Is Social Security Disability Taxable

This is an important question to ask if you receive Social Security disability benefits and the short answer is, it depends. For the majority of people, these benefits are not taxable. But your Social Security disability benefits may be taxable if youre also receiving income from another source or your spouse is receiving income.

The good news is, there are thresholds you have to reach before your Social Security disability benefits become taxable.

This Is Bad: Your Stimulus Check Could Cost You Disability Benefits

Due to a misunderstanding between the Social Security Administration and other parts of the government, some Americans have lost their eligibility for disability payments.

Due to a misunderstanding between the Social Security Administration and other parts of the government, some Americans have lost their eligibility for disability payments, the HuffPost reported this week.

The whole point of stimulus was to help people who were being harmed during COVID, and now theres going to be people facing a cessation of benefits and theyre going to end up in a worse place, Michelle Spadafore, senior supervising attorney with the New York Legal Assistance Group, told the news outlet.

It appears that the stimulus checks have pushed some beneficiaries incomes above the threshold under which they are eligible for benefits, even though that isnt supposed to happen.

The report also noted that the resource limit of $2,000 for individuals and $3,000 for couples hasnt been updated since 1989. President Biden, however, has proposed raising that figure, although the legislation has not yet been introduced.

Youre going to give me a stimulus check to stimulate the economy, and I cant go out under doctors orders and youre penalizing me for having this money, one man affected by the mistake said. Now its going to cost me money to have this money.

After the American Rescue Plan passed, Forbes looked at what the legislation does to help disabled people.

Reporting Income To The Ssa

Although SSI benefits aren’t taxable, you must nonetheless report all sources of your income to the Social Security Administration if you’re collecting SSI. But you do not have to report SSI income to the IRS. The distinction isn’t so much whether benefits are reportable, but to whom they’re reportable and why.

You must report all sources of income to the SSA because your need for financial support might be partiallyif not entirelyerased if you come upon another source of income. This extra income could mean that you would no longer be eligible for SSI.

State and federal laws change frequently, and the information in this article may not reflect your own states laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney.

Understandably, the SSA wants to know about this turn of events. Likewise, if you should become employed so you’re earning , this would most likely reduce your benefits. However, it may not completely eliminate your benefits.

According to the SSA, reportable income includes all money that comes into your household, including money that you or your spouse receives. The money doesnt have to be earned from a job. If you win a little money from a scratch-off ticket or receive a cash gift from a family member, you must report these things to the SSA.

There are a few sources of income that the SSA does exclude from counting against you for qualifying purposes, such as rent subsidies.

Recommended Reading: How Can I Make Payments For My Taxes

How Do I File My Tax Returns

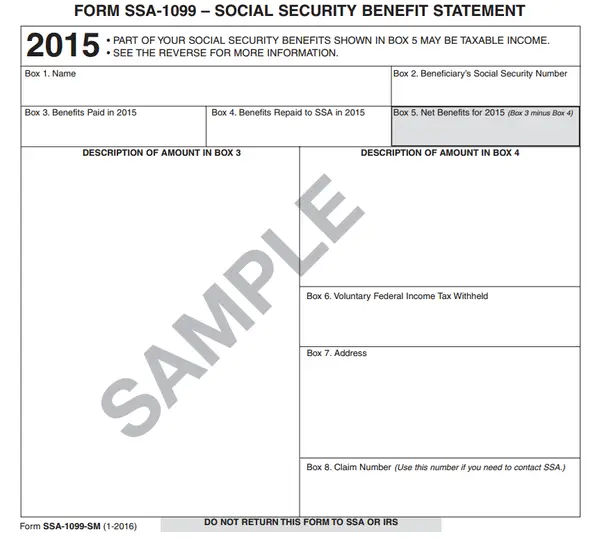

Once its determined that your Social Security disability and outside incomes exceed income guidelines, you must report your Social Security disability amounts on your federal tax returns for federal tax purposes. You dont pay state or local taxes on your Social Security disability benefits. Each January, the Social Security Administration mails you a Social Security Statement, also known as Form SSA-1099, detailing how much you received in benefits the previous year. If you owe taxes, you can pay them by April 15th. You can pay federal taxes early by making estimated tax payments to the Internal Revenue Service every three months, or quarterly, throughout the previous year. You will know when you receive your statement in January if you overpaid or still owe taxes. Another option is to have federal taxes withheld from your monthly disability checks.

