How Long Does A Refund Take Your Guide To Getting Your Tax Refund With Etax

OK, so your tax return is finished and Etax lodged it with the ATO for you. Now youre wondering how long it will take until you receive your hard-earned tax refund, right?

We know waiting for your tax refund is frustrating, and chances are its already on its way. However, it is important to bear in mind that sometimes there are delays at the ATO, especially in July.

Did you know, the ATO process the bulk of the nations finances during July? Thats pretty incredible when you think about it.

So, heres everything you need to know about the average waiting periods between ATO lodgement and your tax refund arriving in your bank account. Plus, a few reasons why it can take a little longer sometimes.

How Us News Evaluated Tax Software

We explain what matters most to consumers, experts, and professional reviewers when it comes to tax software companies. Then we provide an unbiased evaluation of tax software companies available at the time of review. Our goal is to empower consumers with the information and tools they need to make informed decisions. More information about our 360 Reviews methodology for evaluating tax software companies is here.

Scott Berger, CPA, is a Entrepreneurial Services Principal at Kaufman Rossin, one of the Top 100 CPA and advisory firms in the U.S.

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Read Also: How To Lower Your Tax Bracket

What Wages Are Eligible When Calculating The Retention Credit

For businesses that had any shutdown due to the pandemic or experienced a significant decline in gross receipts, all wages paid to their employees are considered qualified wages. The ERTC is a retrievable tax credit that takes the form of a grant that can return several thousand dollars to the employee.

Generally, wages are subject to FICA taxes, and qualified health care expenses are needed when calculating for the ERTC.

When determining the qualified health expenses, the Internal Revenue Service has various ways to calculate it depending on circumstances. They generally include the eligible employer and employee pre tax portion, not the after-tax amounts.

As for determining the qualified wages that they can include, a business owner must first identify the number of their workforce, specifically their full-time employees.

Common Reasons That May Cause Delays

- We found a math error on your return or have to make another adjustment. If our adjustment causes a change to your refund amount, you will receive a notice.

- You used more than one form type to complete your return. The form type is identified in the top left corner of your return. We will return your State tax return for you to complete using the correct form type before we can process your return. View example of form types.

- Your return was missing information or incomplete. Sometimes returns are missing information such as signatures, ID numbers, bank account information, W-2s, or 1099s. We will contact you to request this information so we can process your return. Please respond quickly so we can continue processing your return.

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund.

Recommended Reading: How Do I Find The Amount Of Property Taxes Paid

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

How New Jersey Processes Income Tax Refunds

Beginning in January, we process Individual Income Tax returns daily. Processing includes:

Generally, we process returns filed using computer software faster than returns filed by paper. Electronic returns typically take a minimum of 4 weeks to process.

Processing of paper tax returns typically takes a minimum of 12 weeks.

We process most returns through our automated system. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly.

In some cases, they will send a filer a letter asking for more information. In such cases, we cannot send a refund until the filer responds with the requested information.

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper.

To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

Please allow additional time for processing and review of refunds.

| Sorry your browser does not support inline frames. |

Recommended Reading: When Does Taxes Start 2021

How Do I Do My Taxes Online

Each year, you can choose how you want to prepare and file your taxes. You can do so in one of three ways:

Preparing the tax forms by hand and mailing them in.

Using online tax software to prepare the required forms through on-screen prompts and guidance.

Hiring a tax professional to handle it for you .

If you file with the latter two options, you can choose to e-file your taxes. Using tax software allows you to do your own taxes and file online.

When you use online tax software, you can enter your information the first time you use it and have this roll forward each year. This allows for an easier and quicker experience preparing your taxes each year, leading to less stress and quicker refunds if youre owed one.

