What Are Estimated Taxes

Income that is not subject to federal tax withholding during the course of the year is still subject to tax, requiring you to pay estimated taxes to ensure that you pay as you go. Wage earners can get around this by increasing the amount withheld at their regular job.

Examples of income not normally subject to tax withholding include:

- Interest.

- Unemployment compensation.

- Social Security benefits in some cases.

The IRS wants Americans to pay taxes as they earn money. Normally, penalties and interest apply for underpayments and late payments.

Because of the pandemic in 2020, some tax filing deadlines were relaxed and extended. Similarly, interest and penalties were waived and didnt begin accruing until mid-July.

Keep in mind that due to COVID-19 the 1040 returns for 2019 were moved from being due on April 15 to July 15, says Judy OConnor of accounting firm OConnor & Rodriguez, PA, in Miami Shores, Florida. And then due to COVID the first two quarterly payments for estimated taxes were moved from April 15 and June 15 to July 15.

But as of now, no changes are planned for the 2021 tax year due to the pandemic, she adds. But that could change. There is so much up in the air still with COVID-19, and there could be changes once again.

Farmers Fishermen And Merchant Seamen

Farmers, fishermen and merchant seamen who receive 2/3 of their estimated Virginia gross income from self-employed farming or fishing have special filing requirements, which allow them to make fewer payments. If you meet the qualifications of a farmer, fisherman or merchant seaman, you only need to file an estimated payment by Jan. 15. If you file your income tax return on or before March 1 and pay the entire tax at that time, you are not required to file estimated tax payments for that tax year.

How To Enrol In Bmo Tax Payment And Filing Service

There is a one-time self-registration for this service, with no enrolment costs. To qualify you must be a business banking customer with a BMO Debit Card for Business and have the ability to make bill payments through BMO Bank of Montreal Online Banking.

If youre already registered for BMO Online Banking, and qualify for the service, then youre ready to begin. Simply sign-in to the BMO Online Banking site, click on the Bill Payment tab and then select the Tax Payment & Filing tab. Click on the Register button and complete the registration.

Once you have completed the registration, you can begin adding payment types and filing and paying business taxes online. For more details on how the service works, please refer to the BMO Tax Payment & Filing Service User Guide.

View the list of tax transactions currently available with our service.

®Registered trade-mark of Bank of Montreal

1Subject to interruptions in telecommunications or online systems or in power supply or any other factor or even beyond the control of Bank of Montreal.

Read Also: Which States Freeze Property Taxes For Seniors

Choose A Payment Method

You can pay your tax instalments online, in person, or by mail. There are several payment options with different processing times for each.

- Online:

- In person or by mail:

- Use your instalment remittance voucher to pay in person or by mail

You will need your instalment remittance voucher to ensure your payment is applied to the correct account.

Your remittance voucher is included in your instalment reminder package the CRA mails to you, unless you pay instalments by pre-authorized debit.

Choose your payment method:

- call our automated TIPS line at 1-800-267-6999

If your payment is not honoured, the CRA will charge a fee.

How To Make An Estimated Payment

We offer multiple options to pay estimated taxes.

- Individual online services account. If you don’t have an account, enroll here. You’ll need a copy of your most recently filed Virginia tax return to enroll.

- 760ES eForm. No login or password is required. Make sure you choose the correct voucher number.

- ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

See all options to file and pay estimated taxes.

Electronic filing requirement

You must submit all of your income tax payments electronically if:

- Any installment payment of estimated tax exceeds $7,500 or

- Any payment made for an extension of time to file exceeds $7,500 or

- The total income tax due for the year exceeds $30,000.

If any of the thresholds above apply to you, all future income tax payments must be made electronically.This includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed.

Beginning July 1, 2021, the requirement to pay electronically will apply if:

- Any installment payment of estimated tax exceeds $2,500 or

- Any payment made for an extension of time to file exceeds $2,500 or

- The total income tax due for the year exceeds $10,000.

Recommended Reading: Do You Have To Pay Taxes On Court Settlements

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

How To Make Estimated Tax Payments 7

Estimated Taxes IRS Payments News Offer In Compromise Tax Guide DIY forms IRS payment plans tax resolution Tax Attorney

This guide covers making estimated taxes for individuals.

In order to make IRS estimated tax payments, you can pay online or pay by mail by check. It is strongly recommended that you pay online and pay estimated tax payments on a monthly basis while you are in an Offer In Compromise, so the IRS does not accidentally apply the payment to back due tax debts.

The reason to pay monthly during an Offer in Compromise is that it keeps your average bank account balance at a lower figure, its easier to keep up with the payments, and it looks good to the IRS Offer In Compromise examining officer that you are well caught up when they review your case. If you do not pay monthly, then you should at least pay estimated tax payments on a quarterly basis.

