How To Pay Your Tax Bill

Due to COVID-19, City Hall is still closed to the public. However, City staff are still working and available to you via phone, email or appointment.

During the month of July, commercial and residential tax bills are being mailed to property owners.

How can I pay my bill?Did you know that most payments to the City can be made by debit by calling 311? There is no need to visit contact us by phone at 311 or 754-CITY , or email to discuss options.

The easiest way to make payments on your taxes is online or through bank deduction. To set up online payments with your bank, locate your account number on your municipal tax bill. Most banks want you to omit the first two zeros when setting up the payment. Here are the names the Citys most common banks use for this preauthorized payment:

| City of St. Johns Nfld. Taxes | |

| Simplii Financial | |

| St. Johns City Taxes | |

| TD Canada Trust | St. Johns Taxes |

What if I absolutely need to visit City Hall to complete my business?If you absolutely must speak with one of our representatives in person, you must make an appointment we are not open for drop-ins.

To book a phone appointment with a City representative:

Pay Directly To The City

to pay property tax directly to The City of Calgary. See for more information.

The Tax Instalment Payment Plan is a monthly instalment plan that allows you to pay your property taxes by monthly pre-authorized debit, rather than in a single annual payment. Find out more about the Tax Instalment Payment Plan .

Reduce the risk of late payment penalties by requesting and returning your TIPP agreement early.

TIPP payment not honoured by your bank – making a replacement instalment

Making a replacement instalment, like all other tax payments, can be made through one of the other property tax payment options listed on this page. Replacing a payment before it becomes dishonoured will not stop the next monthly TIPP instalment from being withdrawn or prevent service fees. For more information on replacement instalments, see non-payment and service charges.

Making a lump sum payment to lower your monthly payment amount

Your monthly TIPP payments can be lowered by making a lump sum payment and requesting a recalculation. If you decide to make a lump sum payment, it cannot be automatically withdrawn. A lump sum payment, like all other tax payments, can be made through one of the other property tax payment options listed on this page.

Third floor, Calgary Municipal Building800 Macleod Trail S.E.

Cheque or money order

Avoid last minute lineups and late payment penalties by bringing your cheque to Corporate Cashiers today, post-dated on or before the due date.

Other Tax Payment Information

Keep these important facts in mind when it’s time to pay your taxes:

- If your bank returns a cheque, we charge a fee to your tax account

- Keep your notice as your receipt for income tax purposes

- We charge a fee for duplicate receipts or statements of account

- Submit your entire tax notice with your payment in order to receive a receipt

- Receipts are valid only if the payment cheque clears your bank

- We add a 1.25% charge on the first day of default for late payments and on the first day of each month until the account is paid

- Received payments apply to all interest, penalty and other charges, and then to the oldest overdue taxes

Read Also: How To Get Stimulus Check 2021 Without Filing Taxes

Online Mobile Or Telephone Banking

You can add the City of Kitchener as a bill payee with most banks. Use the tax roll number on your property tax bill as the account number.

Contact your banks customer service department if this does not work.

Allow at least five business days for your bank to process the transaction and send us your payment.

Payment Of Your Invoice

Paying in one or two instalments

If your total account is $300 or more, you can pay it in one or two instalments without any interest charge or penalty.

If your tax account is under $300, you must pay it in full by the first instalment deadline.

Factor in two business days before the actual due date, to give us time to process your payment and credit your account.

Also Check: When Will My Tax Return Come

Property Tax Lookup/payment Application

Fax: 653-7888Se Habla Español

The Property Tax payment system will be unavailable Sunday, September 12th, 2021 12:00am to 3:00am for scheduled maintenance.

This program is designed to help you access property tax information and pay your property taxes online.

If you have questions about Dallas County Property Taxes, please contact , see our Frequently Asked Questions, or call our Customer Care Center at 214.653.7811.

Convenience Fees are charged and collected by JPMorgan and are non-refundable: ACH Fee = $0.00 each. Credit Card Fee = 2.15% of amount charged . Debit Card Fee = $2.95 per transaction.

The City Of Markham Makes It Easy To Pay Your Property Tax Bill

See below to learn about your payment options, payment plans, and late payment fees.

The City of Markham approved property tax and fee reliefmeasures to help residents and businesses experiencing financial hardship dueto the COVID-19 pandemic. Learn more.

There are many ways to pay your taxes:

- Online through your bank: It’s the most convenient way to pay your taxes. Payments can be made online through major banks and financial institutions.

- In person at your bank: You can also pay at your bank or financial institution.

