Do I Pay Short Or Long Term Capital Gains In A Roth Ira

Roth IRAs have only been around for a little over two decades, yet theyve completely changed the way Americans save for retirement. Although Roth IRAs offer the same tax deferral as standard IRAs, they also have special rules that make their earnings tax-free. This means that, for the most part, taxpayers dont have to be concerned about the nature of the income and gains generated by their Roth IRA. Investors in Roth IRAs can only claim losses in unusual circumstances, and given the nature of the stock market, this happens infrequently.

In general, IRAs make it much easier to tax your investments than it would be in a taxable account. Regular account investors must decide whether their gains are subject to relatively high short-term capital gains rates or lower long-term capital gains rates. The length of time you hold an investment can have a significant impact on your after-tax return, so it may be worthwhile to hold off on selling until your profits are qualified for long-term treatment.

Sales of investments within your retirement account in a typical IRA have no immediate tax consequences. Any gain is delayed, and any tax on that gain or other parts of the accounts income isnt owed until the money is withdrawn in traditional IRAs. Furthermore, the IRS does not care whether the revenue created was short-term or long-term in nature at that moment it will impose the ordinary income tax rate regardless.

Can I Deduct 2020 Margin Interest

You may be eligible to deduct your investment interest charges if you itemize your deductions. The interest paid on money borrowed to buy taxable investments is referred to as investment interest expense. This includes margin loans for stock purchases made through your brokerage account. You may be allowed to deduct the interest on the margin loan in certain situations.

Can I Actively Trade In My Roth Ira

You can trade actively in a Roth IRA

But theres no rule from the IRS that says you cant do so. For example, while brokers wont charge you if you trade in and out of stocks and most ETFs on a short-term basis, many mutual fund companies will charge you an early redemption fee if you sell the fund.

Also Check: Mcl 206.707

Are Roth Ira Withdrawals Tax

Your withdrawal from a Roth IRA isn’t taxable under three circumstances:

Roth IRA contributions are made with after-tax dollars. You can’t take a tax deduction for them at the time you make them. Therefore, you can withdraw your contributions at any time without paying tax again.

If I Buy Stock For My Roth Ira Do I Pay Taxes On Dividends

There are two primary ways of making money on stocks. When you buy shares of stock for one price and then sell that stock at a higher price, you have capital appreciation. When the company’s board of directors votes to return a portion of the profits generated by the company to the shareholders, you have dividend income.

Both capital gains and dividend income are subject to taxation when you file your federal income tax return. But if you’re wondering whether Roth IRA dividends are taxable, know you you can shelter your stock gains from federal income taxes if you hold the stock in your Roth IRA.

