Payment Plans And Arrangements

If you are unable to pay the full amount due, you should still file a return and request a payment arrangement. We will process your return and then send you an income tax notice for the remaining balance due for nonpayment of taxes.

Payment Arrangements

You should pay as much as possible with your tax return, and continue making payments while waiting for your return to be processed. To insure proper credit to your account, be sure to note on your payment your Social Security number and the tax period for which the payment is intended.

When your return is processed, a Personal Income Tax Balance Due Notice will be sent to you. If you are unable to pay the notice in full at that time, you may indicate your preferred payment term on the notice and mail it back using the enclosed envelope. If the requested term is not listed, or if you need additional assistance, please contact the Collection Section by phone at or or by email at . If you are emailing us, please include your name, address, the last four digits of your Social Security Number, case number or notice number and your phone number in your message. This will help us generate a quick response to your inquiry. If you prefer, you may request a payment arrangement online.

Payment to Release MVA Hold

Set Up a Recurring Payment Plan

Cash Payments

If you do not know your payment agreement number, call our Collection Section at 410-974-2432 or 1-888-674-0016.

Do You Pay Property Taxes Monthly Or Yearly

Do you pay property taxes monthly or yearly? The simple answer: your property taxes are due once yearly. However, your mortgage payments may have you pay toward property taxes every month. Your lender will make the official once-yearly payment on your behalf with the funds theyve collected from you.

What Are The Tax Laws In North Carolina

North Carolina law requires employers to withhold state income taxes from the wages of resident employees for work performed within or outside of the state and from nonresidents for work done within the state. A resident employees wages are not subject to withholding if the wages have been subject to another states income tax withholding.

Read Also: How Much Does H & R Block Charge To Do Taxes

Payments By Electronic Check Or Credit/debit Card

Several options are available for paying your Ohio and/or school district income tax. For general payment questions call us toll-free at 1-800-282-1780 or adaptive telephone equipment).

If you are remitting for both Ohio and school district income taxes, you must remit each payment as a separate transaction.

Payments made online may not immediately reflect on your Online Services dashboard. Please allow 2-3 business days for the payment made to be applied to your outstanding liability.

The Department is not authorized to set up payment plans. However, you may submit partial payments toward any outstanding liability including interest and penalties. Such payments will not stop the Department’s billing process, or collection attempts by the Ohio Attorney General’s Office.

Note: This page is only for making payments toward individual state and school district income taxes. To make a payment for a business tax, visit our online services for business page.

Whether you file your returns electronically or by paper, you can pay by electronic check or credit/debit card via the Department’s Online Services or NEW!Guest Payment Service .

See the FAQs under the “Income – Online Services ” for more information on using Online Services.

Payment can be made by credit or debit card using the department’s Online Services, NEW! Guest Payment Service, directly visiting ACI Payments, Inc.or by calling 1-800-272-9829.

- The payment itself AND

- The ACI Payments, Inc. convenience fee.

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

Don’t Miss: What Does Locality Mean On Taxes

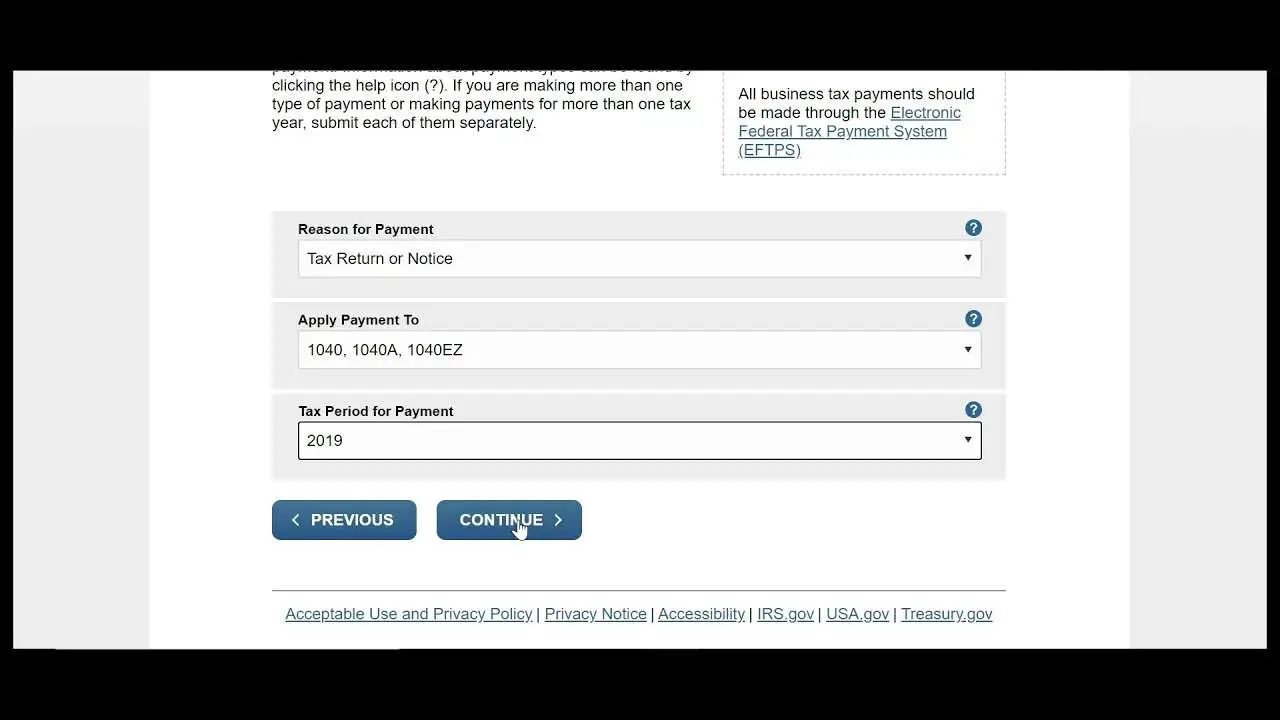

Payment For A Tax Due Return

You may choose a from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2020 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account

- Log in to your online services account to schedule all 4 quarterly payments in advance.

