Does Everyone Pay The Same And If Not Why Not

Our recent research shows theres a lot of variation in the taxes paid by the rich. Most of the revenue from the top one per cent comes from a cohort of high-earning employees, who pay the often-quoted top rate of 45 per cent income tax plus two per cent national insurance contributions, with minimal deductions or reliefs. But a substantial minority pay much lower rates, especially taking into account capital gains, which offer an alternative way of taking rewards, mainly for the richest.

Where you get your money from matters, because investment income and capital gains are taxed at lower rates than income from work.

Using anonymised data from personal tax returns, we show that in 2015-16 the average rate of tax paid by people who received one million pounds in taxable income and gains was just 35 per cent: the same as someone earning £100,000. But one in four of these paid 45 per cent close to the top rate whilst another quarter paid less than 30 per cent overall. One in ten paid just 11 per centthe same as someone earning £15,000. The rich, it seems, are not all in it together.

Hear Andy Summers in the LSE IQ podcast, Can we afford the super-rich?

Increase The Estate Tax

The estate tax is levied on the assets of the very best-off Americans when they die. The Tax Cuts and Jobs Act increased the level at which the federal estate tax kicks in so that the taxat a rate of 40%applies only to estates over $11.2 million. Only two of every 1,000 people are wealthy enough to trigger the tax when they die, or about 1,900 estates in 2018, according to the Tax Policy Center. Only 80 small farms and small businesses paid the estate tax in 2017, again according to the Tax Policy Center. Estate and gift taxes brought the government about $19 billion in 2019, only 0.5% of all federal revenues.

One proposal would lower the threshold to estates worth $3.5 million and impose graduated taxes depending on the size of the estatefrom 45% up to 65%. It would raise more than $300 billion over 10 years. Advocatesof an estate tax hold that it is a good way to avoid dynastic wealth in the U.S.and make the U.S. a fairer place where merit matters more and the net worth of onesparents matters less. As the wealthy get wealthier, they say, a stronger estatetax is increasingly important.

When someone dies with stocks, property or other assets that are worth more than he or she paid for them, the heirs do not have to pay capital gains taxes on those profits. No one does the profits go completely untaxed. Former Vice President Joe Biden, among others, has proposed taxing these profits. Heirs would have to pay tax when they sell the assets they inherit.

The Headline Fact Rests On A Bunch Of Assumptions

Treatment of the corporate income tax is particularly important for this exercise because Congress enacted a big corporate tax cut in 2017.

Prior to that, the Saez/Zucman data shows the top 400 taxpayers paying a lower overall tax rate than the top 0.01 percent or the top 0.1 percent, but a similar rate to the rest of the top 20 percent of the income distribution and a clearly higher rate than the bottom 80 percent.

And this is important because, as first noted by libertarian economic historian Phil Magness, changing how corporate income taxes are handled makes a big difference in terms of assessing what rate the richest Americans are paying in taxes.

The solid orange line represents the tax rates estimated by Saez, Zucman, and Pikettys scholarly article, using the assumption that the burden of the corporate income tax is spread across all non-housing capital , whereas the dotted line shows the Saez/Zucman books estimates based on the idea that corporate taxes are all paid by corporate shareholders.

Since ownership of corporations is very highly concentrated among the richest people, if you consider a corporate tax rate cut to be a pure tax cut for owners of tax-paying corporations, then you will get the conclusion that the Trump tax cut was an incredible windfall for the top 400 taxpayers.

Weve entered a new phase. Lets call it post-truth economics.

Also Check: Efstatus.taxact 2014

Income From Wealth And Income From Work Are Taxed Differently

The vast majority of working Americans get their income from hourly wages or a regular salary. In both cases, it’s typical for income taxes to be automatically deducted. But people with a high net worth, Huang explains, often collect the majority of their income from assets like stock holdings, property, or other investments. As those assets increase in value the stock market goes up, pieces in their art collection get more expensive, the real estate market shifts in their favor their total wealth increases too.

