Paying Your Ifta Balance Just Got Easier

You can now pay your IFTA balance on-line by either e-check or by credit card using Visa or MasterCard. If you file your return on-line and owe a balance, the system will easily navigate you through the on-line payment screens. If you filed your return on paper but have not paid the balance, access our system at MCS.

Filing Quarters And Due Dates

| Tax return quarter |

All accounts must be paid in full. If your account is revoked, you would have received a letter regarding this action and providing requirements. When reinstating, use the “reinstatement” link on your TAP account or fill out a new . All outstanding amounts must be paid in full and a $100 reinstatement fee must be paid. A new may need to be completed if you don’t have current decals.

If the account is managed by a Service Bureau and the IFTA member wants to remove the access of the Service Bureau, a request must be submitted in writing and sent by email or mail, TAP, the POA, etc. Our staff will make the change and your account on TAP will reflect this or we will call you.

Michigan Ifta Accounts Gone Paperless

In December of 2014, the Michigan IFTA Unit made it mandatory to e-file Michigan IFTA quarterly tax returns through the IFTA Processing Consortium . Starting with the 4th quarter 2014 IFTA return, carriers were required to access their online account for not just filing and securely paying the returns, but also for renewing the IFTA license for 2015, ordering decals, accessing previously filed returns and much more. Through this secure online account, carriers have access to manage their IFTA account 24 hours a day, 7 days a week.

Read Also: How To File Missouri State Taxes For Free

Interest Charged On Late Returns

Interest is set annually by IFTA, Inc. at 2 percentage points above the underpayment rate established by the IRS. This rate accrues monthly at 1/12 the annual rate.

Washington charges 1% interest on the full amount owed as of the 1st of the following month if the balance due has not been paid. Washington interest is applied to the net balance due on the first of the month following the due date of the filed return.

What Ifta Credentials Will I Receive From Minnesota

Minnesota will provide you with one IFTA license and a set of decals. A photocopy of the original license must be maintained in the cab of each one of your qualified motor vehicles. The original license should be kept at your business address in a safe place. Your Minnesota IFTA license is valid for the calendar year January 1 through December 31.

Also Check: Www.1040paytax.com Official Site

Online Ifta Quarterly Returns

You may also calculate and print an IFTA Tax Return using the Online IFTA Quarterly Returns. This form calculates the taxes for you but does not require a log-in. You cannot save this form, so if you use this option, be sure to print a copy for your records.

For more information, please refer to the IFTA Tax Reporting FAQ’s.

Benefits Of An Ifta Membership

- A carrier licensed under IFTA is required to submit only one quarterly fuel tax return to its base jurisdiction, where it is registered.

- The single return covers the distance travelled in all IFTA jurisdictions, rather than the carrier being required to complete separate fuel tax returns for each jurisdiction.

- Each base jurisdiction then refunds or collects the net fuel tax for all member jurisdictions.

You May Like: 1040paytax.com Official Site

Confirmation Of Received Edi File

EDI filers transmitting returns to the Comptrollers office receive a confirmation number once the transmission is complete. This is not confirmation that the return has been accepted – only that the EDI file was received.

The automated approval process is available from 4:00 a.m. to 11:00 p.m. , Monday through Friday.

During this time, EDI files will be reviewed and confirmation emails will be sent within an hour of submission. EDI files received outside of these hours will be reviewed during the next approval process window.

- Files with a Passed status have been accepted.

- Files with a Failed status must be resubmitted. Please correct errors noted in the email attachment. For help correcting the file, contact the Comptrollers Electronic Reporting Section at .

Who Has To File Ifta

IFTA is the International Fuel Tax Agreement between the 48 contiguous states of the US and the 10 Canadian provinces. Anyone who wishes to maintain their IFTA license must file with their base jurisdiction on a quarterly basis to accurately report the total miles driven and fuel purchased in each state or province.

