Do I Need To Put Some Money Away For Tax Payment Each Month

That’s a wise idea. It’s important to provide for these liabilities to ensure that interest charges and late payment penalties do not arise, which can significantly increase your liability. By doing income tax calculation and putting away some money from your earnings each month, say, 25% of your gross earnings, you should have enough money in the bank to take care of your tax bills.

The Two Parts Of Self

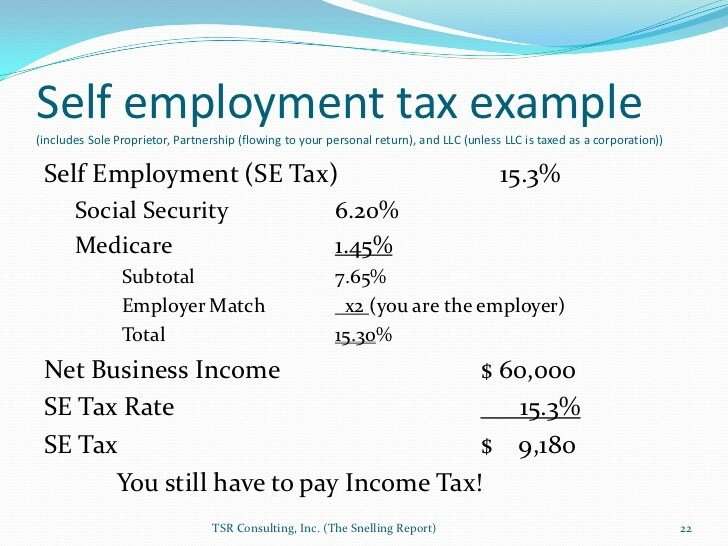

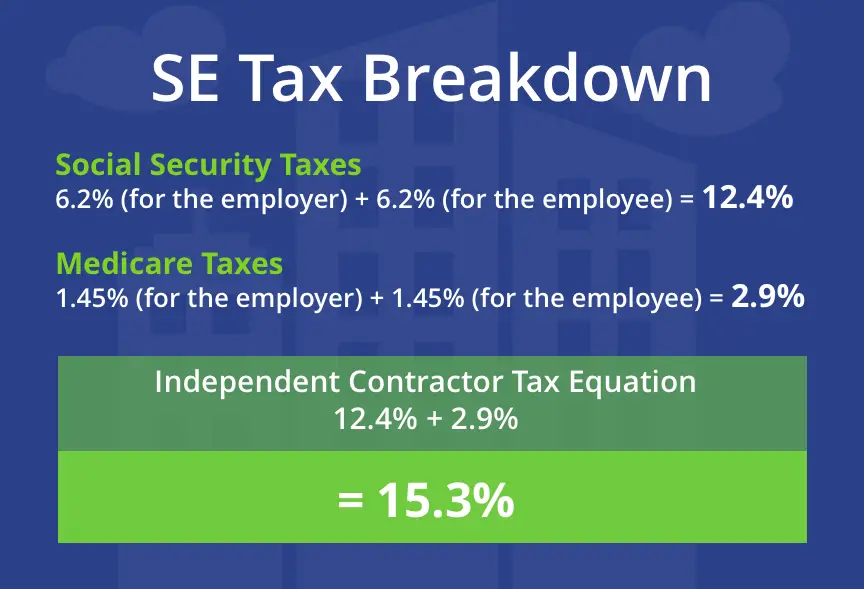

Self-employment taxes are made up of two parts: Medicare and Social Security.

Normally, you pay 6.2% towards Social Security, and your employer pays the other 6.2%. This applies to the initial $128,400 of your salary. After that, you pay 1.45% of your salary for Medicare, with no upper limit.

But if youre self-employed you cover both parts therefore youre paying double these figures. However, you can deduct the amount the employer normally pays.

An additional 0.9% in Medicare taxes are levied if youre a single filer and earned over $200,000. If married and filing jointly, this goes up to $250,000. However, if youre married but filing separately, the limit is only $125,000.

