What Determines How Much My Employer Sets Aside For Fica And Other Tax Withholding

The amount your employer sets aside for FICA is based on percentages set by the federal government. As for federal, state and local income taxes, the amount your employer withholds will usually depend upon the information you provided when filling out your W-4 Form or a similar state or local form.

- Most likely, you completed your W-4 Form upon starting your job.

- On that form, you listed your marital status, tax credits and deductions, and perhaps other income that can affect the amount of tax you need to have withheld from your paycheck.

- Your employer uses your answers from your W-4 Form to determine how much to withhold.

The more tax deductions and credits you claim, the less money your employer will withhold from your paycheck. So, it’s important to make sure you accurately fill out your W-4 Form and that you update your information on that form when needed.

Not sure how much to withhold? Use our W-4 Calculator to help you determine how to boost your refund or your take home pay. You can fill out an updated form and submit it to your employer at any time.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Does Everyone On Medicare Have To Pay This Tax

While everyone pays some taxes toward Medicare, youll only pay the additional tax if youre at or above the income limits. If you earn less than those limits, you wont be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

- flexible spending accounts

- health savings accounts

- retirement accounts

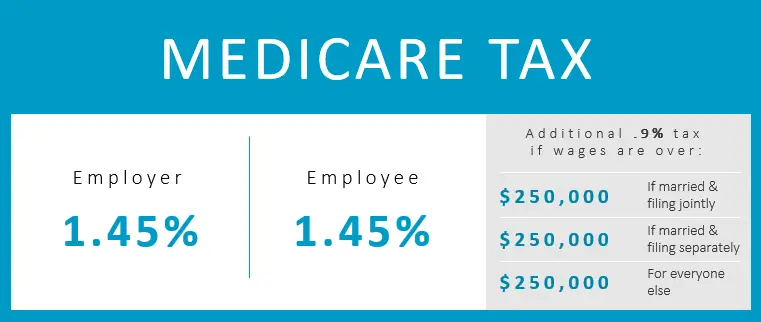

But youll still need to pay the standard 1.45 percent. There is no income limit on the standard Medicare tax amount.

Read Also: How To Look Up Employer Tax Id Number

The Tax On Combined Types Of Income

An adjustment can be made on Form 8959 beginning at line 10, if you’re calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they’re combined and exceed the threshold amount.

Individuals with wages subject to the FICA tax and self-employment income subject to the self-employment tax can calculate their liabilities for Additional Medicare Tax in three steps:

- Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld.

- Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

- Step 3: Calculate the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

Net self-employment income can’t be less than zero for purposes of calculating the Additional Medicare Tax, so business losses can’t reduce the tax owed on wage compensation.

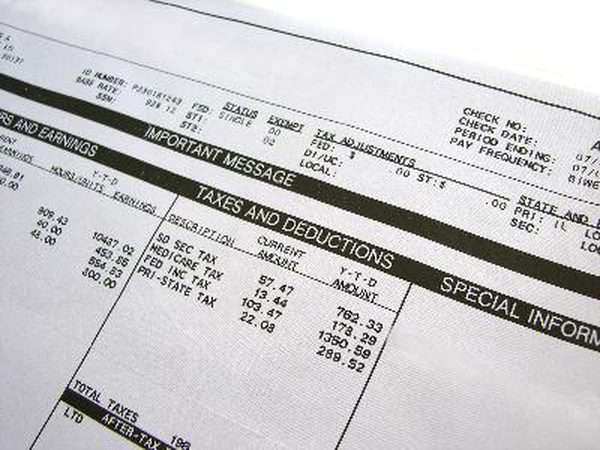

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

| Employee Pay Stub |

|---|

You must make deposits with the IRS of the taxes withheld from employee pay for federal income taxes and FICA taxes and the amounts you owe as an employer. Specifically, after each payroll, you must

- Pay the federal income tax withholding from all employees

- Pay the FICA tax withholding from all employees, and

- Pay your half of the FICA tax for all employees.

Depending on the size of your payroll, you must make deposits monthly or semi-weekly.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid.

If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing service to handle paychecks, payments to the IRS, and year-end reports on Form W-2.

