What Is A Single

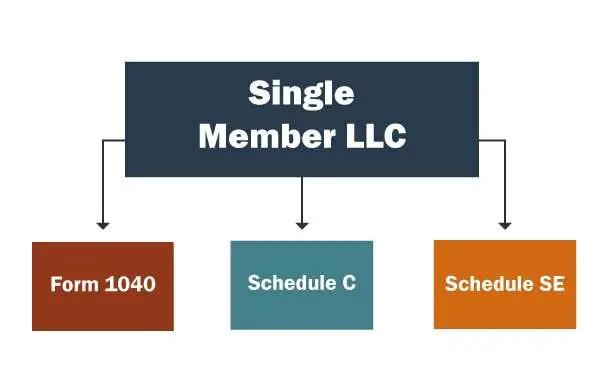

A single-member LLC is a business with only one owner that is not taxed separately from their business. Like a sole proprietorship, a single-member LLC is taxed as a disregarded entity by default.

Because the government ignores disregarded entities, they undergo “pass-through taxation.” This means all profits or losses from the business pass through the business directly to you, the business owner. You, in turn, are responsible for paying income and employment taxes on your earnings via your personal tax return.

For more information about paying yourself as a single-member LLC, visit our guide.

C Corp and S Corp Taxation

Single-member LLCs can choose two other ways of paying income tax: C corporation or S corporation.

C corporation taxation means that the LLC pays taxes on gross income, then distributes the profit to the owner. The owner then pays income tax on the dividends, which is also known as “double taxation.”

S corporation taxation means that the LLC owner can enjoy limited liability status while avoiding double taxation. The owner can be considered an employee of the LLC, meaning they only have to pay tax on the salary they set for themselves and not on the remaining profits.

What Is A Us Person

A U.S. Person is any of the following:

- Trust that meets certain requirements

- and any other person that is not a Foreign Person

Resident Alien vs Non-Resident Alien: For more information on the difference between a Resident Alien and a Non-Resident Alien, please see this IRS page: determining alien tax status.

Joint Ownership Of Llc By Spouse In Community Property States

Rev. Proc. 2002-69 addressed the issue of classification for an entity that is solely owned by husband and wife as community property under laws of a state, a foreign country or possession of the United States.

If there is a qualified entity owned by a husband and wife as community property owners, and they treat the entity as a:

- Disregarded entity for federal tax purposes, the Internal Revenue Service will accept the position that the entity is disregarded for federal tax purposes.

- Partnership for federal tax purposes, the Internal Revenue Service will accept the position that the entity is partnership for federal tax purposes.

A change in the reporting position will be treated for federal tax purposes as a conversion of the entity.

A business entity is a qualified entity if

Note: If an LLC is owned by husband and wife in a non-community property state, the LLC should file as a partnership. LLCs owned by a husband and wife are not eligible to be “qualified joint ventures” because they are state law entities. For more information see Election for Husband and Wife Unincorporated Businesses.

Read Also: How Do I Get My Pin For My Taxes

Benefits Of Good Accounting

- Cuts your tax bill by thousands every year.

- Prevents trouble with the IRS and state governments.

- It provides insight into where your money is going and how to spend it.

- Saves time and frustration

For more on the importance of small business bookkeeping and accounting, visit our guide.

Recommended: QuickBooks has all the accounting features your small business will need.

Llc Filing As A Corporation Or Partnership

A Limited Liability Company is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owners tax return . A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form 8832 and elects to be treated as a corporation. However, for purposes of employment tax and certain excise taxes, an LLC with only one member is still considered a separate entity.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

How To File Llc Taxes

If your business is organized as an LLC, it may be taxed as a sole proprietorship, a partnership, or a corporation, and you may be responsible for self-employment taxes in addition to federal and state income tax.

From a tax standpoint, limited liability companies are like hermit crabs. With no tax classification of their own, they inhabit the tax homes of other types of businesses, and they can choose and change the way they are taxed.

This tax flexibility is one of the things that make LLCs so appealing for small business owners. But if youre just starting out, the LLC tax filing process can seem confusing.

LLCs can choose to be taxed like sole proprietorships, partnerships or corporations. Its important to understand the differences between them because the way your business is taxed can affect both your total tax bill and your obligation to pay self-employment tax.

