If Your Individual Tax Return And/or Refund Have Been Impacted

You can report a tax return preparer for misconduct, such as:

- Filing an individual Form 1040 series return without your knowledge or consent.

- Altering your tax return documents.

- Using an incorrect filing status to generate a larger refund.

- Creating false exemptions or dependents to generate a larger refund.

- Creating or omitting income to generate a larger refund.

- Creating false expenses, deductions or credits to generate a larger refund.

- Misdirecting your refund.

How you report a tax return preparer for misconduct associated with your individual tax return depends on whether or not you received a notice or letter.

|

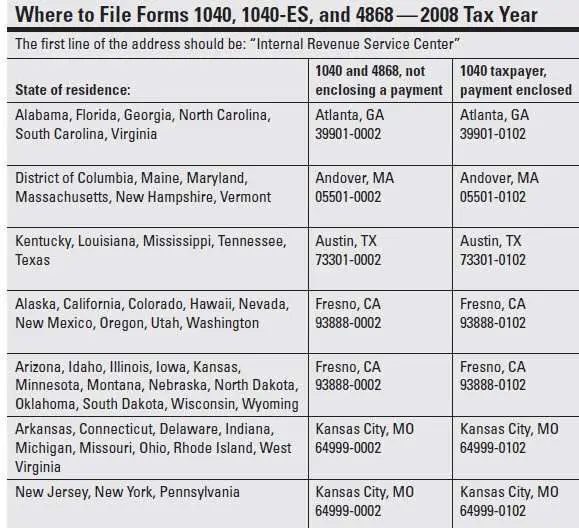

If you received a notice or letter from the IRS Complete Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit PDF, and Form 14157, Complaint: Tax Return Preparer PDF. Mail them with all supporting documentation to the address where you would normally mail your Form 1040. |

Chat Or Email The Irs Online

If you are not in a hurry, you can just send a message to the IRS.

The website accepts both chat and email messages. The IRS usually sends a reply within 48 business hours.

Send a message to their IRS Navigate page. Just make sure you only send one email, since duplicated emails will result in delays.

You can also try the IRS email address at if you want to have an electronic record in your email.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Read Also: How Do I Protest My Property Taxes In Harris County

Can I Report State Tax Fraud

The IRS deals with federal income taxes. If you suspect a person or business of committing tax fraud at the state level, you should contact the states department of revenue or other taxing body to learn how to report the information. States have their own forms and rules for reporting fraud.

For example, Colorado allows citizens to report suspected tax fraud online or by mail. South Carolina accepts its fraud complaint forms via email or mail. And New York accepts reports of tax evasion and fraud via an online submission form, phone, fax or mail.

Need Help Try Contacting Your Local Irs Office

If you cant reach a real person over the phone, you can contact your local IRS office. The Taxpayer Assistance Center operates by appointment only, where you can get help directly from an agent.

The IRS also provides a great service called the Taxpayer Advocate. to find a Taxpayer Advocate in your area.

You May Like: Do Businesses Get Tax Refunds

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Here’s How To Check Your Child Tax Credit Payment Status

The easiest way to see what’s happening with your previous checks is to log in to the IRS Update Portal to view your payment history. To use it to manage all of your advance payments, you’ll need to first create an ID.me account.

If the portal says your payment is coming by mail, give it several business days to arrive. If you have direct deposit set up, make sure all the information is accurate. If you haven’t set up banking details in the portal, or if the bank account on file with the IRS has closed or is no longer valid, you should expect all further payments to come as paper checks.

If your payment history in the portal says that the money was sent by direct deposit, check your bank account again in the next few days to make sure it’s cleared. According to the White House website, transactions will show the company name “IRS TREAS 310” with a description of “CHILDCTC” and an amount for up to $300 per kid . Don’t get this deposit confused with those for stimulus checks, which show up as “TAXEIP3” when deposited. Also, if you’re waiting on a tax refund, it’ll show up as “TAX REF.”

Follow Up As Required

It turned out my taxes hit some kind of system error. The first time I called, after the 21-day mark, they said my taxes had an error and the system should resolve the issue itself within the 12-week window after filing.

Once 12 weeks passed, I called again. This time, the gentleman I spoke to said there was a system error that wouldn’t fix itself. He submitted a request to another team to re-process my taxes and said I should get the refund within another eight weeks.

Everyone has a different tax situation. Luckily I wasn’t facing an audit or a penalty. But I did need to call to get my refund resolved. You will probably get different news, but you won’t know until you call to find out.

This article was originally published in August 2019. It was updated in March 2021.

Don’t Miss: Mcl 206.707

Most Americans Agree That Its Everyones Duty To Pay Their Fair Share Of Taxes According To A 2018 Irs Survey Yet Not Everyone Does

While nearly 84% of federal income tax gets paid on time, a gap does exist aptly dubbed the tax gap between how much tax all Americans owe in any given year and how much tax gets paid to the Internal Revenue Service. After factoring in late payments and IRS enforcement efforts, the net tax gap for tax years 2011 through 2013 was estimated at $381 billion per year, according to a September 2019 release from the IRS.

