How And When To File Your Tax Return

Learn how to fill out your return using tax preparation software or on paper.

The deadline for filing personal income tax returns and paying outstanding income tax is . After April 30, penalties and interest start to apply to any outstanding balance owed.

If you are self-employed or filing for someone who has passed away, please see the CRAs website for filing deadlines.

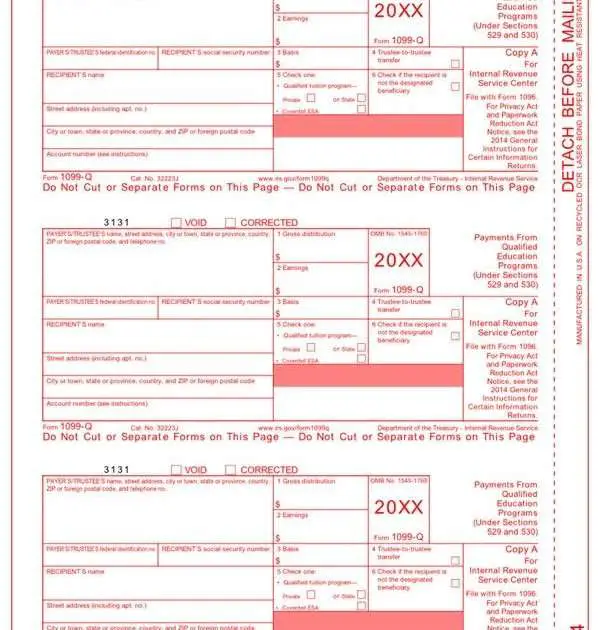

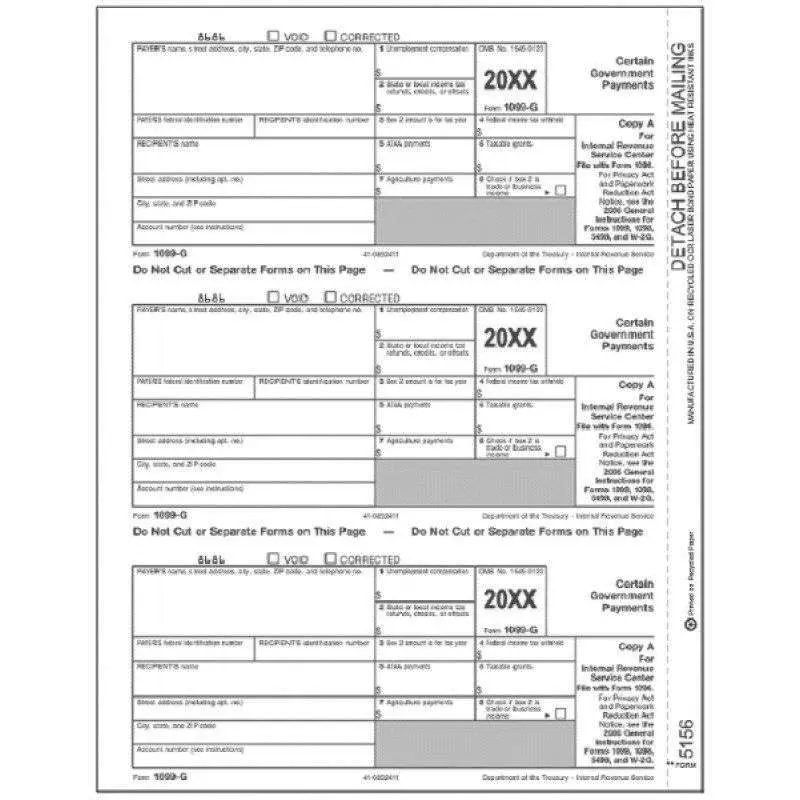

Do Post Offices Carry 1099 Forms

Most post offices and some public libraries have them. You can print them off online at http://www.irs.gov/ There are opportunities for filing free online, too. If you dont have a computer, you can go to the library. If they dont have the forms, most libraries have computers and printers you can use.

What You Need To Know

Before filing, you can learn more about the advantages of filing online. Electronic filing is the fastest way to get your refund. If you file online, you can expect to receive your refund within 2 weeks. If filing on paper, you should receive your refund within 6 weeks.

These forms are subject to change only by federal or state legislative action.

All printable Massachusetts personal income tax forms are in PDF format. To read them, you’ll need the free Adobe Acrobat Reader.

If you have any suggestions or comments on how to improve these forms, contact the Forms Manager at .

If you need information about the most common differences between the federal and Massachusetts state tax treatment of personal income, please visit our overview page.

Read Also: How To Protest Property Tax Harris County

What Is The Penalty For Not Issuing A 1099

The penalty for not issuing a Form 1099 is $250 per 1099. If you file 1099s late the penalty is $50 or $100 per 1099 depending on how late they are filed. Example: If you have paid 10 unincorporated businesses more than $600 in 2015 and dont file the required 1099s, the IRS can access a whopping penalty of $2,500.