You May Like: How Much Time To File Taxes

How Do I Obtain A Ifta Return For Minnesota

All licensees in Minnesota can complete and generate an IFTA quarterly return at ExpressIFTA. You can also use the IFTA return provided by Minnesota or file electronically with Minnesota at dps.mn.gov/divisions/dvs/pages/dvs-content-detail.aspx?pageID=578 if you are comfortable doing IFTA calculations on your own.

What If An Intrastate Fleet Is Suddenly Required To Operate Out Of State

For one-time trips between two or more jurisdictions, fleets can use temporary trip permits. These are only valid for one vehicle on a specific journey into another jurisdiction.

To acquire a single-trip permit, the carrier must define the time period and total distance to be covered. This information will be used to calculate the fuel tax to be paid along with other applicable fees.

You May Like: How To Get Tax Preparer License

Do I Need To Register For Ifta In Minnesota

The state of Minnesota considers an IFTA qualified motor vehicle as one that is designed, used, or maintained for the transportation of persons or property that have:

- Two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms or

- Having three or more axles regardless of weight or used in combination, when the weight of such combination exceeds 26,000 pounds, or 11,797 kilograms gross vehicle or registered gross vehicle weight.

The state of Minnesota does not include recreational vehicles in the IFTA tax unless they are used in conjunction with any business endeavor. Recreational vehicles include motor homes, pickup trucks with attached campers and buses when used exclusively for personal pleasure by an individual.

Ifta Licence And Decals

To receive your IFTA licence and decals:

- complete the IFTA application, and

- pay the required decal fee of $10 per set.

Read Also: How To Correct State Tax Return

Information Provided To Other Jurisdictions And Ifta Inc Clearinghouse

Please be aware:

- the information provided to Ontario, as required under IFTA, will be provided to other member jurisdictions and to the International Fuel Tax Association, Inc. Clearinghouse for the purposes of the IFTA program

- the information Ontario provides to other member jurisdictions and IFTA, Inc. may be subject to further mandatory disclosure under the federal, state and provincial laws in that jurisdiction and that the licensee may not be informed of this further disclosure

- the information includes, but is not necessarily limited to, name, addresses, phone number, account number, financial data, and fuel/trip data.

Revoke An Ifta Account

The Minister of Finance may revoke your IFTA licence if you fail to:

- file complete IFTA tax returns on time

- pay taxes in full, or

- follow the ministrys record-keeping requirements.

In the absence of a valid IFTA license, qualified vehicles must obtain separate single trip permits prior to any interjurisdictional travel.

Don’t Miss: How Can I Make Payments For My Taxes

How Do I Register To File Online

If you are a business owner, select the User ID link and follow the instructions to sign up as a Registered User.

Note: You must have your account number and Express Login Code before you sign up as a Registered User. Once you are registered, you will receive three separate e-mails that identify your default password, User ID, and account permissions.

Everything You Need To Know About Ifta

Youve heard about IFTA, but the details are complicated.

Well go over:

- Who needs to file IFTA fuel tax

- How to do IFTA, i.e., how to calculate IFTA fuel tax reports

- How to simplify IFTA calculation with fleet management software

To stay in business and on the right side of the law, a fleet must adhere to a number of rules and regulations that govern the roads.

Compliance is a responsibility most carriers pass on to their fleet managers. This includes licensing, USDOT numbering, adherence to hours-of-service rules, material regulations, and the International Fuel Tax Agreement.

While fleet managers ensure the company follows compliance rules, awareness of the regulations can help drivers and carriers make better-informed decisions to benefit their fleet.

One such regulation is IFTA.

