Nc Military Retirement Tax

Taxing military retirement pay in North Carolina has a long history. The boiled-down version is this: For a long time, military retirees had to pay state income tax on their retirement benefits, as did federal government retirees. However, state and local employees, including teachers, did not. This policy was challenged in 1984 in a case that went all the way to the Supreme Court in 1989. The Supreme Court decided that military and federal government retirees could not be taxed differently than North Carolina state and local retirees.

North Carolina responded by deciding to tax state and local government retirees. All federal, state, local and military retirees had to pay state income tax on benefits of over $4,000 a year. The new policy was challenged and in 1998 the North Carolina Supreme Court ruled that the state could not tax retirement benefits for military, federal, state and local government employees if they were vested in their retirement system as of Aug. 12, 1989. Vested meant that you had to have at least five years of service before Aug.12, 1989. If you didnt, you had to pay state tax on benefits above $4,000. This is where things stand today.

South Carolina Is Tax

My colleagues on Kiplinger.com maintain the incredible Retiree Tax Map — a state-by-state guide to taxes on retirement income, state sales taxes, property tax breaks for seniors, estate taxes, and more. Read up on how North Carolina taxes retirees and how South Carolina taxes retirees.

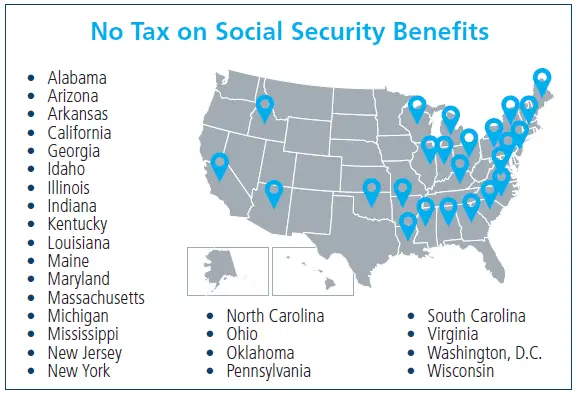

In North Carolina, your Social Security benefits are not taxable however, the state taxes most other retirement income at the flat rate of 5.25%.

Kiplinger ranks South Carolina as one of the most-friendly states for taxes on retirees. As in North Carolina, South Carolina does not tax Social Security benefits. The state also offers other generous exemptions on other types of retirement income. Theres no inheritance or estate tax, and property taxes are on the low side: For homeowners 65 and older, the state’s homestead exemption allows the first $50,000 of a property’s fair market value to be exempt from local property taxes.

There is a dark side concerning taxes in South Carolina: Sales taxes. Statewide, the rate is 6%. However, localities can add as much as 3%, potentially topping out at a 9% hit to your wallet, though the average combined rate is 7.46%, according to the Tax Foundation.

Does North Carolina Tax Federal Retirement Income

4.8/5North Carolinaretirement benefitsincome taxesretirement incomeNorth Carolinaincome taxtaxesretireesNorth Carolinataxes

Military Retirement:Military benefits are not taxed in the State of North Carolina if the retiree had five or more years of creditable service as of August 12,1989. If this does not apply to the retiree, up to $4,000 of the retirement pay can be excluded.

