Qui Dpose Le Jour De L’impt

Presque tous ceux qui gagnent un revenu produisent une déclaration le jour de l’impôt.

Cela inclut tous ceux qui ont un employeur qui prélève des impôts sur leurs chèques de paie. Il comprend également les travailleurs indépendants et les propriétaires de petites entreprises.

qui doit produire une déclaration trimestrielle pour payer les impôts estimés, puis produire des déclarations annuelles pour aligner ses comptes ?

Les retraités déposent des impôts sur le revenu le jour de l’impôt pour tenir compte des revenus qu’ils ont reçus de la sécurité sociale. et tous les retraits de retraite, de revenu de placement et de compte de retraite.

Cependant, toute personne ayant un revenu supérieur à 12,400 65 $. pour les personnes de moins de 14,050 ans ou 65 2021 $ pour les personnes de XNUMX ans et plus en XNUMX doit produire.

Le jour de l’impôt est la date d’échéance pour les déclarations de revenus et les paiements d’impôts fédéraux. Pour la plupart des contribuables, dans la plupart des années, les déclarations de revenus fédérales doivent être soumises à l’Internal Revenue Service

Cependant, d’ici le 15 avril, cette date s’applique aux particuliers qui produisent des impôts sur la base d’une année civile. Si vous utilisez une année fiscale, vous devez produire vos impôts avant le 15e jour.

Pour demander une prolongation

Payez tout ou une partie de votre facture fiscale estimée et montrez que votre paiement est pour une prolongation

Considérations particulières

Calendrier De Remboursement D’impt 2021

Où est mon remboursement ? L’outil vous permet de vérifier l’état de votre remboursement. Via le site Web de l’IRS ou l’application mobile IRS2Go.

Si vous soumettez votre déclaration de revenus par voie électronique, vous pouvez vérifier l’état de votre remboursement dans les 24 heures. Mais si vous envoyez votre déclaration de revenus par la poste, vous devrez attendre au moins quatre semaines.

Quiconque, avant vous, peut recevoir toute information sur votre remboursement d’impôt. Gardez à l’esprit qu’habituellement, vous pouvez déclarer vos impôts en janvier.

Afin de connaître l’état de votre remboursement d’impôt. Vous devrez fournir votre numéro de sécurité sociale .

En outre, le statut de dépôt et le montant exact en dollars de votre remboursement attendu. Si vous entrez accidentellement le mauvais SSN, cela pourrait déclencher un code d’erreur IRS 9001.

Cela peut nécessiter une vérification d’identité supplémentaire et retarder votre remboursement d’impôt.

La plupart des contribuables reçoivent leur remboursement dans les 21 jours. Si vous choisissez d’avoir, votre remboursement déposé directement dans votre compte.

Vous devrez peut-être attendre cinq jours avant de pouvoir y accéder. Si vous demandez un chèque de remboursement, vous devrez peut-être attendre quelques semaines pour qu’il arrive.

Cependant, le tableau ci-dessous vous donnera une idée du temps d’attente. À partir du moment où vous déposez jusqu’à ce que vous obteniez votre remboursement.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