How Bench Can Help

When you change business structures, it means all new bookkeeping requirements. With Bench, your expert bookkeeping team makes sure you never miss a step. Weâll walk you through what a change in structure means for your business to keep your books up to IRS standards. Add in our tax filing solution, and youâre completely covered for tax season. Learn more.

Also Check: File Missouri State Taxes Free

How To Form A Single

To form a single-member LLC, you must file articles of organization with the state where you want to do business and pay a filing fee. After filing this state business registration, you should consider also preparing an operating agreement to spell out how you will run this business.

You will also need to get an employer ID number for your new business, even if you don’t have any employees. In some states, you may need an EIN before you file your organization papers. You can apply online for the EIN, which is used for federal income tax and employment tax purposes.

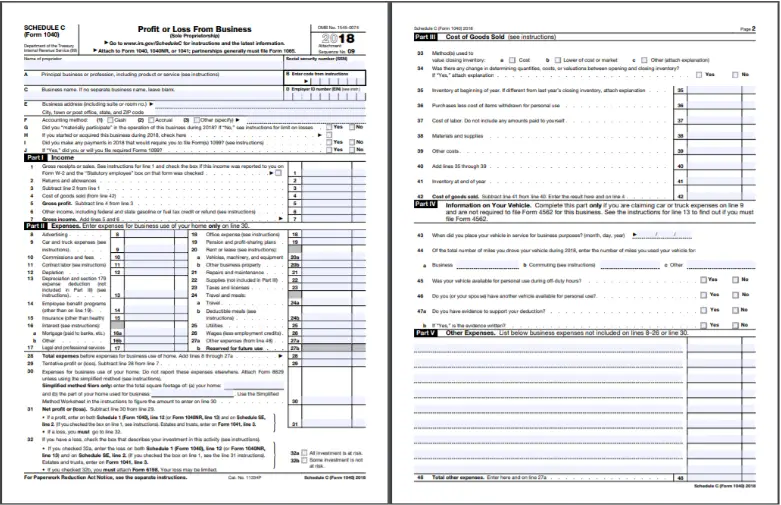

Most single-member LLCs calculate their business income taxes on Schedule C of their personal tax returns, In this case, you must use your personal tax ID when completing a W-9 form when you work as an independent contractor.

The Pros And Cons Of A Single Member Llc

Hereâs a short summary of the single member LLC business structure vs. sole proprietorships.

| Pros | Cons |

|---|---|

| Liability protectionâan LLC is a separate legal entity | Have to file lots of paperwork to form one |

| Ability to bring on new members | Must submit compliance forms to prove youâre following the rules and stay in good standing |

| Flexible federal income tax filing | Must maintain corporate veilâpiercing it puts your assets at risk |

| Can pass on ownership to others, eg. family members |

Recommended Reading: How To Look Up Employer Tax Id Number

Salary Or Draw: How To Pay Yourself As A Business Owner Or Llc

The most compelling aspect of running your business is that you get to pay yourself as a business owner. Unlike a corporate business structure, you are not dependent on others to either run the show or pay you for your efforts.

This means that you have the flexibility to decide how much you earn as a business owner, how much effort you put in, and thus earn the rewards of the efforts made.

There are many advantages to running your own business. Still, the major contention you face is how to pay yourself as a business owner?

The way you pay yourself as a business owner depends upon the type of business structure you choose. You receive a draw if you are a sole proprietor. Likewise, you distribute profits or losses based on the percentage mentioned in your partnership agreement if you run a partnership firm.

Similarly, single-member LLCs are like sole proprietors and draw funds from businesses. However, multi-member LLC is treated like a partnership firm where profits and losses are distributed among members.

In this article, we will discuss how to pay yourself as a business owner, that is, pay yourself from a sole proprietorship, partnership, and Limited Liability Company .

Single Member Llc Vs Multiple Member Llc

Although the primary difference between a Single-member LLC and a Multi-member LLC may be obvious , these variations of the Limited Liability Company business structure have other nuances to consider. They share many characteristics, but theres more than just the difference in the number of owners to ponder when deciding whether one or the other might be a good fit for your business.

