Louisiania Sales Tax Due Dates

If you file and pay your Louisiana state sales tax returns quarterly, they will be due on the 20th of the month following the close of the reporting period, as outlined below.

| Period |

|---|

For instances in which a due date falls on a weekend or a holiday, returns and payments will be due on the next business day.

Sales Tax Nexus In Louisiana

Of course, you only need to collect sales tax in Louisiana if you have a significant presence, or nexus, there. This is true of most states, although the precise definition of a nexus can vary from one state to another. In Louisiana, you are considered to have a nexus if you:

- Sell, rent, or lease tangible personal property in the state

- Provide taxable services within the state

- Store property in the state for resale, lease, or rental

- Have a physical office or store in the state

- Employ a full- or part-time salesman or agent who operates in the state

- Deliver goods to customers in the state using your personal vehicle

In many states, using Amazon fulfillment services to deliver your goods creates a nexus for you if your product is stored in a warehouse in that state, but Louisiana does not currently have any Amazon fulfillment centers.

If you do have a nexus, the rate at which you will collect from your customers depends on the destination location of the product. If you have a physical store, you will charge the rate applicable at that location. If youre shipping product to customers in Louisiana, however, you will have to collect at the rate in effect at the delivery address.

What Goods And Services Are Considered Taxable In Louisiana

The following items are all taxable in the state of Louisiana:

- Sales of tangible goods at retail.

- Repairs or alterations of tangible personal property.

- Property rentals, leases, or licenses

- Selling service warranty contracts.

- Short-term rentals for living accommodations .

- Charges for admission to any place of amusement, sport, or recreation.

- Manufacturing or producing goods for retail sales.

- Operating vending machines or amusement rides.

- Services are mostly exempted

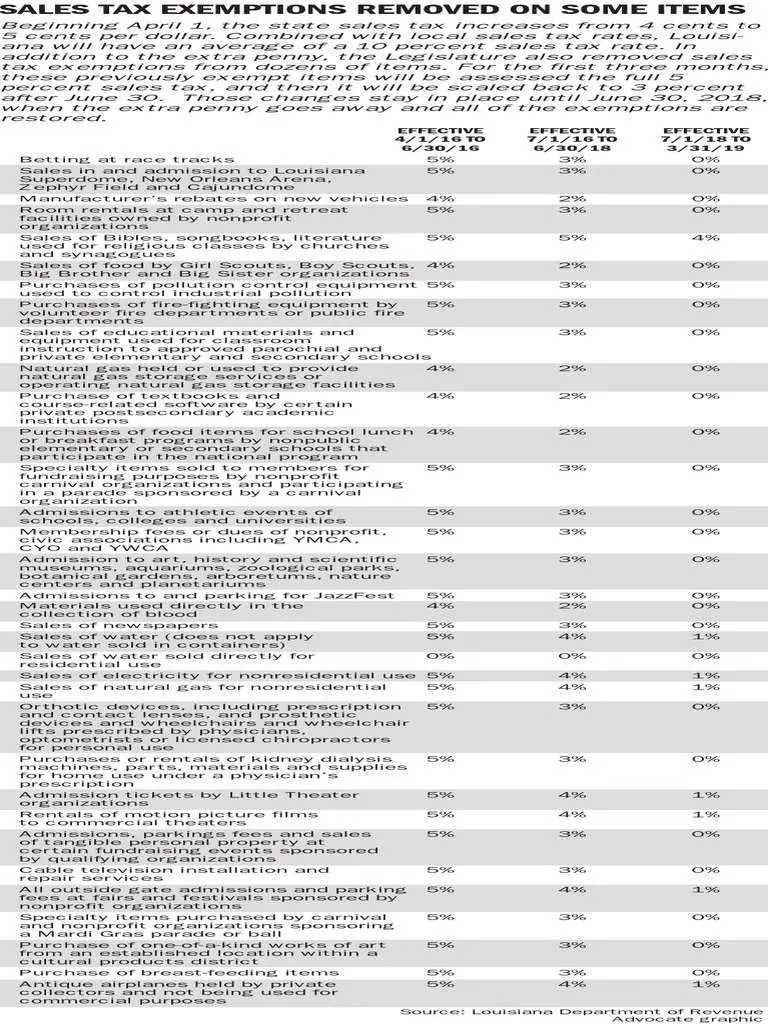

The complexity of which items are taxable and at what rate is too much for us to lay out in this article. The Louisiana DOR provides this document which has tables full of specific details.