Don’t Miss: Where Is My Federal Tax Refund Ga

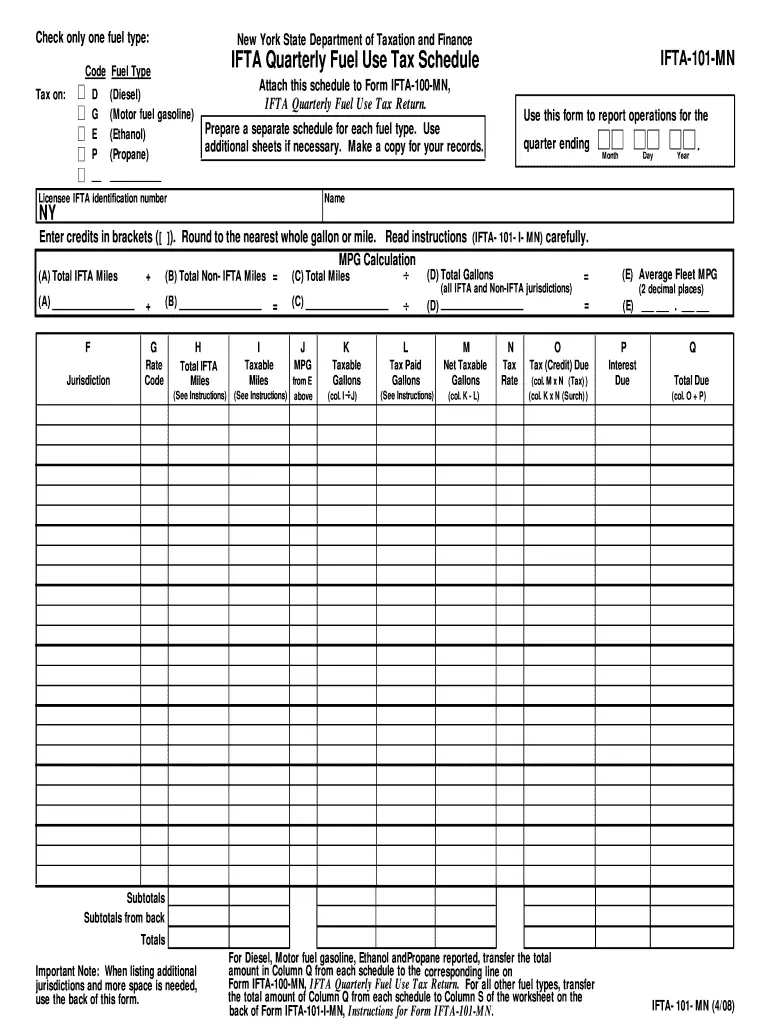

Filing A Quarterly Ifta Tax Return

As an IFTA licensee, you report your fuel purchases and jurisdictional travel within one month after the end of every quarter. The Ministry of Finance will mail an IFTA tax return to you at least 30 days before each due date.

On your IFTA tax return, you will report how much tax-paid fuel you purchased and the distance travelled in each jurisdiction. You will balance overpayments in one jurisdiction against amounts owed in other jurisdictions. If the net result is an underpayment, you will send one payment to Ontario. If the net result is an overpayment, you will receive one refund from Ontario.

The IFTA Tax Rate Matrix is the official source for all IFTA fuel tax rates.

To view the IFTA Tax Rate Matrix, please visit the International Fuel Tax Association’s website.

Generate Your Ifta Report

Our system automatically calculates the MPG for your vehicle. Before generating your IFTA fuel tax report, you can select the appropriate MPG range for your vehicle and ExpressIFTA will catch if the data you entered falls out of that range at any time throughout the quarter to find any data entry errors that need to be corrected.

Once any errors are corrected, ExpressIFTA will calculate any penalties, interest, or credits/refunds, based on your Base Jurisdiction’s instructions. You always have the ability to come back and run IFTA tax and IRP Reports on any specific quarter for business-related records and auditing purposes.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

What Is The Penalty And Interest Rate For Filing A Late Quarterly Fuel Tax Report

Neglecting or skipping to pay or remit the tax due on time will owe you a penalty up to $50 or 10% of the total tax due to all member jurisdictions. Not only penalty but also an interest will be drawn for late filing or any underpayment tax due. The interest will be calculated at a rate of .4167% per month. You must pay late filing penalty even if your net tax liability is zero or a credit.