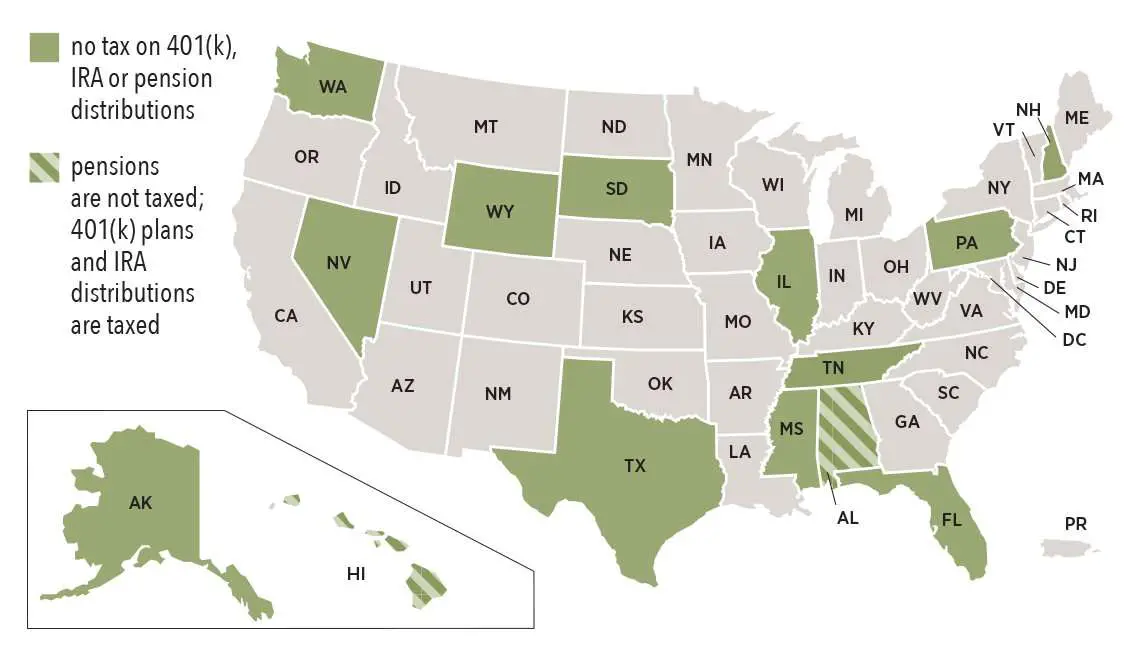

Likewise, which states do not tax pensions? States without pension or Social Security taxes include:

- Alabama.

- Pennsylvania.

Keeping this in view, what is the federal tax rate on retirement income?

If your provisional income is between $25,000 and $34,000 , then up to 50% of your benefits are taxable. If your provisional income is more than $34,000 , then up to 85% of your benefits are taxable.

Do I have to pay taxes on my pension in Michigan?

Under Michigan law, qualifying pension and retirement benefits include most payments that are reported on a 1099-R for federal purposes. Payments not reported in federal adjusted gross income are not taxable in Michigan and not subject to withholding.

Also Check: Do I Charge Sales Tax On Services

Overview Of South Carolina Retirement Tax Friendliness

South Carolina does not tax Social Security retirement benefits. It also provides a $15,000 taxable income deduction for seniors receiving any other type of retirement income. The state has some of the lowest property taxes in the country.

To find a financial advisor near you, try our free online matching tool.

| Annual Social Security Income |

| Annual Income from Private PensionDismiss | Annual Income from Public PensionDismiss |

| Your Tax Breakdown |

| is toward retirees. |

| Social Security income is taxed. |

| Withdrawals from retirement accounts are taxed. |

| Wages are taxed at normal rates, and your marginal state tax rate is %. |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

You Can Live Larger With Our Lower Taxes

South Carolina does not tax Social Security benefits and provides a generous retirement-income deduction when calculating state income tax. State income-tax rates are reasonable and property taxes are very low. Taxes are based on 4 percent to 6 percent of the market value of the home, and senior homeowners qualify for a homestead exemption. When you consider the total package of housing, taxes, utilities and daily living expenses, Myrtle Beach is one of the most affordable cities to live in, and property taxes in the area are among the lowest in America with city of Myrtle Beach residents receive an astounding 88 percent property tax credit.

You May Like: What Is The Date To Pay Taxes

Are Other Forms Of Retirement Income Taxable In South Carolina

Yes, but they are also largely deductible. For taxpayers under the age of 65 the deduction is $3,000. For seniors 65 and older the deduction is $15,000. This can be applied across all types of retirement income, including income from a 401, an IRA, a government pension or a public pension.

If you are a senior and your total income from all those sources is less than $15,000, you will not pay any South Carolina income taxes. Above that limit, you may need to pay taxes at the rates shown in the table below.

An Abundance Of Professional Sports

No matter which sport you love, North Carolina has it. Home to a combination of 21 professional and minor league teams, North Carolina has a football team, minor league baseball teams, basketball, and hockey teams. The state also has major league lacrosse games and all of that is before getting into college sports where there is a fierce following for several college teams.

Also Check: What To Do When Taxes Are Late

Reasons To Retire In North Carolina

North Carolina is making headlines as an up and coming place to retire, even earning some retirees moving there the nickname, halfbacks as retirees from Florida move halfway back home to the mid-Atlantic and mid-South states. Drawing people from all over the country with its beauty, stunning coastline, and southern hospitality, theres a lot to love about retiring in North Carolina.

