Save The Right Paperwork All Year Long

Stay on top of tax-related paperwork throughout the year it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

Income Requirements For Filing A Tax Return

Your first consideration is how much do I have to make to file taxes?. If your gross income for 2020 is above the thresholds for your age and filing status, you must file a federal tax return next year. See the table below.

Tax-filing earnings thresholds for 2020 taxes| Filing status | |

|---|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, seven states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

Check With Your Tax Preparer

In many cases, your tax preparer may actually be able to access a copy of your W-2. H& R Block, for example, has a free W-2 Early Access service. The service is easy to use and in just three steps, you could have an electronic copy of your W-2.

First, you’ll need to search for your employer in the database using either his name, the company’s name or the employer’s Federal Employer Identification Number . Second, you’ll need to follow the prompts to request a copy of your W-2. Third, you’ll need to pick up the W-2 from your nearest H& R Block storefront.

Note: Should your employer not have uploaded the W-2 in the database at the time of your search, you can put in a request to be notified by email when he or she does finally add it.

Read More:How to Find Your Employer Identification Number

Recommended Reading: Buying Tax Liens California

Can My Tax Service Get My W

Some tax services are able to obtain your W-2 for you electronically before you would receive yours in the mail, or in the event you lost yours. The availability of your W-2 through such services does depend on whether your employer has filed your W-2 yet or not, so it may still take until the end of January to get your W-2 this way.

Not all W-2s will necessarily be available through these services, however, and often if they are, its because your company already provides you with a means to electronically access your W-2 form.

Youre All Prepared To Start Your Tax Return And Then Realize Youre Missing A W

There is little that is more vexing as you prepare to file your taxes than to realize that your W-2 or 1099 form has gone missing. Sure, it could have just been shuffled about with other papers. If you think this is the case, then stop reading now and go tackle that stack of paperwork on your desk.

On the other hand, if you never received it in the first place, even Spring cleaning cant help you. Previous and even current employers often fail to observe due diligence when it comes to providing an employee with necessary tax documents. The task of obtaining them can be quite frustrating as a result.

The situation is usually made worse if you are filing a prior year tax return, at which point a company you worked for years ago may simply have ceased to exist.

Lets take a look at the steps you can take to obtain your income statement. Well even let you know how to file without one altogether.

Read Also: Where’s My Tax Refund Ga

Request More Time To File

If you want to wait for your official W-2, you may need to request more time to file your tax return. Filing Form 4868 will give you an automatic six-month extension to file your 1040.

An extension only gives you more time to file your tax forms. It is not an extension to pay any tax you owe. You must estimate how much tax you owe and include that amount with Form 4868. Interest and penalties may apply if you pay less than what you actually owe, so take your estimate seriously.

Regardless of which approach you take, file your return or extension request by the tax-filing deadline. If your official earnings statement arrives after you’ve filed your taxes, you can amend your tax return to reflect the accurate amount.

How To File Taxes Without A W

Its that time of year again.

The deadline for employers to provide W-2 forms to their employees is February 1, 2021. . But sometimes, for various reasons, employers do not provide W-2s. In some cases, a business has had to close its doors and has chosen not to pay for its former employees to receive W-2s. So, whats a taxpayer to do?

Recommended Reading: How To Buy Tax Lien Properties In California

Its Easy To Lose Your W

E-filing your tax return these days is pretty straightforward. You just plug in the numbers on your W-2 to the online tax application, take the credits and deductions youre entitled to, and VOILA! Couldnt be simpler.

But what happens if you dont have a W-2? Suddenly things get a lot more complicated. Dont worry. There are steps to take to make sure you get your tax return to the IRS.

Tax Credit For Foreign Income

If the country from which you get your income applies taxes and that country has established a tax treaty with the US. You may be able to claim the Tax Credit for foreign income. The expected net result of the tax credit is to ensure that the total income tax you pay is no more than the highest result you would have paid to a single government.

If you hire an accountant or a tax lawyer to calculate your taxes, he or she will undoubtedly apply for the Foreign Income Tax Credit on your tax return. Some tax preparation software programs also include provisions to calculate the Foreign Income Tax Credit, if applicable. If not, choose a different tax preparation program.