- : Make sure that you write a cheque for the full installment amount. Please match the dates on the cheques to the installment due dates. You must also write the Tax Roll Number on the front of your cheque and send us the bottom portion of your bill .

Tax Department101 Town Centre BoulevardMarkham, Ontario, L3R 9W3

- At the Civic Centre: Temporarily closed due to COVID-19. You can also drop off your payments in the drop box found at the Thornhill Entrance of the Markham Civic Centre .

- Through a Pre-Authorized Tax Payment Plan: No more cheques or postage. Choose a payment schedule that meets your needs and pay in 4, 6 or 11 instalments. See below about pre-authorized tax payment plan.

Important Notes:

Don’t Miss: When Is Tax Time 2021

Property Tax Payment Options

We encourage you to pay your taxes and utilities online or via telephone banking.

Our customer service team is happy to assist you over the phone or via email if you have any questions. For property tax and utility information, call 604-591-4181 or email .

You can also mail your payment to City Hall or pay in person. Appointments to pay in person are encouraged to avoid wait times.

Your Property Tax Notice

The City is the agent for all property tax collection within its boundaries. Your property tax notice is a statement identifying how much your property tax is for the current tax year, including details of the taxing authorities that receive a portion of your tax dollars.

Supplementary Tax Notice

If you make changes to your home that affect the assessment, you may also receive a Supplementary Tax Notice in addition to your Tax Bill. This notice represents a change in your taxes for a portion of the year.

Also Check: How Can I Make Payments For My Taxes

Roll Number Is The Account Number

Make sure the Calgary property tax account number registered in your banks bill payment profile matches the 9-digit property tax roll number shown on your tax bill or statement, entered without spaces or dashes. If an invalid 9-digit roll number is used it may result in a Payment Alignment fee of $25.

Roll number location on a property tax bill

Roll number location on a property tax statement of account

Apply payment to the correct property – check your roll number

The property tax roll number is linked to the property NOT the owner.

When you sell a property, that propertys tax roll number does not follow you to your next property.

Your new property will have its own roll number, which appears on your bill.

You must register your new propertys 9-digit roll number as the account number before making payment. Not changing the roll number registered with your bank will result in your payment being applied to your previous property, not your current bill. If your previous roll number is used to make the payment, it may result in a Payment Alignment fee of $25.

Need a copy of your tax bill? Visit Property Tax Document Request.

Keep your receipt as proof of the date and time of payment.

Add Calgary Property Tax As A Payee

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online, by phone or in person at a branch.

Add Calgary Property Tax payee to your bank accounts bill payment profile:Search keywords: Calgary property tax and select the payee name closest to Calgary Property Tax or Calgary Property Tax.

Cant find Calgary property tax as a payee or are unsure which payee to select?

Contact your bank for more information.

Don’t Miss: What Is The Limit For Donations On Taxes

Your Propertys Assessed Value

Your property is assessed at the amount indicated in this field. This amount acts as a basis for calculations of the property taxes.

Provincial legislation requires that the assessment reflect the market value of your property as of July 1st of the previous year.

All properties are assessed using similar factors that real estate agents and appraisers use when pricing a home for sale.

If your property was only partially completed as of December 31, your assessment reflects the value of the lot plus the value of the building, based on the percent complete.

If the building is completed during the current year, a supplementary assessment and tax notice will be sent to the assessed person reflecting the increase in assessment from new construction.