Bailey Decision Concerning Federal State And Local Retirement Benefits

As a result of the North Carolina Supreme Court’s decision in Bailey v. State of North Carolina, North Carolina may not tax certain retirement benefits received by retirees of the State of North Carolina and its local governments or by the United States government retirees . The exclusion applies to retirement benefits received from certain defined benefit plans, such as the North Carolina Teachers’ and State Employees’ Retirement System, the North Carolina Local Governmental Employees’ Retirement System, the North Carolina Consolidated Judicial Retirement System, the Federal Employees’ Retirement System, or the United States Civil Service Retirement System, if the retiree had five or more years of creditable service as of August 12, 1989. The exclusion also applies to retirement benefits received from the state’s §401 and §457 plans if the retiree had contributed or contracted to contribute to the plan prior to August 12, 1989. The exclusion does not apply to retirement benefits paid to former teachers and state employees of other states and their political subdivisions.

You May Like: How To Buy Tax Forfeited Land

What Is The North Carolina Low

Homeowners who are at least 65 with a household income of no more than $31,500 can claim the North Carolina low-income homestead exclusion. The exclusion is subtracted from taxable value and is equal to either $25,000 or 50% of taxable value, whichever is greater. For eligible seniors, this can mean hundreds in property tax savings every year.

Senior homeowners whose income is no more than $47,250 may also qualify for a property tax deferral via the Circuit Breaker Tax Deferment Program. This does not reduce property taxes, but instead defers payment of taxes owed until a later time, typically when the home is sold.

Lead An Active Lifestyle In A Community That Cares

Over 60 miles of uninterrupted shoreline and 90 championship golf courses and over 600 fine arts events annually ensure there is plenty to do in your downtime. While we believe in making the most of playtime, the Myrtle Beach area is also a community that cares about our residents. In addition to being able to lead an active lifestyle, retirees will also find plenty of ways to give backall while meeting interesting people in the area! Religious organizations, arts groups, professional associations, community service groups and medical facilities are always in need of volunteers while they supply valuable support and assistance to the community we call home.

Jeanie Reeder vacationed along the Grand Strand growing up, but she and husband Tom traveled from their Lexington, Ky., home to Oak Island, N.C., with their children for getaways. Expecting to retire to the North Carolina coast, Jeanie and Tom looked for five years without finding the perfect spot.

When a girlfriend of Jeanies invited the couple to Barefoot Golf & Resort to see a lot she had just purchased, they visited and ended up buying a neighboring lot that very morning. Says Jeanie, “That was eight years ago, and from that day on we have not looked back. We absolutely love it here! Tom is an avid golfer, and I enjoy the beach. I go every day in the summer.”

Read Also: Do You Have To Claim Social Security On Taxes

Popular Destinations In The Carolinas Retirees Are Targeting

The short list is a long one. The Carolinas are actively recruiting retirees, and local governments are friendly to the developers of the numerous active adult over-55 communities that surround beach and mountain communities.

U.S. Census Bureau population estimates from April 2010 to July 2019 — note this is well before the pandemic — show:

- The region straddling the North Carolina-South Carolina border that includes Myrtle Beach, Conway, and North Myrtle Beach grew a whopping 32.6% last decade with the arrival of 122,581 new residents.

- Raleigh, N.C.s population grew by 16% with the arrival of 180,756 new residents.

- South Carolinas Hilton Head Island-Bluffton-Beaufort regions population grew 15.6%, with 29,093 new residents.

- Charleston-North Charleston, S.C., gained 101,288 new citizens in that time frame, a 15.2% growth rate.

Popular retirement communities in North Carolina include Pinehurst Trace in Pinehurst and The Gables at Kepley Farm in Salisbury. Popular retirement towns in North Carolina include Brevard and Asheville in the mountains, New Bern and Oak Island, as well as Southport, Carolina Beach and Chapel Hill.

Retirement communities also dot some of the top retirement destinations in South Carolina as well, including popular destination towns Georgetown, Spartanburg, West Columbia, Greenville and Hilton Head Island.

My Civil Service Retirement Income Is Exempt From Nc State Taxes But I Can’t Find Where To Input This Information On Turbo Tax

Be careful….many currently retiring NC-State/Federal/Military people find out they are not eligible for the NC-exemption of those pension $$. A service person retiring in 2015 found they would need more than ~30 years of military service before they could get that exemption.