Here is how the payments can be made:

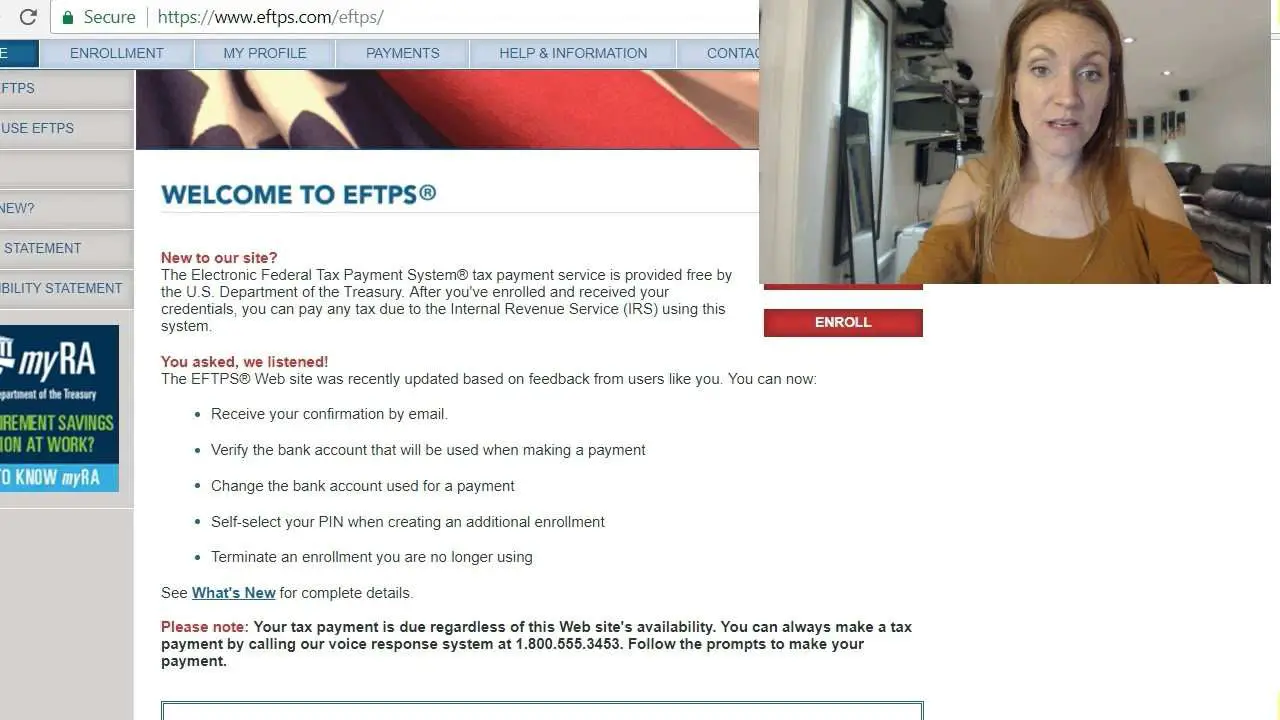

Make Estimated Tax Payments Online

To make estimated tax payments online:

Make Estimated Tax Payments by Check

To make estimated tax payments by check:

You May Like: Where Can I Find My Tax Return From Last Year

Tra’s Online Services And Special Notices

Given the current exceptional circumstances surrounding the outbreak of COVID-19, Tax and Revenue Administration encourages taxpayers to use electronic means to submit payments, registrations, applications, returns, claims, objections, waivers and appeals.

In order to reduce the necessity for taxpayers and tax preparers to meet in person, TRA will recognize electronic signatures. This administrative measure applies to all prescribed forms administered by TRA. To add a digital signature, the form must first be downloaded or opened as a PDF.

For more information, see TRA online services. This page also includes links to TRA Special Notices related to changes due to COVID-19, listed under the applicable program.

For COVID-19 updates, visit COVID-19 info for Albertans.

How Do I Make A Payment Using The Tax Payment And Filing Service

Make a Payment Using Tax Payment & Filing Service

If you are a Small Business customer, you can make a tax payment in EasyWeb from the Pay Bills screen.

If your business is not registered yet, you need to register your business to use this service.

On the Tax Payment & Filing main menu, you will see a list of all the payment types that you have previously added. To make a payment:

Recommended Reading: How To Get The Most Out Of Tax Return

Balance Of $10000 Or Below

If you owe less than $10,000 to the IRS, your installment plan will generally be automatically approved as a “guaranteed” installment agreement.

- Under this type of plan, as long as you pledge to pay off your balance within three years, there is no specific minimum payment required.

- For balances above $10,000, you may have to provide additional information in order to qualify.

Who Qualifies For Advance Payments

To qualify for advance payments of the Child Tax Credit, you must have:

- Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or

- Given us your information in 2020 to receive the Economic Impact Payment with the Non-Filers: Enter Payment Info Here tool or

- Given us your information in 2021 with the Non-Filer: Submit Your Information tool and

- Lived in a main home in the United States for more than half the year or filed a joint return with a spouse who has a main home in the United States for more than half the year and

- A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number and

- Made less than certain income limits.

