Filing Your Own Return

You can use commercial software to complete your income tax return and file it online using the integrated NetFile Québec feature.

When you file your income tax return online, do not send us any paper copies of the return.

When can I file my income tax return using NetFile Québec?

2020 income tax return

- You can file your 2020 income tax return as of February 22, 2021.

Returns from previous years

- You can file your original 2017, 2018 and 2019 income tax returns in the four-year period following the taxation year covered by the return .

- If you did not file an income tax return for 2017, 2018 or 2019 taxation year, and we sent you a notice of assessment for the year covered by the return, you cannot file an original return using authorized software. You have to mail the return to us.

Amended income tax returns

- You can file an amended 2017, 2018 or 2019 income tax return as of February 22, 2021.

Having Your Return Filed By An Accredited Person

You can have a person accredited by Revenu Québec file your return. Note that accredited persons who file more than 10 income tax returns are required to file them online.

Before having an accredited person file your return online, you must complete and sign two copies of the authorization form .You and the accredited person must each keep a copy of the form for a period of six years from the date on which the tax return was filed. Do not send us a copy unless we ask for it.

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Recommended Reading: How To Look Up Employer Tax Id Number

How Do I File My Taxes Online

Filing your taxes with TurboTax Free is quick and easy. First youll be asked to set up a profile and follow a simple process to find all the credits and deductions youre entitled to. With the CRAs Auto-fill my return, you can also import your tax info directly from the CRA. This service pulls info from your income slips , government benefit slips, RRSP receipts, and unused tuition credits. All the relevant info will be populated from these forms into your tax return saving you time and effort.

If you decide not to use CRAs Auto-fill my return service, or if you have additional info to enter that isnt captured through the import, you can find all the forms you need quickly and easily through TurboTaxs search feature.

You can also easily look for all the credits and deductions that apply to you using the search bar in TurboTax Free. If youre not sure where to start, heres a list of common credits, deductions, and expenses you may be eligible for:

Once youve entered all your info for the year and youre ready to file, our software will guide you through the steps to NETFILE your return online or print and mail your return. Well also give you step-by-step instructions on how to pay the CRA if you owe taxes.

Taxslayer Terms Of Service

Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website . TaxSlayer, LLC. may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service.

General Terms and Conditions. In consideration of use of the Site, you agree to: provide true, accurate, current and complete information about yourself as prompted by the registration page and to maintain and update this information to keep it true, accurate, current and complete. If any information provided by you is untrue, inaccurate, not current or incomplete, TaxSlayer has the right to terminate your account and refuse any and all current or future use of the Site. You agree not to resell or transfer the Site or use of or access to the Site.

You acknowledge and agree that you must: provide for your own access to the World Wide Web and pay any service fees associated with such access, and provide all equipment necessary for you to make such connection to the World Wide Web, including a computer and modem or other access device.

User Conduct On the Site.

While using the Site, you may not:

IRS Circular 230 Notice. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

- PreSDDSpare, E-file, and Print

- Prepare, E-file, and Print

- Prepare, E-file, and Print

Also Check: Where Is My State Refund Ga

Efile For Free Eligibility Requirements And Approved Products

Click a product link below to access an online eFile for Free* product using any other link may result in fees being assessed then follow product directions.