What Do I Need To File My Ifta Quarterly Tax Return

To file an IFTA quarterly tax return you will need:

- The total miles, taxable and nontaxable, traveled by the IFTA licensees qualified motor vehicle in all jurisdictions/states, regardless if they participate in IFTA, which includes all trip permit miles

- The total gallons or liters of fuel that is consumed by a qualifying motor vehicle, including taxable and nontaxable, in all jurisdictions/state whether they participate in IFTA or not

- The total miles and total taxable miles traveled in each member jurisdiction

- The total taxable gallons consumed in each member jurisdiction

- The tax-paid gallons/liters that are purchased in each member jurisdiction and

- The current tax rates for each member jurisdiction.

Also Check: Where Is My State Tax Refund Ga

Due Dates And Payments

Electronic filers must comply with established report due dates. Payment may be included with EDI returns. Use Webfile for payment-only options – EDI does not support payment only.

- EDI returns with payment need to submitted with Passed status before 2:30 p.m. on the last banking day before the due date to be considered timely.

- EDI returns without payment must be transmitted with Passed status by 11:59 p.m. on the due date to be considered timely.

Transporting Goods For Someone Else

When you transport goods for someone else, a contract may hold the carrier and not the vehicle owner responsible for interjurisdictional reporting and payment of fuel taxes. The contract needs to identify:

- the start and end dates of the agreement

- who is responsible, the carrier or the vehicle owner, for reporting and paying the motor fuel tax.

The responsible party identified in the contract should obtain the IFTA licence.

Also Check: How Can I Make Payments For My Taxes

Keep Your Tax Rate Files Up

To ensure that your balances and billings are computed correctly, the Sales Tax EDI software will prompt you to automatically import the newest tax rates each quarter.

You can also manually import the tax rate tables by downloading the

You can use the Sales Tax Rate Locator to verify the taxing jurisdiction for your outlet or list return. Enter the address and we’ll tell you which taxing jurisdiction apply.

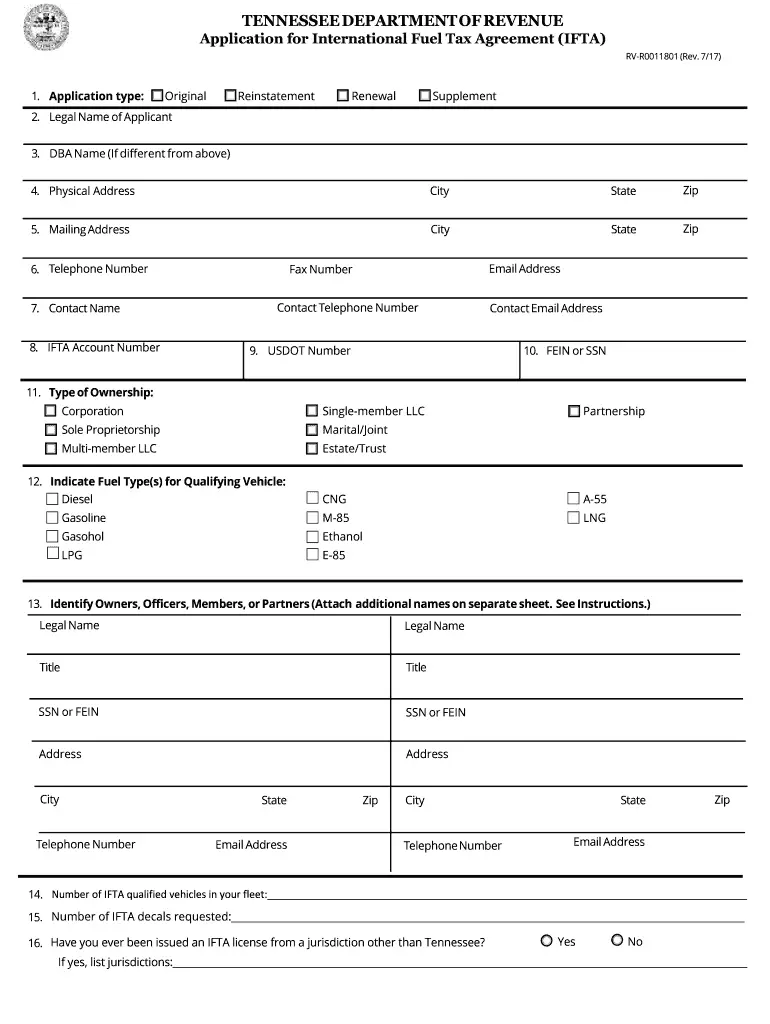

Applying For An Ifta License And Decals

If you need an IFTA license, the first step is to fill out the application form used in your base state.

