Contributing To Retirement Accounts

Another key advantage of ongoing earned income even after you collect Social Security is that you can keeping contributing to your retirement savings accounts like traditional IRAs, health savings accounts , Roth IRAs, and 401s.

Note: If you are over 72, you will have to take the required minimum distribution from your traditional IRA, except for during the 2020 pause because of COVID-19.

Your traditional 401, or similar employer-based retirement plan, is a different story. In general, you can continue stashing away money in your current employer-provided plan as long as you’re still working, even part-time, and you can delay taking your RMD until after you retire.

This additional savings can help, especially if your savings are running a bit behind your goals. The combination of the added savings, tax-deferred growth potential, and the ability to defer tapping into your savings can be powerful, even at the end of your working career.

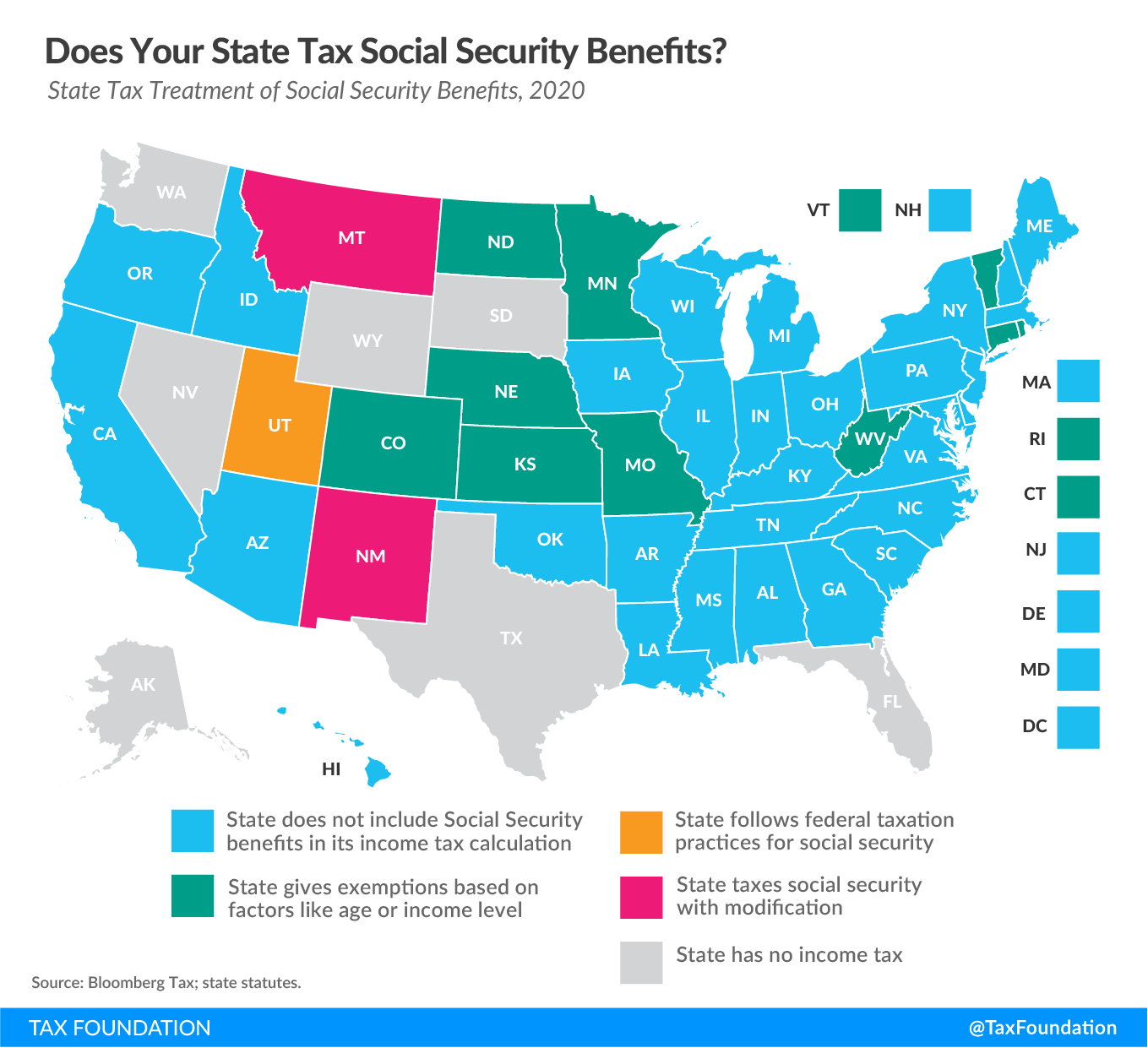

How The West Taxes Social Security

Nine of the 13 states in the West don’t have income taxes on Social Security. Alaska, Nevada, Washington, and Wyoming don’t have state income taxes at all, and Arizona, California, Hawaii, Idaho, and Oregon have special provisions exempting Social Security benefits from state taxation. That leaves Colorado, Montana, New Mexico, and Utah, which impose taxes on Social Security for some individuals.