You May Like: How Can I Make Payments For My Taxes

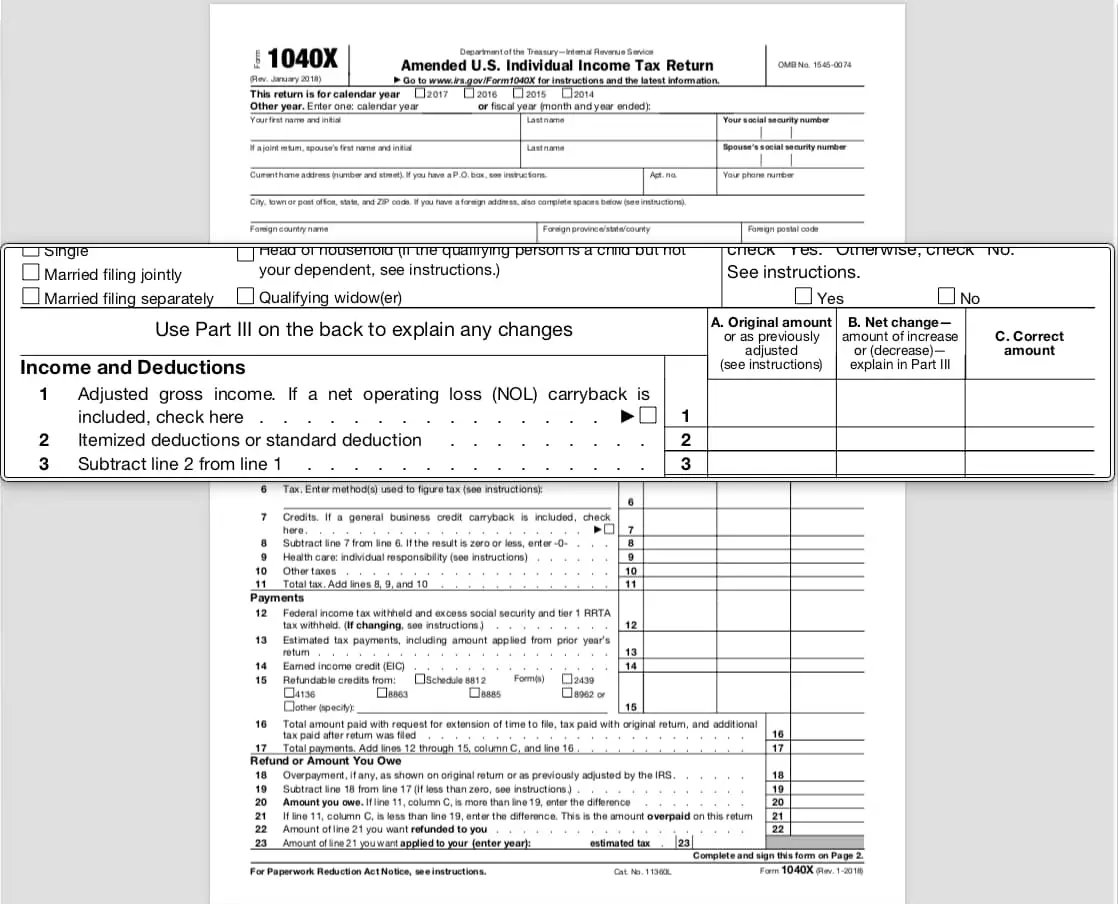

Obtain Your Irs Transcript

Create an online IRS account by searching for Get Transcript Online at IRS.gov and following the prompts. Youll need to provide this information to register your account:

- Your Social Security number, mailing address from your most recent tax return, filing status and date of birth

- Your email address

- A mobile phone that has your name on the account

- Verification of a personal account from a , mortgage or certain types of consumer loans

After you have created your online IRS account, youll be able to view a transcript of your tax return immediately. You can also print or download the information. If you request a copy of your transcript by mail or by fax, expect a five to 10-day wait.

Go Online And Use The Wheres My Refund Irs Tool It Works

THAIPOLICEPLUS.COM” alt=”How do i get my agi from last year online > THAIPOLICEPLUS.COM”>

THAIPOLICEPLUS.COM” alt=”How do i get my agi from last year online > THAIPOLICEPLUS.COM”> Although the IRS Wheres My Refund tool is available to check the progress of your return, it only applies to the tax return you filed for the mostcurrent tax year.

For example, lets say you file your 2013 tax return and soon after remember to file your late 2012 return. Although you filed your 2013 taxes before your 2012, 2013 is going to be the one that the IRS site shows the status for since it is the most recent tax year in their database for you.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Reasons For A Late Tax Refund

Many things can hold up the processing and delivery of your tax refund. For example, it could be delayed if you filed your return too early or waited until the last minute. If you tried to file in January, for example, a last-minute change to the tax code could have triggered an error on your return that slowed down the processing. Similarly, waiting until the very last minute to get your return in can mean a longer wait for your refund if the IRS is clogged up with a larger than usual volume of returns.

Also, keep in mind that filing a paper return can slow things down. The fastest way to fileand to get your refundis to do it electronically online.

Beyond those possibilities, here are some of the most common causes of delay.