The tax gap matters. The IRS said a 1-percentage point increase in voluntary compliance would bring in about $30 billion in additional tax receipts.

As IRS Commissioner Chuck Rettig noted in a September 2019 IRS news release, Those who do not pay their fair share ultimately shift the tax burden to those people who properly meet their tax obligations.

But honest taxpayers can help the IRS narrow the tax gap. If you suspect that an individual or business has been committing tax fraud, you can report it to the IRS. Doing so can help the IRS enforce tax laws. And you may even be eligible for a cash reward in some cases.

The IRS fraud hotline is one tool to help Americans give the agency information about suspected tax cheating. Lets look at possible signs of tax fraud and some things to know about how the IRS fraud hotline works.

- Fake or altered tax returns

Mistakes On Your Return

If you file an incomplete return or if you have any mistakes on your tax return, the IRS will spend longer processing your return. This will slow down any potential refund. Mistakes could include mathematical errors or incorrect personal information.

Using a tax filing service, such as TurboTax, will likely eliminate mathematical errors from your return. The software will do the math for you. However, its still possible to make a mistake if you are inputting any information manually For example, lets say you manually input the information from your W-2. If you earned $50,000 over the year but you accidentally input $51,000, you may run into problems.

The IRS will contact you if there are any issues with your return. In some cases, the IRS will correct small mathematical errors. That could save you the work of having to file an amended return.

Incorrect personal information will also slow down your return. As an example, lets say you file a joint return and incorrectly input your spouses Social Security number . The rest of the information on your return could be correct, but the IRS may not be able to confirm that because it cant match your spouses SSN.

Also Check: How Can I Make Payments For My Taxes

Contact A Local Taxpayer Advocate

The Taxpayer Advocate Service is an independent organization that operates within the IRS. The TAS helps ensure that all taxpayers are treated fairly. If you are having trouble resolving your tax problem, you can contact the TAS to get assistance from a local advocate. There is at least one TAS office in every state. To find the address and phone number of your local TAS office, visit the IRS Local Taxpayer Advocate page or call 1-877-777-4778. Or you can complete Form 911 and fax/mail it to your local TAS office.

When Preparing To Contact The Irs Be Sure To Have The Following Information Available

When Calling About Your Own Account

- Social Security cards and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you dont have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return

- A copy of the tax return youre calling about

- Any letters or notices sent to you by the IRS

When Calling About Someone Elses Account

- Verbal or written authorization to discuss the account

- The ability to verify the taxpayers name, SSN/ITIN, tax period, form

- IRS PTIN or PIN if you are a third-party designee

- A current, completed, and signed Form 8821, Tax Information Authorization or a completed and signed Form 2848, Power of Attorney and Declaration of Representative

What Does the IRS Help With?

The IRS can assist with concerns such as

Filing requirements/ status/ dependents/ exemptions

|

Department of the Treasury Internal Revenue Service Fresno, CA 93888-0045 |

For certain types of debts, the IRS has the authority to garnish your tax refund.

Common reasons that the IRS will garnish your refund include

- You owe money for back taxes

- You defaulted on a federal student loan

- You owe money for child support

- You filed a joint return and your spouse has outstanding debt

You May Like: Is Donating Plasma Taxable Income

If Your Tax Return And/or Refund Have Not Been Impacted You Can Report A Tax Return Preparer For Improper Tax Preparation Practices Such As:

- Failing to enter a Preparer Tax Identification Number on a tax return or improperly using a PTIN belonging to another individual.

- Refusing to provide clients with a copy of their tax return.

- Failing to sign tax returns they prepare and file.

- Neglecting to return a client’s records or holding the records until the preparation fee is paid.

- Preparing client returns using off-the-shelf tax software or IRS Free File, both of which are intended for use by individuals.

- Falsely claiming to be an attorney, certified public accountant, enrolled agent, enrolled retirement plan agent, or enrolled actuary.

- If you are a tax return preparer and discover that another tax return preparer is committing any of the practices mentioned above.

To report a tax return preparer for improper tax preparation practices, complete and send Form 14157, Complaint: Tax Return Preparer PDF with all supporting documentation to the IRS. The form and documentation can be faxed or mailed, but please do not do both. Faxing and mailing the form may delay the processing of your complaint. Do not useForm 14157:

- If you suspect your identity was stolen. Use Form 14039. Follow Instructions for Submitting this Form on Page 2 of Form 14039.

