Where Can I Find My Tax Id

Did you lose the letter from the Federal Central Tax Office stating your tax ID? No worries it can also be found on your pay slip , your income tax statement , or on your last tax assessment notice .

You can also request your tax ID from Federal Central Tax Office using this form. The processing time lasts up to four weeks and in some cases, the information can take a bit longer than that.

Where To Find Your Tax Id

If you already have a tax ID, you can find it here:

- Your employer and your tax advisor know your tax ID.

If you lost your tax ID, there are 2 ways to get it back:

- Go to the nearest Finanzamt, and ask for it. They will tell you your tax ID1, 2. You don’t need an appointment.

- Fill this form, and the Finanzamt will send you a letter with your tax ID. It takes up to 4 weeks1. They will send it to the address you registered, not anywhere else.

Electronic Data Gathering Analysis And Retrieval System

Using the Electronic Data Gathering, Analysis, and Retrieval System is the easiest way to search for a federal tax ID number.

Maintained by the SEC, the EDGAR system is a database that includes information about for-profit companies. This online service is completely free.

The EDGAR database includes several forms that may contain a business’s EIN, including the 8-K, 10-K, and 10-Q forms.

Before you start your EDGAR search, you should keep in mind that searching just the first few letters of a business’s name will provide you better results, as many businesses are not listed under their full names.

Don’t Miss: Where’s My Tax Refund Ga

Finding The Federal Tax Id Number Of A Third Party

The Following Organizations Are Required By Law To Possess An Ein:

- Non-profits

- Businesses

- Government agencies at the state and local level

You can use the EIN to research information about different businesses. It is sometimes possible to perform a federal ID tax lookup for free, but there are also paid services that can be used. Businesses will use their FTIN to correctly file documents with the federal government. Employees can find their employer’s EIN by referencing their W2 forms.

Recommended Reading: How Can I Make Payments For My Taxes

Is A Tin Number The Same As An Ein

An employer identification number is a type of tax identification number . An EIN is used by employers to open a business bank account, apply for a business loan, for business licenses and permits, and for reporting and paying federal payroll taxes.

Your business needs an EIN if you:

-

Have employees

-

Operate your business as a corporation or partnership

-

File employment, excise, or alcohol, tobacco and firearms tax returns

-

Withhold taxes on income paid to a resident alien

-

Have a Keogh plan

Option : Check Your Ein Confirmation Letter

The easiest way to find your EIN is to dig up your EIN confirmation letter. This is the original document the IRS issued when you first applied for your EIN. The letter will show your business tax ID and other identifying information for your business.

-

If you applied online for your EIN, the IRS would have issued your confirmation letter right away, accessible online. You would have also had the opportunity to choose receipt by traditional mail.

-

If you applied by fax, you would have received your confirmation letter by return fax.

-

If you applied by mail, you would have received your confirmation letter by return mail.

Your EIN confirmation letter is an important tax and business document, so ideally you stored it away with other key paperwork, such as your business bank account information and incorporation documents.

In this sample EIN confirmation letter, you can find your EIN at the top of the page, as well as in the first paragraph.

Don’t Miss: Efstatus Taxact Com Return

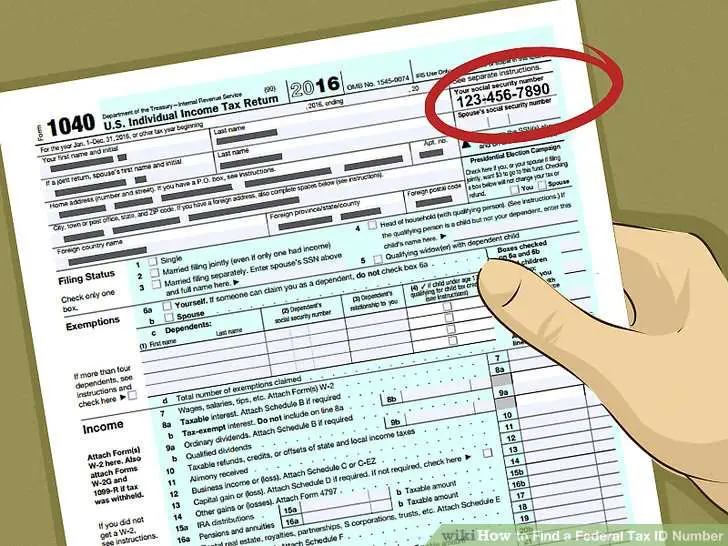

The Three Types Of Tax Id Number

You may already have a tax ID number, and not even know it.