Don’t Miss: 1040paytax.com Official Site

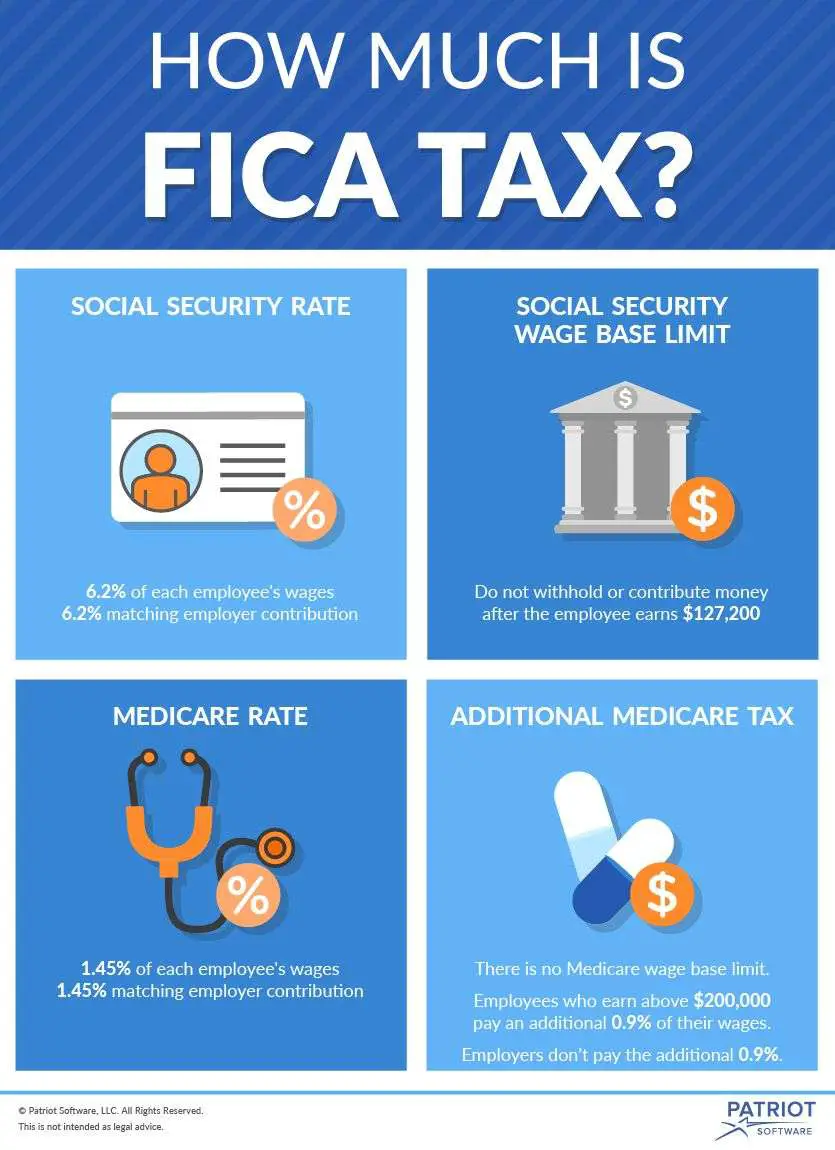

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information or Publication 51, , Agricultural Employers Tax Guide for agricultural employers. Refer to Notice 2020-65 and Notice 2021-11 for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees.

Medicare Taxes For The Self

Even if you are self-employed, the 2.9% Medicare tax applies.

Typically, people who are self-employed pay a self-employment tax of 15.3% total which includes the 2.9% Medicare tax on the first $142,800 of net income in 2021.2

The self-employed tax consists of two parts:

- 12.4% for Social Security

- 2.9% for Medicare

You can deduct the employer-equivalent portion of your self-employment tax in figuring your adjusted gross income. If youre unsure of how to do this, a tax professional may be able to help.

Also Check: Where Is My Federal Tax Refund Ga

Why Do I Have To Pay Fica Tax

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible.

