Comparing Life Insurance Policies

Comparing life insurance policies is the best way to ensure you’re not missing anything in case the worst happens.

Consider whether or not you want to secure life insurance through your superannuation.

The premiums are made with pre-tax income, but they also count towards your concessional contribution cap, limiting the amount you can contribute to your super before facing taxes.

There is also more of a limit on policies you buy through your super.

You can’t secure policies like trauma insurance, which you may benefit from.

Either way, it’s important to arm yourself with knowledge when choosing a life insurance provider.

Get started with our comparison tool today.

This guide is of an informative nature only and not representative of Compare Club products. It should not be taken as medical or financial advice. Check with a financial professional before making any decisions.

Our Services

You Withdraw Money From Cash Value

If you have a cash value life insurance policy, you can generally access the money through a withdrawal or loan, or by surrendering the policy and ending it.

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy. When you pay premiums, the payments generally go to three places: cash value, the cost to insure you, and policy fees and charges. Money within the cash value account grows tax-free, based on the interest or investment gains it earns . But once you withdraw the money, you could face a tax bill.

Money thats withdrawn is generally made up of two parts:

- Money that came from premium payments you made. This component of a withdrawal is not taxable. In the life insurance industry this part is called the policy basis.

- Money that came from interest or investment gains. This portion is subject to income taxes. Your life insurance company will be able to tell you what amount in a withdrawal is above basis and taxable.

If your life insurance policy is a modified endowment contract, or MEC, different tax rules apply and its best to consult a financial professional to understand tax implications.

Estate And Inheritance Taxes

One poor decision that investors seem to frequently make is to name “payable to my estate” as the;beneficiary;of a contractual agreement, such as an IRA account, an annuity, or a life insurance policy. However, when you name the estate as your beneficiary, you take away the contractual advantage of naming a real person and subject the financial product to the probate process. Leaving items to your estate also increases the estate’s value, and it could subject your heirs to exceptionally high;estate taxes.

Section 2042 of the Internal Revenue Code;states that the value of life insurance proceeds insuring your life is included in your gross estate if the proceeds are payable: to your estate, either directly or indirectly or to named beneficiaries if you possessed any “incidents of ownership” in the policy at the time of your death.

Read Also: Do You Have To Claim Social Security On Taxes

Are Life Insurance Proceeds Subject To Creditors

In general, when a life insurance policys proceeds pay out, these proceeds usually only become taxable when the policy holder names his or her estate as the beneficiary.; In the event the policy holder named another person as the beneficiary, these policy proceeds will be exempt from the policy owners creditors unless the death benefit proceeds revert to the deceaseds estate.

However, in the event the beneficiary has money owed to creditors, these life insurance proceeds do not automatically become exempt from creditors, unless the state has specific state protection laws in place.

If you purchased a term life insurance policy through a company like Fabric and named a beneficiary who is not your estate, a minor, or otherwise disqualified from having these life insurance proceeds avoid taxation, you will not have the proceeds go to a creditor.

- Online application and policy origination process with potential for medical exam

- Sells term life insurance , accidental death policies

- Coverage up to $5,000,000

- 10, 15 and 20 year terms available

- Premium covers any age while Instant covers up to age 60

When You Have An Alimony Agreement That Went Into Effect Before 2019

Life insurance tied to divorce proceedings is usually not tax-deductible. The exception is if you have an alimony agreement or divorce decree that both:

-

Requires you to purchase life insurance on behalf of your ex-spouse

-

Went into effect before 2019

Any alimony agreements that took effect in 2019 or later are not eligible for this deduction because of recent tax code changes. If your alimony agreement says you have to name your ex-spouse as the beneficiary of your own policy, those premiums are not deductible.

A tax professional can answer any additional questions you have about whether your premium payments are deductible.

Ready to shop for life insurance?

Recommended Reading: How To Efile Just State Taxes

Profit From Surrendering A Cash

Over time, life insurance policies can build cash value. If you ever decide you don’t want your life insurance policy anymore, you may be able to terminate the policy in exchange for a cash payment. This is known as surrendering a policy. If you do choose to surrender your life insurance policy and earn a profit from doing so, the profit portion of the cash value you receive is considered taxable income.

