What Do Property Taxes Pay For

Barry Choi12 **This post may contain affiliate links. I may be compensated if you use them.

Tonight a new Mayor of Toronto will be named. The campaign has been long and I cant wait for it to end and for the city to move forward from its troubled reputation. Many voters have complained about increasing property taxes with one candidate promising to cut them if elected. Of course, these same people who complain about taxes being too high also say they dont want their services cut.

Taxes are a fact of life, many people dont understand what do property taxes pay for. In Toronto, theyve been falsely told that our politicians have been wasting tax dollars but that simply is not the case. Property taxes pay for the services we use every day, whereas our Canadian income taxes cover major things like health care and employment insurance.

Regardless of where you live, if you want better services taxes are what pays for them.

How Income Taxes Work

There’s nothing quite like the excitement and pride of receiving your very first paycheck. You worked hard for a solid month, and here’s your much-deserved compensation. But wait a second … what’s the story with this line that says “net pay?” That can’t be your actual salary, could it? What happened to all of your money? By the time you get your paycheck, it’s been cut up like a pizza, with several government agencies taking a piece of the pie. Exactly how much money is withheld from each check varies from person to person, company to company and state to state. However, almost every income earner has to pay federal income tax.

We generally don’t think much about taxes except during the annual tax season. It’s probably the most dreaded time of the year for millions of Americans, yet we circle it on our calendars, along with holidays and birthdays. But little joy is connected to April 15, the deadline for filing tax forms.

The American tax system is a huge machine with a tax code that seems more complex than rocket science. In this article, we will examine how individual income taxes work, take a look at the history of income taxes in the United States and consider two alternative tax plans.

Contents

Proving That Fear Of Pain Is Why Youre Afraid Of The Dentist

A $3.5 million study conducted by the National Institutes of Health in 2016 examined why half of Americans report being afraid of the dentist, with as many as 20% reaching the level of a serious phobia. If you guessed that it might have something to do with the use of a drill to bore into bones embedded in your skull, you are correct. The most commonly cited source of dental anxiety is fear of pain.

Keep Your Money Away From Taxes: 9 Legal Tax Shelters To Protect Your Money

Don’t Miss: How Do I Get A Pin To File My Taxes

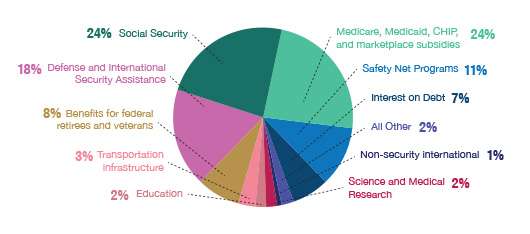

The 10 Biggest Things Your Income Taxes Pay For

Now that tax season is over , it’s natural to wonder exactly where the hard-earned dollars you paid in tax over the past year actually went.To answer that question, the White House put together a website that gives details on the government’s expenditures. Dubbed the Federal Taxpayer Receipt, you can enter in your income, Social Security, and Medicare taxes and get a personalized look at where your tax dollars got spent. Understanding that Social Security and Medicare taxes go toward funding those respective programs, here are the 10 areas where the greatest percentage of income tax revenues gets spent.%Gallery-186742%

Tax Rules For Canadian Expats In The Us

Depending on how long you spend in the USA as a Canadian employee, your tax liabilities may change. Heres how to determine your tax liability, if you started working in the US three years ago:

- For the first year, each day that you spent in the US counts as 1/6 of a day.

- For the second year, each day that you spent in the US counts as 1/3 of a day.

- For the third or current year, each day that you spent in the US counts as one day.

Lets say youve spent at least 31 days in the current year and the overall number of days is 183 or more. You will thereafter be regarded as a US resident for tax reasons and be required to pay US taxes.

Pained by financial indecision? Want to invest with Adam?

You May Like: Amended Tax Return Online Free

The Vice Presidents National Anthem Stunt

In October 2017, Vice President Mike Pence attended an Indianapolis Colts game against the San Francisco 49ers. Colin Kaepernick and about a dozen other 49ers players knelt during the national anthem to protest racial inequality, as they had done the previous week. In response, Pence left the stadium after the anthem to show his disgust.

Pences political stunt cost taxpayers at least $325,000, according to HuffPost calculations. This included $250,000 for Air Force Two transportation, plus additional expenses for hotels and security.

