Net Income Vs Gross Income

Lets say you started working at a clothing store for $9.00/hour. You worked 27 hours this pay period, so you might be expecting to get a paycheck for $243. Instead, your take-home pay is closer to $200. Why is that?

Every person who earns money working in the U.S. is supposed to pay federal income tax and now that youre employed, this includes you. Youre also required to contribute to Social Security and FICA. Most states governments charge a state income tax, too.

Since the government expects you to pay taxes, they make it easy for you that is, they take it directly out of your wages. As a result, the amount of money you take home will not be equal to the amount you earned.

Your gross income is the amount of salary or wages your employer paid you before any tax was taken. So, the $243 you earned for 27 hours of work is your gross income. But your net income is what you take home after you have paid income tax, Social Security, and FICA.

Reporting Your Child’s Income On Your Tax Return

Your child might be allowed to skip filing a separate tax return and include their income on your return in 2020, but only if:

- Your child’s only income consists of interest, dividends, and capital gains .

- Your child was under age 19 at the end of the year.

- Your child’s gross income was less than $11,000.

- Your child would be required to file a return unless you make this election.

- Your child doesnt file a joint return for the year.

- No estimated tax payments were made for the year, and no overpayments from the previous year were applied to this year under your child’s name and Social Security number.

- No federal income tax was withheld from your child’s income under the backup withholding rules.

- You are the parent whose return must be used when applying the special tax rules for children.

Include your child’s unearned income on your tax return by using IRS Form 8814. It’s important to note that doing so could result in a higher tax rate than if the child filed their own tax return. It all depends on the amount of unearned income your child reports.

Explain to your child the basics of Social Security and Medicare and the benefits of earning credits in these programs.

Do Teenagers Need To File A Tax Return If They Work Part

By Special to MoneySense on July 19, 2019

Like many milestones, this one can be used as a teachable moment for kids and parents.

Q. I have three children, aged 14, 17 and 18. All have part-time jobs and make less than $3,000 per year, which they receive T4s for. They also all make charitable donations.

I have four quick questions for you: Do I need to file income taxes for them? Can I still claim them as dependents? Do I need to claim their income on my tax return? And can I claim their charitable donations?Brad

A. Before I answer your questions, Id like to congratulate your children. I find that most teens are eager to work, and by doing so, they gain valuable skills that will serve them now and in their future careers.

While you do not need to file returns for them , I always urge parents to get their children into the habit of filing an annual return as soon as possible, as it teaches them to be responsible citizens. And by filing a return, they will start to establish some Registered Retirement Savings Plan* room so they can begin to contribute at age 18.

I also recommend that you file together as a family, as this will allow you to claim all the family credits you are eligible forand so that, yes, you can claim your childrens charitable donations as a family on the return which will provide the best tax result. That means more possible savings for your family as a whole.

What does the * mean?

You May Like: How Much Does H& r Block Charge To Do Taxes

Tax Filing Requirements For Dependents

Taxpayers usually think of dependents in terms of children, but you can still claim a child as a dependent even after they turn 18, as long as they meet other rules for dependency. Because of this, the rules below apply to any qualifying dependent who is under age 65 and is not blind.

Keep in mind that theres no lower limit on age. If your newborn received a gift of dividend-paying stocks or mutual funds, you might have to start thinking about filing a tax return on their behalf sooner than you think.

The first step in the process of helping your children file their taxes is figuring out what theyre eligible for. To do this, you need any W-2s or other tax documents detailing their taxable income. Once you have this paperwork in hand, consider the following.

Pro tip: If youre unsure if your child needs to file a tax return, talk to a qualified tax preparer at a company such as H& R Block. Theyre available to answer all of your tax questions.

Does An 80 Year Old Need To File Taxes

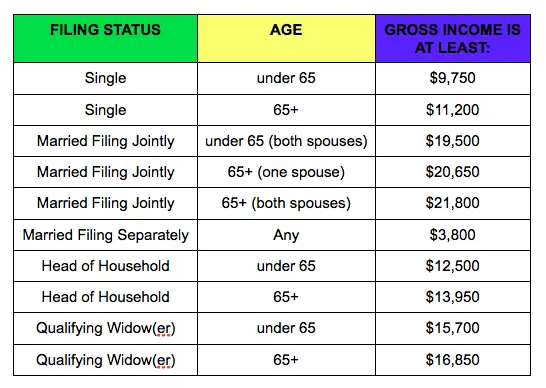

Children and Teens classified as a dependent: $5,700

Single, under 65: $9,350

Even if you do not have to file, you should file to get money back if Federal Income Tax was withheld from your pay,which if you were an employee most certainly happened or you qualify for any of the following:

- Earned Income Tax Credit. The Earned Income Tax Credit is a federal income tax credit for eligible low-income workers. The credit reduces the amount of tax an individual owes, and may be returned in the form of a refund.

- Additional Child Tax Credit. This credit may be available to you if you have three or more qualifying children or if you have one or two qualifying children and earned income that exceeds $11,300. The Additional Child Tax Credit may give you a refund even if you do not owe any tax.