You May Like: Reverse Ein Search

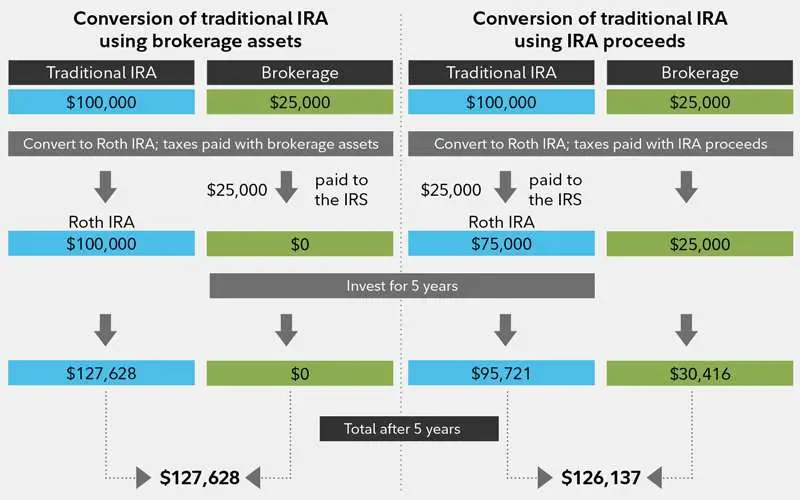

What Else Could A Conversion Affect

Health care is an important part of the Roth conversion puzzle. If the conversion would push your taxable income above a certain threshold, your Medicare Part B premiums could go up. Converting too much could also cause a larger percentage of your Social Security benefits to be taxed. If you are under age 65 and not yet eligible to qualify for Medicare, and no longer covered by an employer plan, then you likely are looking at Affordable Care Act Marketplace plans for your health insurance needs. ACA plans provide premium tax credits to families whose income falls between 100% and 400% of the federal poverty level. However, theres a subsidy cliff at the 400% poverty level, meaning if you make $1 too much, you have to pay the full-priced premium. These subsidies can equate to thousands of dollars a year, so disqualifying yourself through Roth conversions can be a serious cost.

Theres some good news, though. The American Rescue Plan Act of March 2021 increased the subsidies and allowable income for 2021 and 2022. This gives those on Marketplace plans an opportunity to convert to a Roth IRA without losing their health insurance subsidies because of the temporary increase in income.