What Are The Most Common Types Of Taxes

Taxes come from a variety of sources. The nature of what is taxed and the method required to collect the tax often determines the different types of taxes. Understanding taxes can help you better manage your personal finances.

Taxation on annuities is a bit different here, taxes arent due until you start to receive income payments from your annuity.

Common Types of Taxes

Also Check: How To Take Taxes Out Of Doordash

Turning Computers Into Couch Potatoes

Your tax dollars paid for computers to binge-watch hundreds of hours of television during a 2016 study as if you werent already burning through your paycheck on subscription services.

The program which was funded by a $460,000 grant from the National Science Foundation and other funds from the Department of Defenses Office of Naval Research was designed to train computers to both understand and predict human behavior. The results were inconclusive. But the good news is that the computers are all caught up on their favorite shows.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Where Is My Federal Tax Refund Ga

How Much Income Tax Do You Pay On Rrsp Withdrawals

RRSP withholding tax isnt the only payment you might have to make. The gross amount that you withdraw from your RRSP is included in your income for the year, so you may have to pay even more in income tax, when it comes time to file your taxes. The exact amount will depend upon your tax rate and your total taxable income for the tax year .

Tax Rules For Canadian Expats With Resident Status

If the CRA determines that you are a Canadian resident, you must pay income tax on all income generated anywhere in the globe. Even if you work temporarily outside of Canada, you must still pay federal and territorial taxes. The amount of tax you pay is determined on your earnings.

As a Canadian resident, you must file a T1 tax return each year, covering your income and expenses from January 1 to December 31. It should be noted that the annual deadline for submitting tax returns and paying income taxes is April 30th.

When completing your tax returns as a resident, you must declare your income received outside of Canada. This is due to the fact that even though the income will be taxed in Canada, if you have previously paid taxes outside of Canada, you may be able to claim a foreign tax credit for it.