That income subject to taxes if they actually sell the asset that generated that income, Huang says. So, unlike the ordinary wage and salary owner who’s paying taxable income in real time, very high net worth people can choose whether and even when to pay taxes on the growth of their wealth.

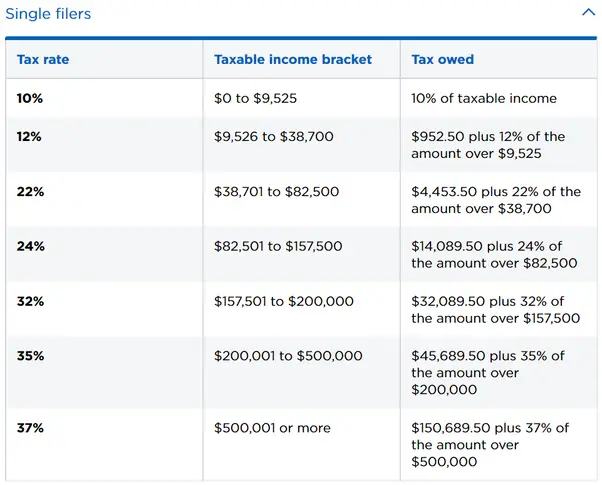

The current federal income tax rate, at its highest, enforces a tax rate of 37% for individual taxpayers making $523,600 or more and for married couples making $628,300 or more. To avoid the tax rate in this income bracket, its not uncommon for business owners with a high net worth to pay themselves lower salaries. For example, Bezos collected just $80,000 per year as the CEO of Amazon. Apple founder Steve Jobs, former CEO of Hewlett-Packard Meg Whitman, Google cofounders Larry Page and Sergey Brin, and Facebooks Zuckerberg all accepted a salary of $1 per year, likely for the same purpose.

Buy Borrow Die: How Americas Ultrawealthy Stay That Way

So how do megabillionaires pay their megabills while opting for $1 salaries and hanging onto their stock? According to public documents and experts, the answer for some is borrowing money lots of it.

For regular people, borrowing money is often done out of necessity, say for a car or a home. But for the ultrawealthy, it can be a way to access billions without producing income, and thus, income tax.

The tax math provides a clear incentive. If you own a company and take a huge salary, youll pay 37% in income tax on the bulk of it. Sell stock and youll pay 20% in capital gains tax and lose some control over your company. But take out a loan, and these days youll pay a single-digit interest rate and no tax since loans must be paid back, the IRS doesnt consider them income. Banks typically require collateral, but the wealthy have plenty of that.

One example: Last year Tesla reported that Musk had pledged some 92 million shares, which were worth about $57.7 billion as of May 29, 2021, as collateral for personal loans.

With the exception of one year when he exercised more than a billion dollars in stock options, Musks tax bills in no way reflect the fortune he has at his disposal. In 2015, he paid $68,000 in federal income tax. In 2017, it was $65,000, and in 2018 he paid no federal income tax. Between 2014 and 2018, he had a true tax rate of 3.27%.

Recommended Reading: Does Doordash Tax

Tax Havens Are Millionaires Safe Point

Tax Havens come right behind charity donations as the most popular tax avoidance tools.

A tax haven is any country that offers no tax liability for individuals and businesses.Most popular tax havens are The British Virgin Islands, Panama, Belize, Bahamas, and the Cayman Islands. They require an annual business license at a 0% tax rate and provide business people with financial privacy.

Many celebrities and politicians like Madonna, Mitt Romney, Martha Stewart, and Shakira have used tax havens, as was shown in the leaked Panama and Paradise Papers.

The Cayman Islands are home to 85 000 registered companies- more than the people living there!

Reducing Tax Breaks On Wealthy Peoples Income That Already Is Taxable

As discussed above, much of wealthy peoples annual income is not taxed. Wealthy people also enjoy another broad tax advantage: significant streams of their income that are taxed often enjoy special tax breaks or discounted tax rates. Prominent among these are realized capital gains and dividends, carried interest, and pass-through business income. All three of these are potential areas of reform. Policymakers should also consider enacting a surtax on high-income people.