Choosing between a Single-member LLC vs. a Multi-member LLC or other business entity type involves thinking about:

- Ownership

- Formation

- Compliance

Because the entity type affects so many critical aspects of starting and running a business, its essential to research the pros and cons of each and ask for advice and direction from an attorney and an accountant or tax advisor.

Read Also: How Do I Get My Pin For My Taxes

How Do You Pay Yourself With A Single

A single-member LLC owner doesn’t take a salary or wages from their business you can take money out of the business at any time. These payments are called a “draw,” because you are drawing money from your ownership in the business. It’s important to remember that you get paid last, after all other business bills are paid.

You don’t pay income tax on the amount you draw out of your owner’s account every year. The business pays taxes on its net income each year, calculated on Schedule C of your personal tax return.

In addition to paying income tax on net income, you must pay self-employment tax for Social Security and Medicare taxes on the business’s net income every year.

How Will My Llc Get Taxed

The flexibility of the LLC structure means there are four separate tax scenarios that your LLC could fall under:

If itâs a single-member LLC and hasnât opted to file as a corporation, it will file its taxes exactly as a sole proprietor would.

If itâs a multi-member LLC and hasnât opted to file as a corporation, it will file its taxes exactly like a partnership.

If it has opted to file its taxes as a C corporation by submitting IRS Form 8832, then it will file its taxes like a C corporation.

If it has opted to file its taxes as an S corporation by submitting IRS Form 2553, then it will file its taxes like an S corporation.

You May Like: How Much Does H& r Block Charge To Do Taxes

Filing Taxes As A Multi

The LLC files Form 1065 to report the business income or loss to the IRS, then gives each member of the LLC a Schedule K-1, which is used to report their share of the LLCâs income and deductions on their personal tax returns.

LLCs are âpass-throughâ entities, meaning their profits and losses pass through directly to their owners. Owners of multi-member LLCs report their businessâs profits and losses on Schedule E, and report self-employment taxes using Schedule SE.

To file Form 1065, youâll need all of your LLCâs important year-end financial statements, including a profit and loss statement that shows net income and revenues, a list of all the partnershipâs deductible expenses, and a balance sheet for the beginning and end of the year.

Schedule K-1 is generated along with Form 1065, which identifies each partnerâs allocated profits and losses over the course of the reporting period. Each partnerâs Schedule K-1 becomes part of their personal tax return.

How Llc’s Pay State Income Tax

Each state has a different way of classifying LLC’s for state income tax purposes. After you have figured out your LLCs tax status, you can go to your state’s department of revenue to find out how your state might be taxed.

You will need to look at two factors:

- What is the tax based on? Most states use the federal income tax liability as a basis, but states modify that basis for their state tax.

- How does the LLCs tax classification affect the state income tax?

Some states call their income tax a franchise tax. Other states may charge LLCs a gross receipts tax rather than an income tax.

This article is a general overview not tax or legal advice. LLC taxes are complicated, and every business situation is different. If you are thinking about forming an LLC or you want to change its tax status, talk to your tax professional first.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Overview Of Steps For Single

The requirements for foreign-owned Single-Member Disregarded LLCs are:

1. Get an Employer Identification Number .

2. File Form 5472 and Form 1120. On Form 1120, you only need to complete the LLC name, address , Employer Identification Number , and check any applicable boxes . For example, check the Initial return box if this is your first year filing.

3. Maintain financial records that prove the information on Form 5472.

4. Depending on multiple factors , you may need to file a 1040NR and get an ITIN .

Having said that, depending on those same factors, you may not have US source income and you may not have to file a 1040NR or get an ITIN. Youll need to speak with an accountant to determine your tax filing obligations in the US. We recommend sending an email to Gary at GW Carter.

An Smllc Is Not A Sole Proprietorship

Even if you elect to pay taxes like a sole proprietorship , a single member LLC is not a sole proprietorship. Unlike a sole proprietorship, an SMLLC can:

- Elect how it files taxes

- Bring on additional members

- Protect membersâ assets from liability

That being said, an LLC structure may not be the best type of business entity for you itâs important to consider the pros and cons.

Don’t Miss: Mcl 206.707

Other Irs Tax Forms For Foreigners

Important: This article doesnt list all requirements foreign owners of U.S. LLCs have with the IRS.