Also Check: Where’s My Tax Refund Ga

How To Pay Estimated Taxes

Ideally, the IRS would like to get your estimated taxes in four equal payments over the course of the year, but some businesses are seasonal. For example, a landscaping business makes most of its money during the warmer months of the year. Its wise to pay the tax as you get income. In this event, youd follow the annualized income installment method that enables you to pay when youre flush with cash. Instructions can be found in IRS Publication 505, Tax Withholding and Estimated Tax and Form 2210.

Once you determine the amount to pay, the IRS will accept your money in any number of ways. Instructions for payment options can be found at IRS.gov/payments. These include:

- Direct pay from your checking or savings account.

- The IRS2Go mobile app.

- Cash at a participating retail establishment.

If you pay online, which you can do any time of the year, be sure to select the tax year and tax type or form associated with your payment. If you pay by check or money order, send the payment along with a Form 1040-ES voucher to the address specified for your state or territory on that form. Make the check out to the United States Treasury, and in the notes section in the lower left corner, specify the tax year and estimated taxes.

Limit On The Use Of Prior Years Tax

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than:

- $150,000

- $75,000 if married/RDP filing separately

Then you must base your estimated tax based on the lesser of:

- 90% of your tax for the current tax year

- 110% of your tax for the prior tax year

This rule does not apply to farmers or fishermen.

You May Like: Where Can I Get My Taxes Done By Aarp

Late Payment Penalty Policy

When payments are not made on or before the established due dates, Late Payment Penalty at the rate of 1.25% is levied on the first day of the month following the due date on the installment amount that was not paid on time. Authority to levy Late Payment Penalty is provided under Section 345. of the Municipal Act, 2001 and administered through a Town By-Law.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How Much Is My Salary After Tax

Payment Options For Individual Income Tax

To make paying taxes more convenient and hassle-free, the Office of Tax and Revenue allows the use of:

- ACH Debit

- Direct Debit

OTR will receive the electronic transaction from the vendor and apply it to the taxpayer’s account. The District’s third-party payment vendor will charge taxpayers a nominal fee for the credit/debit card transaction based on 2.5 percent of the transaction amount.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Recommended Reading: What Happens If You Cannot Pay Your Property Taxes

What Is The Minimum Monthly Payment For An Irs Installment Plan

OVERVIEW

Can’t afford to pay your income taxes? You may be able to qualify for an installment plan with the Internal Revenue Service. The minimum monthly payment for your plan depends on how much you owe.

If you cant afford to pay your taxes, you may be able to qualify for an installment plan with the Internal Revenue Service.

- An installment plan allows you to pay your taxes over time while avoiding garnishments, levies or other collection actions.

- You’ll still owe penalties and interest for paying your taxes late, but it can help make the payments more affordable.

- The minimum monthly payment for your plan depends on how much you owe.

Add Calgary Property Tax As A Payee

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online, by phone or in person at a branch.

Add Calgary Property Tax payee to your bank accounts bill payment profile:Search keywords: Calgary property tax and select the payee name closest to Calgary Property Tax or Calgary Property Tax.

Cant find Calgary property tax as a payee or are unsure which payee to select?

Contact your bank for more information.

You May Like: How To Pay Ny State Taxes

Closing Of Individual Po Box Addresses Could Affect Your Clients

Effective January 1, 2022, certain Post Office Boxes will be closed in Hartford, CT and San Francisco, CA. If you have pre-printed mailing labels for one of these payment addresses, destroy them now. To avoid delays, use the current address shown below. IRS encourages the use of electronic payment options available on IRS.gov.

Fees For Irs Installment Plans

If you can pay off your balance within 120 days, it won’t cost you anything to set up an installment plan.

- If you cannot pay off your balance within 120 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person.

- If not using direct debit, then setting up the plan online will cost $149.

- If not using direct debit, setting up the plan by phone, mail, or in-person will cost $225.

- If you’re a lower-income taxpayer, you may be able to reduce these fees.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

Easy Ways To Pay Taxes

IRS Tax Tip 2018-87, June 6, 2018

The IRS offers several payment options where taxpayers can pay immediately or arrange to pay in installments. Taxpayers should not ignore a bill from the IRS because as more time passes, interest and penalties accumulate.

Here are some ways to make payments:

- Direct Pay. Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. Taxpayers receive instant confirmation once theyve made a payment. With Direct Pay, taxpayers can schedule payments up to 30 days in advance. They can change or cancel a payment two business days before the scheduled payment date.

- Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. The IRS does not charge a fee, but convenience fees apply and vary depending on the card used.

- Installment agreement. Taxpayers who are unable to pay their tax debt immediately may be able to make monthly payments. Before applying for any payment agreement, taxpayers must file all required tax returns. They can apply for an installment agreement with the Online Payment Agreement tool, which also has more information about whos eligible to apply for a monthly installment agreement.