Who Has To Pay The Self

If you earn all your income from being self-employed, you have to pay the self-employment tax. But you also have to pay it if you work a regular job and earn more than $400 a year from a side hustle, gig, freelance workwhatever you call it.2 Do you have to pay the self-employment tax on the money you earn driving for a rideshare company? Yep. Mowing yards? Yep. Selling your handmade friendship bracelets on Etsy? For sure. Any amount over $400 is subject to the self-employment tax. And in a strange piece of tax code, any amount over $108 earned while contracting for a church is taxed.3

But as your income increases, you do get some relief on the 12.4% Social Security portion of the self-employment tax. For the 2021 tax year, the maximum amount of income subject to Social Security is $142,800.4 And this limit can be reached through a combination of what you earn from your regular job, which would already have Social Security taxes taken out, and your side job.

But if your self-employed income exceeds $200,000 as a single filer or $250,000 as married filing jointly, the IRS will charge you an additional 0.9% in Medicare taxes.5

You May Like: How To Get A License To Do Taxes

Federal Income Tax Rates For Self

If youre self employed as a sole-proprietorship or partnership, you must file your personal income tax return and pay the same amount of tax as any employed wage earner. Your business income, after deductions, is considered your annual wage, you report it as professional or business income on a T2125 form.

- 15% on the first $48,535 of taxable income, plus

- 20.5% on the next $48,534 of taxable income , plus

- 26% on the next $53,404 of taxable income , plus

- 29% on the next $63,895 of taxable income , plus

- 33% of taxable income over $214,368

Is Rental Income Subject To Self

On top of paying ordinary income tax on earnings, self-employed taxpayers have to pay an additional tax on earnings. At its current rate of 15.3 percent, self-employment taxes can dig into a taxpayer’s profit margin. Luckily, rental income usually is not subject to self-employment tax. There are some exceptions, however, for real estate dealers and real estate complex owners that provide services to tenants.

You May Like: Harris County Property Tax Protest Services

What If I Have Problems In Completing My Tax Return

If you get a tax return, please do not worry if you are not sure how to fill it in. You can contact HMRC for help. If you are concerned about completing the form contact the phone number on any of your Self Assessment correspondence or HMRCs Self Assessment helpline number. Alternatively, you may wish to contact the charity TaxAid who offer help to those on low incomes with tax problems. They can be contacted via their helpline 0345 120 3779 .

How Can I Best Prepare For My Tax Bill

For most people, setting aside a rough percentage of their net income , will help make sure that their tax bill, along with the payments on account, can be met. Our table may help you work out your rough % using 2021/22 rates :

|

Net income |

Example: Hugh

Hugh began trading as an electrician in April 2021. In the tax year 2021/22, he worked on a number of home renovations and issued invoices as follows:

- Job 1: Labour £3,500, Materials £750, Total: £4,250

- Job 2: Labour £5,250, Materials £930, Total: £6,180

- Job 3: Labour £3,900, Materials £450, Total: £4,350

- Job 4: Labour £1,305, Materials £80, Total: £1,385

- Job 5: Labour £4,870, Materials £310, Total: £5,180

His total income in 2021/22 was £21,345 but his expenses totaled £2,520, so his net income was £18,825. Hugh looks at the table above and decides to put aside 17% of his net income each time his invoices were paid, meaning at the end of the tax year, he had saved £3,200 towards his tax bill. His 2021/22 tax bill looks like this:

Total due by 31 January 2022 £3,156.37

|

Net income |

Don’t Miss: Www.1040paytax.com Official Site

Goods And Services Tax

Businesses that earn over $75,000 per year must register for GST. Once you’ve registered, you must lodge a regular Business Activity Statement to report how much GST your business has collected and is claiming. This may be quarterly or annually.

Easily calculate the amount of GST you have to charge your customers or pay your suppliers.

How To Manage Tax Returns For The First Time

Youll find a lot of guides on our site to help youunderstand your tax responsibilities as a self-employed contractor orfreelancer:

- Going Self-Employed for the First Time Ashort yet detailed guide to the many things youll have to consider as a newlyself-employed person, from your pension plan to your first tax return. Read ourguide togoing self-employed for the first time.

- Allowable Expenses for Self-Employed Workers You only have to pay taxes on your profits. This basically means thatyoure allowed to subtract certain expenses from your tax return, which ofcourse can significantly reduce your ultimate tax bill. You can read our guide to allowableexpenses for self-employed workers.

- Tax Records What records should youkeep, and how long should you keep them? Read our full guide to keepingtax records.