Read Also: Doordash Tax Write Offs

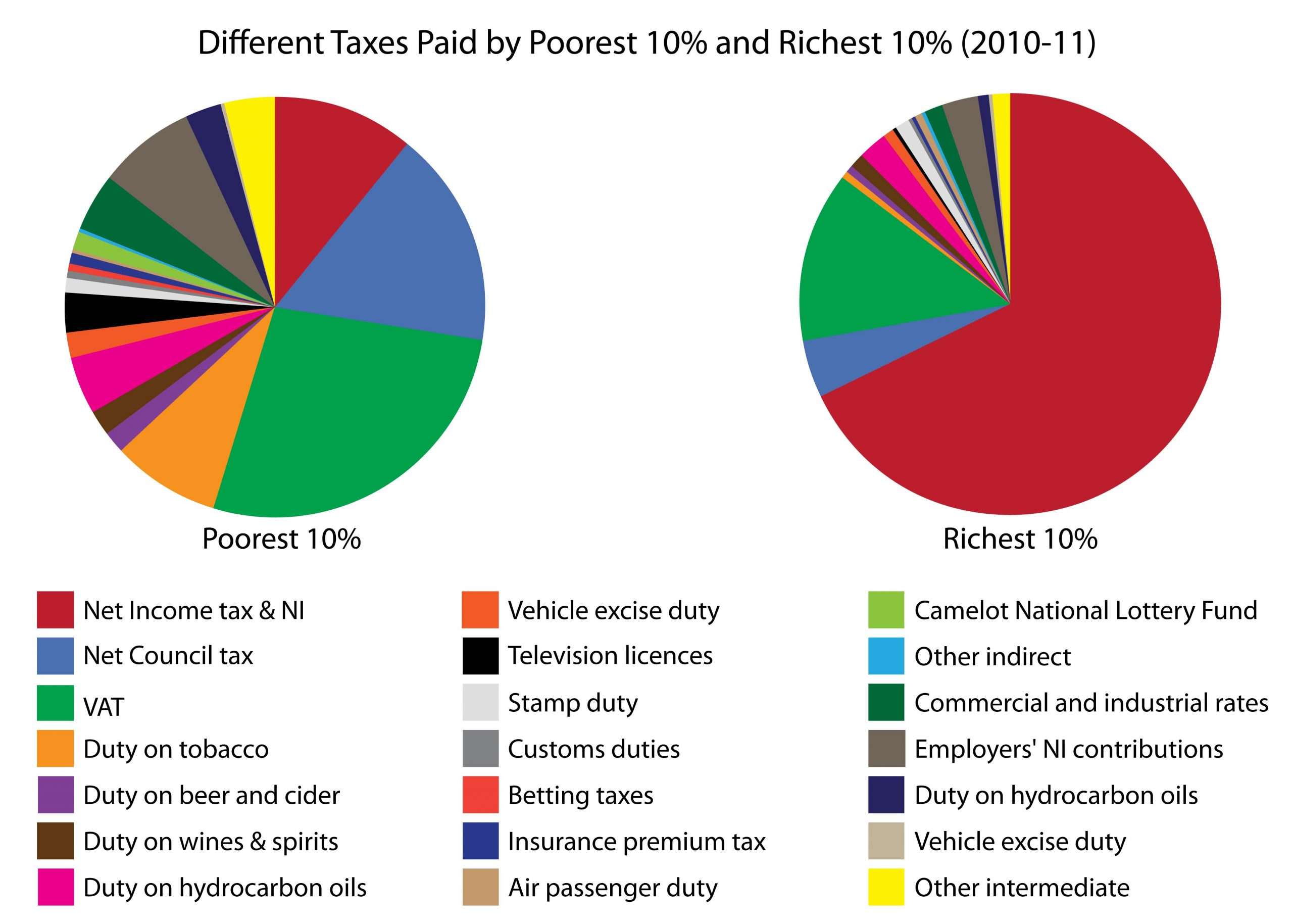

How Much Do We Actually Pay

Before breaking down where the federal government spends our money, it’s worth considering how the amount of taxes the average American pays has been calculated. In a recent article, my Motley Fool colleague Brian Feroldi broke the numbers down using data from the Internal Revenue Service .

Americans filed more than 150.6 million tax returns in 2015. During that year they also earned $10.17 trillion in adjusted gross income and had a total tax liability of $1.45 trillion. Some quick division means that the average gross income per return was $67,564 while the average federal tax hit was $9,655.

He also noted that many lower-income Americans either pay no taxes or even get money back because of the Earned Income Tax Credit. Take those returns out of the picture, he wrote, and “you are left with 99 million Americans who recorded an average federal tax hit of $14,654.”

So What Do My Taxes Pay For Exactly

Its all spelled out in Uncle Sams budget. Which is made up of two main types of expenses: essential and non-essential. Or in gov speak: mandatory and discretionary expenses. Heres a closer look at what these mean:

-

Mandatory spending includes funding for programs and payments that are required by law. Think: Medicare Medicaid Social Security benefits and services for veterans and federal employees and safety net programs like unemployment insurance, SNAP benefits, and the child tax credit.

-

Discretionary spending isn’t written into law and can change every year. It includes funding for the federal govs many departments and agencies. Like the Department of Defense, the Interior, Health and Human services, Energy, and many more.

Another big-budget category: interest on debt. Because even Uncle Sam gets charged for money owed.

Read Also: How Much To Set Aside For Taxes Doordash

How Are State And Local Taxes Used

State spending varies depending on a lot of different factors, from population to overall wealth to the amount of taxes they collect. But education is the single biggest expense for every state in the union.

State and local taxes often go to the same service public schools are a good example. The state may fund part of the costs and local counties, cities or school districts spend local taxes on them as well.

Combined spending on elementary, secondary and higher education accounts, on average, for nearly a third of state and local expenditures, according to the nonprofit Urban Institute.

Public welfare costs include most Medicaid costs while police spending also includes money spent on courts and correctional facilities in the Urban Institute analysis.

The remaining 22 percent went to direct expenditures money paid to current employees, retirees and private sector entities outside of government such as contractors.

State and local governments spent $3.2 trillion dollars in 2018. Thats a 183 percent increase after you adjust for inflation since 1977, according to the analysis.

How To Calculate Rrsp Withholding Tax

RRSP withholding tax is taken off at source, so you dont need to calculate it yourself. When you withdraw money from your RRSP, your financial institution will deduct the withholding tax automatically. However, to give you an idea of how much RRSP withholding tax you might have to pay, below are some examples of what you will receive when withdrawing from your RRSP:

|

Withdrawal amount |

As you can see, RRSP withholding taxes can be significant.

People living in Quebec can find out their total withholding tax amounts from Revenue Quebec.

You May Like: How Can I Make Payments For My Taxes

Room And Board For Chimps

The National Institutes of Health once used chimpanzees in biomedical research projects, but eventually stopped the practice. The 139 chimps that were liberated from the NIHs experiments have been retired to the National Center for Chimpanzee Care. About $18,700 is spent per chimp per year for food, shelter and other costs thats enough to put each chimp through college every single year.