There are three types of ID number that can serve as your identification for tax purposes:

- a Social Security Number

- an Individual Taxpayer Identification Number

- an Employer Identification Number

Either your SSN or ITIN can serve as your tax ID number. SSNs and ITINs both have additional uses besides tracking your business.

However, the EIN is essential if you want to hire employees. Hereâs how to choose which tax ID number is right for you.

How Can I Get A Tin

You can get a tax identification number by applying directly to the correct agency. For instance, you can get a Social Security number through the Social Security Administration. If you need an Individual Taxpayer Identification number or one for a business, you may be able to obtain one directly from the Internal Revenue Service.

Recommended Reading: Can You File Missouri State Taxes Online

Can You Look Up An Ein Number Of Another Business

It is not a common situation, but sometimes small business owners may want to find out the EIN of another company, sometimes called a reverse EIN lookup. For example, some vendors require an EIN from companies theyre doing business with. In certain industries, like insurance and law, you may need another companys EIN as a part of your day-to-day business. Another possibility is that you want to look up another businesss EIN to make sure their information is valid.

The bad news is that theres no convenient, searchable database in which you can just type in the name of the company and get its EIN if its a private company. If the company is publicly traded and registered with the Securities and Exchange Commission , then the business is required to have its EIN on all documents. You can use the SECs EDGAR system to conduct an EIN lookup of a publicly-traded company for free.

When finding the EIN of a private company, things get a bit more difficult. Here are some basic steps you can take to track down another businesss EIN:

- Contact the companys payroll or accounting department and ask for the EIN.

- Get the companys business credit report through a credit bureau like Experian, Equifax or Dun & Bradstreet. You can purchase or view another companys credit report, which contains their EIN.

- Hire a service to look up the EIN for you.

- Check to see if the company filed any local or federal registration forms, which can sometimes be found online.

Check Anywhere Your Ein Could Be Recorded

Doing a tax ID or EIN lookup should be simple since it should be stamped all over your documents. First, check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied.

Second, check your prior tax returns, loan applications, permits or any documents that your EIN would’ve been printed on. Assuming this isn’t the first time that you’ve had to use your EIN, it should be on most official government forms youve filled out. If you have a hard time finding your documents, it could be time to organize them.

If you used your EIN to open a business bank account or apply for state or local licenses, the IRS suggests contacting your bank or government agency to find EIN on your account. Performing a tax ID or EIN lookup isnt difficult you dont need to hire a service to find your EIN on your behalf.

You May Like: How To Buy Tax Lien Certificates In California

Need To Look Up Someone Else’s Ein

The nature of your business may require that you regularly look up EINs of other businesses, or you may want to look up another business’s EIN to validate their information.

If the company is publicly traded and registered with the Securities and Exchange Commission , you can use the SEC’s EDGAR system to look up such a company’s EIN for free. For nonprofit organizations, you can do an EIN lookup for them on Guidestar.

If a company is not registered with the SEC and is privately held, it will be more difficult since theres no central EIN database for these companies. Here are a few strategies you can use:

- Contact the company’s accountant or financing office and ask for the EIN, though they dont have to provide it.

- Try to find the companys W2, or any local or federal filings that may be online.

- Hire a service or use a paid database to do the EIN search.

How To Find Your Employers Ein

Due to the coronavirus, a massive surge in unemployment has swept the nation. And in many states, you may need your employers EIN in order to file for unemployment. If you need to locate a current or former employers EIN for that or another reason, you can do so in two ways:

- Locate Your W-2: Your employers EIN will appear on your W-2 form in Box b. If you have past tax records, this is the easiest way to find your employers identification number. If you cannot find your physical copy of your W-2, check your tax filing software such as TurboTax or any online payroll records you may have through companies such as ADP.