- Be sure the product that you select supports the forms you want to file

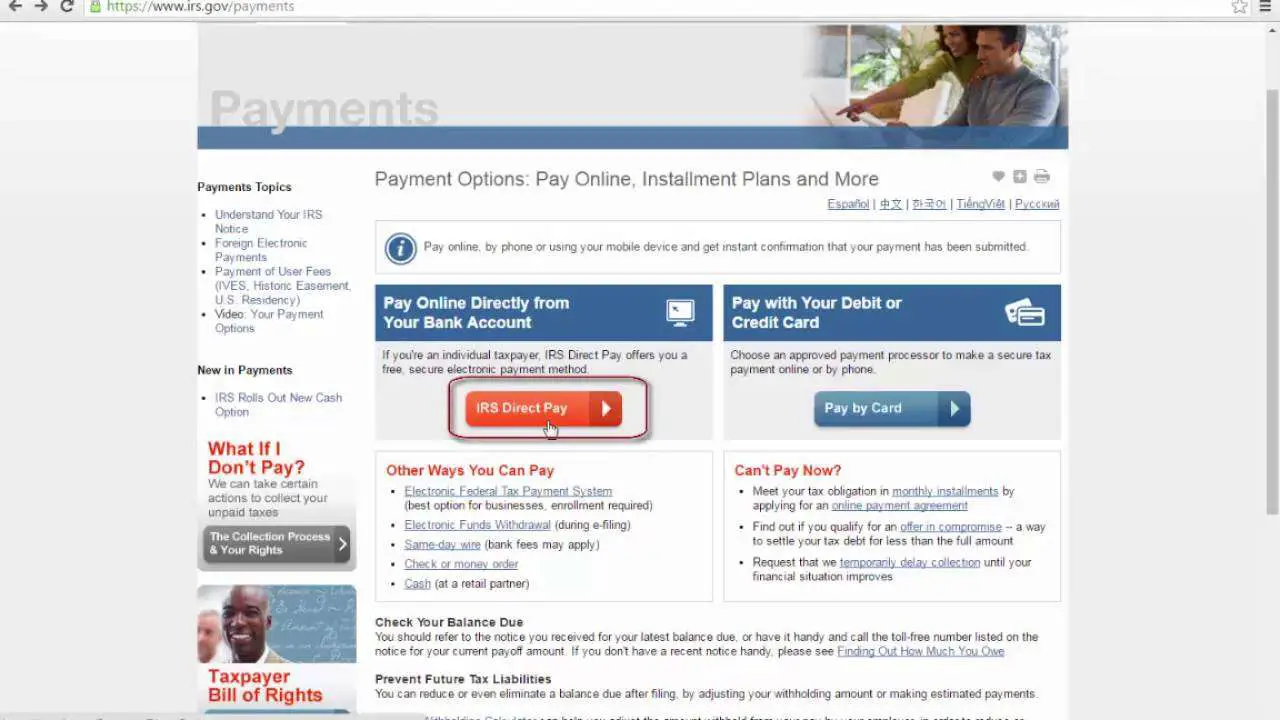

- If the product that you select does not offer payment options or you prefer to pay by Visa or MasterCard, you can use our website to pay your tax online

The following Free File products are affiliated with Free File, Inc. providers.

- Free File, Inc. providers partner with the IRS and state revenue agencies to offer free electronic tax services to qualifying taxpayers.

| Product Name | Eligibility Requirements |

|---|---|

|

|

|

|

|

|

|

|

|

Product NameEligibility Requirements

What Happens If You File Your Taxes Late

If youve somehow forgotten to file your prior years taxes, youre not alone. It happens. Youll be wading into more dangerous waters if youve made a habit of not filing taxes at all for many, many years. A word of advice: dont drag your feet any longer since the longer you wait, the worse it will get for you. As the CRA site sets out in rather vague terms, you may have to pay a federal and provincial or territorial repeated failure to report income penalty. Youll obviously be in better stead had you not owed anything to the government, but either way, you could be in some major trouble. Should you not file taxes, the government may simply send you a bill based on whats known as a notional or involuntary assessment, which means that theyll take all the information available through income thats been reported to them and assess taxes and penalties These rarely turn out well for taxpayers.

Don’t Miss: How Much H And R Block Charge For Taxes

Some Private Sector Firms Have Offered Free E

IRS Free File program is a multi-year agreement between IRS and the Free File Alliance to provide free service to more taxpayers. To be true IRS Free File, the services must be accessed through IRS.gov.

With IRS Free File, taxpayers have easy access to IRS.gov/freefile, which offers a list of the participating free offerings on a single web page. Under our agreement, Free File Alliance companies offer both free preparation and free e-filing services. There is no cost for a federal tax return to qualifying taxpayers.

Note: The IRS does not endorse any individual Free File Alliance company. While the IRS manages the content of the IRS Free File pages accessible on IRS.gov/freefile, the IRS does not retain any taxpayer information entered on the Free File site.

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

Also Check: Efstatus Taxact Com Login

Efile For A Fee Other Available Efile Options

If you don’t qualify for free electronic filing, please visit the listing of the approved software products to determine which software product will meet your filing needs.

- Be sure the product that you select supports the forms you want to file

- If the product that you select does not offer payment options, you can use our website to pay your taxes online

To find out if you qualify to use free software, review the eFile for Free options listed above.

What Does It Cost To File Your Taxes On Your Phone

Most of the companies behind these applications offer multiple levels of their services. The price is the same whether you access the service via your desktop or a dedicated app.

If your financial situation is simple enough that you can file a 1040 and little else, several of these serviceslike TurboTax, H& R Block, and TaxSlayeroffer free editions that you can use to file both your federal and state income taxes. Other free versions, such as those from and FreeTaxUSA, support more advanced tax topics, like self-employment, capital gains, and rental income. Does it sound like there are still a lot of confusing forms and levels to worry about? There are. That’s why using tax software is such a good idea.

In most cases, the more complex your return, the more you’ll pay. You’ll rarely pay more than $100, and sometimes much less. Unlike desktop software, these solutions do not collect money until your return is ready to file, which means you can try before you buy.

Note, too, that you might qualify to use paid commercial software like TaxSlayer for free, if your income is low enough or if you’re in the military. The IRS Free File Program allows you to submit your federal taxes for free, even if you use a premium app. To find out if you qualify, visit this page. Note that since the 2020 tax season ended, TurboTax has exited the Free File Program.