- Health Coverage Tax Credit. Limited to certain individuals who are receiving certain Trade Adjustment Assistance, Alternative Trade Adjustment Assistance, or pension benefit payments from the Pension Benefit Guaranty Corporation.

Additional information on filing taxes:

Simple Common Sense:

The only time you actually do WANT to file is when the IRS says you don’t have to!

They don’t do that because it’s good for you. They do it because it is more likely to be good for them. Certainly if you don’t have to file, NOTHING BAD, in fact only good things, can happen by doing so.

Federal Taxes are the same throughout the country. State tax laws are specific to each area.

Recommended Reading: How To File Missouri State Taxes For Free

Senior Tax Credits For Elderly Or Disabled Taxpayers

Even though you may have to file a income tax return, there are a couple ways you can lower the amount of tax you have to pay. Are you 65 or older and have other income than just Social Security? Its quite possible that the Senior tax credit for the elderly or disabled could reduce the amount of tax your have to pay on your combined income. Although, you cannot use this credit if you dont owe any money to the IRS. Its only useful when you owe money.

At What Income Does A Minor Have To File An Income Tax Return

OVERVIEW

If your kids are young enough to be your dependents, they may have to pay taxes. In some cases, you may be able to include their income on your tax return in others, they’ll have to file their own tax return or you will have to file a separate return on their behalf. Whether this is required depends on both the amount and source of the minor’s income.

Youngsters are especially ambitious these days, and even if your kids are young enough to be your dependents, they may have to pay taxes. In some cases, you may be able to include their income on your tax return in others, they’ll have to file their own tax return or you will have to file a separate return on their behalf. Whether this is required depends on both the amount and source of the minors income.

Read Also: Notice Of Tax Return Change Revised Balance

If You Have Not Filed A Tax Return You Can Sign Up To Get The Child Tax Credit

If you earned less than $12,400 , you can use GetCTC, a simplified tax filing portal to get the Child Tax Credit, receive a missing stimulus payment, and get cash now.

To get the Child Tax Credit you will need to provide the Social Security Numbers of your children. You can sign up for the Child Tax Credit even if you have little to no income or receive other federal benefits like SSI or SSDI.

Chat with our tax experts if you need help.

Earned Vs Unearned Income

The IRS has two categories of income:

- Earned Income. This refers to wages, tips, salaries, professional fees, or commissions your child earned from doing actual work.

- Unearned Income. This is any other income that your child didnt directly work for, such as dividends, interest, or capital gains. If a child has a trust fund, distributions from the trust count as unearned income unless the child has a disability trust, in which case distributions are considered earned income.

Knowing where your childrens earnings fall is critical to determining whether theyre required to file a tax return.

You May Like: Where Do I File My Illinois Tax Return

Individuals Required To File A North Carolina Individual Income Tax Return

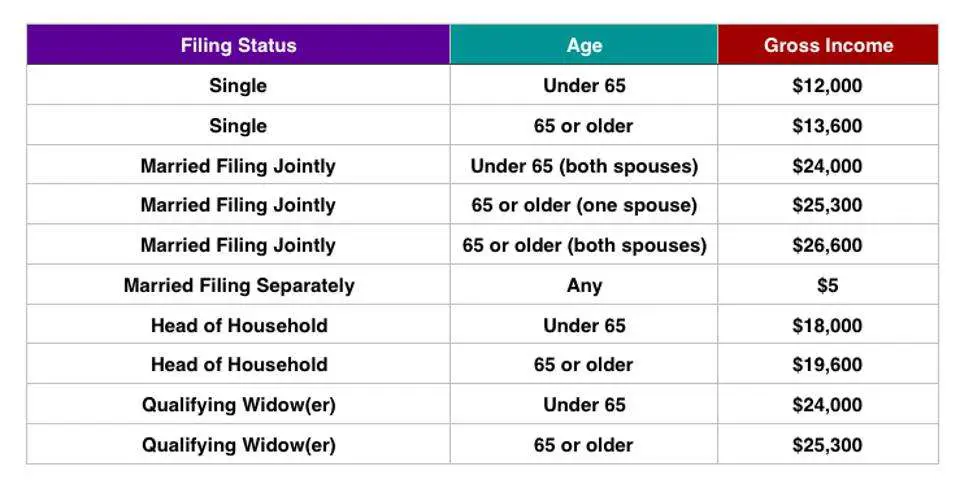

The following individuals are required to file a 2020 North Carolina individual income tax return:

- Every resident of North Carolina whose gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020 for the individual’s filing status.

- Every part-year resident who received income while a resident of North Carolina or who received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income for the taxable year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020.

- Every nonresident who received income for the taxable year from North Carolina sources that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina and whose total gross income from all sources both inside and outside of North Carolina for the taxble year exceeds the amount shown in the Filing Requirements Chart for Tax Year 2020. For nonresident business and employees engaged in disaster relief work at the request of a critical infrastructure company, refer to the Personal Tax Division Bulletins.