- Contact Your Employer: If you cannot locate your personal tax forms or dont have sufficient forms due to being an independent contractor, the next step is to contact your employer. Reach out to the accounting, payroll and/or HR departments. They should be able to help you out right away. If your employer is a publicly traded company, you should be able to find it online on the companys 10-K, which is public record. If your employer went bankrupt, look online for public court records which may include its EIN.

You May Like: Tax Lien Investing California

Making Changes To Your Employer Identification Number

Keep in mind that just because you have an EIN, donât assume itâs written in stoneâthere are occasions when you may need to change your EIN. There are other cases where your EIN may remain the same, but you will still need to notify the IRS of changes to your business.

If you have an EIN, you need to get in touch with the IRS in the event that:

- you change your business name*

- you change your business address*

- your business changes ownership

- your business management team changes

- your business changes entity types*

* In these circumstances your EIN doesnât change, but the IRS still needs to be notified

If youâre unsure whether you need to notify the IRS of a change, check out their page on EIN changes.

Get Detailed Information On Nonprofits

Another helpful resource is GuideStar. The organizations database includes information on over 1.8 million IRS-recognized, tax-exempt companies. Users can register for free to check a nonprofit’s annual reports, obtain its contact information or conduct an EIN lookup. A similar resource is Melissa Data, which provides information on non-profit organizations.

There are many other ways to verify the EIN of a business. It all comes down to your particular situation. For example, if you need to check your former employer, you can find his tax ID number on one of your W-2 Tax forms or contact the accounting department. A more expensive option is to hire a private investigator.

References

- To verify a private company’s TIN, there are many for-fee services, including Knowx.com, FEINSearch.com, and LexisNexis.com.

Writer Bio

Don’t Miss: How Do I Get My Pin For My Taxes

What Is An Ein

Any organization that has employees is required to apply for an Employer Identification Number . This category includes corporations, government agencies, charities, estates and other legal entities. The same goes for sole proprietorships that employ people.

This number has the role in identifying a business to the IRS, banks and private or public companies. Its similar in purpose to the SSN assigned to individuals. Without it, you cannot open a checking account, hire employees and file taxes.

As a business owner, you want to check whether or not your suppliers and partners have an EIN to make sure they comply with the law. You may also need this number for invoicing purposes.

Several websites allow users to verify the EIN of an employer or organization. All you need to do is to conduct a tax ID lookup online. The EIN or FEIN is a public record, so it shouldn’t be difficult to find it.

Finding The Employer Id

If you’re looking for the EIN of a business, there are several places to search.

Hire the top business lawyers and save up to 60% on legal fees

Also Check: How Can I Make Payments For My Taxes

Itin Requests To Pay Withholding On Forms 8288 And 8288

If a transferee does not have a TIN, and an amount withheld under section 1445 is due to the IRS, complete Form 8288, 8288-A and mail the forms along with the payment to Internal Revenue Service, Ogden Submission Processing Campus, PO Box 409101, Ogden UT 84409, by the 20th day from the date of the sale.

In a separate package, mail a completed Form W-7 with supporting documentation and a photocopy of Form 8288 and 8288-A to Internal Revenue Service, Austin Submission Processing Campus, ITIN Operation, PO Box 149342, Austin TX 78714-9342. Make sure you select reason “h” and write “Exception 4” on right side of reason line “h.” The Austin IRS campus will fax Form 8288/8288-A to the Ogden campus.

The Ogden Submission Processing Campus will not date stamp or mail out Form 8288-A, Copy B to the foreign transferor, if the transferors TIN is missing. Instead, Ogden IRS will mail letter 3794 SC/CG to the transferor with instructions to apply for an ITIN. Once the transferor receives the ITIN number they are to write it on the letter 3794 SC/CG and mail it back to the Ogden IRS office. The Ogden IRS office will document the ITIN number on Form 8288-A Copy B, date stamp “Copy B mailed” on it, and mail it out to the transferor.

How To Get A Federal Tax Id Number

You can apply for your EIN online through the IRS website, or you can let CorpNet do the work for you. Having us help you can help save you time and money, and we can bundle your Federal Tax ID Number with one of our other business filing services.

A Federal Tax ID allows the IRS to track certain business transactions. It connects tax records to individuals or corporations. The number is sometimes referred to by an old term: TIN, for taxpayer identification number.

Recommended Reading: What Does H& r Block Charge

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.