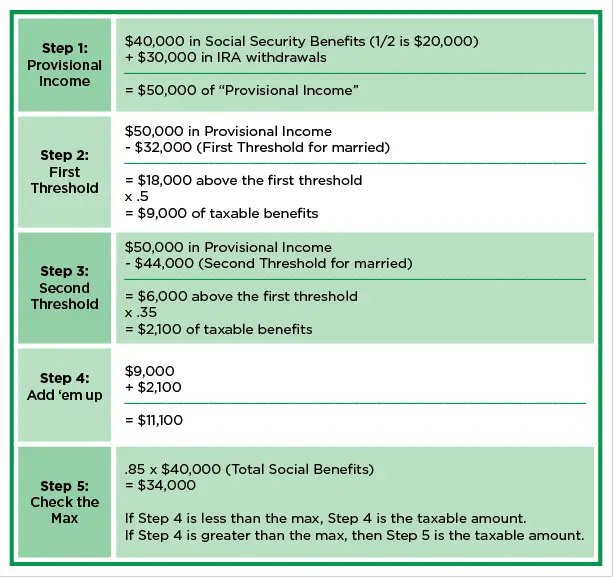

How Do You Calculate And Report Taxable Benefits

The IRS provides worksheets to help you calculate how much of your Social Security benefits to include as taxable income. The worksheet you use will depend on your tax situation. The most commonly used worksheet is for Form 1040 filers who do not have foreign earned income, foreign housing exclusion or deduction, or US savings bond interest exclusion and do not contribute to an IRA while at the same time having you or your spouse covered by a retirement plan at work. A copy of this worksheet can be found in the IRS packet of Forms and Instructions sent to most taxpayers.

The worksheet for those with foreign income or filing Form 4563, Exclusion of Incomefor Bona Fide Residents of Samoa, or Form 8815, Exclusion of Interest from Series EE orI US Savings Bonds Issued After 1989, or with income from Puerto Rico is found in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits.

The worksheets you must use if you contribute to a traditional IRA and you or your spouse are covered by a retirement plan at work or through self-employment are found in IRS Publication 590, Individual Retirement Arrangements . These worksheets are fairly complicated and have lots of instructions, but they also are used to calculate how much, if any, of your IRA contribution is deductible.

Also Check: Www.1040paytax.com

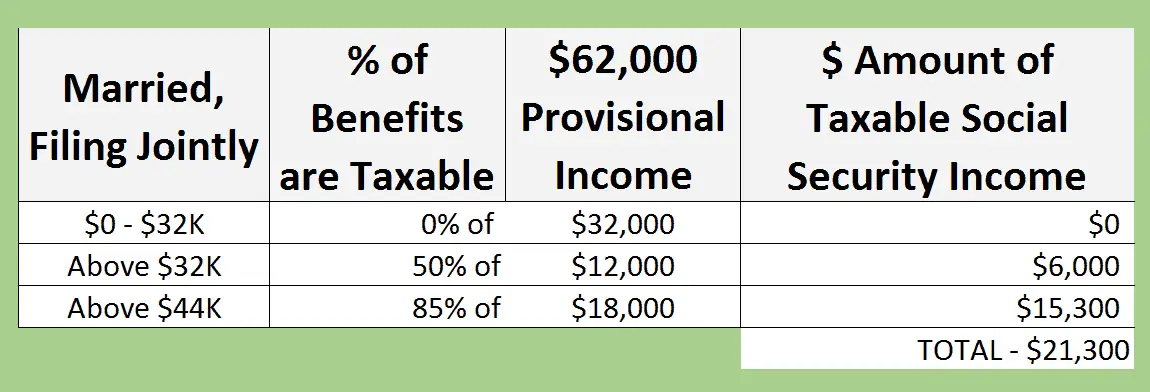

Combined Income And Income Thresholds

Whether you owe tax on your Social Security benefits depends in part on IRS-defined income thresholds and your “combined income.”

Income Thresholds 2020: If your income is greater than $25,000 per year and you file an individual federal tax return, you may pay taxes on your Social Security benefits. The same is true for those filing jointly with annual earnings greater than $32,000. These thresholds apply whether your Social Security benefits take the form of retirement, spousal, survivor or disability payments.

Combined Income 2020: Whether you file an individual tax return or a joint return, your combined income determines what part of your Social Security benefits are taxed at the federal level. Whether you file an individual return or a joint return, combined income is the sum of the adjusted gross income, nontaxable interest and one half of your Social Security benefits that you are reporting.

According to the 2020 IRS rules:

Examples Of Tax Scenarios

File as Individual in 2020: Assume that you’re single and you received $28,000 in Social Security benefits in 2019. Also assume that you had additional income of $15,000 and received $500 in tax-exempt interest. Half of your benefits, or $14,000, plus your other income of $15,500 gives you a combined income of $29,500. In this case, your income is below the 2020 $34,000 threshold for an individual filer, so only 50 percent of your $28,000 Social Security benefits are subject to federal income tax.

: Assume that you’re married and that you receive $20,000 in Social Security benefits and your spouse receives $18,000. Also assume that you and your spouse had additional income of $25,000 plus $1,000 in tax-exempt interest. In this case, half of your combined benefits plus your other income totals $45,000, an amount that exceeds the threshold of $44,000 for those filing jointly. Consequently, up to 85 percent of your total Social Security benefits are subject to income tax.