What Is A Roth Ira

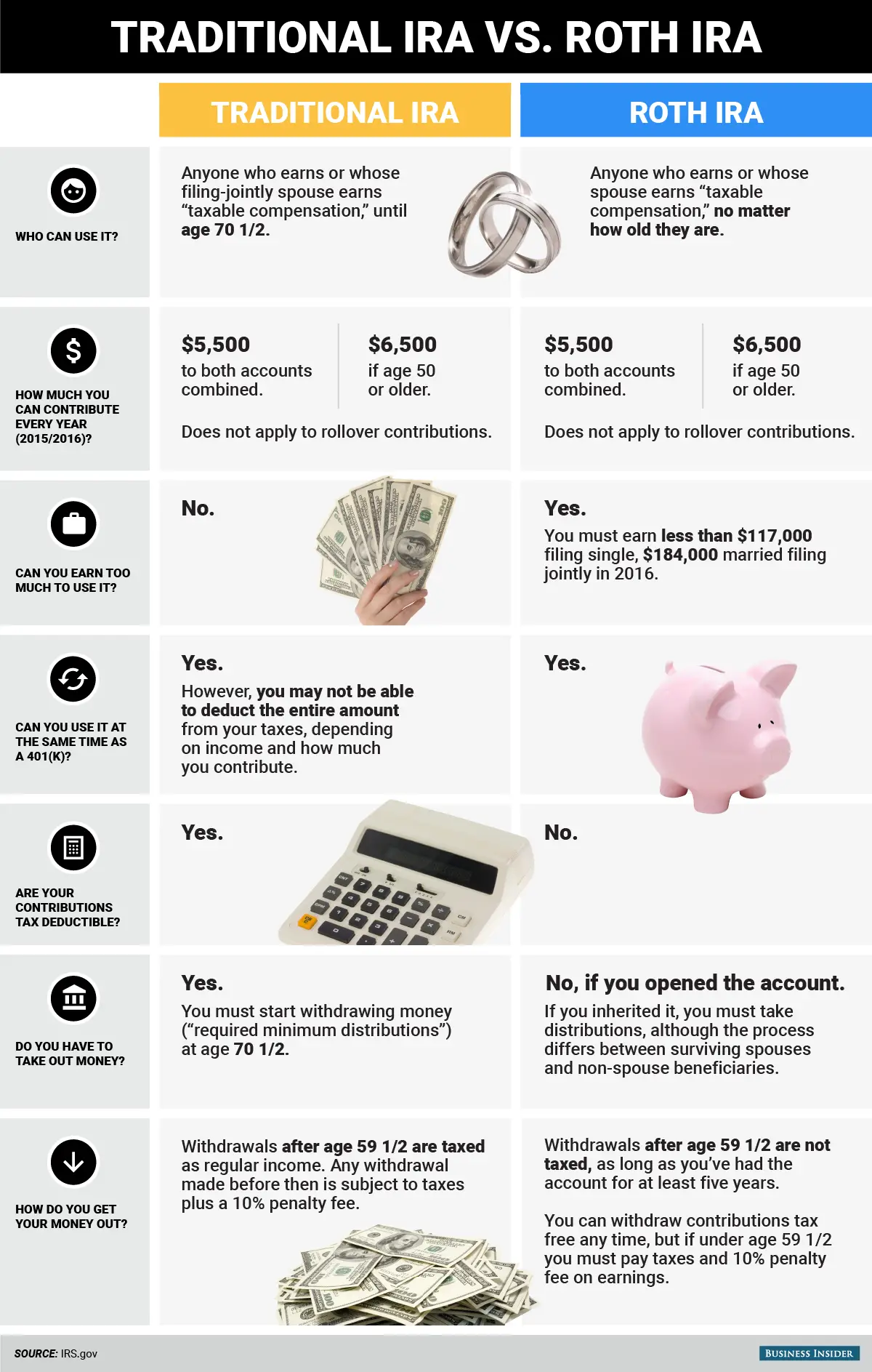

Like a traditional IRA, a Roth IRA is a retirement account you open yourself at a brokerage. Where they differ, though, is in their tax treatment. Traditional IRAs are tax-deferred, which allows for a tax deduction, while Roth IRAs are funded with after-tax dollars. As a result, you cant deduct your Roth IRA contributions from your taxable income.

The major benefit of a Roth IRA is that you can make tax-free withdrawals once you retire. While theres no upfront deduction while youre saving, your after-tax contributions grow and compound over time, and then can be withdrawn with no income taxes whatsoever.

You May Like: Appeal Property Tax Cook County

You Pay Taxes Up Front But Withdrawals Are Tax

How exactly is a Roth 401 taxed? The essence is that you don’t get a tax deduction when you contribute part of your pay to it, just as you get with a traditional 401. Instead, a Roth 401 allows employees to contribute after-tax dollars. The payoff is that this money and its earnings over the years are not subject to income tax when you withdraw them after retiring.

These plans have only been available since 2006, but they are gaining in popularity as a way to establish a retirement income that is free from tax liability.

Not all company-sponsored retirement schemes offer a Roth 401. But in just the last five years, the percent of plans offering Roth in 401s have increased by 29%. This option has been increasingly popular with younger participants and contributions are also on the rise. Millennial Roth IRA accounts increased 58.5% in Q3 2021 YTD compared to Q3 2020 YTD, with overall dollar contributions increasing 58.1%.

Which You Should Choose

Traditional and Roth IRAs both are tax-advantaged ways to save for retirement. While the two differ in many ways, the biggest distinction is how they are taxed.

Traditional IRAs are taxed when you make withdrawals, and you end up paying tax on both contributions and earnings. With Roth IRAs, you pay taxes upfront, and qualified withdrawals are tax-free for both contributions and earnings.

This is often the deciding factor when choosing between the two.

Read Also: Is Selling Plasma Taxable

Are Ira Management Fees Deductible

Fees paid from an IRA account are never deductible on your federal tax return.

Furthermore, according to the Tax Cuts and Jobs Act , which Congress enacted into law on December 22, 2017, separately-paid IRA management fees are no longer deductible in tax years 2018 through 2025.

Are Roth Ira Management Fees Tax Deductible

When analyzing my customers tax returns, I frequently come across a common blunder: the failure to deduct investment management costs. Far too frequently, these expenses are handled incorrectly deductions are made when they shouldnt be, and no deductions are made when they should be. The answer to this question, like most tax-related questions, is more complicated than a simple yes or no.

In the end, the answer is determined by how management fees are paid. When paid from a taxable account, investment management fees can be deducted as an itemized deduction. A non-retirement account, to put it simply. Schedule A, under Job Expenses and Certain Miscellaneous Deductions, lists the deduction. The deductible part of any item stated in this section must exceed 2% of your adjusted gross income . For example, if your AGI was $100,000 and you had $3,500 in miscellaneous deductions, your deductible amount would be $1500 .