States That Do Not Tax Retirement Income

In retirement, one of the largest burdens is tax liabilitiesthe money paid to the government from your social security, military retirement plan, pension account, and/or investment retirement account. And since youre no longer working, your income is fixed, and may be very limited. As such, every dollar you can hold on to is all the more beneficial.

Heres a focus on states that you may want to consider living in during retirement, since some states are more tax-friendly to retirees than others. Below are details on which states do not require taxes paid on retirement income, and how property and sales taxes could impact you.

Read Also: How To Get Money Back From Taxes

Does Social Security Income Count As Income

Yes, but you can minimize the amount you owe each year by making some wise moves before and after you retire. Consider investing some of your retirement savings in a Roth account, to shield your withdrawals from income tax. Take out some retirement money after you’re 59½ but before you retire, to take care of the taxes before you need the money. And, you might talk to a financial planner about a retirement annuity.

What Income Is Included In Your Social Security Record

Only earned income, your wages, or net income from self-employment is covered by Social Security. If money was withheld from your wages for Social Security or FICA, your wages are covered by Social Security. This means you are paying into the Social Security system that protects you for retirement, disability, survivors, and Medicare benefits.

Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. You may need to pay income tax, but you do not pay Social Security taxes.

You May Like: How To Avoid Federal Taxes

States That Don’t Tax Social Security Benefits

Many people are surprised to learn that they can end up having to pay federal income tax on their Social Security benefits. To add insult to injury, some states also require residents above a certain income threshold to pay state income tax on what they receive from Social Security. Yet the majority of states are kind enough not to tax Social Security, so it’s worth considering the issue in choosing where you want to live after you quit your job and start drawing your benefits.

What Are The Worst States To Retire In

Here, in ascending order, are WalletHubs top 10 worst states to retire to in 2020.

- Rhode Island.

- Mississippi.

- New York. You can tour the Big Apple without retiring to the Empire State.

- Louisiana. Come to Louisiana for Mardi Gras, jazz and Cajun cuisine, but not to retire there.

- Texas.

- Arizona.

- West Virginia. West Virginia rounds out the top 10 best states to live in for seniors thanks to their numerous hospitals, low property taxes, and affordable cost of living.

You May Like: How Does The Irs Tax Bitcoin

Social Security In The Midwest

Out in the Midwest, only seven of 12 states are free of Social Security taxes. South Dakota doesn’t have an income tax. Meanwhile, Illinois, Indiana, Iowa, Michigan, Ohio, and Wisconsin have full state income tax protection for those receiving Social Security benefits.

On the other hand, Kansas, Minnesota, Missouri, Nebraska, and North Dakota tax Social Security in varying degrees. Minnesota and North Dakota are notable for following the federal rules on taxation.

How High Are Sales Taxes In New Jersey

Sales taxes in New Jersey are close to the average among all U.S. states. The statewide rate is 6.625%. Local governments do not collect their own sales taxes. However, there are two exceptions. First, there are New Jerseys Urban Enterprise Zones, where purchases made at qualified businesses face a reduced sales tax rate of 3.3125%. As of May 30, 2018, there are 37 Urban Enterprise Zones in New Jersey, including parts of Newark, Trenton, Camden and more. The other exception to New Jerseys state sales tax is Salem County. In Salem County, nearly all purchases are also subject to a reduced sales tax rate of 3.3125%. The only items that do not get that reduced rate are alcoholic beverages, cigarettes, motor vehicles, services and any transactions made from outside the county.

There are also some key exemptions for items that are especially important to seniors. Medicine , groceries and many types of clothing are all exempt from sales tax in New Jersey.

Don’t Miss: How Do I File My Missouri State Taxes For Free

What States Do Not Tax Pensions And 401k

Nine of those states that dont tax retirement plan income simply have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three Illinois, Mississippi and Pennsylvania dont tax distributions from 401 plans, IRAs or pensions.

Which States Have No Property Tax For Seniors

Retirees Moving to These States Can Get Some Great Tax Breaks

- New Hampshire. New Hampshire has no general income tax.

- South Carolina. South Carolina is friendly to veterans.

- Hawaii. Hawaii has low property taxes.

- South Dakota. South Dakota has no state income tax.

- Alabama. Alabama retirees dont have to pay property tax.

- Tennessee.

Also Check: How To Pay Federal And State Taxes Quarterly

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income in addition to your Social Security, you won’t owe taxes on it. If you’re an individual filer and had at least $25,000 in gross income including Social Security for the year, up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more, up to 85% may be taxable. The minimum for a couple is $44,000.