You will need to speak with an accountant who specializes in working with foreigners who formed a U.S. LLC and are doing business in the U.S.

Some things to research and speak to your accountant are:

- US Nonresident Alien Income Tax Return

- Sales tax and/or excise tax

- Conduct of a U.S. trade or business

- Effectively Connected Income

- and more

There Is No Limited Liability For Sole Proprietors

There are a lot of benefits that come with running your business as a sole proprietor, but one big drawback is that sole proprietorships dont provide owners with limited liability.

What does this mean? Well, as a sole proprietor, youre personally liable for all debts and other liabilities incurred by your business. A business creditor can go after all of your assets, including your personal assets, when you owe them money. This means that your personal bank accounts, car, and even your house could be at risk.

On top of that, sole proprietors are personally liable for business-related lawsuits. For example, if someone injures themselves in your office. Youd be personally sued for damages. Yikes!

But, wait, there is some good news here. If you still want to operate as a sole proprietor, you can give yourself some extra protection from these liabilities by investing in the appropriate business insurance.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

Benefits And Disadvantages Of A Single

- As an LLC, the business shares the benefits of limited liability of a corporation and potential tax benefits as a disregarded entity.

- Each state has its own regulations that determine the eligibility of a single-member LLC.

- A single-member LLC provides the owner with more control of the business.

- A downside for a single-member owner can be the informality of the LLC that may hinder an owner from establishing credit.

- Single-member LLC owners can opt to be taxed as a corporation or a sole proprietorship.

- One of the main benefits of an LLC versus a sole proprietorship is an LLC provides limited liability. This means an SMLLC owner is not typically liable for business debts. Limited liability also protects the owner’s personal funds if the business goes bankrupt or is unable to pay its debts.

- Some states do not allow single-member LLCs.

- LLC’s have the benefit of “pass-through” taxation.

- With pass-through taxation, profits are “passed” to the members who are then responsible for reporting the income on personal tax returns.

- A single-member LLC owner is the same as a sole proprietor in that the owners of both are in complete control of the daily operation of the business. The member also makes all decisions without input from other members and the owner receives all the LLC’s profits.

- An LLC requires much more paperwork than a sole proprietorship along with interaction with the state and at the federal level.

Hire the top business lawyers and save up to 60% on legal fees

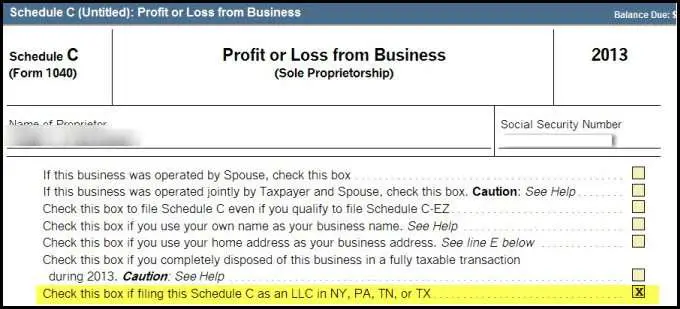

Tax Treatment Of Llcs And Llps

- The New York personal income tax and the corporate franchise tax conform to the federal income tax classification of LLCs and LLPs.

- An LLC or LLP that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York tax purposes.

- An LLC or LLP that is treated as a corporation, including an S corporation, for federal income tax purposes will be treated as a corporation for New York tax purposes or as a New York S corporation if the New York S election is made .

- A single-member LLC that is treated as a disregarded entity for federal income tax purposes will be treated as a disregarded entity for New York tax purposes.

- If the SMLLC is disregarded and the single member is an individual, the SMLLC will be treated as a sole proprietorship for New York tax purposes.

- If the SMLLC is disregarded and the single member is a corporation, including an S corporation, the SMLLC will be considered a division of the corporation for New York tax purposes.

- If the SMLLC is disregarded and the single member is a partnership, the SMLLC will be considered a division of the partnership.

- For information regarding the tax treatment of an LLC or LLP for purposes of the New York City Business Corporation Tax, New York City General Corporation Tax , and the New York City Unincorporated Business Tax , please visit the New York City Department of Finance Business webpage.

Read Also: How To Buy Tax Liens In California