You May Like: Pastyeartax Com Review

Its Not Only About High Earners

Steve Webb, former pensions minister in the coalition government and now Director of Policy at Royal London, stated that it is hard to believe that this is a sensible way to run a tax system, calling on the Chancellor to make it simpler, fairer and easier to understand.

Royal London estimates 775,000 people are affected by the marginal tax rates they identify. This is not an exact figure, as it is made using certain assumptions applied to HMRC data on incomes.

Royal London also focused on high earners only 10% of people earn enough to be affected by the tax on child benefit. But low earners can have high marginal tax rates too.

There is a debate over Universal Credit and how much it pays to work more, due to loss of benefits caused by going into work.

For a childless claimant without a disability, for every £1 earned in work their Universal Credit benefit is reduced by 63p. This tapering of Universal Credit creates a marginal tax of 63% on net earnings.

Coupled with other direct taxes, some people could have a marginal tax rate of 75% on earnings under Universal Credit, or 80% if we include council tax. For students repaying tuition fees it could be 85% on certain parts, including council tax.

On average, low earners also end up paying a larger percentage of their salary on indirect taxes such as VAT, and overall see a higher percentage of their income spent on taxes than the highest earning households.

How Much Does 100000 Dollars Get Taxed

Tax returns for individuals making $100,000 per year will run $30,460 if they reside in California, USA. Youll earn around $69,540 per year, or $5,795 per month, if you decide to apply for the job. Tax rates in your area are currently 30 percent. Your marginal tax rate is 43 percent after taxes of 5%.

Read Also: How Do You File Taxes For Doordash

The Corporate Tax Is The Most Harmful For Economic Growth

A seminal study by economists at the OECD ranked the major taxes in terms of their harm to economic growth. Corporate income taxes were found to be the most harmful for growth, followed, in order, by personal income taxes, consumption taxes, and property taxes.

The reason corporate income taxes were determined to be most harmful for growth is because capital is the most mobile factor in the economy and, thus, the most sensitive to high tax rates. People and the things we own are less mobile and, thus, less sensitive to high tax rates. This is not to say that these factors are insensitive to taxation, just less so than taxes on capital.

Tax Foundation economists used our Taxes and Growth General Equilibrium Tax Model to measure the economic impact of raising the corporate tax rate to 28 percent. The model determined that such a rate increase would reduce long-run GDP by 0.8 percent, eliminate 159,000 jobs, and reduce wages by 0.7 percent.

| -159,000 |

The model also determined that even a less dramatic increase in the corporate rate to 25 percent would still dampen economic growth. It found that a 25 percent rate would reduce GDP by 0.4 percent, lower the capital stock by 1.1 percent, and eliminate over 84,000 jobs.

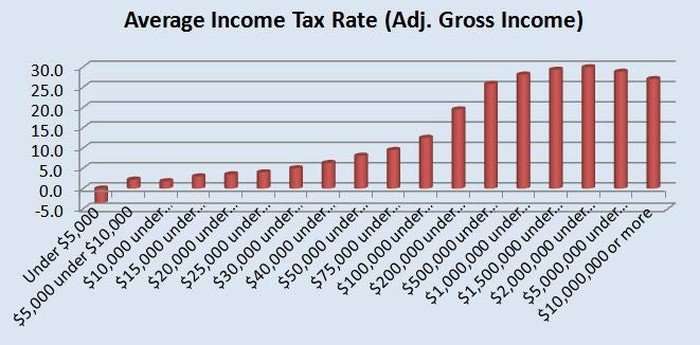

America’s Billionaires Pay An Average Income Tax Rate Of Just 82% Biden Administration Says

The wealthiest 400 families in the United States are paying an average income tax rate of just 8.2%, according to a new analysis from the Biden administration. President Joe Biden and Democrats are pushing to raise taxes on the richest Americans as they look for ways to pay for their ambitious agenda, making its way through Congress as a $3.5 trillion budget reconciliation package.