Your business must pay taxes on sales of any non-exempt goods, and some taxable services.

*****

Lets now review some of our clients frequently asked questions:

- Is Louisiana an Origin or Destination sales tax state?

- What creates a sales tax nexus in Louisiana?

- What is the economic threshold in Louisiana?

- Does Amazon have fulfillment centers in Louisiana?

- Does Louisiana have a ?

To best understand your tax obligations, new businesses need to consider how they are doing business and the type of relationships they have with buyers and any third parties to their transactions .

Lets discuss some questions that will help you understand the nature of your small business and the subsequent tax implications.

Read Also: Doordash How To File Taxes

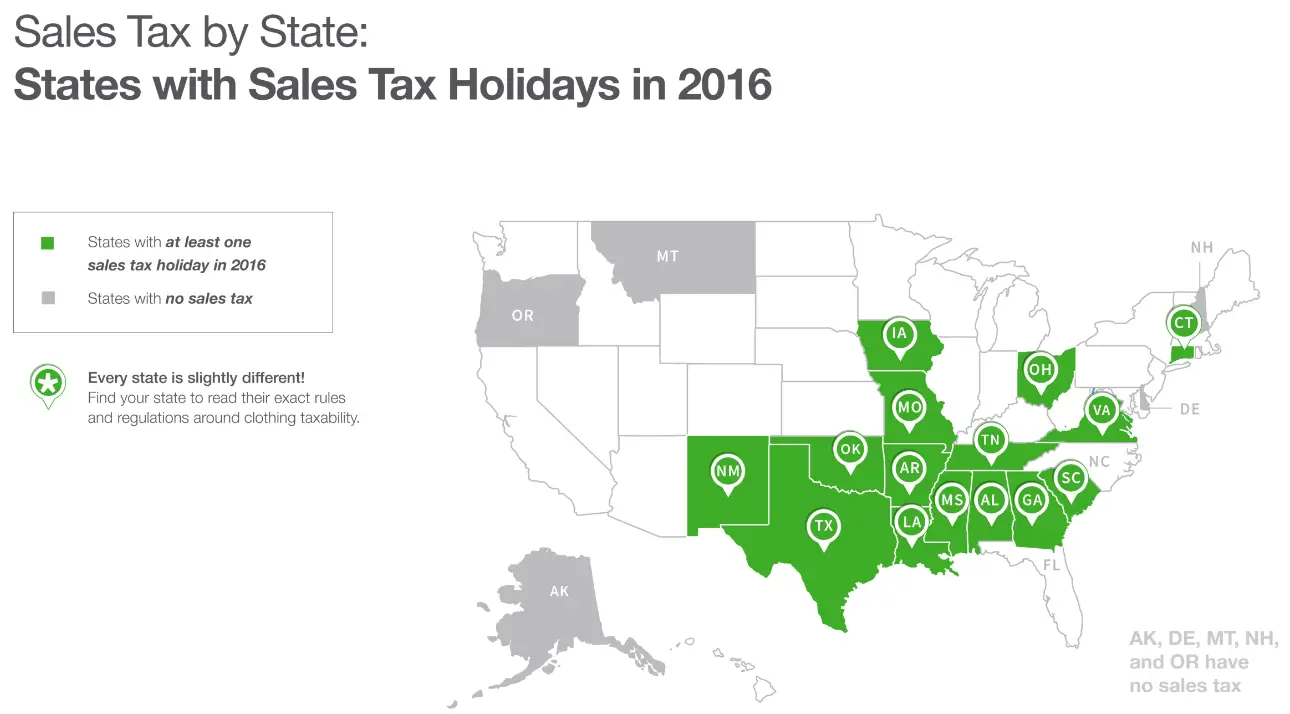

Does Louisiana Have A Sales Tax Holiday

Yes, several in fact, and they were just restored after having been yanked away:

- Back-to-school tax holiday: August 7-8

- Disaster preparedness tax holiday: May 30-31

- 2nd Amendment tax holiday: September 4-6

*****

We have now covered who you need to collect sales taxes from, how to determine whether goods for sale are deemed taxable, what goods and services fall under tax exemptions, who is eligible for tax exemption certificates, and, finally, the process of collecting sales tax in Louisiana state.

Now that were this far down the rabbit hole theres only one thing we need to learn about next how to pay the piper!

Who Are Eligible For Louisiana Sales Tax Exemptions

At this point, you should know what products are exempt from sales tax in Louisiana. You also want to know who may be exempt.

Under Louisiana law, the type of buyer or the way the goods will be used can qualify can buyer for a sales tax exemption. A good example of this is a merchant purchasing goods for resale, aka a wholesaler.

Other common examples of an exempt buyer may include:

- Government agencies

- Religious groups

- Out-of-state buyers .

Note that a non-profit or contractor status doesnt necessarily immediately confer tax exempt status. Louisiana keeps a list of tax-exempt organizations .

Read Also: How To File Doordash Taxes

Louisiana State Rate For 2022

4% is the smallest possible tax rate 4.45%, 7.45%, 7.7%, 7.8%, 7.95%, 8%, 8.075%, 8.2%, 8.45%, 8.6%, 8.7%, 8.8%, 8.9%, 8.95%, 9%, 9.05%, 9.075%, 9.15%, 9.2%, 9.28%, 9.4%, 9.45%, 9.575%, 9.6%, 9.7%, 9.8%, 9.85%, 9.943%, 9.95%, 10%, 10.116%, 10.2%, 10.44%, 10.45%, 10.95%, 11.2% are all the other possible sales tax rates of Louisiana cities.11.45% is the highest possible tax rate

The average combined rate of every zip code in Louisiana is 8.964%

What Happens If I Dont Collect Sales Tax

If you were required to collect sales taxes and failed to do so for whatever reason, thats a big no-no! The business may be held liable for the due tax, although Louisiana is one of the few states that may also potentially go after the consumer for the tax. Which can certainly create a bad impression with the customer!

Always be sure to collect sales tax at the point of sale. Attempting to collect after the fact will be time consuming and most likely unsuccessful.

Protip: You may still be responsible for remitting sales taxes even if you failed to collect them.

Read Also: How Do Doordash Taxes Work

Analysis Shows Louisiana Has Highest Combined Sales Tax In Us

BATON ROUGE Louisiana has the highest combined sales tax rate in the country, according to a new midyear analysis by a national tax policy nonprofit.

The Tax Foundation, a Washington, D.C.-based conservative think tank, analyzed state and local sales tax rates from January through June and found the Pelican States 9.55% combined rate was tops in the nation.

Close competitors included Tennessee , Arkansas , Washington and Alabama .

Rate increases in Evangeline, St. Mary, Tangipahoa, West Feliciana and other assorted small parishes attributed to the uptick.

While state sales tax rates are readily available, local rates involve cities, counties, parishes and municipalities. Researchers compensated for these variables by averaging differing local government rates and weighing them by population.

The result was a 5.1% average local sales tax rate in Louisiana, that when added to the states 4.45% rate, leaves several million residents facing cost increases on many goods and services.

Tangible personal property items such as business equipment, furniture and automobiles are among the highest-taxed goods. A $25,000 car, for example, would cost an extra $2,387.

Groceries, prescription medicine and utilities such as electricity, natural gas and water are exempt from sales tax, according to the Louisiana Department of Revenue.

There are risks involved with exceedingly high rates, the Tax Foundation said.