When investment management costs are paid directly from a qualified retirement account, such as an IRA or a Roth IRA, they cannot be deducted as an itemized deduction. When fees are paid from an IRA, they are paid entirely with pre-tax funds and are never reported as taxable income. Fees are paid with tax-free funds when paid from a Roth IRA. Taking an itemized deduction for management fees paid from a qualified retirement account that already qualifies for preferential tax treatment would, in our opinion, be regarded double dipping.

Don’t Miss: Employer Tax Identification Number Lookup

Consideration #: You Dont Ever Have To Pay Capital Gains On Stocks That You Never Sell However Never Harvesting Any Capital Gains Can Make Rebalancing More Difficult Down The Road

This is something I see quite often in clients. A clients investment account, which used to be smaller than their retirement accounts, ends up with a couple of blue-chip holdings .

After a while, those investments become outsized parts of the entire portfolio. In one extreme example, a client bought $1,500 of Microsoft in 1990 that is now valued at over $400,000 today. Fortunately for that client, Microsoft isnt an outsized part of the portfolio, so we are able to still rebalance tax-efficiently in other accounts.

But if most of your money is locked up in an employer-sponsored plan with limited options, or if your appreciated holding becomes a significant part of your overall investments, then you might have difficulty when you look to rebalance down the road.

No Roth Ira Taxes On Earnings

One thing about Roth IRA taxes is that Roth IRAs offer one of the sweetest tax benefits you can find for your retirement savings: Youll never pay tax on any investment returns you earn in your account, as long as you play by the Roth IRA withdrawal rules and don’t withdraw your investment earnings early.

While you can withdraw your contributions at any time without tax or penalty, you need to leave your investment earnings in the account until at least age 59½ or face a fairly steep 10% penalty plus income tax on what you withdraw .

|

no promotion available at this time |

Promotioncareer counseling plus loan discounts with qualifying deposit |

Promotionof free management with a qualifying deposit |

Also Check: Amend Tax Return Online For Free

You Can Still Recharacterize Annual Roth Ira Contributions

Prior to 2018, the IRS allowed you to reverse converting a traditional IRA to a Roth IRA, which is called recharacterization. But that process is now prohibited by the Tax Cuts and Jobs Act of 2017.

However, you can still recharacterize all or part of an annual contribution, plus earnings. You might do this if you make a contribution to a Roth IRA then later discover that you earn too much to be eligible for the contribution, for instance. You can recharacterize that contribution to a traditional IRA since those accounts have no income limits. Contributions can also be recharacherized from a traditional IRA to a Roth IRA.

The change would need to be completed by the tax-filing deadline of that year. The recharacterization is nontaxable but you will need to include it when filing your taxes.

Tax Diversification Across Retirement Accounts

For many younger taxpayers or the merely moderately well-off, making a close to definitive conclusion about whether conversion is financially optimal may not be possible. There can be too many uncertainties about retirement year financial circumstances to make an accurate estimate of applicable future tax rates. This is one of the reasons that taxpayers may want to pursue a strategy of tax diversification. In this scenario, taxpayers split retirement accounts between Roth and traditional. This approach effectively hedges the taxpayer against the risk of being in a much higher or lower marginal tax bracket during retirement than they anticipated when they made the decision between traditional and Roth. Tax diversification makes especially good sense for Americans abroad because the complexity of the conversion calculation is augmented by their special tax and planning circumstances.

You May Like: Www 1040paytax

Roth Ira Vs Traditional Ira

When looking at types of tax-advantaged accounts, consider that there are two primary types of individual retirement accounts: traditional IRAs and Roth IRAs. Both types of accounts offer tax deferment on income generated within the account, but they also have some significant differences. You can deduct contributions to your traditional IRA, but you cannot deduct contributions to your Roth IRA.

Qualified withdrawals made from a traditional IRA are taxed as ordinary income in the year they are withdrawn. Qualified withdrawals from a Roth IRA are free from federal income taxes.