- HMRC and Self-Employed Workers SometimesHMRC investigates small businesses and self-employed workers. Hopefully this isnot something youll ever have to worry about. But its worth knowing the sortof things that might trigger an investigation, so that youll know how to avoidone of your own. Read our guide toHMRC investigations.

Insurance can provide essential protection against many ofthe problems that self-employed workers face, from unpaid invoices to taxdisputes. At Tapoly, we specialise in affordable insurance forself-employed freelancers and contractors, with cover starting from just35p a day.

Recommended Reading: Amended Tax Return Online Free

Never Pay More Than Necessary

Remember that self-employment tax is always levied against the net income from your own business. Any deductible expenses are taken from the total revenue generated by the company. So, then the income is reduced in calculating self-employment tax.

You must, therefore, take every deduction you possibly can. Theyre extremely valuable.

If you happen to owe a large amount in self-employment taxes, you do have the option of making estimated tax payments every quarter. This is important because the IRS can hit you with fines if you dont pay enough throughout the year.

Self-employment taxes are a constant thorn in the sides of the self-employed. Therefore, its important to estimate what you might need to pay in advance to avoid getting stressed out when tax season officially rolls around.

Keep in mind, if you file your taxes online, they will ask you the correct questions to let you know which self-employed tax deductions you qualify for and guarantee you will pay the least amount of tax possible.

Do You Need To Make National Insurance Contributions

National Insurance contributions go towards state benefits, whether thats your pension or welfare support like Universal Credit.

Whereas employees have such contributions taken directly out of their earned income, the majority of self-employed people pay National Insurance contributions, given that theyre making at least £6,515 in profit. Once over this amount, they will pay £3.05 weekly .

If youre self-employed and are making profits of £9,568 or higher, youll pay 9% on profits between £9,568 and £50,270, and 2% on anything above .

Recommended Reading: How To File Uber Taxes On Taxact

Line 8760 Business Taxes Licences And Memberships

You can deduct all annual licence fees and some business taxes you incur to run your business. Some examples of licence fees are: beverage licenses business charges trade licences motor vehicle licenses and motor vehicle registration permits. Some examples of business taxes that may be deductible are: municipal taxes land transfer taxes gross receipt tax health and education tax and hospital tax.

You can also deduct annual dues or fees to keep your membership in a trade or commercial association, as well as subscriptions to publications. You cannot deduct club membership dues if the main purpose of the club is dining, recreation, or sporting activities.

Licences for fishers

Enter the total cost to renew your annual licences. If you bought a licence from another fisher, you can only deduct part of the cost each year. For details on depreciable property, see Chapter 4.

If you bought a fishing boat and the price included the cost of a licence, you need to know what part of the price was for the licence and what part was for the boat. Try to agree on these amounts with the seller. See the example, Tax treatment for fishing equipment.

Exempt On Interest Paid On Loans

Moreover, if youve availed of loans to help you expand your business, the interest on that is also exempt from tax. Availing of such loans is quite easy these days with the pre-approved offers provided by Bajaj Finserv. All you have to do is give some basic information and you can get your pre-approved offer.

DISCLAIMER:While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click onreach us.

*Terms and conditions apply

Don’t Miss: Does Doordash Send You A 1099

Your Share Of Net Income Before Adjustments

On Form T2125 for business and professional income, enter your share of line 9369 on amount 5A.

On Form T2042 for farming income, enter your share of amount 4C on amount 5A.

On Form T2121 for fishing income, enter your share of line 9369 on amount 5A.

This is the amount left after you subtract the amounts that the other partners are responsible for reporting. On the “Details of other partners” chart, indicate the full names and addresses of the other partners, as well as a breakdown of their shares of the income and their percentages of the partnership. You can also get this amount from your T5013 slip.

Contributing To The Canadian Pension Plan

Canadians between the age of 18 to 70 who have net self-employment income and pensionable employment income greater than $3,500, have to contribute to the Canada Pension Plan . Regular workers contribute a particular percentage of their wages above $3,500, up to an annual maximum, while their employer contributes an equal amount. These rates change each year so to be aware of current rates by checking the CRA website, here.

Self-employed Canadians, however, do not have employers deducting CPP from their pay, matching that amount and remitting it to the CRA, so they are responsible for both their portion of CPP and what would have been their employers contribution.