Who Files A 1099 Form

The basic rule is that you must file a 1099-MISC whenever you pay an unincorporated independent contractor-that is, an independent contractor who is a sole proprietor or member of a partnership or LLC-$600 or more in a year for work done in the course of your trade or business by direct deposit or cash.

Don’t Miss: Is Freetaxusa A Legitimate Company

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if you’re expecting a refund and you want it as soon as possibleyou can file your 2020 return as early as Feb. 12, 2021.

That’s a little later than usual, and the reason is important: If you didn’t receive the economic stimulus check approved by Congress by the end of 2020, you can claim it on your 2020 return.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

How Income Tax Works

Federal and Ontario income taxes are paid to the Canada Revenue Agency , which is part of the federal government.

Income tax is commonly taken off your pay by your employer, or off your pension, and sent directly to the CRA. You may also have to calculate the tax you owe and send a payment to the CRA.

Each year, you should file a tax return with the CRA to:

- report the income youve made

- ensure youve paid the correct amount of income tax

- access tax credits and benefits

Learn more about how much tax you should pay on each portion of your income.

Read Also: 1040paytaxcom

Where To Get Copies Of Tax Forms Due To You

Before you can file, youll need tax forms from the financial institutions with which you have accounts. They should either arrive in the mail, or you’ll receive information on how to access them online. These forms report how much interest youve earned on high-yield savings accounts and certificates of deposit, how much money you made or lost from selling investments, and the amount of any distributions youve taken from retirement accounts.

Youll also need tax forms documenting your earned income and the taxes youve already paid. The most common of these is Form W-2 employees receive it from their employers. Freelancers and independent contractors should receive Form 1099-MISC from each client who has paid them $600 or more . You might also receive a 1099-MISC for certain other types of income, such as prize money.

In addition, you may receive forms documenting any interest youve paid on a student loan or mortgage. This interest may be tax-deductible, depending on your circumstances.

Traditionally, financial institutions, employers, and clients mailed paper copies of these forms to you. Today, you may need to retrieve them yourself by logging into your account online. Sometimes this service is optional, but other times it will be the only way you can get the forms you need.

Is Filing Electronically Safe

The appeal of electronic filing is obvious, but is it safe? Your tax filing contains some of the most sensitive data about you: where you live, how much you earn, how many dependents you have, your Social Security number, how high your medical expenses were, and how much you gained or lost from selling investments.

Can you trust the tax software companies and the government to have employed best-in-class security to protect your data both as its being transmitted and while its being stored? If you use online tax software, your information is also being stored in the cloud, creating another point of vulnerability.

For this reason, some people prefer to purchase downloadable software so their data is stored only on their own computer. That way, they are vulnerable to one less data breach possibility.

In this era of data breaches and identity theft, security and privacy questions are important to ask. The table below shows what security features online tax services provide as of January 2021 for the 2020 tax return season. Note that the absence of a feature in the table doesnt necessarily mean the software provider doesnt have it, just that the information wasnt available on the companys data security page. Also, while each service describes its encryption practices differently, all appear to be using appropriate methods.

| Security and Fraud Prevention Features in Popular Tax Preparation Software, January 2021 | |

|---|---|

| Software Brand | |

| not advertised | not advertised |

Don’t Miss: How To Buy Tax Lien Certificates In California

We Provide Qualified Tax Support

E-file’s online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it. Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all users.

If you’ve ever tried calling the IRS during the tax season, you probably know that telephone hold times at peak periods can be hours long. Our dedicated support team enables customers to get their questions answered just minutes after a question is sent, even during peak times. Simply send us a “help” request from within your account and our experts will begin working on your problem and get you an answer as quickly as possible. Prefer to call us? We also provide full telephone support to all taxpayers filing with our Deluxe or Premium software.

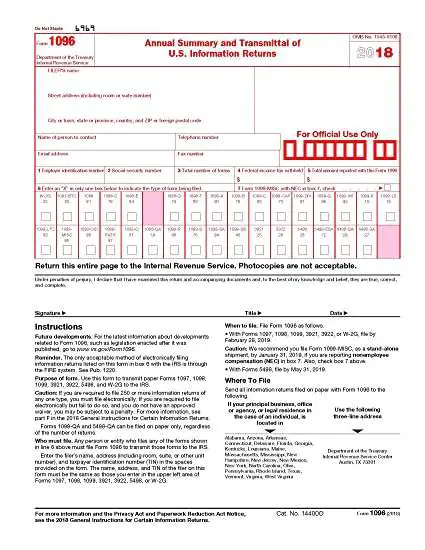

Individual Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free iFile service.

Do Not Send

- Federal forms or schedules unless requested.

- Any forms or statements not requested.

- Returns by fax.

- Returns completed in pencil or red ink.

- Returns with bar codes stapled or destroyed.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online. You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process.

IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. To do so, you must have the full Adobe Acrobat 4.1 product suite, which can be purchased from Adobe. Maryland fill-out forms use the features provided with Acrobat 3.0 products. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information.

