What Are The Qualifications For Each Child

A person must meet both of these tests to qualify as your child for the Child Tax Credit or the Additional Child Tax Credit:

- The child must be under age 17 at the end of the calendar year, and

- You must claim the child as a dependent on your return.

You can use TaxAct’s Dependent Quiz to help you determine if someone qualifies as your dependent.

How Much Money Will I Get From The 2021 Child Tax Credit When Will I Get The Payments

The 2021 CTC is worth up to $3,600 for children under six and up to $3,000 for children ages 6-17. Half the credit will be delivered through monthly payments in 2021. You can get the remaining half when you file a tax return in 2022.

Advance payments started in July 2021. If you havent received your payments, you can sign up for the payments through late fall. Once the IRS has processed the information you provided from either the IRS Non-filer Portal or your 2020 tax return, you will start receiving the CTC advance payments. These payments will be half of your CTC, even if you started receiving them after July.

Example: Catlin has a 12-year-old daughter and 3-year-old son and earned $12,000 in 2020. When he filed his 2020 tax return , he claimed the current CTC and received a total of $1,425 in 2021. Because of the new rule changes to the CTC, when he files his 2021 tax return , his CTC will be worth $6,600. Through the advance payments, he will start receiving half of his new credit in 2021 in monthly payments from the IRS between July and December 2021. He will claim the remaining amount when he files his tax return in 2022.

You can use Propels 2021 Child Tax Credit Calculator to calculate how much money you will receive from the CTC.

Previous Changes To The Child Tax Credit

The Tax Cuts and Jobs Act of 2017 brought some big changes to the U.S. tax code. These changes went into effect for the 2018 tax year and applied to 2020 taxes. This new tax plan included the following changes to the CTC:

- The credit amount increased from $1,000 to $2,000.

- The CTC is refundable up to $1,400. It previously was not refundable.

- Children must have a Social Security number to qualify.

- The earned income threshold to qualify for the CTC is $2,500.

- The CTC phases out at an income level of $200,000 for single filers and $400,000 for joint filers. In 2017 the phase-out level was $75,000 for single filers and $110,000 for joint filers.

- There is now a $500 credit available for each dependent older than 17.

Another big change was that the new tax plan largely combined the Additional Child Care Tax Credit with the CTC. This is part of the reason the CTC became refundable and its limits increased.

The American Rescue Plan, passed to help relieve the pressure from the COVID-19 economic crisis, expanded the CTC, making it worth $3,600 for children under 6 and $3,000 for children ages 6 to 17. It also removed the income floor and made the credit fully refundable and allowed for up to half of the credit to be available as a refund in advance, during the second half of 2021.

You May Like: Do I Need W2 To File Taxes

How Has The Child Tax Credit Evolved Over The Years

The credit has its roots in a 1991 report by a bipartisan National Commission on Children, which declared that it is a tragic irony that the most prosperous nation on earth is failing so many of its children and recommended a $1,000 refundable credit for all children through age 18. A version of the credit was proposed by Republicans in their 1994 Contract with America and by President Clinton in 1995, and was eventually enacted in 1997 as a $500-per-child, non-refundable credit aimed at middle and upper middle income families.

After George W. Bush promised to double the credit as part of the tax cuts he proposed during his 2000 campaign, my Brookings colleague Isabel Sawhill argued for making it refundable so it would aid poor children. This would be, she wrote, controversial: Many Republicans, in particular, are likely to label it as social welfare by another name. Democrats will point out that, without some refundability, income tax cuts do little to help many Americans. But it was one way, she argued, to make sure that at least some of the benefits of the Bush tax cuts went to low-income families. When Congress enacted the Economic Growth and Tax Relief Reconciliation Act of 2001, it both doubled the Child Tax Credit to $1,000 per child and made it partly refundable.

Some Families Must Act By Nov 15

Some families who have not received any advance payments in 2021 can get money but only if they act very quickly.

The deadline is Monday, Nov. 15, for low-income families who have not received any money yet to sign up for the advance child tax credit payments.

The IRS notes that people can get these benefits even if they dont work and even if they receive no income.

Any family not already receiving the payments and not normally required to file a tax return can explore the tools, such as the non-filer tool for the credit, available at IRS.gov.

The IRS notes that the tools can help determine eligibility for the advance credit or help families in this group file a simplified tax return to sign up and also possibly receive Economic Impact Payments and the Recovery Rebate Credit.

Families who sign up by the Nov. 15 deadline, according to the IRS, will normally receive half of their total child tax credit on Dec. 15. This means a payment of up to $1,800 for each child 5 and younger, and up to $1,500 for each child ages 6 to 17.