For 2020, self-employed Canadians must prepare to pay to the CRA 10.5% of their income up to a maximum of $5,796.00.

Recommended Reading: Www.1040paytax.com Review

Line 9814 Salaries Wages And Benefits

You can deduct employees’ gross salaries and other benefits you incurred. Do not deduct salaries or drawings paid or payable to yourself or a partner. For more information, see Part 9 Details of equity.

As the employer, you must deduct your part of CPP or QPP contributions and employment insurance premiums. You can also deduct workers’ compensation amounts payable on employees’ remuneration and Provincial Parental Insurance Plan premiums. The PPIP is an income replacement plan for residents of Quebec. For details, contact Revenue Québec. For more information on making payroll deductions, go to Payroll.

You can also deduct any insurance premiums you pay for an employee for a sickness, an accident, a disability, or an income insurance plan.

You can deduct the salary you pay to your child, as long as you meet all these conditions:

- you pay the salary

- the work your child does is necessary for earning farming income

- the salary is reasonable when you consider your child’s age, and the amount you pay is what you would pay someone else

Keep documents to support the salary you pay your child. If you pay your child by cheque, keep the cancelled cheque. If you pay cash, have the child sign a receipt.

Instead of cash, you may pay your child with a product from your business. When you do this, claim the value of the product as an expense and add to your gross sales an amount equal to the value of the product. Your child has to include the value of the product in his or her income.

What Happens If I Dont Pay Self

If you estimate that youll owe at least $1,000 in tax for the year and dont pay your self-employment tax on time , you could end up owing a penalty for underpayment of estimated tax or if you pay your estimated taxes late. This is true even if you are due a refund when you file your return.

The IRS calculates your underpayment penalty by figuring out how much you should have paid for each of the four quarterly installments, then multiplying the difference between what you paid and what you should have paid by the effective interest rate for the period. The effective interest rate is set quarterly. For the third quarter of 2018, the effective interest rate for underpayments is 5%.

The penalty is calculated separately for each installment due date, so you can be charged a penalty for one quarter but not the others.

Recommended Reading: How Do Taxes For Doordash Work

Is A C Corporation Eligible For The Qualified Business Income Deduction

No. According to the Internal Revenue Service , income earned through a C corporation or by providing services as an employee is not eligible for the deduction. A C corporation files a Form 1120: U.S. Corporation Income Tax Return, and it is not eligible for the deduction. You also cannot deduct any portion of wages paid to you by an employer and reported on a Form W-2: Wage and Tax Statement. Independent contractors and pass-through businesses are eligible for the deduction. They report their percentage of business income on a Schedule C: Profit or Loss from Business that accompanies the Form 1040: U.S. Individual Tax Return.

Can Llc Members Avoid Or Reduce Self

LLC owners choose to lessen their individual self-employment tax burden by electing to have the LLC treated as a corporation for tax purposes.

Classification as an S Corporation is what most LLCs select when aiming to minimize their owners self-employment taxes. S Corporations remain a pass-through tax entity, so profits and losses of the business flow to the individual owners just as with a disregarded entity LLC. However, LLC members who work on the business are considered employees. As such, they only pay Social Security and Medicare taxes on the wages and salaries they get from the business. The individuals pay half of the FICA taxes, and the business pays the other half.

You might be wondering how this can save money since, ultimately, theyre paying the same percentage in FICA taxes as they would for self-employment taxes. Well, after the owners who are set up as employees are paid a reasonable wage, any profits given to them as distributions are not subject to Social Security and Medicare taxes. They must still pay income tax on those profits but not FICA or self-employment tax.

What is double taxation? The businesss profits are first taxed on the corporation . Then, if the corporation distributes profits as dividends to shareholders, the dividends get taxed again on each shareholders personal tax statement at the applicable individual tax rates.

LLCs that want to be taxed as a corporation must file additional forms with the IRS:

Don’t Miss: Doordash Taxes Calculator

What Youre Required To Pay As A Self

Okay, with all of that knowledge in your head now, lets talk about what youre on the hook to pay to the government come tax time. When youre self-employed, and youre operating your business as a sole proprietorship, you must pay:

- Personal income tax on your business earnings minus business expenses

- Contributions to the Canada Pension Plan

- Contributions to Employment Insurance voluntary