Don’t Miss: How To Report Ppp Loan Forgiveness On Tax Return

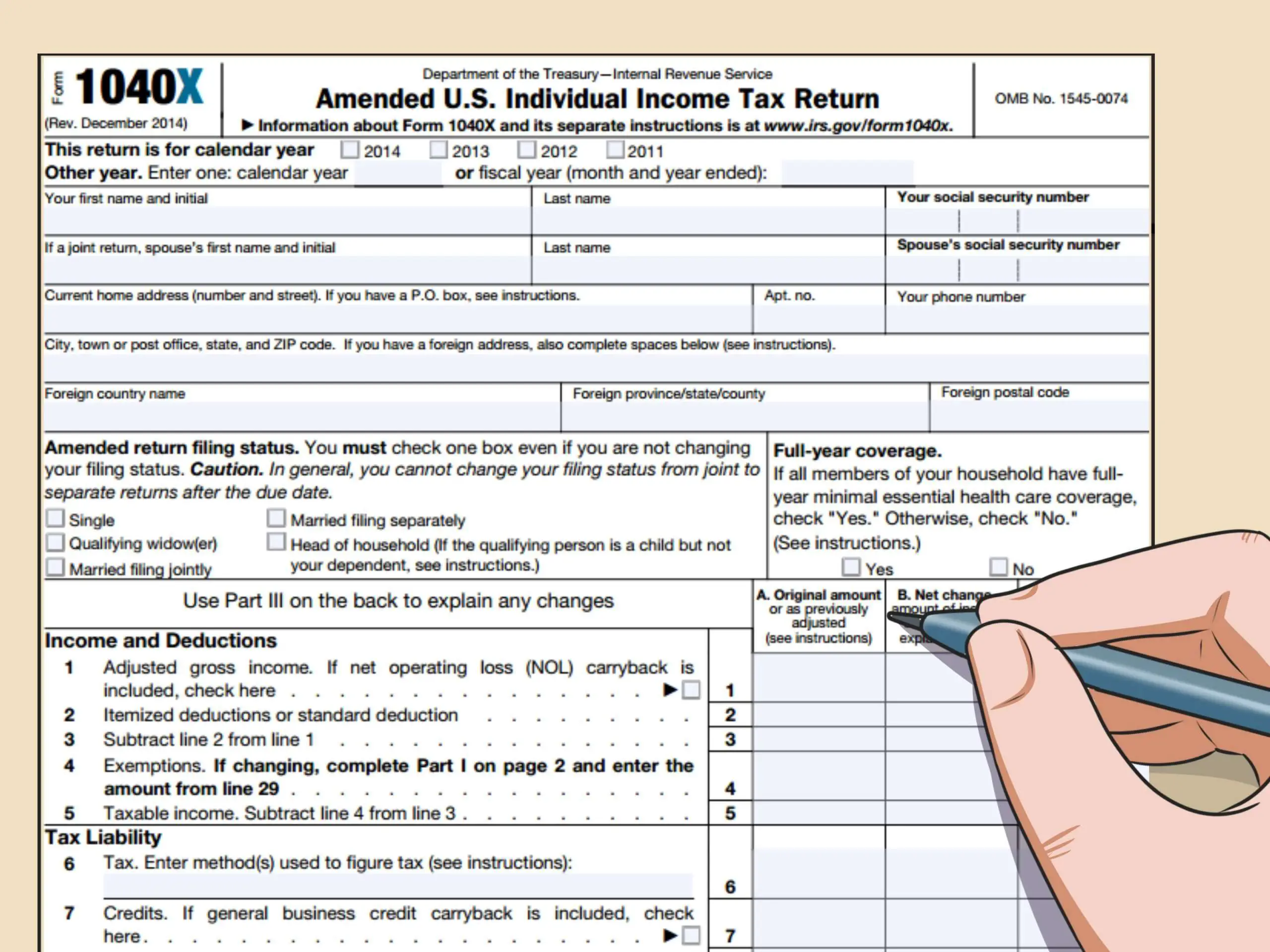

How To File Form 4852

The IRS does not accept online submissions of Form 4852, so you will need to print and mail the required forms to the IRS. To fill out this form, you will need to enter the following:

- Estimated numbers for all wages earned and taxes withheld that would have been listed on your W-2

- A statement explaining how you came up with those numbers

- Your employers name and address

- An explanation of how you tried to obtain your W-2 from your employer

The information you enter on this form can be a good faith estimate, but if you later obtain information suggesting your numbers werent correct, you are required to file an amended return with updated information.

How To File Tax Without W2

If you dont get your W-2 in time to file, use Form 4852, Substitute for Form W-2, Wage and Tax Statement. Estimate your wages and withheld taxes as accurately as you can. The IRS may delay processing your return while it verifies your information.

How do you do your taxes without a W-2?

- How to File Taxes Without a W2 Method 1 of 3: Using Form 4852. Find a copy of your final pay stub for the year. Method 2 of 3: Accessing Your W2 Electronically. Ask your employer if electronic W2s are available. Many employers make electronic W2s available to their employees. Method 3 of 3: Getting a Copy of Your W2. Wait until mid-February to see if your W2 arrives in the mail.

You May Like: How To Buy Tax Lien Properties In California

Do I Get An Automatic Extension If My W

Unfortunately, even if your W-2 took longer to get to you, you must still file or request an extension by the deadline in April, usually the 15th. Filing an extension gives you an additional six months to complete your return. If you are waiting for your W-2 or other forms and the tax deadline is approaching, filing an extension may be a good idea.

Can I File My Taxes Without A W2

Your employer has until January 31 to provide you with a W-2 either by mail or through a website. Make sure that your employers have your current mailing address. If you try to file a return without waiting for the W-2 and the IRS receives your W-2 then your tax return will either be rejected or the IRS will hold your tax return for several weeks or months to investigate the discrepancy.