Will My Beneficiaries Have To Pay Taxes On My Life Insurance Policy

Under current law, death benefit proceeds from life insurance are generally income tax-free. If you name a spouse, child, or other individual as a beneficiary to a life insurance policy you own, that person will not have to report any of the proceeds as income due to your death.

If a beneficiary elects to receive the death benefit in installments instead of a lump sum, any interest portion of the payments is taxable as ordinary income. If a beneficiary keeps the proceeds with the insurer rather than taking receipt, and the proceeds are held in a savings account, any interest earned on the balance would also be taxable. Insurers may use terms such as;assurance or access;to market these types of accounts. In these cases it is always important to comparison shop and review any administrative or maintenance fees, for example what the insurer is offering compared to similar bank savings or checking accounts. One insurer was recently paying 0.110% on a six-figure deposit, when 1.00% was available from a bank.

The income tax-free nature of life insurance makes it a valuable tool for family protection, liquidity and wealth transfers. The best-intentioned plans, however, can go awry if life insurance details are not well incorporated into a complete financial plan.

These are two scenarios where missteps, or missed opportunities, could impact the tax treatment of life insurance:

1. POLICY TRANSFER

2. ESTATE TAXES

You May Like: How To Save Money On Taxes

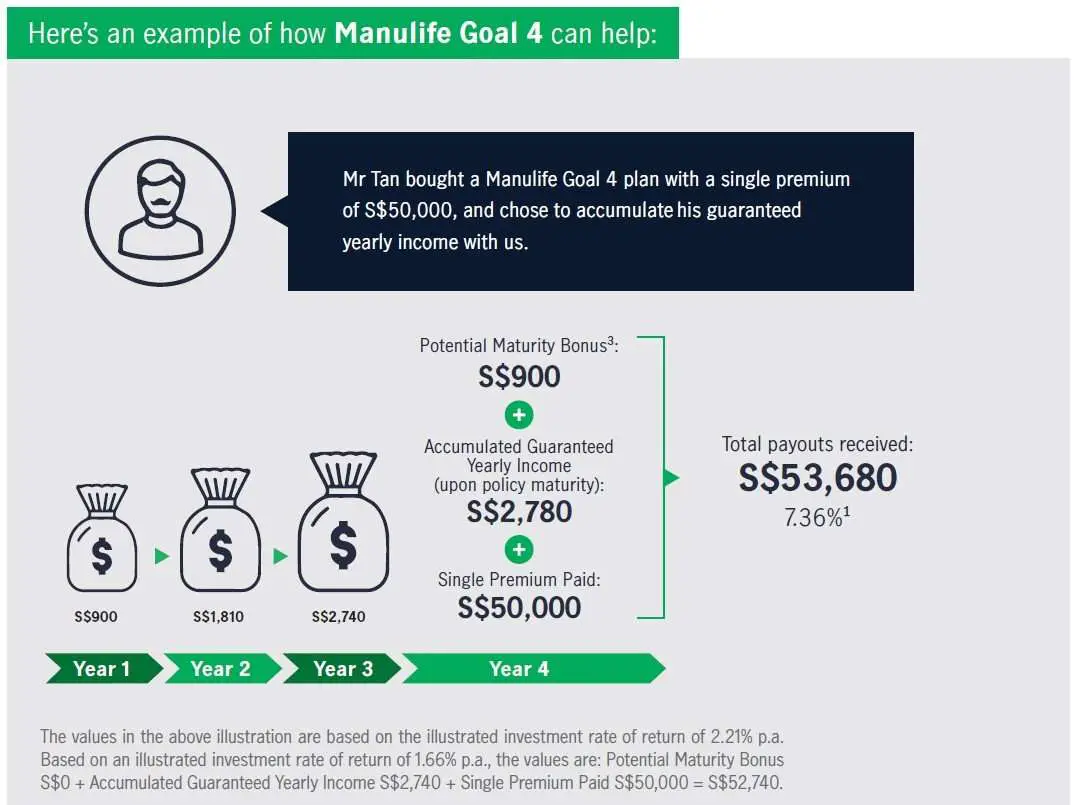

Tax Liability Of Single Premium Insurance Policies

Taxpayers may not be sure about how payouts from a single-premium insurance policy must be treated. Let us understand the taxability with an example. Consider that Sandesh had taken a policy from an insurance company with a maturity value of Rs 1,10,000. He paid a single premium of Rs 45,000 on 16 September 2013. 10% of the premium works out to be Rs 11,000. The premium of Rs 45,000 exceeds 10% of the sum assured. Therefore, the insurance maturity proceeds are taxable, and not entitled to exemption under section 10 of the Income Tax Act. Sandesh surrendered the policy on maturity on 16 September 2019. Since the maturity payment is above Rs 1 lakh, the insurance company is liable to deduct tax on the maturity proceeds. The insurance company is liable to deduct tax at 5% of the income component of the payment, before releasing the payment to the taxpayer. Here, the TDS would be on the net maturity proceeds i.e., on Rs 65,000 . The TDS would be 5% on Rs 65,000 amounting to Rs 3,250. The net proceeds receivable by Sandesh would be Rs 61,750 . While filing his income tax return, Sandesh should report the net maturity proceeds under âincomeâ from other sourcesâ. Also, Sandesh can claim the credit for TDS of Rs 3,250 against his tax liability determined while filing his return of income.

Browse by Topics

Life Insurance And Taxes

The proceeds your beneficiaries collect known as a death benefit are generally income tax-free.

- Individuals cannot deduct life insurance premiums on their tax returns.

- The same is generally true for businesses. Businesses cannot deduct life insurance premiums except in certain limited situations.

When you use a cash-value life insurance policy for income, the tax impact depends on your approach.