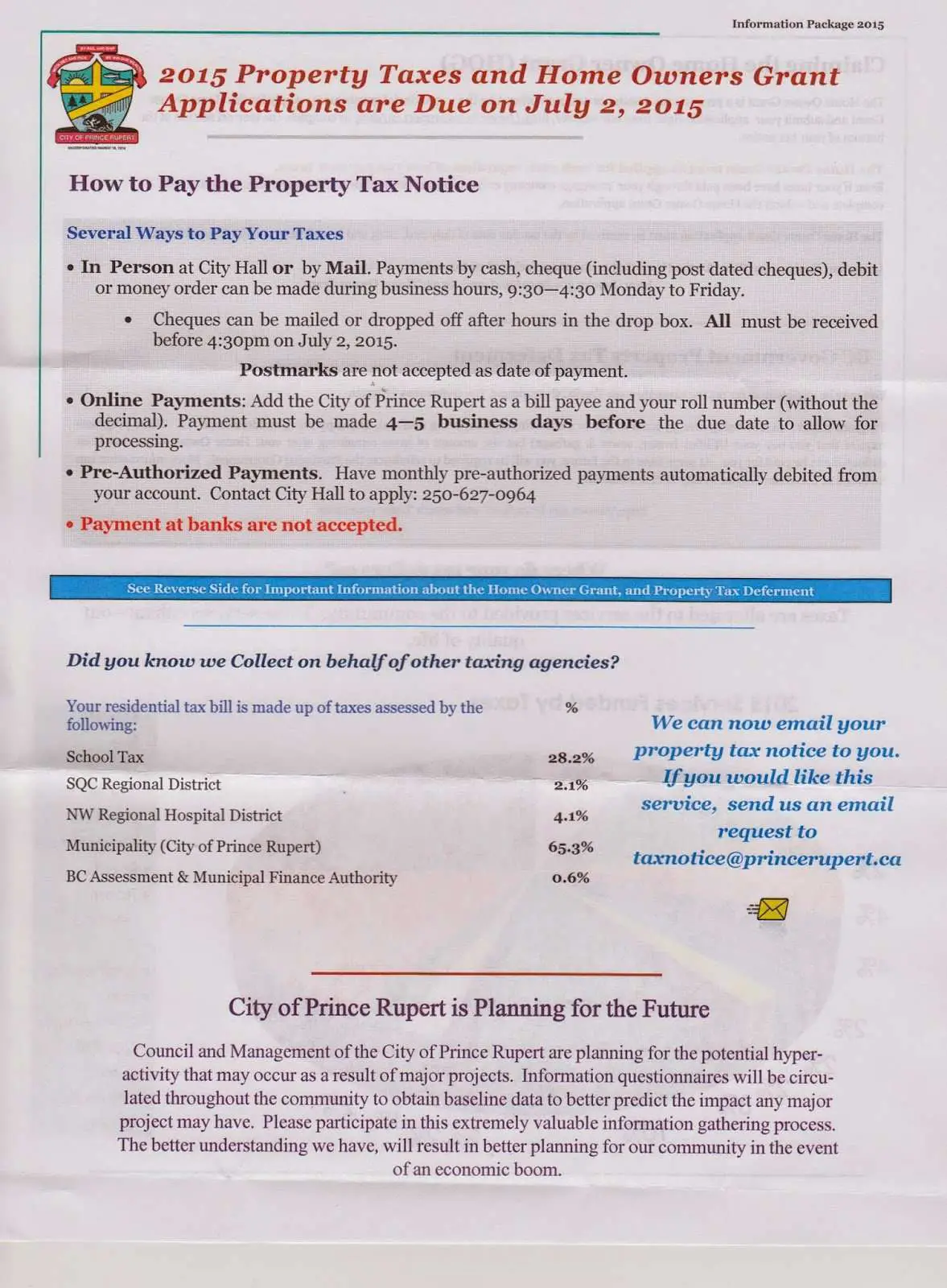

Property Taxes Are Due On July 2 2021

Property tax notices are mailed each year in late May and include a brochure “How to do it all online” . Have you considered going paperless? Register for Property Account to access your City accounts information and opt-in to receive next year’s tax bill by email.

City Hall is located at 1435 Water Street, Kelowna BC V1Y 1J4.Our hours of operation are 8 a.m. to 4 p.m. Monday to Friday . In the interest of health and safety, we recommend taxpayers use one of the online payment options to pay property taxes instead of visiting City Hall in person. General enquiries can be emailed to,or sent byservice request.

The Speculation and Vacancy Tax is a provincial initiative. For more information, visit the BC Government’s Speculation Tax website or contact the Provincial office toll-free at .

Read Also: Do I Have To Pay Taxes On Social Security Income

Payments By Electronic Check Or Credit/debit Card

Several options are available for paying your Ohio and/or school district income tax. For general payment questions call us toll-free at 1-800-282-1780 or adaptive telephone equipment).

If you are remitting for both Ohio and school district income taxes, you must remit each payment as a separate transaction.

Note: Payments made online may not immediately reflect on your Online Services dashboard. Please allow 2-3 business days for the payment made to be applied to your outstanding liability.

Pay via Guest Payment Service Register & Pay via Online Services

The Department is not authorized to set up payment plans. However, you may submit partial payments toward any outstanding liability including interest and penalties. Such payments will not stop the Department’s billing process, or collection attempts by the Ohio Attorney General’s Office.

Note: This page is only for making payments toward individual state and school district income taxes. To make a payment for a business tax, visit our online services for business page.

See the FAQs under the “Income – Online Services ” for more information on using Online Services.