Some people are exempt workers, which means they elect not to have federal income tax withheld from their paychecks. Social Security and Medicare taxes will still come out of their checks, though.

Typically, you become exempt from withholding only if two things are true:

-

You got a refund of all your federal income tax withheld last year because you had no tax liability.

-

You expect the same thing to happen this year.

Breaking Down The Additional Medicare Tax

The Affordable Care Act enforces high wage earners to pay an extra Medicare payroll tax, or Medicare surtax, of 0.9% on earned income. All U.S. employees have to pay the Medicare tax.No matter the citizenship or residency status, each individual must pay this tax. Single filers with an income of at least $200,000 will need to pay the additional Medicare tax.

This cost will be added to your Social Security and state income taxes.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual’s Medicare wages that exceed a threshold amount based on the taxpayer’s filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual’s wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There’s no employer match for Additional Medicare Tax. For more information, see the Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax.

Tips For Tax Planning

- Due to the COVID-19 pandemic, the IRS moved its deadline for filing taxes this year to May 17.

- If you are looking to make charitable contributions, transfer some of your wealth or leave your estate to your heirs in the most tax-advantageous way, a financial advisor can help. To find one, use our free financial advisor matching tool. It will connect you with up to three financial advisors in your area.

Also Check: How Much Does H& r Block Charge To Do Taxes

Account For The Employer’s Portion Of Fica Taxes

After you have completed the FICA tax calculations for all employees, you must set aside an amount equal to the total for your employer portion of the FICA taxes. This amount includes:

- 6.2% of the employee’s total FICA wages for Social Security, with no maximum, and

- 1.45% of the employee’s total FICA wages for Medicare .

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

- The amount of gross pay for the employee for that pay period

- The total year-to-date gross pay for that employee

- The Social Security and Medicare withholding rates for that year

- Any amounts deducted from that employee’s pay for pre-tax retirement plans.

Employee pay subject to Social Security and Medicare taxes may be different from gross pay. This article on Social Security wages explains what’s included and what’s not.

In addition, you will need to know, for each year:

The Social Security Maximum. This is the maximum wages or salary amount for Social Security withholding for that year. Each year the Social Security Administration publishes a maximum Social Security amount no Social Security withholding is taken from employee pay above this amount. Go to this article on the “Social Security Maximum” to find this year’s maximum withholding amount.

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual’s tax status At the specified level for the year, an additional 0.9% must be withheld from the employee’s pay for the remainder of the year. You must begin deducting the additional 0.9% when the employee’s wages reach $200,000 for the year, no matter what the employee’s marital status is.

Don’t Miss: Www.1040paytax

Fica And Withholding: Everything You Need To Know

OVERVIEW

In order to ensure you’re filing your taxes correctly, it’s crucial to understand everything that goes into them and how your money is affected with each paycheck. For starters, what exactly is FICA and what does it mean to have withholdings?

As you prepare your taxes and review your W-2 and pay stubs, you’ve likely seen the terms “FICA” and “withholding.” But do you know what they mean and how they affect your annual taxes?

What Are Medicare Wages

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government’s Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 and older and the disabled.

Medicare and Social Security taxes are levied on both employees and employers under the Federal Insurance Contributions Act .

You May Like: Do You Have To Report Roth Ira On Taxes

Fica Taxes: The Basics

Every payday, a portion of your check is withheld by your employer. That money goes to the government in the form of payroll taxes. There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes.

Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act of 1935. The funds are used to pay for both Social Security and Medicare.

If you own a business, youre responsible for paying Social Security and Medicare taxes, too. For self-employed workers, theyre referred to as SECA taxes based on regulations included in the Self-Employed Contributions Act.

Interaction With The Net Investment Income Tax

The Net Investment Income Tax, also referred to as the “Unearned Income Medicare Contribution Tax,” is another surtax that’s imposed at 3.8% when investment income, combined with other income, surpasses the same thresholds that apply to the Additional Medicare Tax.

It’s payable only as a percentage of the investment portion of income, however, so wage and self-employment income can’t be subject to both taxes.