Also Check: Do You Have To Claim Plasma Donation On Taxes

Types Of Taxable Income

You have to report any taxable income you earn inside and outside Canada when you file your tax return. This includes:

- any full-time or part-time work

- self-generated income

- rental income, including renting out a portion of your home

- investments

- your pension

You do not have to report certain non-taxable amounts as income, including:

- allowances

- elementary, secondary and post-secondary school scholarships

Request A Copy Of Previously Filed Tax Returns

To request a copy of a Maryland tax return you filed previously, send us a completed Form 129 by mail or by fax. Please include your name, address, Social Security number, the tax year you are requesting and your signature. If you are requesting a copy of a joint return, include the information for both taxpayers and their signatures.

Mailing address:

The following information on your correspondence will help us generate a quick response to your inquiry:

Also Check: Mcl 206.707

What To Do About Missing Tax Forms

If you dont receive one or more of the forms you need, youre not absolved of reporting that information on your tax return. Heres how to handle this situation.

If you file a paper return by mail, youll need to include copies of the forms issuers have sent you if they show taxes withheld. If you file electronically, you wont have to.

Electronic Pitfalls To Avoid

If you do file your tax forms electronically, dont complete them on a public computer, and dont transmit your return over public WiFi.

Use a personal computer with antivirus and firewall software and a secure, password-protected private WiFi network, such as your home or work network. Dont transmit your tax returns over an unsecured coffee shop, airplane, or library network.

Read Also: Protest Taxes Harris County

Locations To Pickup Tax Forms

OTR Customer Service Center1101 4th Street, SW, Suite W2708:15 am to 5:30 pm

John A. Wilson Building1350 Pennsylvania Avenue, NW, lobby8 am to 6 pm

Judiciary Square441 4th Street, NW, lobby7 am – 7 pm

901 G Street, NWNote: MLK Library is closed for renovations but can be obtained from libraries across the city

Municipal Center6:30 am to 8 pm

Reeves Center7 am to 7 pm

How Do I Create A 1099

You can create 1099s by using accounting software or using the copy the IRS provides online.

Also Check: Are Raffles Tax Deductible

Where Do I Get My 1099

The 1099 is a tax form you receive from Payable.com if you earn more than $600 in one calendar year. You use this form to report your annual earnings, and its useful that you have it when you go to file your taxes. The 1099 form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more.

Your employer has an obligation to send this form to you each year before January 31st. As youre an independent contractor when you work for DoorDash, you get the 1099-MISC form. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings.

Note that you need to report the earnings even if you dont receive the form. In case this happens, it doesnt represent an issue if you still report your income and pay your taxes accordingly. You can do it without the 1099 form, so theres no need to call the employer and remind them to send it. You wont have any trouble with the IRS as long as you file the taxes on time. The only thing you should avoid is waiting for the form and missing your deadline.

To access your 1099-MISC form, you need to accept an invite DoorDash sends you. When you do, you automatically get a Payable account, so you dont have to create one on your own. If you have an account from before, you can see the 1099 form for the current year under DoorDash name.

Can I Still File My 2019 Taxes

Yes, you can still file a 2019 tax return. You generally have up to three years to claim a federal income tax refund. After three years the IRS simply won’t pay you the refund. If you are owed a refund, you will not be charged a late filing penalty.

If you can’t afford to pay the back taxes you owe, ask the IRS for a reduction due to a hardship and create a payment schedule. See the 2019 Form 1040 instructions booklet below for more information about late filing penalties and how to request a payment schedule.

Read Also: Efstatus Taxact Online

Tax Situations Requiring A Specific Return Or Form

There are exceptions, such as if you had residential ties in another place, where you would need a specific tax return.

You will also need to file a provincial income tax return for Quebec.

For details: What to do when someone has died

For details: Leaving Canada

Use the income tax package for the province or territory with your most important residential ties.

For example, if you usually live in Ontario, but were going to school in Quebec, use the income tax package for Ontario.

Factual resident

This may also apply to your spouse or common-law partner, dependant children, and other family members.

do not

You may be considered a deemed resident of Canada if you:

- do not have significant residential ties with Canada

- are not considered a resident of another country under a tax treaty between Canada and that country

Use the tax package for non-residents and deemed residents of Canada.

If you are not a factual resident of Canada, or a deemed resident of Canada, you may be considered a non-resident of Canada for tax purposes. Use the tax package for non-residents and deemed residents of Canada.

If you earned employment income or business income with a permanent establishment in a certain province or territory, complete the following instead:

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Corporate Estimated Tax Payment Voucher

- Must be filed electronically through MassTaxConnect. This paper version is for informational purposes only. See TIR 16-9 and TIR 21-9 for more information.

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

You May Like: Is Plasma Donation Taxable Income

Types Of Tax Credits And Benefits

There are two types of tax credits:

Benefits can help with various living expenses, such as raising children, housing, loss of income and medical expenses.

Read the Canada Revenue Agencys General Income Tax and Benefit Guide and Forms Book to learn more about which tax credits you can claim.

With the Ontario Child Care Tax Credit, you could get back up to 75% of your eligible child care expenses. It applies to eligible child care options, including care in centres, homes and camps.

The Low-Income Workers Tax Credit provides up to $850 each year in Ontario personal income tax relief to low-income workers, including those earning minimum wage.