Estate And Inheritance Taxes

Another type of tax that is of particular importance to retirees is the estate tax. In recent years, legislatures across the U.S. have either repealed their state estate taxes or have increased the local estate tax exemption. For reference, the estate tax exemption is the limit below which estates do not owe taxes.

The federal estate tax exemption has increased over the years to $11.58 million in 2020 and $11.7 million in 2021. Of the 12 states that have their own estate tax, seven have an exemption of $4 million or less. Massachusetts and Oregon have the lowest exemption at $1 million.

Similar to the estate tax, an inheritance tax affects property that’s passed on to loved ones. The tax applies not to the estate itself, but to the recipients of the property from that estate. For example, if you receive $1,000 as an inheritance and are subject to a 10% inheritance tax, you would pay $100 back in taxes.

Six states have an inheritance tax. Of these, one state also has an estate tax. Inheritance taxes typically provide exemptions or lower rates for direct family members, while fully taxing non-relatives.

Read Also: How To File Pa State Taxes

What Are Retirement And Pension Benefits

Under Michigan law, retirement and pension benefits include most payments that are reported on a 1099-R for federal tax purposes. This includes defined benefit pensions, IRA distributions and most payments from defined contribution plans. Retirement and pension benefits are taxable based on date of birth . Regardless of date of birth, the following are not taxed:

- US Military pensions

- Rollovers not included in the Federal Adjusted Gross Income

Recipients Born After 1:

All retirement and pension benefits are taxable to Michigan, unless one of following applies:

- Taxpayers born January 1, 1953 through January 1, 1954 should not file Form 4884. A taxpayer may either

- Deduct the personal exemption amount and taxable Social Security benefits, military compensation , Michigan National Guard retirement benefits and railroad retirement benefits included in adjusted gross income or

- Claim a deduction against all income, of $20,000 for a return filed as single or married filing separately, or $40,000 for a married filing joint return.

To ensure you receive your maximum deduction complete Worksheet 2 in the MI-1040 booklet for Tier 3 Michigan Standard Deduction on Schedule 1, line 24.

A surviving spouse who meets all of the following conditions may elect to the take the larger of the retirement and pension benefits deduction based on the deceased spouse’s year of birth subject to the limits available for a single filer or the survivor’s Michigan Standard Deduction:

- Reached the age of 67 and

- Not remarried and

- Claimed a subtraction for retirement and pension benefits on a return jointly filed with the decedent in the year they died.

Nontaxable benefits:

Recommended Reading: What Happens If You Cannot Pay Your Property Taxes

When You Claim Matters

If you claim your Social Security benefits before your FRA, or full retirement age , you will end up with a permanently reduced monthly benefit because of the early age. If you claim at the earliest possible age of 62, your monthly checks could be up to 30% less than at your FRA.1

There will also be an earnings test until you reach that FRA: If you have earned income in excess of $18,240 in 2020, your benefits will be reduced by $1 for every $2 of earned income over the limit.

In the year of reaching your FRA, the earnings test limit is $48,600 in 2020, and your benefits will be reduced by $1 for every $3 of earned income over the limit.

These benefits are not truly “lost,” however. If your benefits have been reduced due to earning, your monthly Social Security check will be increased after your FRA to account for benefits withheld earlier due to excess earnings. Note that “earned” income includes wages, net earnings from self-employment, bonuses, vacation pay, and commissions earnedbecause they’re all based upon employment. Earned income does not include investment income, pension payments, government retirement income, military pension payments, or similar types of “unearned” income.

Once you reach your FRA, there is no earnings test and no benefit reductions based on earned income.

Scenarios: Claiming Social Security at 62 while working

Are Spousal Survivor Disability And Ssi Benefits Taxable

These programs all follow the same general rules as the Social Security program for retirees, with one exception: Supplemental Security Income, or SSI for short, is not a Social Security program. It’s a separate program for people who are needy and disabled people, and payments from it are not taxable.

Also Check: How To Lower Property Taxes In Florida

States Levy Three Main Types Of Taxes: Income Tax Sales Tax And Property Tax You Should Understand All Three And The Impact They Will Have On Your Savings

We all want our retirement savings to last as long as possible and reducing your tax bill can be a great way to stretch every dollar. One of the biggest factors that will determine your tax bill in retirement is where you live. There are significant tax differences depending on which state you retire in.

States levy three main types of taxes: income tax, sales tax, and property tax. You will want to pay attention to all 3 before you make a decision on where to live.

Understand Your Retirement Income

Federal retirement income typically includes a pension, Social Security, and distributions from retirement accounts . On the federal level, all three of these income sources can be taxable. At the state level, it will vary state to state.