Read More:How Do Income Taxes Work?

Recommended Reading: Where Can I File An Amended Tax Return For Free

How To Reduce Your Social Security Tax Liability

If you expect you may owe taxes on your Social Security benefits, there are a few things you can do to potentially minimize them.

- Reduce business profits: If you own a business, you can reduce your tax liability by taking advantage of business tax write-offs you may be entitled to.

- Limit retirement withdrawals: You may also want to consider reducing your withdrawals from retirement income to reduce your tax liability, but you should consider the required minimum distribution rules while doing so. If you dont withdraw at least a minimum from most taxable retirement accounts after age 72, you may actually increase your tax burden.

- Sell capital assets strategically: If you own capital assets, such as stocks, bonds or real estate, you should discuss with a tax professional the best time to sell your assets. Any capital assets sold at a loss can reduce your overall income. Any assets sold at a gain may be subject to capital gains taxes, depending on how long you held them.

How To Calculate Your Self

In order to calculate your self-employment tax, you will first need to calculate your earnings from self-employment in order to understand your net earnings. You need to find your net-earnings because that is what the self-employment tax is applicable to. Tips to keep in mind when figuring out your self-employment tax include:

- First, you will need to figure out your net earnings which is your gross income from self-employment minus your business costs. For example, if your business costs were $100,000 but you made $225,000 then your net earnings would be $125,000.

- A general rule of thumb is 92.35% of your net earnings from self-employment are eligible for self-employment tax.

- Now that you know your net-earnings, you can apply the 15.3% tax rate. This means if your net-earnings were $125,000 then 15.3% would go towards taxes which is $19,125.

- Keep in mind that in 2021 only $142,800 of earnings was subject to the social security portion of self-employment tax. You need to account for that if your earnings were high enough!

Don’t Miss: How Do I Protest My Property Taxes In Harris County

What Is Social Security Disability Insurance

Social Security Disability Insurance is a social insurance program funded by payroll taxes meant to help you if you become disabled. The program’s administrator, the Social Security Administration , allows you to earn coverage benefits if you meet their definition of disabled which includes becoming disabled for at least 12 months or in a way that is expected to be fatal.

The Social Security Disability Insurance program provides modest though vital benefits to you if you have suffered a serious and long-lasting medical disability.

If you worked long enough and recently enough, you and certain family members are considered “insured” by the program. As a result, you can receive benefits if you meet the eligibility requirements.

How To Minimize Taxes On Your Social Security

If your Social Security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to get into that tax-free zone: reducing tax-exempt interest or adjusted gross income. And since most people dont have tax-exempt interest, youre left with one option.

Therefore, the secret is to reduce your adjusted gross income in order to prevent provisional income from triggering a tax on Social Security, says Kelly Crane, president and chief investment officer at Napa Valley Wealth Management in St. Helena, California.

Here are a few ways to reduce your adjusted gross income to get into the tax-free zone:

Also Check: Plasma Donation Taxable

Can I Cash Out My Va Disability

In actuality, the veteran is receiving cash in return for monthly payments for a specified period of time. If you meet these requirements, you may be able to get a lump sum for va disability benefits convert your payments into a lump sum of cash. Both benefits are exempt from both federal and state income tax.

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making some wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account, to shield your withdrawals from income tax. Take out some retirement money after you’re 59½ but before you retire, to take care of the taxes before you need the money. And, you might talk to a financial planner about a retirement annuity.

Also Check: Prontotaxclass

Will I Pay The Tax If I Continue Working After I Start Claiming Social Security

You may still be working when you begin drawing Social Security benefits. It may seem counterintuitive to continue paying the tax once you start taking benefits. However, you must pay the Social Security payroll tax as long as you earn wages or self-employment income that isn’t exempt from FICA or SECA taxes.

The Future Of Social Security Isn’t Clear

Social Security isn’t in great shape, on the whole. According to a 2019 report from the trustees of Social Security and Medicare, the federal program that pays out retirement and disability benefits to millions of Americans was expected to be in the red in 2020 and “all later years,” paying out more than it’s collecting in funding. And that was before the coronavirus pandemic hit and mass unemployment befell America.

Every working American pays into the Social Security and Medicare systems through a 7.65% payroll tax, or a 15.3% tax if self-employed, which covers both the employee and the employer portions. That tax is levied on the first $142,800 of a worker’s income in 2021, up from $137,700 in 2020.

Taxes being paid by workers at present aren’t saved for their own future retirement. Instead, they go toward funding Social Security benefits for the currently disabled or retired, as well as retirees’ spouses and dependents, and surviving dependents and spouses. As Darren Fonda

Read Also: Do You Have To Pay Taxes On Plasma Donations

How To Plan For Social Security Taxes

A balanced approach to distribution is the best way to plan for Social Security taxes, says Freitag. Keep in mind that too much emphasis on one type of distribution or another is not the way to go.

It is better to have a mix of income streams in retirement, he says. As an example, if all your income is taxable, then adding Social Security just makes it worse across the board.