References

Claiming A Dependent Who Receives Ssi

To determine if you need to complete an SSA 1099 for Child, you need to use the IRS-provided work sheet. Fill in your own tax information as usual. Grab the 1040 instructions and fill in the Social Security Benefits Work Sheet. The total amount of benefits your child received is located in Box 5 of Form SSA-1099, which you shouldve received from the Social Security Administration. After youve entered all the information on the work sheet and calculated the total, if the amount on the last line is zero, your child doesnt have to file. If his wages exceeded $5,950 or he collected more than $950 from any other source, he still has to file taxes but he can exclude the benefits from his income. Complete form 1040, but don’t check either box in the Exceptions section because you can claim him as a dependent. You’ll enter any benefits collected in the first field on Form 1040, on the line labeled, “Social Security Benefits.”

Recommended Reading: What Does Agi Mean For Taxes

When To Include Social Security In Gross Income

There are certain situations when seniors must include their Social Security benefits in gross income. If you are married but file a separate tax return and live with your spouse at any time during the year, then 85% your Social Security benefits are considered gross income which may require you to file a tax return.

In addition, a portion of your Social Security benefits are included in gross income, regardless of your filing status, in any year the sum of half your Social Security plus all other income, including tax-exempt interest, exceeds $25,000, or $32,000 if you are married filing jointly.

Is My Disability Income Taxable

If you earn military disability from the government or the VA, you are not required to pay income tax on these amounts. However, any benefits paid to you by your employer are subject to tax and must be reported as wages on Form 1040.

SSI itself is not taxed, but if you earn additional income like self-employment, dividends, or interest, you will need to file a tax return.

SSDI benefits are also not subject to federal tax. However, a few states do tax SSDI:

- Colorado

- West Virginia

You May Like: Do You Have To Report Roth Ira On Taxes

Can You File Income Taxes When You Receive Ssi

More than 8 million Americans received Supplemental Security Income benefits in 2017. If you are one of those SSI recipients, whether you are required to file an income tax a return depends on your other sources of income, if any, and how much you receive. Anyone with a Social Security number can file a tax return, but not all citizens are required to do so. Understanding the relationship between SSI and income tax is critical for individuals who may be in a position to benefit from these payments.

Tips

-

Since SSI isn’t taxable, you won’t have to file an income tax return if that is your sole source of income. For all other income, you are required to file a return if you meet your status’s minimum filing requirements.

Paying Taxes On Social Security

You should get a Social Security Benefit Statement each January, detailing the benefits you received during the previous tax year. You can use it to determine whether you owe federal income tax on your benefits. The information is available online if you enroll on the Social Security site.

If you owe taxes on your Social Security benefits, you can make quarterly estimated tax payments to the IRS or have federal taxes withheld from your payouts before you receive them.

Also Check: How Much Does H& r Block Charge To Do Taxes

Questions Answered About When Ssi Ssdi Recipients Will Get Stimulus Checks

Alison DeNisco Rayome/CNET.com

The third stimulus check is on its way to millions of people. Here are the new qualification rules for SSI and SSDI recipients and their dependents, a timeline for when the payments could arrive and what to do if any money is still missing from the first two checks.

The IRS is continuing to send out the first wave of $1,400 stimulus checks to eligible individuals and families with direct deposit on file with the agency heres how to see where your payment is. But if youre a recipient of Supplemental Security Income or Social Security Disability Insurance benefits, you may not get your check during the first wave. Well help answer questions you have about when to expect your third stimulus check and more.

Other details, however, are more complex for example, if you stopped or started receiving SSI or SSDI in 2019 or 2020, your situation could become complicated now that its tax season. Well explain how to claim any money youre missing from the first two stimulus checks even if you dont usually file taxes and can help answer how your third payment might arrive.

Are There Any Tax Credits For People With Disabilities

Yes. There is a credit called Credit for the Elderly or the Disabled. You can get back an amount from $3,750 to $7,500. You must be either 65 or older or retired on permanent and total disability. You must also receive taxable disability income during the tax year. Finally, you are required to meet a specific adjusted gross income or have a total amount, including Social Security, pensions, annuities, and disability income resulting in a particular amount.

For more information, read IRS Publication 524.

This article is up to date for tax year 2021 .

You May Like: Do You Have To Report Your Roth Ira On Your Taxes

What If You Are A Canadian Resident Who Receives Us Social Security Benefits

We recently published an article about US residents who receive CPP/OAS Canadian pension benefits. What about the opposite?

Lets take the case of our reverse snowbird Emily, a Canadian citizen who has been living and working in the US for the last 30 years and has fully qualified for US social security benefits. Instead of retiring in sunny Florida like a lot of Canadians choose to do, Emily wants to retire back in the frozen tundra otherwise known as Edmonton.

Is Emily crazy to retire in Canada?