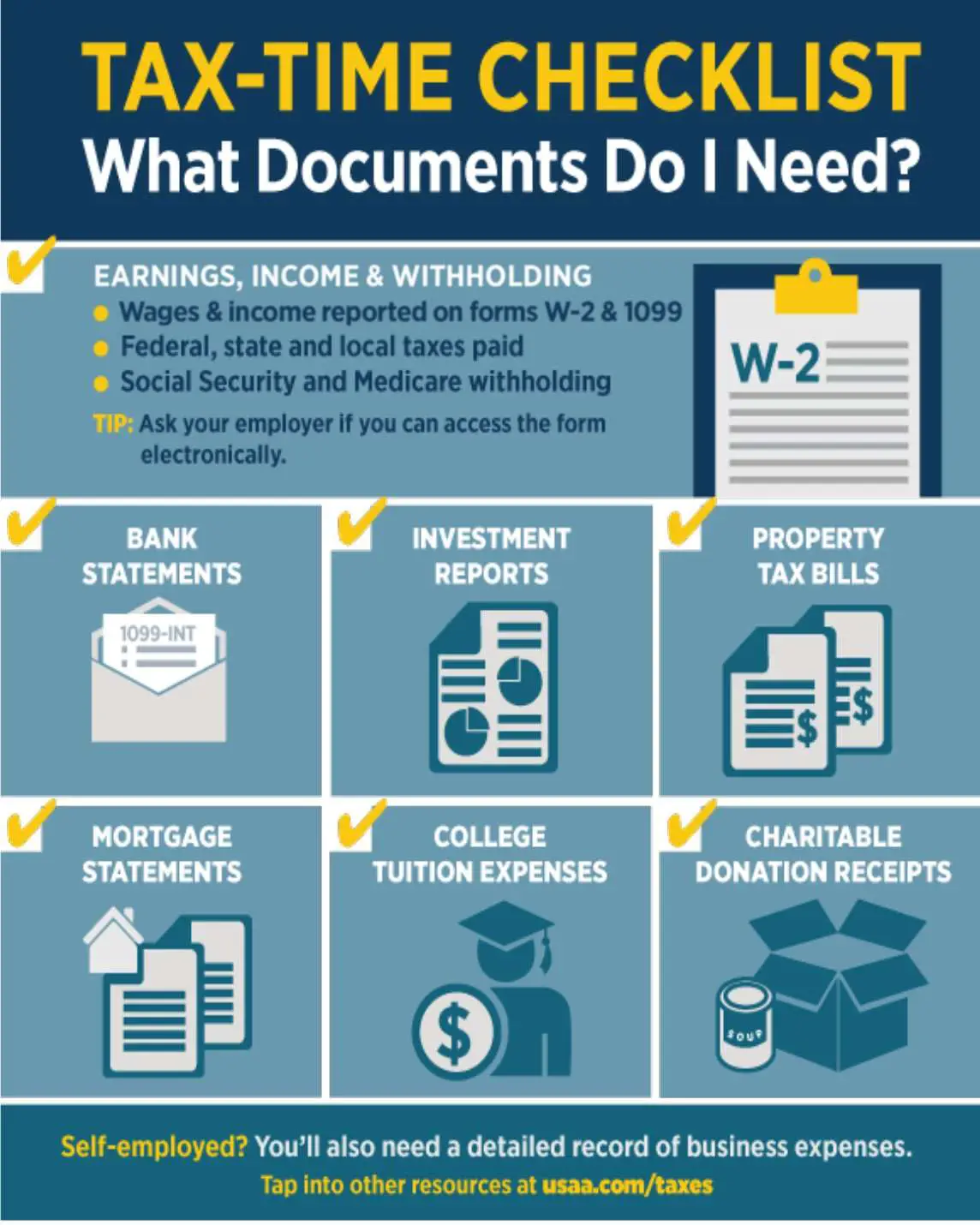

Filing your taxes starts with gathering all the documents you need to prepare your return, such as the forms covered above. To speed up this process, consider keeping all of your supporting paperwork for your taxes in a single and secure location. This helps to keep your tax documentation organized and easily accessible when it comes time to prepare your taxes each year.

After entering your information, tax software works in one of two ways:

From there, you should review your return for accuracy. Afterward, youre ready to file your taxes online.