As long as you had 5 years of service credited before 12 Aug of 1989…then you would qualify for the “Bailey Settlement” .

The procedure is the same in TurboTax every year, so print this out for next year and file it.

____________________________________________________

Go back and edit the 1099-R form in the Federal section.

After you enter your 1099-R form, and “Continue” thru the pages that follow it…until you find the selections for:

1) “Bailey settlement….”………………..< < < < you are selecting this one

2) “Faulkenbury settlement….”

4) “None of the above”

You need to select the “Bailey Settlement…”

Your NC Distribution amount is the same a box 2a of the 1099-R form ……. that $$ will be removed in the NC section depending on what selection you made above.

…..Far fewer retired Military/Fed/NCStateMunicipalTeacher employees can exempt their Pension $$ if they retired this year. BUT…IF you were into your NC-State or Federal/Military pension system, 5 years as of 12 Aug 1989, you can choose the “Bailey Settlement…” and all of that particular 1099-R will be exempted from NC taxation…otherwise you will likely choose “None of the above”

4) “None of the above”

Recommended Reading: How To File 2016 Taxes

Three New Tax Reasons To Retire To North Carolina

Currituck Beach Lighthouse, Corolla, NC

There are the Great Smoky Mountains, the Outer Banks and the Research Triangle, and now there are three new tax reasons for retirees to pick North Carolina, thanks to a major tax reform deal.

Heres how the plan will help retirees:

- The plan will lower income tax rates to a flat rate of 5.8% in 2014 and 5.75% in 2015. In the current three-tiered system, the top rate of 7.75% kicks in on earnings over $60,000 for a single and $100,000 for a couple, and the second tier 7% rate starts at with earnings of just $12,750 for a single and $21,250 for a couple. Further rate reductions could be triggered by revenue growth in 2016 and 2017.

- The plan will abolish the state estate tax retroactive to Jan. 1, 2013. Currently, North Carolina has a generous exemption of $5.25 million per person that matches the federal estate tax exemption. North Carolinas move will bring the tally of states where you have to worry about a separate state estate or inheritance tax down to 19 statesplus the District of Columbia. For a rundown including an updated interactive map on Where Not To Die In 2013, . Abolishing the state estate tax was one of Republican Governor Pat McCrorys campaign promises.

- The plan will continue to exempt Social Security income from state taxation. That was one point of contention during the months of wrangling over competing tax reform bills, with the AARP and other groups lobbying to keep Social Security payouts state income-tax free.

Details On North Carolina Retirement Taxes

When it does come to the tax side of things, if youre considering a move to North Carolina for retirement, its important to keep the following in mind:

- Social Security income in North Carolina is not taxed

- However, withdrawals from retirement accounts are fully taxed

- Additionally, pension incomes are fully taxed

You May Like: How To File Taxes With No Income

Penalties And Interest Rates

Q. What are the applicable interest and penalty rates for underpayments of Delaware Income Tax?

A. The interest and penalty rates for underpayment of Delaware Income Tax are as follows:

North Carolinas Retirement Tax Friendliness

Its true that North Carolina is not the most tax friendly state in the country. Florida offers more deducations, for example, and Delaware has no state or local sales tax. However, what NC lacks in tax options it more than makes up for with a cost of living lower than the national average. This means your dollar will stretch further, even amidst the charming cities and breathtaking beaches. That goes along way.

Don’t Miss: Did The Tax Deadline Get Extended

Is A New York State Pension Taxable In North Carolina

Because cold, long winters are a distinct possibility on the east coast, New Yorkers often dream of and migrate to warmer climates when they retire. Without a job to keep them where they are, some New Yorkers are enticed by warmer weather or small-town living, and move south to states such as North Carolina. However, retirees should consider tax laws before deciding where to move after retirement the North Carolina pension tax is different than the way pensions are taxed in New York.

Is Social Security Taxable In South Carolina

Any Social Security that is included in your Adjusted Gross Income for federal purposes can be subtracted out of your AGI on your South Carolina tax return. This, along with the low cost of living in South Carolina, means it is possible for some seniors in the Palmetto State to survive on Social Security retirement benefits alone.

Also Check: Is Past Year Tax Legit