Other Ways To Find Your Account Information

- You can request an Account Transcript. Please note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Online By Debit Or Credit Card

You can pay the IRS by credit or debit card, but you must use one of the approved payment processors. Three processors are available, and you can access any of them on the IRS website or through the IRS2Go mobile app:

They all charge a processing fee, which can vary. But this fee might be tax deductible, depending on your tax situation. It’s usually a flat fee for a debit card transaction or a small percentage of your payment if you’re using a credit card.

Your credit card company might charge you interest as well.

You can’t cancel payments using the credit card or debit card option.

From Your Bank Account Using Eftpsgov

You can schedule payments up to 365 days in advance for any tax due to the IRS when you . register with the Electronic Tax Federal Payment System . As with DirectPay, you can cancel or change payments up to two business days before the transmittal date.

EFTPS is a good choice if:

- You want to schedule all of your estimated tax payments at the same time

- Your payments are particularly large

- Payments are related to your business

The Treasury Department operates EFTPS, and it doesn’t charge any processing fees. It can handle any type of federal tax payment, including:

- 1040 balance due payments

- Corporate taxes

- Payroll taxes

You must enroll with EFTPS, but the site saves your account information. You don’t have to keep re-entering it each time you want to make a payment. You’ll receive an email with a confirmation number for each transaction. EFTPS saves your payment history for up to 16 months.

You May Like: How Much Does H& r Block Charge To Do Taxes

How To Pay Your Tax Bill In 2020

Getty

Ready to file your federal income tax return? I know: it’s still early in the season. But if you owe taxes, don’t forget to pay what you owe by Tax Day. And you don’t have to file and pay at the same time: You can file at any time so long as you pay your taxes in full by April 15, 2020. Here are several options for paying your tax bill this year:

1. Pay by cash. It used to be the case that you couldn’t pay your federal income tax bill in cash. Now, however, the Internal Revenue Service offers a way for you to pay your taxes using PayNearMe.

To make a payment, you’ll need to visit the Official Payments page and follow the instructions. The IRS will then send you a code that you can take to a participating retailer where the clerk will scan the code so that you can make your payment. The whole process generally takes five to seven business days. There is a fee to use the PayNearMe system, and the largest payment you can make is $1,000.

2. Pay by check or money order. You can pay by check or money order even if you e-file. To pay what you owe, make your check or money order payable to “United States Treasury” for the full amount due. Write “2019 Form 1040” on the memo line together with your Social Security Number . Make sure that your name, address, daytime phone number are on the check that info may already be printed on your check.

KPE/IRS

And remember that the Internal Revenue Service no longer accepts checks over $100 million.

Balance Owing On Your Tax Return

If you have an amount on line 48500, you have a balance owing.

Your 2020 balance owing is due on or before .

You should file your tax return, pay any amounts you owe, or make a post-dated payment to cover your balance owing by the due date to avoid paying interest and late-filing penalties. If your balance owing is $2 or less, you do not have to make a payment.

Recommended Reading: What Is Low Income Tax Credit

Extension Of Time To Pay

If financial hardship makes it impossible to pay your tax obligation by the deadline, you can apply for an extension of time to pay. This is done on Form 1127. Use the chart on page 3 to determine if this is the right option for you. The IRS must receive the form and supporting documentation on or before the due date of the return.

If your application is approved, the IRS wont charge late payment penalties for the duration of your extension. However, interest will still continue to accrue until the balance is paid in full.

The IRS rarely grants extensions of time to pay longer than six months, so if youre applying, be sure you can pay within 180 days. You must pay the tax before the extension runs out.

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then BFS will send the entire amount to the other government agency. If you owe less, BFS will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. BFS will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Don’t Miss: How To Grieve Property Taxes

Federal Quarterly Estimated Tax Payments

Generally, the Internal Revenue Service requires you to make quarterly estimated tax payments for calendar year 2021 if both of the following apply:

- you expect to owe at least $1,000 in federal tax for 2021, after subtracting federal tax withholding and refundable credits, and

- you expect federal withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your 2021 federal tax return, or

- 100% of the tax shown on your 2020 federal tax return .

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2021. Form 1040-ES includes an Estimated Tax Worksheet to help you calculate your federal estimated tax payments.

Payment Options For Corporate Income Tax

Form BIT-V: If your payment is less than $750, you can remit your payment by check or money order. Make check or money order payable to: Alabama Department of Revenue. Include on the check: the corporations federal employer identification number or the Alabama Affiliated Groups federal employer identification number for 20C-C filers, the form type or type of payment , and the tax year end. The check or money order must be remitted along with a complete Form BIT-V, Alabama Business Income Tax Voucher to ensure proper posting of the payment.

Electronic Payments: For payments that are $750 or more, the payment must be made electronically. The payments can be made electronically through the following options:

Don’t Miss: How To File 2 Different State Taxes

How To Pay Federal Estimated Taxes Online

Some individuals and business entities are required to make estimated tax payments to the IRS every quarter.

Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. If they dont, they may owe an estimated tax penalty.

If you want to avoid massive taxes due at the end of the year with penalties and interest, it is important to know 1.) if you need to make estimated tax payments and 2.) how much payments to make.

Freelancers With A Regular Job That Withholds Taxes

If you have a full-time job with tax withholding and also work on the side, and you either receive a 1099-NEC or have clients or customers who pay you directly, you need to determine how much of your income is untaxed. If your freelance work constitutes a significant portion of your income, you should probably pay estimated taxes.