If you do not receive the W-2 after early February, see this IRS website on how to proceed –

See this TurboTax support FAQ for a missing W-2 –

Recommended Reading: Efstatus/taxact

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

Foreign Income Earned While Existing In The United States

If you reside within the United States full-time, in most cases, you must report income earned from foreign sources on your federal tax return, even if the foreign government taxes them with that income. This requirement refers to income earned and not earned. Self-employed workers who earn income from foreign clients must also report their foreign earnings on their federal income tax returns.

Read Also: Property Tax Protest Harris County

What Happens If You Dont Report Cash Income

Not reporting cash income or payments received for contract work can lead to hefty fines and penalties from the Internal Revenue Service on top of the tax bill you owe. Purposeful evasion can even land you in jail, so get your tax situation straightened out as soon as possible, even if you are years behind.

How To File Your Income Tax Return Without Your W

Your employer is responsible for providing a vital piece to your tax-return puzzle by issuing you Form W-2, Wage and Tax Statement. Without this form, you wont have the information you need to file your tax return, and your anticipated refund may seem unreachable. Remember that if you dont file your return because your W-2 is missing, you will likely be facing a stiff penalty. This seemingly complex dilemma is easily resolved by filing a substitute form as a replacement W-2.

You May Like: How To Get Tax Preparer License

Who Should Expect To Receive A W

In general, you will receive a W-2 from an employer if you earned at least $600 in a given year. You will also receive a W-2 if you had taxes withheld earning any amount from your employer. Note that if you were a contracted individual and not an employee, you will likely receive a 1099 instead of a W-2.

Other Situations That Require Filing A Tax Return

In addition to requirements based on age, your filing status and income, along with rules regarding the Affordable Care Act and self-employment income, there are several other situations that require you to file a tax return.

This includes if you owe any special taxes, such as the alternative minimum tax extra taxes on qualified plans like an IRA household employment taxes for employees like nannies, housekeepers or gardeners or tips you didnt report to your employer. You must also file if you had write-in taxes that might include taxes on group term life insurance or health savings accounts. You also have to file if you have recapture taxes on the profitable sale of an asset.

A second instance in which you have to file a return is if you or your spouse received distributions from a health savings account, Archer MSA or Medicare Advantage MSA.

If you worked for a church or a church-controlled organization that is exempt from paying social security and Medicare taxes and you had wages of $108.28 or more, youre required to file a return.

Finally, if you have a tax liability and are making payments under an installment agreement, you must file a return.

You May Like: How Do I Amend My State Tax Return

Request For Tax Extension If Your W2 Cannot Be Obtained Before The Deadline

If you did not receive your W2 or you do not have your pay stubs, which will also make it difficult for you to fill out a Form 4852, you can ask for a Tax Extension. This will give you an ample amount of time to gather all the necessary documents you need for tax filing. This tax extension will serve as your kosher option while you are waiting for your W2 form.

In order to file for a tax extension, you will use Form 4868. This is the Application for Automatic Extension of Time to File form which can be used by U.S. individuals who are filing their income tax return. You can download this from the IRS website.

Note that even if you filed for a tax extension you are still required to pay the same amount of taxes that you owe if you filed your tax on or before the deadline. With the file extension request, you will be given more time to complete the documents needed for a more accurate filing. However, for individuals who need to pay federal income tax, they have to file on or before the due date.To reiterate, filing your taxes is still possible even without the form W2. Use the form 4852, which is the substitute of form W2. Make sure to do everything according to whats mandated by the IRS.

Tracking Down A Missing W

The W-2 tax form spells out how much you made from your job and how much was withheld for federal income tax, Social Security and Medicare taxes and any state and local taxes. Your employer is required to send it to you each year, and you must file it with your taxes or include the information in your return if you file digitally. If you’re an independent contractor, you will likely receive Form 1099-MISC instead.

If you don’t receive a W-2 from your employer early in the new year, contact your employer to inquire. You may be able to get a second copy printed at work or mailed to you at home. If you have an online human resources or payroll portal, log in to it to see if your W-2 is available to download or print out. Some tax software can also automatically import W-2 forms from certain payroll processors, so this may be an option as well.

If none of this works, you can contact the IRS for help. The IRS will reach out to your employer on your behalf and remind the company of its obligation to send you the form.

Don’t Miss: How To Protest Property Taxes In Harris County

Failure To File Taxes

If you fail to file your tax returns on time you could be charged with a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes. Penalties can be as high as five years in prison and $250,000 in fines. However, the government has a time limit to file criminal charges against you. If the IRS wants to pursue tax evasion or related charges, it must do this within six years from the date the unfiled return was due. Non-filers who voluntarily file their missing returns are rarely charged.

People may get behind on their taxes unintentionally. Perhaps there was a death in the family, or you suffered a serious illness. Whatever the reason, once you havenât filed for several years, it can be tempting to continue letting it go. However, not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.