Apply The 2019 Improved Maximums

Beginning with the 2018 tax year, a dependent childs minimum earned income to file taxes is much higher than it used to be. For the 2019 tax year, a child who has only earned income can make up to $12,200 tax-free. The standard deduction will be the amount that was earned plus $350, up to amaximum of $12,200. A return only needs to be filed if this total is over $12,200. This is significantly more than what was allowed tax-free in 2017. On the other hand, the threshold for filing a tax return on unearned income remains pretty low. If your child has only unearned income and it totals more than $1,100, a return must be filed in 2020.

If your child has a combination of earned and unearned income, a 2019 return must be filed if one of these three criteria are met: the earned portion is more than $12,200, the unearned portion is more than $1,100, the combination equals more than $1,100 or more than the earned portion plus $350 , whichever is larger.

Recommended Reading: 1040paytax.com Official Site

To File Or Not To File

Just because a child is required to report her income to the IRS doesnt automatically mean shell owe Uncle Sam. Similarly, just because shes not technically required to file a tax return doesnt mean that she shouldnt.

The IRS doesnt automatically send refunds just because youre eligible to get one: The only way to get a refund check if youre owed is to file a return. In situations where a college-age student can claim an education credit , it may be worthwhile to file.

Not all situations require your child to file her own separate return. She may be able to fulfill her tax reporting duties by piggybacking on yours.

You have the option to report her income on your personal tax return if the only type of income your child earned in 2019 was interest, dividends or capital gains distributions and its less than $10,500.

Attach Form 8814 to your 1040 if you want to fold a childs unearned income into your return. Note that the IRS will tax her income at your rate instead of the childs tax rate. If thats not cool or if including her income bumps you into a higher tax bracket have her file an individual return.

Who Qualifies As A Dependent

You may think its pretty obvious as to who counts as a dependent and who doesnt for the purposes of your federal tax return, but there are subtleties in the tax code.

For someone to qualify as your dependent, they must meet these basic criteria.

- They must be a U.S. citizen, U.S. national or U.S. resident alien, or a resident of Canada or Mexico.

- They must not be claimed as a dependent on anyone elses return.

- They must not file a joint tax return or only file a joint return in order to claim a refund of tax they paid.

- They must not claim anyone else as a dependent on their own return.

- They must have received more than half their total support from you during the tax year.

There are additional criteria for qualifying children.

For example, you might assume a child who lives with you only counts as a dependent child if theyre your child, either biological or adopted. But foster children, your siblings or step-siblings, half-siblings, grandchildren, nieces and nephews might qualify as your dependents if they meet the basic criteria and additional qualifications, including the following:

- The child must be younger than 19 at the end of the tax year and younger than you .

- If a student, then theyre younger than 24 at the end of the tax year and younger than you .

- They can be any age if permanently and totally disabled.

- The child lived with you for more than half the year .

Don’t Miss: How To Correct State Tax Return

Do I Need To Do Anything To Make Sure I Receive My Payments

Most families didnt have to do anything to begin receiving the Child Tax Credit payments. If you filed taxes this year , filed last year , or if you signed up for Economic Impact Payments using the IRSs Non-Filer tool last year, the IRS is automatically sending you monthly payments.

If you did not have to file your taxes this year or last year, and you did not register for Economic Impact Payments last year, you can still . The Administration collaborated with a non-profit, Code for America, who has created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. You can also use the sign-up tool to apply for any Economic Impact Payments that youre entitled to but may not have received yet.

Other Situations That Require Filing A Tax Return

In addition to requirements based on age, your filing status and income, along with rules regarding the Affordable Care Act and self-employment income, there are several other situations that require you to file a tax return.

This includes if you owe any special taxes, such as the alternative minimum tax extra taxes on qualified plans like an IRA household employment taxes for employees like nannies, housekeepers or gardeners or tips you didnt report to your employer. You must also file if you had write-in taxes that might include taxes on group term life insurance or health savings accounts. You also have to file if you have recapture taxes on the profitable sale of an asset.

A second instance in which you have to file a return is if you or your spouse received distributions from a health savings account, Archer MSA or Medicare Advantage MSA.

If you worked for a church or a church-controlled organization that is exempt from paying social security and Medicare taxes and you had wages of $108.28 or more, youre required to file a return.

Finally, if you have a tax liability and are making payments under an installment agreement, you must file a return.

Read Also: Where’s My Tax Refund Ga

The Irs Interactive Tax Assistant

There are a series of questions you should answer to help you determine the minimum income amount that applies to you. Lets start with the IRS questionnaire found on their do you need to file page. This questionnaire is provided through the IRS interactive tax assistant , which is a remarkably easy-to-use program found on the IRS website.

The questions are designed to help you determine whether you need to file a federal tax return and if you need to adjust your Form W-4 to eliminate tax withholding.

The IRS has stated that they want to help eliminate wasted time and money from returns that are filed when they dont need to be. I recommend that you take them up on that offer and work through the questions.

According to the IRS website, answering these questions should take you no longer than 10-15 minutes. This is certainly worth your time, especially if it saves the time it would take you to file or if it saves you from having money withheld unnecessarily.