Also Check: How Can I Make Payments For My Taxes

Incomes Below $6900: Irs Free File Program

If your adjusted gross income for 2019 was $69,000 or less, youre eligible for the IRS Free File Program. This program is a partnership between the IRS and the commercial tax software companies that make applications like TurboTax, H& R Block, TaxAct, FreeTaxUSA, and Tax Slayer. Under some situations, these companies let you use their software for free.

Heres the critical thing to understand: The free tax-filing software available through the IRS Free File Program is different from each tax-filing programs standard free edition! In other words, TurboTaxs Free File Program edition and TurboTaxs Free Edition are different. If youre eligible for the Free File Program and you start a tax return through Free File, you can use all the features you want, and you wont see any upsells asking you to spend money. If you start with something like TurboTax Free Editionwhich isnt the Free File Programyou will have to pay extra for specific forms and other tax situations. With IRS Free File, you can use all the forms and complicated features of the tax software all you want.

To get started, head to the IRS Free File website and look through the offers. Different applications have different requirements for their offers. For example:

Note: To take advantage of the IRS Free File offer, you must start your return by clicking from the IRS Free File page or via the IRS Free File Program delivered by page on the tax softwares website.

It’s Time To Get Started On Your Taxes

Kudos to tax software and website developers for mastering the Herculean task they took on in the early 1990s: taming the 1040. They’ve turned a massive number of IRS forms and schedules into understandable, accessiblesometimes even attractivewebsites and mobile apps. All that’s left is for you to gather your documents, brew up a strong cup of coffee, and get started.

Make sure to visit our article on cryptocurrency and taxes if you’ve used, sold, or exchanged any digital currencies this past tax year. Also, if you’re wondering what to do with all the sensitive documents you aren’t planning to keep after you finish your taxes this year, you should read For Tax Time and Beyond: The Best Shredders We’ve Tested.

Finally, it’s not too early to think about next year’s taxes! Our story on 7 Ways to Start Minimizing Your 2021 Taxes Now can help you get started.

Also Check: How To Buy Tax Forfeited Land

Best For Live Video Help

Pros

- Excellent user experience with clear navigation

- Comprehensive coverage of tax topics

- Always-on, context-sensitive help

- Thorough, understandable explanations of tax topics

- Excellent mobile apps

Pros

- Good navigation tools and data entry options

- New automated W-2 entry

- Good help content in the Answer Center

- Enhanced review process and 2021 tax saving strategies

- New Xpert Help feature

- Some help links lead directly to IRS documents

- Help tools fragmented

Little Difference In Mobile

If you’ve ever used a tax preparation solution on a desktop computer, you may wonder if it’s possible to replicate that experience on a smartphone. The short answer is yes. We were pleasantly surprised when we saw what the apps’ designers were able to do. Content is compressed, of course, and there isn’t as much room for decorative graphics and big icons, however. But the small screens look remarkably similar to their desktop counterparts in many cases.

Navigation schemes differ among the apps, but you’ll still do a lot of moving among screens by using Back and Next buttons. You’ll have to scroll more to read help articles and to simply get through screens that contain a lot of questions, but you can indeed complete a return that includes the Form 1040. Schedules A through F, and myriad other supporting forms and schedules.

Of course, if your return is complex, it’s easier to complete it on a big screen with a full-sized keyboard. We don’t necessarily recommend that you take on a job that big on a smartphone. But no matter where you start your tax preparation, you can continue it on any other device by just signing in with your username and password. So, you could do some work remotely on your smartphone and finish up on your desktop or vice versa.

Also Check: How Much Does H & R Block Charge For Taxes

Can I File My Taxes Online For Free

In Canada, TurboTax makes it simple for anyone with any tax situation to file their taxes for free. These are just a few of the tax situations you could have and use TurboTax Free to file your taxes with the CRA:

- Youre working for an employer and/or are self employed

- Youre a student looking to claim tuition, education, and textbook amounts

- You were unemployed for part or all of 2020, including if you claimed CERB

- Your tax situation was impacted by COVID-19, including if you had to work from home and want to claim related expenses

- You have dependants and want to ensure you claim all related credits and deductions

- Youre retired and receive a pension

- You have medical expenses to claim, including amounts related to COVID-19

- Its your first time filing your taxes in Canada

There are a few situations where youll need to print and mail your return instead of filing online using NETFILE. Dont worry though, you can still enter all your tax info online and well guide you through the process of mailing your return to the CRA.

About Free File Fillable Forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to:

- Choose the income tax form you need

- Enter your tax information online

- Electronically sign and file your return

- Print your return for recordkeeping

If you choose Free File Fillable Forms as your Free File option, you should be comfortable doing your own taxes. Limitations with Free File Fillable Forms include:

- It won’t give you guidance about which forms to use or help with your tax situation

- It only performs basic calculations and doesn’t provide extensive error checking

- It will only file your federal return for the current tax year

- No state tax return option is available

- You can’t make changes once your return is accepted

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

You May Like: How To Get Pin To File Taxes