You can pay using a debit or credit card online by visiting ACI Payments, Inc.or calling 1-800-272-9829. You may also use the Online Services portal to pay using a credit\debit card. You will be redirected to the ACI Payments, Inc. website. This payment method charges your credit card .

You will then be prompted to enter your payment information.

Notify Us Of Changes And Verify Your Details

In order to send you the correct tax assessment for your residence or business premises, the Local Taxes department needs your full, correct details.

Contact the Local Taxes department at .

Moving house? The right address = the right tax assessment!

Many taxes are calculated based on the situation on 1 January of that year. For this reason, it is important to make sure you are registered at the correct address.

Have you moved house or has the composition of your household changed? Depending on your circumstances and on the type of tax, you might be able to get a refund. To find out if you will get money back and if this will happen automatically, please check the specific taxes involved.

New bank account number

Please notify the Local Taxes department immediately if you have a new bank account number or if the number we have on file for you is incorrect.

Also Check: How Much Do I Need To Make To File Taxes

Avoid The Line Pay Online

Using your MyPropertyAccount you can register your property tax, utilities and dog licensing accounts for eBilling. Pay via online or phone banking with your financial institution.

Sign up for eBilling

Log in to MyPropertyAccounts and change your bill delivery method to email by May 1st of the year to get your bill online.

Get Your Payment Together

At City Hall, we accept cash, credit cards, pinless debit cards, and checks or money orders made payable to the City of Boston.

If you use a credit card or pinless debit card, there is a non-refundable service fee of 2.5% of the total payment, with a $1 minimum. This fee is paid to the card processor and not kept by the City.

If your debit card requires you to enter your pin to process a payment, you CANNOT use it to pay your fee.

Recommended Reading: What If I File Taxes Late

Forms: Property Account Assessment And Taxes

School Support Declaration – for corporations

Mailing Address and Ownership Changes

Corrections or changes to mailing addresses, owner names and changes of ownership are administered by Alberta Land Titles. The City of Edmonton receives these updates electronically once they have been processed by Alberta Land Titles.

You can request a change of mailing address by submitting a Change of Address form. Changes or corrections to owners name and changes of ownership can be made by submitting the appropriate forms to Alberta Land Titles.

If you receive a “Please wait….” message opening PDF forms1. Right click on the link2. Choose the option to Save or Download the form to a known location on your computer, such as your desktop3. Locate the file on your local computer4. Open the file using Adobe Reader

Bank Or Financial Institution

You can pay your property taxes through the bank, credit union or other financial institution you have an account with. When you use your bank or financial institution, we recommend that you always confirm when your payment will be processed by your bank to avoid late payment penalties. For example, banks will often process payments received in the afternoon with the date of the next business day.

There are three ways you can pay your property taxes through your bank or financial institution:

Note: You can no longer make a payment at a financial institution you dont have an account with.

Bill payment service

Most banks and financial institutions offer bill payment services for their clients. Bill payment services can generally be accessed through your online banking account, an automated teller machine , telephone banking or in person with a teller at the financial institution that you bank with.

Note: When you pay in person, you need to set up a bill payment service for Rural Property Taxation before you pay with a teller.

To pay your property taxes using a bill payment service you’ll need to add a payee for Rural Property Taxation to your bank account. To add a new payee to your bank account you need to know our payee name and your folio number.

- Our payee name is PROV BC – RURAL PROPERTY TAX

- Your folio number is listed on your Rural Property Tax Notice. It must be entered without spaces or decimals. For example, 012 34567.890 must be entered as 01234567890

Wire transfer

Recommended Reading: How Much Should I Save For 1099 Taxes

Before You Get Started By Mail

The City operates on a fiscal year that starts on July 1 and ends on June 30. We use a quarterly tax billing system, meaning we mail tax bills four times per year:

- First quarter: July 1

- Third quarter: January 1

- Fourth quarter: April 1

We send tax bills 30 days before their due date. Your quarterly tax bills are due on these dates:

- First-quarter bills: August 1

- Third-quarter bills: February 1

- Fourth-quarter bills: May 1

If the first of the month falls on a weekend, your bill is due on the following Monday.

Assessed taxes on real estate stay with the property not the name on the tax bill. So, if you own the property, you need to make sure that the property taxes are paid. Otherwise, the unpaid taxes could result in a lien against the property.

The name on the tax bill is the property owner on January 1 before the start of the given fiscal year. If you sell a property and we still mail you a tax bill, please forward it to the new owner of the property.