The analysis estimated billionaires paid 8.2% of their income between 2010 and 2018, including on forms of income that go largely untaxed lower than the rates paid by most Americans. It notes in that final year of analysis, those families had at least $2.1 billion in wealth, according to Forbes.

The analysis by economists from the Office of Management and Budget and the White House Council of Economic Advisers drew from publicly available data and says the disparity is driven largely by how the tax code treats income generated from wealth such as income from stocks, whose worth increases over time rather than wages, which are immediately taxed.

The Biden administration is pressing for changes to the tax code that they say will force the wealthiest Americans to “pay their fair share.”

Mr. Biden has vowed not to raise taxes on those making less than $400,000 a year as Democrats aim to deliver wide-ranging legislation that tackles issues impacting Americans at every stage of life.

Also Check: Amended Tax Return Online Free

Millions Benefit From Tax Credits And Pay Zero Income Taxes

It is hard to say that the tax code is rigged in favor of the rich when more than 53 million taxpayers, more than one-third of all taxpayers, have no income tax liability because of the numerous credits and deductions that have been created or expanded in recent decades.

As Figure 2 illustrates, the percentage of these filers with no liability began to grow following the Tax Reform Act of 1986 expansion of the zero tax bracket. Since the creation of the Child Tax Credit in 1997 the percentage of income tax filers who have no tax liability increased from 23.6 percent to 34.7 percent in 2018.

The percentage of filers with no liability spiked at 42 percent in 2009 with creation of the Making Work Pay tax credit. As the economy recovered from the Great Recession, the percentage of filers with no liability declined to 32 percent in 2017. The percentage has begun to spike again after the TCJA doubled the Child Tax Credit to $2,000 from $1,000. This increased the number of non-payers by more than 4 million, from 49.1 million to 53.3 million.

Many of these low-income taxpayers receive refundable tax credits, which means that they get a check back from the IRS even if they have no income tax liability.

How Do Millionaires Avoid Taxes

Only 1% of the population controls over 40% of the countrys wealth. It might come as a shock only for those living under a rock this whole time.

The 1% do a great job of hiding their wealth from the government. Luckily for them, the US taxing system offers enough loopholes for the wealthy to pay less tax than me and you.

This leads to tax revenue losses of $70 to $100 billion each year. Tax avoidance equals less money for education, health care, law enforcement, and infrastructure.

Theres an age-old saying that the poor pay more. The rich are getting richer faster while the poor struggle to make ends meet. Its popularly known that Warren Buffet, for example, shared that he pays less taxes than his secretary.

Whats unclear to me- is tax avoidance blatantly lying to the government?

Millionaires dont pay taxes because taxes are mostly based on income, not wealth. If a person has no taxable income, hell pay no income tax even if hes worth millions of dollars. Millionaires also invest any profit they make back into their businesses, so they dont owe anything to the government.A regular person can be making $50 000 a year in salaries, have no other assets, and still end up with a higher tax bill.

Contents

You May Like: Paying Taxes On Doordash

It Only Applies To A Small Part Of People’s Income

Royal London is only talking about specific cases where people’s income increases, called marginal tax rates. 800,000 people do not pay a higher rate of tax overall than millionaires, but some do pay a higher rate on certain portions of their income.

This is because of other taxes which kick in above a certain income threshold. So an extra thousand pounds earned can be taxed at a very high rate.

Royal London looked at how child benefit becomes taxable at 1% for every £100 earned over £50,000 per year. If one partner went from earning £50,000 a year to £51,000, Royal London says a two-child couple would lose about £179 in child benefit per year through taxes.

This loss of £179 through earning an extra £1,000 essentially amounts to a tax of 17.9% on that sum. Coupled with the income tax and national insurance deductions, the overall tax rate for that £1,000 is 59.9%. The income tax rate for millionaires is 45%.

Royal London also looked at two more scenarios, where individuals lose either their tax-free personal allowance or tax-free pension contribution because they earn over a certain threshold. They correctly state that this can lead to marginal tax rates of 62% and 69.5% respectively.