What Happens If I Lose A Louisiana Sales Tax Exemption Certificate

Hmm… Obviously this issue is best to be avoided! Imagine finding out youll be audited and discovering you cannot produce an exemption certificate for a buyer! That nightmare scenario would mean you could be held liable to pay all taxes on behalf of the buyer. This is a bad scene and can be avoided by taking proper care with your paperwork which happens to be one of our specialties! 🙂

Also Check: Do You Pay Taxes On Doordash

Louisiana Sales Tax Calculator

You can use our Louisiana Sales Tax Calculator to look up sales tax rates in Louisiana by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Louisiana has a 4.45% statewide sales tax rate,but also has 180 local tax jurisdictions that collect an average local sales tax of 4.708% on top of the state tax. This means that, depending on your location within Louisiana, the total tax you pay can be significantly higher than the 4.45% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Louisiana:

Where To Get Sales Tax In Monroe La

A: The sales/use tax forms can be mailed to you upon request by calling 318-329-2220, select option #2 Tax & Revenue, then option #2 Sales Tax or can be picked up from the Tax & Revenue Division office located at the City Hall Annex Building, 316 Breard Street, Monroe, LA 71201 or can be downloaded by clicking here.

Recommended Reading: How Do Taxes For Doordash Work

Louisiana Capital Gains Tax

Both long- and short-term capital gains are taxed as regular income in Louisiana, meaning they’re subject to the rates listed above. Remember, they are between 2% and 6%, depending on your taxable income. One exception to that is gains resulting from the sale of a non-publicly traded business or interest in such a business, including corporations, partnerships and limited liability companies.

Business Guide To Sales Tax In Louisiana

Website:

So, you need to know about sales tax in The Pelican State. Look no further!

Whether youâve fully set up shop in Louisiana, or simply ship there once in a while, itâs important you know whether your business is liable to their sales taxes. This guide will tell you everything you need to know, plus direct you to the right places for handling any sales tax responsibility you may have.

Recommended Reading: Is Money From Donating Plasma Taxable

Is Louisiana A Streamlined Sales Tax State

No, Louisiana is not at this time a member of the SSP. Fingers crossed they might join this efficiency boosting project !

While they arent a member of SSP, they do cooperate with a convenient third party for managing local taxes.

More effectively manage your tax needs by keeping this guide handy.

You and your business can be better equipped to avoid situations like paying fines, paying back taxes that you did know you had to pay in the first place, or facing an audit by the tax authorities in Louisiana.

Louisiana Sales Tax Rates

The state sales tax rate for Louisiana is 5%, with 4.97% of that being a straight sales tax and 0.03% designated as the Louisiana tourism promotion district sales tax. Localities are permitted to impose their own sales tax as well, and so in some places, the combined effective rate can be as high as 11.625%. This chart contains a listing of sales tax rate by city in Louisiana, with breakdowns for Parish, City and State rates available by viewing a city in detail.

A different state rate applies to certain items sold or rented in Louisiana as well. For instance, the rental of automobiles for less than 29 days is taxed at a rate of 3%, with 2.5% going towards state sales tax and 0.5% allocated as a local sales tax. The New Orleans Exhibition Hall Authority tax is another example of a specialized kind of sales tax that applies only to food service establishments serving food in Orleans Parish or at the New Orleans International Airport. It must be collected at a rate of 0.5% or 0.75% based on total revenue of the business from the previous year, and its added on to the total sales tax rate for the region.

You May Like: Harris County Property Tax Protest Services

Sales Tax Permits: A State

A sales tax permit, sometimes known as a sales tax license or sellers permit, is something a business must obtain before it starts collecting and remitting sales tax in most states. But how do you know if you need a sales tax permit? How do you go about getting one? Whats the difference between a sales tax permit and a resale certificate? Do marketplace sellers need a sales tax permit? Do you have to pay to get a sales tax permit?

As usual when it comes to sales tax, the answer to each of these questions varies depending on the state, and perhaps also the business itself. Read on to learn more.

Who needs a sales tax permit?

You need to get a sales tax permit and comply with sales tax laws in states where you have nexus, or a connection. Nexus used to be based solely on physical presence, such as having employees, inventory, or an office, store, or warehouse in a state. However, that changed on June 21, 2018, when the Supreme Court of the United States found the physical presence rule to be unsound and incorrect.