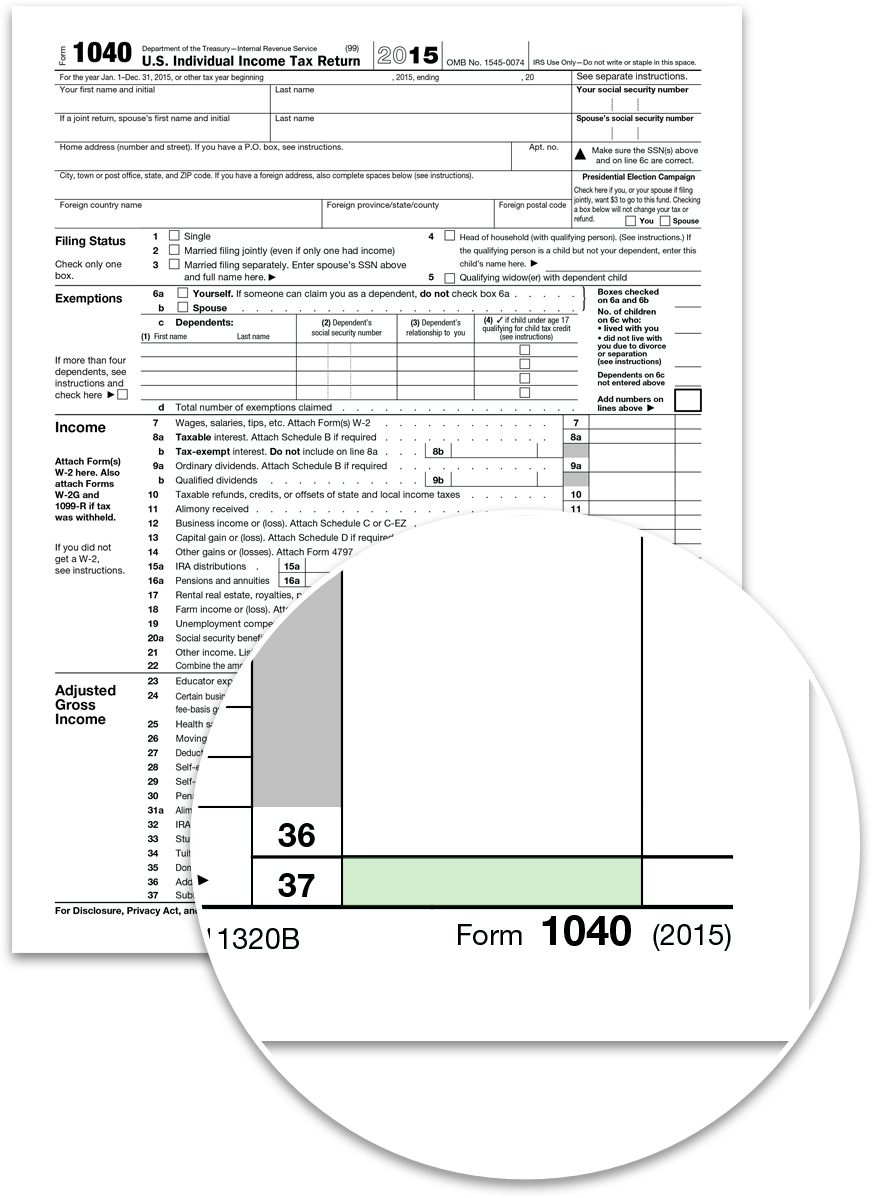

Filing Status & Dependents

The filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow. If you support a child or relative, they may qualify as your dependent. There are different requirements for qualifying children and qualifying relatives, but both types of dependents must be a U.S. citizen, U.S. national, or U.S. resident alien. You must be the only taxpayer claiming them, and they must be filing single or married filing separately if they’re required to file their own return. For more, see Who Can I Claim as a Dependent?

Don’t Miss: How To File Missouri State Taxes For Free

Estimated Irs Refund Tax Schedule For 2020 Tax Returns

In prior years, the IRS issued its refund tax schedule to provide a timeline when you can expect to receive your tax refund. While the IRS no longer publishes a refund tax schedule, we put together an estimate when you might expect to receive your tax refund based on previous years.

|

Date IRS Accepts Your Return |

Expected Direct Deposit Refund Date |

Expected Mailed Check Refund Date |

Many Taxpayers Are Still Waiting To Get Last Years Tax Refund

Its been nearly a year since Lori Meyers and her husband filed their 2019 federal return, but theyre still waiting for their tax refund to arrive. The total amount the government owes them: $11,700.

This has fundamentally changed the way I look at a refund, Meyers, 55, said. I used to look at it as I have a little extra taken out, and then I have a big windfall once a year, and I use it for helpful things. I will never do that again.

Meyers and her husband are supposed to get $8,500 as a regular refund plus $3,200 in stimulus payments they should have received, but didnt. But she has no idea when that money will arrive and neither does the Internal Revenue Service, which is still processing a backlog of 1.7 million tax returns from 2019, according to IRS Commissioner Charles Rettig. Not all necessarily require refunds.