- Withdrawal. Unless you have a modified endowment contract , withdrawals up to your policys investment in the contract are generally tax-free. Your investment is generally the total amount of money you have paid in premiums. Withdrawals beyond your investment are generally taxable.

- Loan. Amounts you borrow from a non-MEC policy are generally tax-free, though tax consequences can occur upon any surrender or lapse of the policy.

- Surrender or sell. When you surrender a policy for cash, any gains you have accrued are taxed as income. In addition, a loan balance may be taxable. If you choose to sell your life insurance policy to someone else, you will not only lose the rights to the death benefit, but you may owe taxes as well.

- MEC policies. MEC policies are subject to less favorable tax rules for withdrawals and loans, as well as a potential 10% tax penalty for taxable amounts received prior to age 59 ½.

Also Check: How To See My Past Tax Returns

When You Have A Cash Value Life Insurance Policy

Term life insurance policies are straightforward in that the policy guarantees your beneficiaries a death benefit, and nothing more. But permanent policies like whole life insurance come with an investment-like cash value component, which can complicate your tax situation.

The cash value of a policy can increase over the years , above a guaranteed minimum interest rate. Cash value gains are tax-deferred, like the gains in a 401. Withdrawals less than or equal to what youâve paid into the policy, known as the cash basis, are not taxable. However, withdrawals greater than the cash basis are taxable.

You can also take out a loan against your cash value amount. Any unpaid loans are taxable income.

Permanent policyholders can also surrender a policy for a cash amount. If you make a profit from the surrender or have an unpaid policy loan when you surrender your coverage, itâs taxed as income.

Ready to shop for life insurance?

Cash Surrender Is Partially Taxable

When you surrender a policy for cash, you may have to pay tax on any proceeds that exceed the cost of the policy. This usually includes the total amount in premiums that you paid for the policy, minus any rebates, dividends, unrepaid loans or refunded premiums that arent otherwise included in the income you report to the IRS.

Read Also: When Is Sales Tax Due

Is A Life Insurance Payout Taxable

One of the perks of a life insurance policy is that the death benefit is typically tax-free. Beneficiaries generally dont have to report the payout as income, making it a tax-free lump sum that they can use freely.

That being said, there are exceptions. Although rare, the life insurance payout can be taxable in the following situations:

The insurer issues the death benefit in installments

Instead of a lump sum payout, the life insurance beneficiary might receive the death benefit in installments. If this happens, the insurer typically holds the principal amount in an interest-bearing account and issues a percentage of the death benefit over a set number of years. Although the original death benefit is tax-free, the interest that accumulates is subject to income tax.

The death benefit becomes part of your estate

The federal estate tax exemption limit is $11.58 million, which means if your estates total taxable value is greater than this amount, the IRS levies an estate tax. The bottom line is that if you know your estate wont exceed $11.58 million, you dont need to worry about this tax. Plus, proceeds left to your spouse are typically exempt from estate tax, even if they exceed the federal limit.