Physical presence in a state still triggers nexus, but with the Supreme Court ruling in South Dakota v. Wayfair, Inc., nexus can also be established solely by economic activity in a state . In pioneering South Dakota, for example, economic nexus is established when a remote seller has more than $100,000 in sales or at least 200 transactions in the state in the current or previous calendar year.

How do you get a sales tax permit?

| State |

Louisiana Sales Tax Guide

Louisiana, the Bayou state, is the 25th most populous state in the union and home to Americas original party city, New Orleans. While Mardi Gras may be one massive party, the complexity of Sales Tax in Louisiana can be a real buzzkill. Despite that, many small businesses thrive out of this low lying state that brings the funk! If youre one of the many small business owners proud to call Louisiana home, youll need to comply with Louisiana’s State and Parish sales tax laws to keep the party going. No worries! We have assembled this all-in-one guide for sales tax so that you can meet the sales tax compliance requirements for a small business in Louisiana.

After reading this guide, you will have learned:

- How to be prepared for your call with the Louisiana Department of Revenue.

- How to contact the Louisiana Department of Revenue.

- When to charge sales tax in Louisiana.

- What goods, products, and services are taxable in Louisiana.

- When you establish a sales tax nexus with the state of Louisiana, and the nuances of various thresholds.

- How to register for a sales tax license in Louisiana.

- How to collect sales tax in Louisiana.

- How to file and pay sales tax in Louisiana.

If, after reading, you still have any questions to help you determine your tax sales obligations in Louisiana and how to fulfill them, we are here for your small business bookkeeping needs!

Do you need to get in touch with the Louisiana Department of Revenue?

- Taxpayer Name

- EIN

- Sales & Use Tax ID Number

Don’t Miss: How Much Taxes Do You Pay For Doordash

Louisiana Sales Tax Exemptions

What is Exempt From Sales Tax In Louisiana?

Beginning on April 1, 2016 the state of Louisiana levies a 5% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes up to 7%. Prior to the 1% increase in the state rate which took place on April 1, 2016 the state rate was 4%. The current range of total sales tax rates within the state of Louisiana is between 5% and 12%.

Use tax is also collected on the consumption, use, or storage of goods in Louisiana if sales tax was not paid on the purchase of the goods. The use tax rate of 8%, which includes 4% to be distributed by the Department of Revenue to local governments. The use tax rate is 8% regardless of whether the actual combined state and local rate in your area is equal to, higher than, or lower than 8%. The use tax is paid in lieu of the actual local rate in effect. Returns are to be filed on or before the 20th day of the month following the month in which the purchases were made. For example, purchases made in the month of January should be reported to the state of Louisiana on or before February 20th.

Does The Louisiana Department Of Revenue Offer A Discount For Filing On Time

Yessiree! Louisiana offers a discount of .935% of tax due If paying on time. Take advantage!

*****

Now that we covered all our bases for filing and paying sales taxes in the state of Louisiana, you should feel more at ease about the process.

Some things to remember:

- Due dates are important. If anything, file and pay your taxes early.

- There are three payment plans for filing and paying your sales taxes depending on how much you collect in sales tax on average in a month.

- You can file and pay your taxes electronically or by mail

- If you need to amend a return, you may do so electronically or by paper.

- If you dont collect sales tax and you were supposed to, you is liable to pay the sales tax to the state of Louisiana.

- You will have to pay late fees if you fail to file your tax return on time and/or if you fail to make your tax payment on time.

- Even if you collect no sales tax, you still need to file a return.

- You need to file a Final sales tax report when you close your business.

Now, you are ready to file and pay your sales tax in Louisiana. If you have any more questions, feel free to contact us.

Read Also: How To Get 1099 From Doordash

What Kind Of Taxes Do You Pay On Services In Louisiana

While Louisianas sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of services in Louisiana, including janitorial services and transportation services. To learn more, see a full list of taxable and tax-exempt items in Louisiana .