Social Security. Many people I talk to are surprised to learn that Social Security benefits are taxable. And because most federal employees have a healthy pension and TSP come retirement time, many of them will have up to 85% of their benefits subject to federal taxes.

The good news however, is that most states dont tax Social Security benefits. There are just 13 states that do: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia. Each state has their own criteria and structure for this taxation.

The Best States for Federal Retirees

Editor’s note: This article has been updated to better reflect some of the nuances in state tax policies.

The Increase In The Social Security Cost

Seniors will get a significant bump in their Social Security benefits in 2022.

The Social Security Administration announced on Wednesday that the cost-of-living adjustment will be 5.9% for next year. The increase was driven by large jumps in all sorts of energy prices: gasoline, natural gas and electricity. Prices of both new and used cars and trucks surged as demand soared and computer chip shortages crimped supply. Ditto for appliances, TVs and other furniture. Restaurants and barbers raised prices as wage rates picked up in the face of shortages of workers. And finally, airfares and hotel rates began to rebound from the lows caused by the pandemic.

This is the largest COLA increase since 1982, when benefits surged 7.4%. It is also in line with the 6% increase that The Kiplinger Letter forecast in September.

Social Security COLAs are calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers. If prices dont increase or fall, the COLA is zero. That happened in 2010 and 2011, as the economy struggled to recover from the Great Recession, and again in 2016, when plummeting oil prices wiped out the COLA for that year. In 2021, the COLA increased payouts by 1.3%.

Also Check: How Do You Add Sales Tax

What Other New Jersey Taxes Should I Be Concerned About

If you are planning on passing savings or other assets on to your loved ones, you should be aware of New Jerseys inheritance tax. Bequests passed on to non-relatives, siblings and distant relatives are taxed at rates ranging from 11% to 16%, with the first $25,000 being exempt.

New Jersey does not have an estate tax as of January 1, 2018. Prior to that date, New Jersey did have one. For any deaths in 2017, the estate tax exemption was $2 million, and with tax rates up to 16%.

States Without Pension Or Social Security Taxes

Reduce your retirement tax bills.

Retirees can help their savings last longer by moving to a place with lower taxes. These 13 states don’t tax Social Security or pension income. However, they have very different property and sales tax rates, which should also be taken into consideration, according to data from Wolters Kluwer Tax & Accounting, the Tax Foundation and the U.S. Census Bureau. Check out these low tax places to retire.

Alabama

The state of Alabama doesn’t tax Social Security benefits or traditional pension payments. Property owners in Alabama paid a median of just $558 in real estate taxes in 2017. The state sales tax rate is also a relatively low 4 percent, but there may be additional local sales taxes in some areas of the state.

Alaska

Alaska is the only state with no state income tax and no state sales tax. However, property taxes can be high. Homeowners paid a median of $3,117 for real estate taxes in 2017.

Florida

Year-round warm weather isn’t the only perk of retirement in Florida. The state doesn’t levy an income tax. Real estate taxes were a median of $1,752 across the state in 2017. The state sales tax rate is 6 percent.

Illinois

Mississippi

Pension and annuity payments and income from Keogh plans and IRAs are generally exempt from state tax in Mississippi, and income from Social Security is also not subject to taxation. Median real estate taxes were just $879 in 2017. However, Mississippi has a relatively high state sales tax rate of 7 percent.

Nevada

Recommended Reading: How Much Are Annuities Taxed

What States Do Not Tax 401k Withdrawals

Nine of those states that dont tax retirement plan income simply have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. The remaining three Illinois, Mississippi and Pennsylvania dont tax distributions from 401 plans, IRAs or pensions.

Recipients Born Before 1:

For 2020 you may subtract all qualifying retirement and pension benefits received from public sources, and may subtract private retirement and pension benefits up to $53,759 if single or married filing separately or up to $107,517 if married filing jointly. Private subtraction limits must be reduced by public benefits subtracted. Withholding will only be necessary on taxable pension payments that exceed the pension limits stated above for recipient born before 1946.

- Complete Form 4884, Michigan Pension Schedule.

- Military pensions, Michigan National Guard pensions and Railroad Retirement benefits are entered on Schedule 1, line 11. These continue to be exempt from tax. They must be reported on Schedule W Table 2, even if no Michigan tax was withheld.

- Social Security benefits included in your adjusted gross income are entered on Schedule 1, line 14 and are exempt from tax.

- Public pensions can include benefits received from the federal civil service, State of Michigan public retirement systems and political subdivisions of Michigan.

- Rollovers not included in the Federal Adjusted Gross Income will not be taxed in Michigan.

- Subtraction for dividends, interest, and capital gains is limited to $11,983 for single filers and $23,966 for joint filers, less any subtractions for retirement benefits including US military, Michigan National Guard, and railroad retirement benefits.

Also Check: How Do Property Taxes Work In Texas