The policy involves three different people

The death benefit may be subject to gift tax if different people fill each of the policys three roles:

The insured: The person whose life the policy covers.

The policy owner: The person who buys and/or owns the policy.

When Your Life Insurance Policy Goes Into A Taxable Estate

If the beneficiary isnt named in your policy, your life insurance benefits will go into a taxable estate. The first $11.7 million is not taxed at a federal level this is the threshold. Anything above this amount is subject to being taxed. State regulations have a lower chance of exemption and vary depending on location.

Peace of mind doesn’t have to break the bank

Dont wait until its too late. Help cover yourself and your family with affordable coverage from Aflac.

Don’t Miss: How Much Does H&r Block Cost To File Taxes

Can I Use An Irrevocable Trust To Shield My Death Benefit From Taxes

Some people with larger estates may consider naming the beneficiary in their life insurance policy as an irrevocable trust. This way, the life insurance payout will not be considered part of the estate of the insured, which lowers the estate value and the potential for estate taxes.

The trust itself has its own tax ID number and will receive the death benefit directly at the death of the insured. Afterward, the trustee of the trust will distribute the funds to the beneficiaries named in the trust. Even a skip person will escape paying income taxes on the trust assets they receive.

Here are two ways to look at trusts and taxes:

If you set up the irrevocable trust from the beginning as the owner and the beneficiary of the life insurance policy, then the death benefit is in force with no taxes due from day one.

If, however, you set up the trust and transfer the policy into the trust, a three-year implementation period comes into play to prevent people from undertaking last-minute sneakiness to avoid taxation.

If you can set up a trust so that all the is are dotted and the ts are crossed, its all good. It will be available for your heirs to use to pay any estate taxes on your other assets. But its really not practical except for estates worth over the magic number of $11.4 million and should be set up by an estate law professional who does this all the time. ;

Will My Spouse/children Pay My Taxes After I Die

Your taxes will need to be paid out of your policy, first and foremost. Life insurance proceeds may be used to pay for taxes owed by the deceased, says Wouters. Debts and taxes have to be paid before distributions may be made to heirs from an estate. He adds that life insurance can speed up the process of distribution of assets from the estate.

Read Also: How Do You Report Bitcoin On Taxes

Earnings From Investing Or Saving The Payout

Lets say you split up your $300,000 insurance payout and invest half of it in stocks and save the other half in an interest-earning savings account. Any interest you earn must be reported on your tax return. Likewise, if your invested money increases in value from $150,000 to $180,000 and you sell your stock, youll pay taxes on the $30,000 you gained if your taxable income is $78,750 or higher, in most cases. The only part of the insurance payout thats tax-free is the value of the policy on the date of death, according to the IRS.

Taxes On Life Cover Outside Super

Payouts from a personally-held life insurance policy are generally tax-free when paid to your nominated beneficiaries. However, the lump sum benefit is almost always taxed if life insurance is for a key person, for example, the policy is owned by a business and the insured is a director. Please see Keyman Insurance for more information.

Don’t Miss: Where To File Taxes For Free

When You Receive An Incremental Payout

The death benefit is most often paid as one lump sum of money. However, your beneficiaries can choose to receive it in incremental payouts, also known as an annuity. This more closely resembles an income stream and can be helpful for beneficiaries who might be overwhelmed by a large one-time payout while grieving.

However, if a beneficiary elects to receive payouts as an annuity, the funds will accrue interest over the years. The beneficiary wonât be taxed on the benefit, but may be taxed on any interest gained. This is an important extra cost to keep in mind and an argument for taking the death benefit as a lump sum.

Using Life Insurance To Reduce Tax On Your Final Return

Instead of naming someone as the beneficiary of your life insurance account, you may name your estate as the beneficiary.

- The CRA does not charge inheritance taxes.

- Whoever inherits your estate does not have to pay tax on it.

- If you have a life insurance policy, you can ensure it is used to cover your final taxes so your heirs can inherit as much as possible.

However, the agency requires your representative to file a final tax return on your behalf. For the purposes of this return, it assumes you have disposed of all of your assets, and it assesses your capital gains tax as relevant. Once those taxes have been settled, the remainder of your estate passes to whomever you have named in your will.

Don’t Miss: Who Can I Call About My Tax Refund