White House Responds To Speaker Mccarthy

With the GOP only controlling the House of Representatives, the party cannot exert much leverage to force spending cuts. The White House is aware of the limits of GOPs position and has made clear that Congress must deal with the debt limit and must do so without conditions.

Starting this week, Treasury Secretary Janet Yellen will begin to take steps to extend the period under which the federal government can pay its loans without a debt ceiling increase. However, unless an agreement is reached, the debt limit will be surpassed by June and if no efforts are made to raise it, the US risks defaulting, which could trigger a global economic crisis. As the deadline approaches, the GOP must finalize its proposal to curtail spending, and if the White House and Senate reject it, McCarthy will have to navigate getting the votes from a caucus that may not be willing to offer them.

Don’t Miss: Where Can I Get Tax Forms

How Long Does It Take To Get Your Tax Refund

Many Americans look forward to receiving their tax refund each year to help make important personal finance decisions, and you may be wondering how soon youll get yours. The time it takes to receive your tax refund can vary based on several factors, including when and how you file your tax return.

According to the IRS, the best way to avoid delays on your tax refund is to file an accurate tax return using e-file software to file electronically and opting to receive your refund via direct deposit. Most filers who use this method should receive their refunds within 21 days of submitting their return online.

If you mail your return, you can expect to receive your refund in about six to eight weeks from the date the IRS receives your return. You can choose to receive your refund as a check in the mail, but keep in mind that you will likely receive your refund anywhere from a few days to a few weeks later than you would have with direct deposit due to transit time.

Whether filed electronically or on paper, all returns are opened and processed by the IRS in the order they are received, so the earlier you file your taxes, the earlier youll receive a refund.

Join Thousands of Other Personal Finance Enthusiasts

What To Do Once Your Refund Arrives

For many people, their IRS tax refund is the biggest check they receive all year, the IRS says. In anticipation of your windfall, its wise to have a plan for how youre going to use your windfall. Deciding how to spend, save or invest the money in advance can help stop the shopping impulse from getting the best of you.

Your refund is yours to use how you see fit and can be used to help pay for day-to-day expenses or invested for long-term financial stability.

If youre expecting a refund, put it to good use. Looking for inspiration? Bankrate offers five smart ways to invest your tax refund.

Read Also: Will Irs Extend Tax Deadline

Other Factors That Could Affect The Timing Of Your Refund

Additional factors could slow down the processing of your tax refund, such as errors, incomplete returns or fraud.

Taxpayers who claim the earned income tax credit or the additional child tax credit may see additional delays because of special rules that require the IRS to hold their refunds until Feb. 27. You should also expect to wait longer for your refund if the IRS determines that your tax return needs further review.

Refunds for returns that have errors or that need special handling could take up to four months, according to the IRS. Tax returns that need special handling include those that have an incorrect amount for the Recovery Rebate Credit and some that claim the EITC or the ACTC. Delays also occur when the IRS suspects identity theft or fraud with any return.

Respond quickly if the IRS contacts you by mail for more information or to verify a return. A delay in responding will increase the wait time for your refund.

If you submitted an amended tax form, it may take more than 20 weeks to receive a refund due to processing delays related to the pandemic.

Tips For Getting Through Tax Season

- Taxes are just one aspect of your overall financial life. A financial advisor can help you plan your retirement, estate and optimize your tax strategy for all of your financial goals. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you still need to file your taxes, make sure to consider all of your filing options. Two of the largest tax-filing services are H& R Block and TurboTax. Both are easy-to-use and offer step-by-step guidance to help you maximize your return. Check out SmartAssets comparison of TurboTax and H& R Block to see which one is better for you.

- State governments use their own systems for handling tax returns. In some states youll get your refund within a couple of days, while other states will take weeks or months for processing. Learn how to check your state tax refund status.

- If you find yourself relying on your tax refund to make ends meet, you may be able to make some changes to your tax withholding. Claiming more or fewer allowances on your W-4 will impact how much tax your employer removes from checks. Withholding less in taxes will mean more take home pay. If you receive a big refund come tax time, there may be room for you to increase your allowances.