- Dont have an account? Create one now.

Not ready to create an account? Use eForms – make sure to choose the correct voucher number for the payment you’re making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Pay using a credit or debit card through Paymentus . A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

What Happens If You Don’t Pay Property Taxes In Arizona

Again, if you dont pay your property taxes in Arizona, the delinquent amount becomes a lien on your home. This auction is called a tax lien sale. Then, if you dont pay off the amount of the lien plus various other amounts in a specified amount of time, the winning bidder can get title to your home.

Recommended Reading: How Can I Make Payments For My Taxes

Idaho State Tax Commission

Electronic payments are a safe and efficient way to make tax payments.

ACH is a nationwide network used by the Federal Reserve to handle electronic payments.

Payments of $100,000 or more: You must use ACH Debit or ACH Credit. This is required by Idaho law . If you don’t use these methods when required, we can charge you interest and a $500 penalty.Check or cash payments required for: Form 850-U Form 1550-U Form 1350-U

Page last updated July 6, 2021. Last full review of page: February 23, 2018.

TAX REBATE

Pay It Individual Tax Payments

Below you will find links for methods to pay your Maryland tax liability. If you are unable to pay the full amount due, you should still file a return and consider making payment arrangements. We will process your return and then send you an income tax notice for the remaining balance due for nonpayment of taxes.

If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card. Electronic payment options eliminate postage costs, the potential for lost mail and possible penalties for late payments.

Also Check: Tsc-ind Ct

How Do I Pay My Arizona Property Taxes Online

You may make payments up to $2,000,000.00. Please allow 1-3 business days for the payment to post to the Treasurers database. Pay online using an E-check or you may make an E-check payment by calling FIS Customer service Toll Free at 866-757-3948.

Can Arizona property taxes be paid online?

You may make payments up to $2,000,000.00. Please allow 1-3 business days for the payment to post to the Treasurers database. Pay online using an E-check or you may make an E-check payment by calling FIS Customer service Toll Free at 866-757-3948.

How do you pay your property taxes in Arizona?

How do I pay my Maricopa property taxes online?

How To Pay Pay Your Personal Income Tax

Online

Department of Revenue recommends using MassTaxConnect to make tax payment online. You can make your personal income tax payments without logging in. You can use your credit card or Electronic Fund Transfer from either your checking or saving account. Note that there is a fee for credit card payments.

You can send us a check or money order through the mail to make your income tax payment.

When you make a payment by sending a paper check, be sure to enclose your payment voucher with it.

You can find your payment voucher attached to your tax bill.

If you’re making estimated tax payments, be sure to include an estimated tax payment voucher. The correct mailing address will be printed on your payment voucher.

Estimated payments:

Recommended Reading: Do I Need W2 To File Taxes

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

What You Need For Pay Your Personal Income Tax

You can choose from several different payment options:

- Electronic Funds Transfer

You will need the following:

- Your legal name

- Your Social Security Number or Individual Taxpayer Identification Number

- Your payment voucher if you are making a bill payment.

You can find your payment voucher attached to your tax bill. If you’re making estimated tax payments by mail, be sure to include an estimated tax payment voucher.

Please read the following carefully and choose the best payment option.

Estimated tax payments can also be made electronically.

Also Check: Where’s My Tax Refund Ga

Penalty & Interest Charges

- You will receive penalty on your individual income tax return/payment if not paid within the specified time due per The Revenue Act of 1941.

- Penalty is charged at 5% for the first two months and then 5% for each additional month thereafter up to a maximum of 25%.

- Interest is calculated by multiplying the current interest rate by the amount of tax you owe.

- You may request a waiver of penalty in writing. You are required to explain your reason for late payment of tax. You must submit supporting documentation and meet the reasonable cause criteria outlined in the Revenue Administrative Bulletin 1995-4 before a waiver of penalty will be considered.

Other Ways To Find Your Account Information

- You can request an Account Transcript. Please note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Also Check: How Much Does H& r Block Charge To Do Taxes

Making Payments Late Payments And Filing Extensions

To make a payment on individual Arizona income tax owed, taxpayers can either do so electronically or by mail. Taxpayers who file electronically can authorize an electronic funds withdrawal from a checking or savings account.

Individuals who have already filed a tax return and would like to make a payment can do so at www.AZTaxes.gov. Most major credit cards, including Visa or MasterCard branded debit cards, are accepted. Individuals who filed their returns but forgot to enclose payment can also make payments online by e-check or credit card under Make a Payment and 140V.

See the step-by-step guide or tutorial for assistance on making an individual income tax payment.

Individuals can also send the payment, attached to the top portion of the billing notice received, to the address provided. Taxpayers who have not received a billing notice can mail payments to:

Arizona Dept. of RevenuePhoenix, AZ 85038-9085

For correct application of a payment and to avoid processing delays, taxpayers must provide their tax identification numbers and tax periods they want the payments applied to. Additionally, taxpayers who have already filed tax returns and remitted their payments separately must not send a paper copy of a return with their payment.

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Recommended Reading: Do You Have To Report Roth Ira On Taxes