How Are Federal Taxes Spent

OVERVIEW

All citizens must pay taxes. How are these federal taxes being spent?

All citizens must pay taxes, and by doing so, contribute their fair share to the health of the government and national economy.

The federal taxes you pay are used by the government to invest in technology and education, and to provide goods and services for the benefit of the American people.

The three biggest categories of expenditures are:

- Major health programs, such as Medicare and Medicaid

- Social security

- Defense and security

Interest on the national debt and various safety net programs such as low-income assistance comprise a sizable chunk of national expenditures, while other categories such as transportation and infrastructure spending round out the government budget.

Recommended Reading: Irs Gov Cp63

However You Make Your Money

For now, though, let’s just consider your federal tax bite on common forms of income.

Income taxes: Your “earned” income — that which you make by working — will be taxed on a graduated scale.

There are 7 income tax rates: 10%, 15%, 25%, 28%, 33%, 36% and 39.6%.

The first dollar you make will be taxed at the 10% rate while the last dollar you make likely will be taxed at a higher rate. The more you make, the higher your top rate will be.

For example, in 2015, if your taxable income is $65,000 and you’re single, you’ll be in the 25% bracket. You’ll owe 10% on the first $9,225 of your income, 15% on the next $28,225 and 25% on the rest.

Remember, your taxable income is not your gross income. It generally reflects your gross income minus any deductions, credits and exemptions you may claim.

So if you gross $100,000, your taxable income might be closer to $80,000.

Social Security and Medicare taxes: Payroll taxes — or FICA taxes as they’re also called — are intended to fund the two biggest U.S. safety net programs.

You will owe 12.4% in Social Security tax on the first $118,500 of your earned income.

If you’re an employee, you’ll pay 6.2% of that and your employer will pay the other 6.2%.

If you’re self-employed, you’ll pay the full 12.4% but may deduct half of it on your tax return as a business expense.

You’ll owe another 2.9% in Medicare taxes on all of your earned income. Again, if you’re employed, you’ll pay half while your employer will pay the other half.

Putting Fish On Treadmills

In 2017, Sen. Jeff Flake of Arizona released a list of the most outlandish tax splurges he could find. One involved the Scripps Institution of Oceanography in San Diego, which used a $560,000 grant from the National Science Foundation to force fish to exercise to exhaustion on treadmills as part of a 2009 study.

The scientists chose mudskippers because of their unique ability to use their fins like legs for extended periods of time when out of the water. The exhausted fish were then given 48 hours to rest before hitting the gym again. Different oxygen levels were used as variables to test their progress and recovery.

More: Sales Tax by State: Heres How Much Youre Really Paying

Also Check: Form 5498 H& r Block

Is There A Withholding Tax On Rrsps

Normally, when you make RRSP withdrawals, taxes are withheld at source, . These are essentially an estimate and prepayment of the income taxes you may owe when you eventually file your income tax returns.

The amount of RRSP withholding tax youll pay will depend on how much money you take out. These are the withholding tax rates for residents of Canada:

|

over $5,000 and up to $15,000 |

|

|

over $15,000 |

Residents of Quebec will also pay a provincial withholding tax . Non-residents of Canada pay 25% in withholding taxes .

Why Do We Pay Taxes

Total US federal spending for fiscal 2021 was about $10.1 trillion, according to data compiled by USAspending.gov. State government general fund spending, meanwhile, was $931.7 billion, according to a report from the National Association of State Budget Officers. All that money has to come from somewhere. That’s why we pay taxes: to help fund governments at all levels.

The taxes collected by governments foster economic growth and development, paying for essential goods and services such as infrastructure, health care, and education in order to achieve the common goal of a prosperous, functional, and orderly society, says the World Bank, which provides development finance for collecting public revenue. Taxes are also a key ingredient in the social contract between citizens and the economy. How they’re collected and spent can determine a government’s very legitimacy.

“At their most basic level, taxes address the ‘free-rider’ problem,” says Poppy MacDonald, president at USAFacts, a not-for-profit and nonpartisan civic initiative that makes it easy to access and understand US government data. “If government didn’t require citizens to pay for services, those services would be underfunded and, as a result, underprovided.”

Don’t Miss: Doordash 1099 Form