We expect to get through this, you know the term that we use, fortunately or unfortunately, summer, Rettig told the Senate Finance Committee on Tuesday. Summer could be May or it could be September.

You May Like: How Can I Make Payments For My Taxes

Your Return Is Incomplete

Having an incomplete return can also trigger an IRS review, which could mean a longer wait for your refund. If you filed a paper return, for example, and forgot to enter in a key piece of information like your Social Security numberor you failed to sign your tax formsthe IRS won’t process your return until those items are checked off.

Still Waiting For Your 2019 Tax Refund Get In Touch With Silver Tax Group

At Silver Tax Group, our team of skilled tax attorneys is dedicated to helping clients pursue what they deserve. Were prepared to assist individuals who have not received their 2019 tax refunds and our team can help you contact the individuals and entities that will offer more insight.

If youd like to know more about why you havent received your 2019 tax refund, get in touch with us today. You can take advantage of a free consultation with a tax professional prior to partnering with an attorney.

Ready to secure your financial future? Subscribe Today For Tax Knowledge Tomorrow

Also Check: Can You File Missouri State Taxes Online

Get Last Year’s State Return

If you need a copy of last year’s state tax return, check with your state’s tax or finance department website. You can often create an account to view old tax returns online. In other cases, your state will have a tax form for your to submit to request the tax return, and you may have to pay a fee for this service.

How You File Affects When You Get Your Refund

The Canada Revenue Agency’s goal is to send your refund within:

- 2 weeks, when you file online

- 8 weeks when you file a paper return

These timelines are only valid for returns we received on or before their due dates.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

We may take longer to process your return if we select it for a more detailed review. See Review of your tax return by CRA for more information.

If you use direct deposit, you could get your refund faster.

Recommended Reading: Buying Tax Liens California

Irs Employees Did Not Answer More Than 75 Million Telephone Calls

In the meantime, getting in touch with the IRS has been onerous.

You have to call very early in the morning and you’re still going to be on hold for hours, she said. The longest I waited for somebody to pick up was maybe two and a half hours.

Read more: Here’s how you should use your tax refund in 2021

Some of the backlogged returns were frozen by the IRS fraud filters, the National Taxpayer Advocate report found. For 1 in 4 returns flagged for income verification, it took refunds longer than 56 days to be sent. For nearly 1 in 5 flagged for identity verification, it took refunds over four months to be sent. That may be the reason Meyers refund has been held up.

They said they put it aside for a reason, but they didn’t know what the reason was, said Meyers, who has been using an accountant for 28 years to prepare her taxes and has never had an issue before.

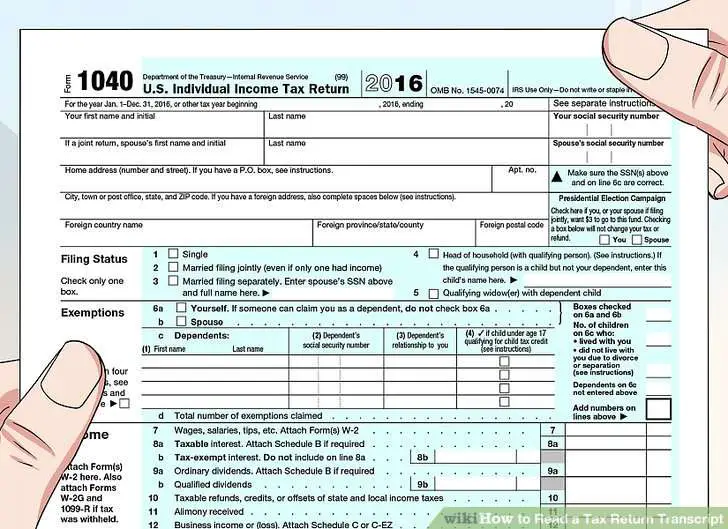

So How Do You Check Your Prior Year Tax Refund Status After Mailing Your Return To The Irs

Brace yourselves as many of you arent going to like Plan B. Youll need to call the IRS. Of course, you dont want to mail your return and call on your lunch break the following day. The IRS insists that you wait it out for at least 6 weeks after mailing your return to call and check on the status. When you call, make sure you have the following handy:

- tax year

- filing status

- exact refund amount

You can call 1-800-829-1040 and follow the prompts for a live representative. The person that you speak with will have direct access to your tax return and be able to provide you with a status update.

Tip: Request a tracking number when mailing your return. Itll give you peace of mind to know that it arrived safe and sound.