Also Check: Amended Tax Return Online Free

Child Tax Credit: Missing A Payment Here’s How To Track It

If you’re looking for your November child tax credit check or one from the previous months, we’ll tell you how to trace it.

If you haven’t received your child tax credit check, it could be late.

Five child tax credit payments have been disbursed this year, with one left to go. However, if you haven’t received any checks yet or if you’re missing money from one of the other months, know that several glitches have caused child tax credit problems for parents each month. Don’t fret — we’ll help you figure out what’s going on.

We found that if only one parent in a married household made a correction to banking info or a mailing address, it could have reduced the amount of the payment. Also, parents might have received more money than they qualify for due to outdated tax information from old returns, and inaccurate payment amounts could affect their taxes in 2022.

We’re here to help you figure out how to review your payment history online using the IRS Update Portal and file a payment trace if a few weeks have passed and there’s no sign of your money. Here’s what you need to know if you plan to opt out of the final monthly check before the next deadline, Nov. 29 . Also, here’s the latest on the child tax credit extension. We’ve updated this story.

How To Track And Trace Your Child Tax Credit

Eligible recipients who did not get a payment, or received the incorrect amount, should verify their information on the IRS Child Tax Credit Update Portal.

For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

Payments could be delayed depending on the disbursement method. The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasnt received the payment

- 4 weeks after the payment was mailed by check to a standard address

- 6 weeks after the payment was mailed, and you have a forwarding address on file with the local post office

- 9 weeks after the payment was mailed, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Don’t Miss: How To Buy Tax Lien Properties In California

What If My Information Or Situation Has Changed

If you have moved, had a child, changed your bank, or had other information about your living situation change since you last gave information to the IRS, you should update the IRS on your situation. This will help make sure they can get you the Advanced Child Tax Credit you are owed. To do this, you can use the Child Tax Credit Update Portal.

Mybenefits Cra Mobile App

Get your benefit information on the go! Use MyBenefits CRA mobile app throughout the year to:

- view the amounts and dates of your benefit and credit payments, including any provincial or territorial payments

- view the status of your application for child benefits

- change your address, phone number, and marital status

- view information about the children in your care

- sign up for email notifications to receive an email when there is mail to view online in My Account such as important changes made on your account

For more information, go to Mobile apps.

Also Check: How To Buy Tax Lien Properties In California

Why You Should File Even If You Cant Deduct

The IRS places limits on the amount of child tax credit you can claim.

This stops people from playing the system. A prominent example of this is the home office deduction. In the past, many taxpayers were tempted to claim enormous deductions on their home offices. Obviously, the IRS declared it absurd that you would claim a home office deduction so large that it would cause your business to lose money.

Whats interesting, though, is even if you earned nothing during the last tax year, its worth filing taxes still because then you can claim the leftover deduction in future tax years.

This means that even if you are not eligible to claim a credit or a deduction now, you can still claim it in future years when you do have income. You need to start filing taxes now, though, rather than waiting until you are legally obligated to file a return.

Why Would I Want To Opt Out Of Ctc Advance Payments

Advance payments allow you to receive half of your CTC through monthly payments sent from July to December 2021. If you opt out of advance payments, you are choosing to receive your full Child Tax Credit when you file your 2021 tax return .

Here are some reasons why you may want to unenroll from getting CTC advance payments:

While you may be concerned about repaying back your CTC advance payments, Congress has enacted repayment protection for families with lower incomes if the IRS overpays you. Depending on your income, you may not have to pay anything back .

In addition, if you are married filing jointly, remember that your spouse also needs to unenroll if your household does not want to receive any advance payments. If your spouse does not unenroll, your spouse will still get half of the joint advance payments.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Not Required To File Tax Returns

Question: I do not file tax returns because my income is below the threshold required to file. Will I still qualify for the advance monthly payments?

Answer: Yes, but you’ll have to jump through a few hoops if you didn’t use the IRS’s online tool for non-filers in 2020 to provide information to the tax agency for purposes of qualifying for stimulus payments. That tool was called the “Non-Filers: Enter Payment Info Here” portal.

The easiest way to do this is to use the IRS’s Non-Filer Sign-Up Tool on the agency’s website. If you want your payments directly deposited into your bank account, which is faster than getting a paper check, you can also provide your account information through the tool. If you use the Non-Filer Sign-Up Tool, you’ll be asked to provide personal information such as your name, address, email, date of birth and Social Security number . If you want your payments by direct deposit, you’ll also have to give your bank account number, account type and routing number.