IFTA application forms may vary and can sometimes serve other purposes. Carriers based in Ohio, for example, can use the IFTA application form to request additional decals or make changes to their account.

Some of the basic carrier information required for new IFTA applications are:

- Registered business name

- Federal business number

- USDOT number

If downloaded online, completed IFTA forms can be sent by mail. Other jurisdictions also allow IFTA forms to be sent by fax or through taxpayer service offices.

Once your application has been processed, the IFTA authority in your state will issue official IFTA decals for the current year. A temporary IFTA license can be sent to you by fax while you wait for your decals.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Hydrogen & Electricity Added As Fuel Types

IFTA, Inc. has announced the addition of hydrogen & electricity as fuel types to the IFTA tax rates matrices . Although its in the early stages and many jurisdictions dont have a tax rate established for these fuel types, carriers who do utilize hydrogen or electricity in the power units must report the purchases of these fuels on their IFTA returns using gallon equivalents.

International Fuel Tax Agreement

What is the International Fuel Tax Agreement?

The International Fuel Tax Agreement is a tax collection agreement by and among the 48 contiguous states and Canadian provinces bordering the United States to simplify the reporting and collecting of motor fuel taxes used by commercial carriers operating in more than one jurisdiction. People who operate qualified motor vehicles are subject to IFTA licensing.

Opening and Renewing an IFTA Account

Online

- You can open a new ITFA account, renew your account, and gain access as a third party using the Tennessee Taxpayer Access Point . Use this checklist to gather the information you will need to create a TNTAP logon and password.

- Step-by-step instructions for creating a TNTAP Logon.

Forms

- To open a new IFTA account, complete an IFTA Application, and mark it as a new account.

- To renew an IFTA account, you will need to complete the IFTA Application, and mark it as a renewal.

- If a third party will be completing the application, the IFTA Power of Attorney will have to be completed.

Filing Quarterly IFTA Tax Returns

Online

- You can file a quarterly IFTA return using the Tennessee Taxpayer Access Point . Use this checklist to gather the information you will need to create a TNTAP logon and password.

- Step-by-step instructions for creating a TNTAP Logon.

Forms

To file quarterly IFTA returns, you will need to submit the IFTA Tax Return. The instructions are attached to the form, or can be found separately here.

Temporary Fuel Use Permits

Also Check: What Does Locality Mean On Taxes

Using Elds And Fleet Management Software For Ifta Calculation

Traditionally, drivers and fleet managers had to manually track their vehicle miles and fuel purchases when filing quarterly IFTA taxes. Everything, from fuel purchase receipts to a list of miles driven in each jurisdiction, must be accounted for.

Drivers can use the tax reporting worksheet from the Owner-Operator Independent Drivers Association to keep track of their fuel purchases, miles driven, jurisdictions, and routes traveled.

Alternatively, they can turn to cloud-based reporting tools and fleet management software with IFTA reporting features.

We offer an IFTA reporting feature that allows you to automatically monitor and sorts your vehicles fuel purchases, utilization, and costs for each jurisdiction.

There are two ways to import fuel purchase data.

The first method is to upload a CSV file from your fleets fuel card vendor via the KeepTruckin web dashboard. Secondly, drivers can manually submit their fuel purchases as well as upload photos of fuel receipts from the KeepTruckin App.

For more information, read: How to prepare IFTA reports in just a few clicks.

We recently updated our IFTA feature which now makes it easier for drivers to upload fuel purchases at the point of purchase directly to the KeepTruckin dashboard. This allows you to make bulk imports from major fuel cards. In other words, you can import all of your receipts at once.

Try the KeepTruckin ELD solution by clicking the following image and see how KeepTruckin simplifies IFTA reporting.