When Can You File For An Extension On Your Taxes

You can file an extension for filing your federal taxes up to the tax due date. Filing for an extension is free and it gives you until October 15 to file your return. Note that this only extends when your tax returns are due. If you owe taxes, your payment is still due on the federal tax filing deadline .

What About State Taxes

More than half of states levy an income tax on jobless benefits. States will have to decide if they will also offer the tax break on state income taxes.

Its possible that some may still opt to tax the jobless aid, experts say.

Some already exempt taxes on unemployment, including California, New Jersey, Virginia, Montana and Pennsylvania. And some dont levy state income taxes at all, including Texas, Florida, Alaska, Nevada, Washington, Wyoming and South Dakota.

How To Report Unemployment Benefits On Your Taxes

With your unemployment benefits, youll receive Form 1099-G . This form should show exactly how much you received. That total amount must be entered on your tax return.

The IRS already knows you received this money, so dont try to hide it or you could face an audit as well as penalties and interest.

When you file your return, report your unemployment income on line 19 of Form 1040 , line 13 of Form 1040A , or line 3 of Form 1040EZ , depending on which tax return you decide to file.

Rather than going to the hassle of filling out these forms and calculating your taxes, youll be able to just enter your unemployment income and any other tax information on the PriorTax tax application. From there, well look for any way to boost your total refund!

Don’t Miss: How To Report Self Employment Income On Taxes

Income Taxes And Your Social Security Benefit

Some of you have to pay federal income taxes on your Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits .

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service rules. If you:

- file a federal tax return as an “individual” and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

Getting Started With Your State Income Taxes

Whether you e-File or file by paper, planning ahead will help you avoid problems and delays with your income taxes.

First: View the Individual Income Filing Requirements to determine if you should file a North Carolina individual income tax return.

Second: determine your federal adjusted gross income, which is the starting point for your State individual income tax return. You determine that figure by completing a federal income tax return. Visit the Internal Revenue Service webpage to help you get started with your federal return.

Once you have determined that you should file, review these tips to give you a head start on your State income taxes:

Remember: Please don’t file photocopies of tax forms. That could delay the processing of your return or cause errors that would require you to file an amended return.

You May Like: Do You Have To Do Taxes For Doordash

How Much Will Your Benefits Be

Once you file for unemployment and are approved, you will begin to receive benefits. Your benefits might come in the form of a check, but more often they will come in the form of a debit card or direct deposit to your bank account. It varies by state. You typically can file weekly online, by email, or by phone.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum.

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available.

Regardless of how much you make, you never can collect more than the state maximum.

Do I Have To Pay Taxes

When your money is in an RDSP, you do not pay tax on it.

When you begin to take money out of your RDSP, you must pay tax on part of it. Your financial institution will probably do a tax calculation and send the tax directly to the federal government. Then, when you file your taxes at the end of the year, you might get some of that money back.

Which part of the RDSP is taxed?

The government considers every dollar withdrawn from an RDSP to be made of three parts: private contributions, government contributions, and income/growth. When you withdraw money from an RDSP, private contributions are not subject to tax. Both federal contributions and income/growth count as income. You will have to pay tax on them.

Recommended Reading: What Does Garnish Tax Levy Mean

Which Form Do You Need

While using a computer program can make doing your taxes a breeze, Id encourage you to at least try doing your taxes the old-fashioned way with pen and paper at least once. Flipping through the IRS instruction book to help you figure out your taxable income is a great way to become familiar with the basic rules and regulations of the tax code. Plus, theres something about the tactile nature of pen, paper, and calculator that makes doing your taxes oh so romantic. Wear a green eyeshade for added effect. You can or just swing by your local library they should have a rack full of them.

There are three different kinds of personal tax forms to choose from: 1040EZ, 1040A, and 1040. They vary in length and complexity. Your goal is to pick the simplest form for your situation. When you do your taxes with tax software, the computer determines what form you should use based on the information you provide. When you do your taxes by hand, you have to figure out which form to fill out yourself. Heres how to do it:

1040EZ. The 1040EZ form is the shortest and EZiest to fill out. You qualify to use the 1040EZ form if you meet the following requirements:

Basically, if your income only came from wages and some bank interest, and you dont have any income adjustments in the form of deductions, use the 1040EZ form. If youre young, in college, or dont own a home, this probably describes you.

How Much Does It Cost To Pay Arizona Income Tax With A Credit Card

2.35% convenience fee, minimum of $1.50, to make a tax payment with a credit card. $3.50 convenience fee to make a tax payment with a debit card. Note: To determine if you have a Visa Corporate debit card or a Visa Consumer branded debit card, please contact your financial institution that issued the card.

Don’t Miss: How Do I File My Taxes Electronically

When Do I Have To Pay My Taxes

If you owefederal income tax for 2019, you can now delay paying until July 15, 2020.

When thefederal government first announced the payment delay on March 17, it originallylimited the deferral to individuals who owed up to $1 million and corporationsthat owed up to $10 million. On March 21, the IRS announced that the paymentdeferral applies to everyone, regardless of how much they may owe.

If you already filed your 2019 return and scheduled a payment, youll need to take action to reschedule the payment if you want to postpone it to July 15. The rescheduling method will depend on how you initially made the payment. The IRS has issued detailed guidance on how to do this. Check out question 14 on this IRS page of FAQs about the filing and payment deadline extension.