- To report alleged tax law violations by an individual, a business, or both. Use Form 3949-A. Submit to the address on the Form 3949-A.

| Where to send your complaint |

|---|

| FAX: |

Only Call During Irs Hours

The IRS hours are from 7 a.m. to 7 p.m. in all US timezones from Monday to Friday. This timeframe means you can call as early as 7 a.m. Eastern Standard time and as late as 7 p.m. Pacific Standard Time.

If you are too busy, you may still call outside of their office hours as well. However, expect to get an automated system or a voicemail, which may not provide you with all the information that you need.

You May Like: Have My Taxes Been Accepted

How Do I Reach A Real Person At The Irs

Before calling the IRS, take a deep breath with me.

Please remember that there are some wonderful people working at the IRS. They have families and souls, just like the rest of us. They pay taxes and have to follow the same laws that we do.

With that being said, here are the steps you need to take to reach a real person on the phone at the IRS.

Some Tax Returns Take Longer To Process Than Others For Many Reasons Including When A Return:

- Includes errors such as an incorrect Recovery Rebate Credit amount

- Is incomplete

- Is affected by identity theft or fraud

- Includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit using 2019 income.

- Includes a Form 8379, Injured Spouse Allocation, which could take up to 14 weeks to process

- Needs further review in general

For the latest information on IRS refund processing during the COVID-19 pandemic, see the IRS Operations Status page.

We will contact you by mail when we need more information to process your return.

Also Check: How To Get Tax Preparer License

How To Reach A Taxpayer Advocate

- File Form 911, Request for Taxpayer Advocate Service Assistance, with the Taxpayer Advocate Service or request that an IRS employee complete a Form 911 on your behalf .

800-304-3107866-297-0517

Wheres My Refund? will give you personalized refund informationThe IRS issues more than 9 out of 10 refunds in less than 21 days. Wheres My Refund? has the most up to date information available about your refund. The tool is updated once a day so you dont need to check more often. IRS representatives can research the status of your refund only if youve already checked Wheres My Refund? and its been 21 days or more since you filed electronically, more than six weeks since you mailed your paper return, or if Wheres My Refund? directs you to contact us.

Suspicious e-Mails, Phishing, and Identity TheftThe IRS does not send out unsolicited e-mails asking for personal information. An electronic mailbox has been established for you to report suspicious e-mails claiming to have been sent by the IRS.

Contact Your Local IRS OfficeIRS Taxpayer Assistance Centers are available for when you believe your issue is best handled face-to-face. Before you visit, check hours and services offered. Return preparation services are no longer available at your local IRS office. Use IRS Free File, free brand-name software that will figure your taxes for you. Or visit the nearest volunteer site for free help preparing and e-filing your tax return.

When To Contact The Irs

1. IRS Audit

One of the most common reasons why tax filers contact the IRS is due to receiving a dreaded IRS audit letter. If you receive one, try not to panic as most tax issues are simple to fix. Before you contact the IRS, start by finding out what section of your tax return the government wants to audit. Once you know what the auditor is questioning, you can start gathering the requested information. An audit doesn’t always indicate a problem. You may be getting audited for one of the following reasons:

Random selection and computer screening

This type of IRS audit is selected based solely on a statistical formula. The IRS compares your tax return against “norms” for similar returns. The IRS develops these “norms” from audits of a statistically valid random sample of returns.

Related examinations

The IRS may select your returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for an audit.

2. Missing W-2

Missing tax forms such as a W-2 is another popular reason why filers contact the IRS. However, if you haven’t received your form by mid-February, there are a few options available to you, including contacting the IRS.

Contact your Employer. Ask your employer for a copy. Be sure they have your correct address.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Tax Refund Delay: What To Do And Who To Contact

There are many reasons your tax refund could be delayed. Perhaps your numbers and your employers numbers didnt match. Or you accidentally skipped a lineor an entire form. Or maybe you claimed a credit that the IRS takes longer to check. This year, however, the mostly likely reason your tax refund is delayed is that you filed a paper return.There was an additional backlog of tax returns created by the COVID-19 pandemic. While IRS workers have been back at work for a while, there is always a chance this is still impacting your return. Of course, the reasons for a delayed tax refund before the coronavirus crisis may still apply. Read on for more reasons and how to prevent future delays.

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

What Should I Attach To A Letter To The Irs

Where relevant, such as if you want to file an amended or corrected return, attach the relevant form, completely filled and signed, along with relevant attachments that have changed since your original filing. If your contact information has changed, include your new contact information and phone number.

Recommended Reading: How To Appeal Property Taxes Cook County

Find A Local Taxpayer Clinic

Low Income Taxpayer Clinics help individuals to resolve tax disputes with the IRS, including tax audits, appeals, and collection matters. The LITC Program receives some funding from the IRS, but its considered an independent organization. You may qualify for free or low-cost assistance if you meet certain LITC income requirements and other criteria. Use the LITC map to find your local clinic or see IRS Publication 4134 . For general questions, you can contact the LITC Program Office by phone or by email .