Another option for non-filers is expected to be available in the next few weeks. Code for America, a non-profit organization, is finalizing a new mobile-friendly, bilingual tool to help more families who don’t normally file taxes provide the necessary information to claim their advance child tax credit payments. More information about the soon-to-be-released tool, which has been blessed by the Treasury Department, is available online.

Advance Child Tax Credit Payments In 2021

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer:

- Half the total credit amount is being paid in advance monthly payments. See the payment date schedule.

- You claim the other half when you file your 2021 income tax return.

Advance payments are sent automatically to eligible people. You do not need to take any action if we have your tax information.

Don’t Miss: How Can I Make Payments For My Taxes

Is There A Deadline To Sign Up

The IRS will send checks starting in July to the families it knows about. If you file taxes or use the CTC non-filer portal later in the year to sign up for the CTC payments, you will get larger payments each month until December so you still receive half of the total amount of the CTC in 2021. The non-filer portal will be open until November 15, 2021.

If you dont get the advance payments of the CTC in 2021, you can still claim it by filing a tax return in early 2022. Everyone will need to file a return then to get the other half of their CTC credit.

Are Daca Recipients Eligible For The Ctc

Yes, qualifying residents, including DACA recipients, are eligible for the CTC so long as the children being claimed in the household have a valid SSN. DACA recipients who are dependents of ITIN filers can also be claimed for the CTC because they have valid SSNs. Review more information for DACA recipients filing taxes here.

Also Check: Do You Have To Report Plasma Donations On Taxes

Tips For Saving Money On Your Taxes

- A financial advisor can help you optimize your tax strategy for your familys needs. SmartAssets free tool connects you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors, get started now.

- To make sure you dont miss a credit or deduction that you qualify for, use a good tax software. SmartAsset evaluated common tax filing services to find the best online tax software for your specific situation.

- Some savings options, like a health savings account , dependent care or health care flexible spending account or 401, allow you to contribute pre-tax money. With a dependent care FSA, that means you are not paying taxes on contributions that you then spend on dependent care. This decreases your taxable income and could potentially drop you into a lower tax bracket. Even if your contributions didnt change your bracket in the past, make sure to check the current tax brackets. They may have changed since you last filed, so contributing slightly more might now help you to really boost your savings.

How The American Rescue Plan Expanded The Ctc

The American Rescue Plan includes a number of measures aimed at easing economic pressure on American families. In addition to a third round of stimulus checks sent directly to millions of taxpayers, the plan also temporarily expands the CTC from $2,000 per child to as high as $3,600 for the 2021 tax year. Half of the credit amount will be paid in advance in installments, and the other half will be claimed by families on their tax returns next year.

Also, the American Rescue Plan makes the CTC fully refundable for the 2021 tax year, not just refundable up to $1,400.

This increased payment is phased out for wealthier families. The tax break begins to phase out at $75,000 for single returns, $112,500 on head of household returns, and $150,000 on joint returns. Essentially, the increased payment goes down by $50 for every $1,000 earned above the limit. The previous credit of $2,000 per child is still available subject to an upper income limit of $400,000 for married couples and $200,000 for individuals.

Normally, families must have taxable earnings of at least $2,500, but the plan temporarily eliminates that requirement. Families eligible for this credit will get payments of $300 per month per child starting in July until the end of the year.

Don’t Miss: How To Find Your Employer’s Ein

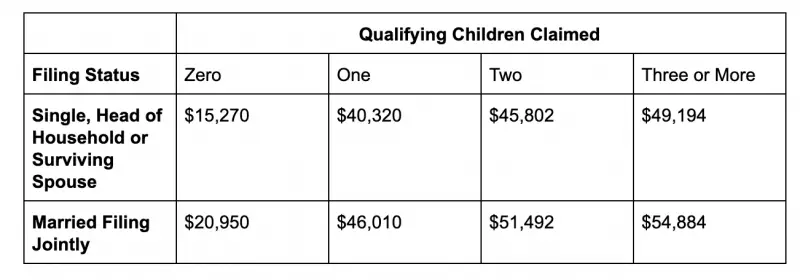

What Are The Income Limits For The Ctc

There is no minimum income required to get the CTC for tax year 2021. Even if a family has $0 in reported income and didnt work during the previous year, they can still be eligible for the full CTC as long as they have children within the age limits who have Social Security numbers.

The upper income limit is $150,000 per year for married couples and $112,500 for single parents filing as head of household to get the full $250 or $300 monthly CTC benefit. Once a familys income goes above these thresholds, the CTC will begin to phase out.