Other Factors To Consider With Roth Conversion

The hypothetical Jones family example is a clear case where living abroad creates a great planning opportunity to take advantage of Roth contributions and even conversion before returning to the U.S. State taxes, however, can themselves be hard to forecast.

Where will you retire?

The biggest issue is considering the tax rate of the state in which you expect to retire . If you plan to retire in Florida, or one of the other six states with no income tax, then state tax analysis will have no impact on the Roth conversion calculation. If you expect to retire in one of the states with a relatively low income tax rate, such as Illinois, the role of state taxes may tip the scale in favor on Roth, or it may not. If you expect to retire in a high tax state such as California, New York or Oregon, there is a high likelihood that the inclusion of state taxes into the Roth calculation will yield a recommendation to employ Roth, if that conclusion was not clear already simply based on analysis of federal tax rates. Of course, if you intend to retire abroad, then state taxation is again not to be factored.

Country of Residence Tax Implications

Americans abroad must also consider local tax implications of Roth conversion. In many jurisdictions, IRA distributions could be taxed at rates that make the conversion unattractive.

Changing Tax Policies

Read Also: Is Money From Donating Plasma Taxable

Can Anyone Contribute To A Roth Ira

No, you have to meet certain income qualifications to open and contribute to a Roth IRA, according to the IRS. In 2020, individuals earning up to $124,000 can contribute up to the full limit of $6,000 to a Roth IRA.

Individuals who earn more than $124,000 and less than $139,000 can contribute a reduced amount. Married couples who file taxes jointly can contribute to a Roth IRA if they earn less than $196,000, or a reduced amount for those earning more than $196,000 and less than $206,000.

Can You Have Too Much Money In Tax

View All | April 2017 Newsletter Edition

In some cases, individuals reach a point where deferring taxes to the max is counter-productive.

There are several reasons why this happens. For one thing, while deferring taxes is a good idea when personal tax rates are going down or staying the same, its likely that federal income tax rates have bottomed out and could start heading higher in the future. If this happens, you may be paying significantly higher tax rates on withdrawals from traditional IRAs during your retirement years.

Another thing to remember is that traditional IRAs impose restrictions on your ability to withdraw money before age 59 1/2 without being hit with a 10 percent penalty tax . This can prevent you from taking advantage of some investment opportunities, such as certain real estate deals that cannot be financed with IRA money.

In addition, you could be charged a 50% penalty tax for failing to take required minimum distributions from your traditional IRAs each year after you reach age 70 1/2.

Last but not least, profits earned in your traditional IRAs can never qualify for the reduced federal income tax rates on long-term capital gains and qualified dividends. Instead, all income accumulated in traditional IRAs will eventually be taxed at higher ordinary rates when you take withdrawals. The current maximum federal rate on ordinary income is 39.6% .

These decisions depend on how much tax deferral you already have.

One Size Does Not Fit All

Copyright 2017

Also Check: Www.1040paytax.com Review

What Is The Tax Implications Of Selling A Stock In A Roth Ira That Has A Current Value Of $1500 And A Cost Basis Of $1000

Buying and selling stocks in the Roth IRA has no tax impact at all.

Taking money out of the IRA is the only time it has tax impact, no matter what internal transactions generated the money.

If you are over 59-1/2 and the Roth has been opened at least 5 years, you can withdraw money from a Roth with no taxes or penalties.

If you are under 59-1/2, you can withdraw up to the amount of your original after-tax deposits in the account without tax or penalty. If you withdraw earnings, you will pay ordinary income tax plus a 10% penalty if you are under age 59-1/2 or if you are over 59-1/2 but the account is less than 5 years old.

For example, if you are 35, and funded the Roth IRA with $5000 of deposits, you can withdraw up to $5000 without penalty, no matter what the account is currently worth or how its investments performed. But if you funded your current account with $1000, and are closing it out, you will owe income tax plus a 10% penalty on the $500 of earnings, unless you are both over 59-1/2 AND the account is at least 5 years old.