NOTE: Tax laws change periodically. You should always consult with a tax professional for the most up-to-date advice. The information contained in this article is not intended as tax advice, and it is not a substitute for tax advice.

You May Like: Do I Need W2 To File Taxes

What If Too Much Tax Is Withheld From Your Bonus

Are you worried that too much tax might be taken from your bonuses? Well, it is possible for you to be over-taxed, although it’s easily resolvable if you know what you’re doing! If you prepare your tax return and notice that your withheld bonus amount is way too much based on your end-of-year tax rate on your taxable income, you should receive a refund.The IRS will work out how much tax you have paid, and if it’s above the flat rate of 22% of your overall income, you’ll get issued a refund. Want to know how the IRS checks your tax is correct? They’ll check your Form 1040 tax return, as this will show an overpayment of taxes if you have indeed been paying too much.The IRS will then refund any difference between the balance you paid in over the year and what your tax return determined that you should have paid.

Medicare Surtax On Wages And Self

Some taxpayers are required to pay an additional 0.9% Medicare surtax over and above the “regular” Medicare tax. It’s referred to as the “Additional Medicare Tax.”

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

Recommended Reading: How Much Does H And R Block Charge

Withholding For The Additional Medicare Tax

The Additional Medicare Tax applies when a taxpayer’s wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

This $200,000 rule can result in underpayment when a taxpayer holds two jobs, neither of which pays more than the threshold amount, so neither employer withholds for this additional tax.

Employees are accustomed to having Medicare taxes withheld from their wages by their employers, and to having the right amount of Medicare tax withheld. But the rules for AMT withholding are different from the rules for calculating the regular Medicare tax. This can result in an employer withholding an amount that’s different from the correct amount of tax that will ultimately be owed.

The number that employees arrive at when they calculate the AMT on their tax returns might or might not match up with what was withheld from their earnings. An employee is liable for the Additional Medicare Tax even if the employer doesn’t withhold it.

It’s best to figure out in advance what your additional Medicare surtax will be, if possible, and then cover this tax cost. You can do this in a few ways:

How Does Your Tax Bracket Impact How Much Fica Is Withheld

Your tax bracket doesn’t necessarily affect how much money you contribute to FICA. However, you’ll pay an additional 0.9% of your salary toward Medicare if you earn over

- $200,000 per calendar year or

- $250,000 per calendar year .

This is often called the “Additional Medicare Tax” or “Medicare Surtax.” In 2021, its also important to keep in mind that only the first $142,800 of earnings is subject to the Social Security part of the FICA tax.

Recommended Reading: Do You Report Roth Ira Contributions On Taxes

Example Of How The Additional Medicare Tax Works

Single individuals can have a maximum income of $200,000 before they are subject to the Additional Medicare Tax. Should the cumulative income exceed that amount, they will then be required to pay the Additional Medicare Tax amount .

All wages currently subject to the Medicare Tax are also subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income that exceeds the threshold for their filing status.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

How Social Security And Medicare Tax Is Paid

If you are an employee, FICA taxes are withheld from your paycheck along with income tax.

The Social Security portion of the FICA tax is subject to a cap$137,700 in 2020, and $142,800 in 2021. This is referred to as the “wage base.” You do not owe Social Security tax on income you make over this amount.

If you work for yourself rather than an employer, FICA taxes are your self-employment tax. You must make quarterly estimated payments to the IRS for your FICA taxes if you are:

- Self-employed

- A sole proprietor

- A member of a single-member LLC

- A partner in a business that has elected to be treated as a partnership for tax purposes

If you pay the self-employment tax, you must pay the full 15.3% to cover both the employee and the employer portions. However, you can claim an above-the-line tax deduction as an adjustment to income for half of this amount.

Recommended Reading: Do I Have To Report Roth Ira Contributions On My Taxes

Calculate The Social Security Withholding

Multiply the current Social Security tax rate by the amount of gross wages subject to Social Security. In Sally’s example above , her FICA withholding for each paycheck would be $98.81.

Double-check that the employee’s year-to-date wages/salaries are not over the Social Security maximum wages for the year. Stop withholding Social Security for the year at the point where the employee’s total pay reaches the maximum for that year.