A good rule of thumb is that if your side income is less than 10% of your gross income earnings before taxes you probably wont need to make estimated tax payments.

Recommended Reading: How Much Time To File Taxes

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2020. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,875 you pay 12% on the rest.

-

Example #2: If you had $50,000 of taxable income, youd pay 10% on that first $9,875 and 12% on the chunk of income between $9,876 and $40,125. And then youd pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,800 about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate.

» MORE:See state income tax brackets here

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account

- Log in to your online services account to schedule all 4 quarterly payments in advance.

- Dont have an account? Create one now.

Not ready to create an account? Use eForms – make sure to choose the correct voucher number for the payment you’re making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Pay using a credit or debit card through Paymentus . A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

Recommended Reading: What Do Tax Accountants Do

What Is A Marginal Tax Rate

Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income. This typically equates to your tax bracket.

For example, if you’re a single filer with $30,000 of taxable income, you would be in the 12% tax bracket. If your taxable income went up by $1, you would pay 12% on that extra dollar too.

If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. Your marginal tax rate would be 22%.

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

You May Like: What Is E Filing Of Income Tax Return

How To Check The Status Of Your Coronavirus Stimulus Check

If you’re trying to find out the status of your coronavirus stimulus payment, go to the IRS’s Get My Payment page. You can learn whether your payment has been issued, and if it’s coming by direct deposit or mailed check.

Learn more about the stimulus payments, including whether you qualify for one and what, if anything, you may have to do to get yours.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Also Check: Are Tax Returns Delayed This Year

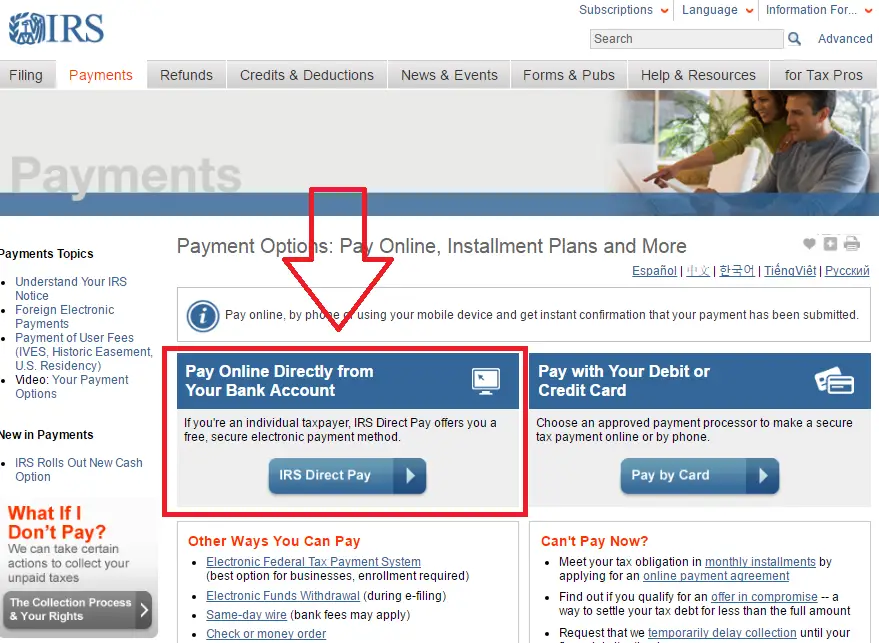

Where Do I Pay My Taxes Owed

Whether youre paying off your taxes, making an installment payment, or paying your quarterly estimated taxes, you have options to pay any taxes online. The IRS like most businesses and agencies is moving away from paper payments. Paying online is secure, efficient, and quick, and its the IRS preferred method to make your tax payments. You dont have to worry about finding envelopes, stamps or the correct paperwork.

Important: No matter how you decide to pay, make sure youre paying by the deadline so you can avoid penalties and interest.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are called brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2020 tax year, which are the taxes due in early 2021.

Don’t Miss: How Do Expats Pay Taxes

Escape The Underpayment Penalty

You may be liable for an underpayment penalty if you pay less than 100% of your tax liability by the tax filing deadline. You can avoid the penalty if you meet one of the exceptions below:

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Read Also: Where To File Georgia State Taxes

How To Pay Your Business Taxes Online

- Participating financial institutions

Many of these financial institutions also provide business customers with non-resident payment options.

How Does The Cpp Work

You will contribute towards the CPP from your employment earnings from age 18 to 70. The CPP Investment Board then invests CPP funds. Once you retire, you will then receive a monthly retirement pension that is equal to a certain percentage of your lifetime average earnings.

The base CPP benefit provides a monthly pension of up to 25% of your contributory earnings for the best 40 years of earnings. With changes enhancing CPP contributions, the monthly pension amount can rise to up to 33.33% of your contributory earnings. This pension amount counts as income, and so you must pay income tax on your CPP benefit.

The earliest that you can receive your retirement pension is when you turn 60 years of age. If you have a disability, you may receive the CPP disability benefit if you are under the age of 65, or the CPP post-retirement disability benefit if you have already started to receive your CPP retirement pension.

If you start receiving your pension between 60 and before you turn 65, your pension amount will be permanently reduced at a rate of 0.6% for every month before age 65, for a maximum reduction of 36%.

Every month after age 65 permanently increases your pension amount by 0.7%, up to a maximum of 42% when you turn 70.

Recommended Reading: How Much Tax Do You Have To Pay On Stocks