Don’t Miss: Where To File Taxes Online

Tips For Speeding Up Your Tax Refund

If you are waiting for your tax refund and want to speed up the process, there are a few things you can do. First, double-check your return to make sure all of your information is correct. Second, if the IRS sends you any notices, respond to them as quickly as possible. Finally, if you are expecting a large refund, consider requesting that it be split into multiple payments.

Reasons For Your Tax Refund To Be Delayed

People typically receive their tax refund two weeks after the IRS accepts their tax filing if they opt to receive a direct deposit, or in three weeks if they choose to get a check in the mail. But if youre still waiting after that point and wondering, where is my tax refund?, here are a few possible reasons for the delay:

If anything in your return is incomplete or incorrect, the IRS may need to give the return further review before sending you a refund check. In this case, you may get a notice from the IRS in the mail with instructions for fixing or completing your tax return. It may take up to four months for the IRS to process returns that require extra handling. The sooner you respond to the IRS request for information, the sooner your return will be processed.

If you are claiming the Earned Income Tax Credit or Additional Child Tax Credit, there may be a delay in receiving your tax refund. The IRS is required to hold any tax returns for people claiming those two tax credits until February 15th. This hold will show up in the Wheres My Refund tool on the IRS site if it applies to you.

Your bank or credit union may take more time to post a refund to your account. The time for posting IRS refunds varies from institution to institution.

Also Check: Can Irs Take 401k For Back Taxes

Why Do I See A Tax Topic 151 Tax Topic 152 Or Irs Error Message

Although the Where’s My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see.

One of the most common is Tax Topic 152, indicating you’re likely getting a refund but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps.

Tax Topic 151 means your tax return is now under review by the IRS. The agency either needs to verify certain credits or dependents, or it has determined that your tax refund will be reduced to pay money that it believes you owe. You’ll need to wait about four weeks to receive a notice from the IRS explaining what you need to do to resolve the status.

There are other IRS refund codes that a small percentage of tax filers receive, indicating freezes, math errors on tax returns or undelivered checks. The College Investor offers a list of IRS refund reference codes and errors and their meaning.

If Your Refund Isnt What You Expected

If your refund amount isnt what you expected, it may be due to changes we made to your tax return. These may include:

- Corrections to any Recovery Rebate Credit or Child Tax Credit amounts

- Payments on past-due tax or debts, offset from all or part of the refund amount

For more details, see Tax Season Refunds Frequently Asked Questions.

Don’t Miss: How To File Quarterly Ifta Taxes

When Every Dollar Matters It Matters Who Does Your Taxes

-

WE SEE YOU

Our Tax Pros will connect with you one-on-one, answer all your questions, and always go the extra mile to support you.

-

WE GOT YOU

We have flexible hours, locations, and filing options that cater to every hardworking tax filer.

-

GUARANTEED

Weve seen it all and will help you through it all. 40 years of experience and our guarantees back it up.

What Employers Qualify For The Employee Retention Tax Credit

ERC is available to any business with employees. The company only needs to meet one of these two eligibility requirements to qualify for the credit:

- Experience a vast and significant decline in gross receipts during the calendar quarter.

- Due to governmental orders, the business had a full or temporary suspension of operations during any calendar quarter in 2020.

While businesses of all types and sizes can benefit from the Employee Retention Credit, the program favors small businesses over larger eligible employers.

For 2020, a small business is defined as an organization that averaged 100 or fewer full-time employees in 2019. For 2021, the definition is expanded to include businesses that averaged 500 or fewer full-time employees in 2019.

A more significant eligible employer can claim the Employee Retention Credit but only for wages paid to eligible employees not to work or for some qualified health care expenses. Small businesses can claim the ERC for all employees, whether they worked or not.

For recovery startup businesses, the ERC was amended in 2021 to let them gain access. A so-called recovery startup business can apply for credit for 2021s third and fourth quarters. A recovery startup business is defined as one that was opened after February 15, 2020, with annual gross receipts under $1 million.

Read Also: What Is 7.99 Plus Tax