Don’t Miss: Www.1040paytax

Double Check Your Tax Return Before You File

Double checking your tax return prior to submission can ensure your tax refund is processed quickly. Failure to do so may cause the IRS to delay the processing of your tax refund.

Here is a list of questions to review prior to filing your tax return to ensure the IRS processes your tax refund as quickly as possible.

- Did I review my identifying numbers for myself, spouse and dependents?

- Did I ensure the names on my tax return are spelled correctly?

- Did I review my dependents information?

- Have I reviewed my banks routing and account numbers for accuracy?

- Did I include the correct date of birth for myself and dependents

- Did I electronically sign my tax return ?

As Per The Income Tax Act A Person Is Required To File His/her Return In The Relevant Assessment Year By July 31 To Claim The Tax Refund

income tax refundincome taxITRProcess to claim Income Tax RefundRefund claimed shows in ITR filed by youInterest on income tax refunda) b)c)Interest to be paid by you in case of excess refund by the departmentRefund pending due to incorrect detailsITR filing guide: The process of claiming income tax refund

Read More News on

Also Check: How Do I Get My Pin For My Taxes

I Have Questions About My Taxes Can I Call The Irs

There are numerous ways to contact the IRS. The agency no longer offers live online chatting, but you can still submit questions through its online form. If you prefer to talk to a person, the IRS maintains a number of dedicated phone lines that are open Monday through Friday, from 7 a.m. to 7 p.m. . Individuals can call 800-829-1040 and businesses can call 800-829-4933. Note, however, that the IRS says “live phone assistance is extremely limited at this time.”

And there’s always the Interactive Tax Assistant, an automated online tool that provides answers to a number of tax law questions. It can determine if a type of income is taxable, if you’re eligible to claim certain credits and whether you can deduct expenses on your tax return. It also provides answers for general questions, such as determining your filing status, whether you can claim dependents or if you even have to file a tax return.

If you have a question for the IRS specifically related to stimulus checks and your taxes, the IRS recommends that you check IRS.gov and the Get My Payment application.

Where Do I Send My Taxes

If you file online, there’s nothing to print out or mail, but we recommend you save an electronic copy for your records regardless. This could be especially useful if a third stimulus check is approved, since for the first two rounds of checks, your eligibility was based on your tax returns.

Otherwise, you’ll need to mail your return to the IRS. The specific mailing address depends on which tax form you use and which state you live in. The IRS has published a list of where to file paper tax returns this year here. Be warned, however: The IRS says that due to staffing issues, processing paper returns could take several weeks longer this year.

Also Check: How Much Does H & R Block Charge For Taxes

Request Federal Return From Irs

To get a photocopy of your federal tax return, download and print Form 4506 from the IRS website. Fill in the information requested about yourself and the tax return year requested and then sign the form.

You’ll need to include a money order or check for $50. However, there’s an exception if you’re eligible for a fee waiver for disaster assistance and emergency relief. The IRS notes that you’ll need to use the memo or note field to write “Form 4506 request” along with your Social Security number or tax ID.

The second page of Form 4506 will list IRS offices sorted by location. Find your local office’s address and mail the form and payment to that location. The IRS will mail the photocopied tax return within 75 days.

Combien De Temps Faut

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> Vous recevrez généralement votre remboursement dans les trois semaines. Cependant, l’IRS reçoit votre déclaration, encore plus rapidement si vous choisissez de l’avoir directement. De plus, ils déposeront sur votre compte d’épargne.

Cependant, il y a un avis sur le Site de conseils de l’IRS. les états qu’ils ont des problèmes de personnel, donc le traitement des déclarations de revenus papier.

Cependant, cela pourrait prendre plusieurs semaines de plus, ils ont encouragé les contribuables et les fiscalistes à déposer par voie électronique.

Quand et comment vous produisez votre déclaration de revenus affectera également le délai pour le remboursement. En plus de la demande, le remboursement vous sera envoyé.

Cependant, la plupart des contribuables reçoivent leurs remboursements dans les 21 jours. Si vous choisissez d’avoir, votre remboursement déposé directement dans votre compte.

Vous devrez peut-être attendre cinq jours avant de pouvoir y accéder. Si vous demandez un chèque de remboursement, vous devrez peut-être attendre quelques semaines pour qu’il arrive.

Le tableau ci-dessous vous donnera une idée du temps d’attente. À partir du moment où vous déposez jusqu’à ce que vous obteniez votre remboursement.

Also Check: How Can I Make Payments For My Taxes

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000, but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.