How Do I Avoid Paying Taxes When I Sell My House

There are several ways to avoid paying taxes on the sale of your house. Here, we’ll list a few:

- Offset your capital gains with capital losses. Capital losses from previous years can be carried forward to offset gains in future years.

- Consider using the IRS primary residence exclusion. For single taxpayers, you may exclude up to $250,000 of the capital gains, and for married taxpayers filing jointly, you may exclude up to $500,000 of the capital gains .

- Also, under a 1031 exchange, you can roll the proceeds from the sale of a rental or investment property into a like investment within 180 days.

Don’t Miss: How Is Capital Gains Tax Calculated On Sale Of Property

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Read Also: How Do I Change My Address For Unemployment Online

You May Like: How To Lower Property Taxes In Florida

Open A Separate Business Bank Account

Opening a separate bank account will help keep your OnlyFans income and expenses separate. Do not do business transactions in your personal account and vice versa. We also recommend not using your personal credit cards for business transactions. Keeping good records will help keep youre your taxes lower.

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

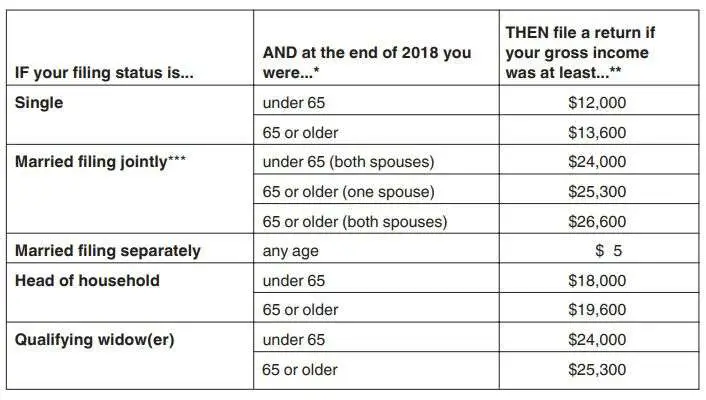

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

Also Check: Where Can I Get My Taxes Done By Aarp

What If I Need More Time To Pay

If youre notable to pay the tax you owe by July 15, you may have other options. Here are afew.

- Request a payment plan that will allow you to stretch your tax obligation over multiple months. Keep in mind that while a payment plan can prevent you from incurring penalties, interest will still apply to the unpaid balance.

- Explore an offer in compromise, which may allow you to settle your tax debt for less than the full amount you owe. But youll have to meet the qualifications.

- Ask to have collection temporarily delayeduntil you can pay.

I Have Questions About My Taxes Can I Call The Irs

There are numerous ways to contact the IRS. The agency no longer offers live online chatting, but you can still submit questions through its online form. If you prefer to talk to a person, the IRS maintains a number of dedicated phone lines that are open Monday through Friday, from 7 a.m. to 7 p.m. . Individuals can call 800-829-1040 and businesses can call 800-829-4933. Note, however, that the IRS says “live phone assistance is extremely limited at this time.”

And there’s always the Interactive Tax Assistant, an automated online tool that provides answers to a number of tax law questions. It can determine if a type of income is taxable, if you’re eligible to claim certain credits and whether you can deduct expenses on your tax return. It also provides answers for general questions, such as determining your filing status, whether you can claim dependents or if you even have to file a tax return.

If you have a question for the IRS specifically related to stimulus checks and your taxes, the IRS recommends that you check IRS.gov and the Get My Payment application.

Also Check: Do I Have To Pay Taxes On My Unemployment

Capital Gains Tax On Home Sale Example

Consider the following example. Susan and Robert, a married couple, purchased a home for $500,000 in 2015. Their neighborhood experienced tremendous growth and home values increased significantly. Seeing an opportunity to reap the rewards of this surge in home prices, they sold their home in 2020 for $1.2 million. The capital gains from the sale were $700,000.

As a married couple filing jointly, they were able to exclude $500,000 of the capital gains, leaving $200,000 subject to capital gains tax. Their combined income places them in the 20% tax bracket. Therefore, their capital gains tax was $40,000.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Recommended Reading: How Do I Pay My State Taxes In Missouri

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

Are Gambling Winnings Taxed As Income In My State

Most states require residents to pay state income tax. Some of those also require the payment of state tax on gambling winnings .

To find out if your state requires you to pay state income tax on gambling winnings, see the table above under the heading Which states require payment of state taxes on gambling winnings?

You May Like: How To Get Social Security Tax Statement

Are Ador Offices Open

In light of COVID-19, the Arizona Department of Revenue has temporarily modified current services in an effort to protect the health and safety of its customers and employees while continuing to provide information and support to Arizona taxpayers.

Customers requiring in-person assistance can make an appointment with a department representative at ADORs locations in Phoenix and the Southern Regional Office in Tucson. They can do this by emailing or calling 716 ADOR .

A drop-box is available at the three ADOR locations for payments, forms, applications, and returns without an appointment. Items are collected throughout the day and taxpayers can receive a submission confirmation by including their email address on the top of the envelope.

Online Filing and Call Center AssistanceADOR also offers a Live Chat feature, which is available online Monday through Friday from 7 a.m. to 6 p.m. to answer inquiries for general questions and offers navigational guides in real-time.

Customers seeking information on particular private taxpayer matters or confidential account information can speak to our Customer Care Center at 255-3381 or 800-352-4090.