Yes, if the weather is the only factor you consider.

But from a tax perspective, the US-Canada tax treaty is actually very favorable to Emily when it comes to the taxation of her US social security benefits when she moves back to Canada.

How so? Well, to begin with, Emily will not have to pay any US tax on the US social security benefits she receives in Canada. In order words, Emily does not need to pay a US withholding tax or even US income tax on the social security income received.

But wait. What if Emily is a US citizen living in Canada? Luckily for Emily, even a US citizen is treated the same way as other residents of Canada when it comes to the taxation of US social security benefits.

Namely, the US social security benefits will be subject to tax only in Canada.

What this means is that Emily will include in her Canadian taxable income only 85% of the US social security benefits she receives. For those of you doing the math, the other 15% will be exempt from tax in Canada.

Can I Claim My Parent As A Dependent If

they receive Social Security Retirement Benefits?

Yes. Your parent is receiving benefits for the time and effort they put in while on the workforce. This amount is not included in their gross income amount for the year. That means that Rule #4 above is still met even if their benefits come to more than $4,000 annually.

EXCEPTION: If your parent decides to go back to work after retiring, then that income could affect Rule #4 and Rule #5 above. Heres how. If their income amount from the new job comes out to be more than $4,000 for the year, then you can not claim them as a dependent on your taxes. In turn, if they are providing more than 50% of their own support with the new job, then you cannot claim them as a dependent either.

they receive Social Security Disability?

Yes. Millions of Americans each year enter into the Social Security Disability program because they are no longer able to work due to a medical condition. Disability is available to those whose condition is expected to last longer than 12 consecutive months . One can receive this benefit until they are either no longer disabled or have reached full retirement age.

EXCEPTION: You can claim your parent as a dependent on your tax return without their benefit being affected. However, Social Security benefits can limit any wage income they receive while on disability .

they receive Supplemental Security Income ?

they have a job?

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

If I Havent Received My Stimulus Check What Should I Do

If theres a problem with your stimulus check, the SSA and VA refer you back to the IRS. However, the IRS doesnt want you to call if you have an issue with your payment, and points out repeatedly on its FAQ pages that phone staff dont have additional information beyond whats available to you in the IRS tracking tool. So, what then?

Depending on the situation, there may be a few self-service options if you run into stimulus check trouble or are looking for an explanation of whats holding up your check. Otherwise, you may need to request a payment trace with the IRS, but there are specific timing rules for that.

Some of the rules surrounding the third stimulus payment get complicated.

What If I Dont Have A Bank Account

If you dont have a bank account, checks will be mailed to your address.

If you wish to open a bank account, visit the Federal Deposit Insurance Corporation for information on opening an account online.

Reloadable prepaid debit cards or mobile payment apps with routing and account numbers may also be an option.

You May Like: 1040paytax.com Official Site

Tax Credit For Seniors

Even if you must file a tax return, there are ways you can reduce the amount of tax you have to pay on your taxable income. As long as you are at least 65 years old and your income from sources other than Social Security is not high, then the tax credit for the elderly or disabled can reduce your tax bill on a dollar-for-dollar basis.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Is My Social Security Income Taxable The Quick Answer

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income .

If your combined income is above a certain limit , you will need to pay at least some tax.

The limit is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The limit for joint filers is $32,000. If you are married filing separately, you will likely have to pay taxes on your Social Security income.

Read Also: What Does H& r Block Charge

The Rules For Qualifying Relatives

Some qualifying relatives must live with you all year, but others, like your parents, can live elsewhere as long as you pay for more than half of their support needs. All told, about 30 different relatives are exempt from the must-live-with-you rule. Also, you must pay for more than half of their support needs if they live with you.

And theres an income cap for qualifying relatives they must earn less than $4,150 as of the 2018 tax year. And they cant be claimed as a dependent by any other taxpayer.

Keep Some Retirement Income In Roth Accounts

Contributions to a Roth IRA or Roth 401 are made with after-tax dollars. This means they’re not subject to taxation when the funds are withdrawn. So the distributions from your Roth IRA are tax-free, provided their taken after you turn 59 1/2 and have had the account for five or more years. Distributions taken from a traditional IRA or 401 plan, on the other hand, are taxable.

That means the Roth payout won’t affect your taxable income calculation. That also means it won’t increase the tax you owe on your Social Security benefits.

This advantage makes it wise to consider a mix of regular and Roth retirement accounts well before retirement age. The blend will give you greater flexibility to manage the withdrawals from each account and minimize the taxes you owe on your Social Security benefits.

A similar effect can be achieved by managing your withdrawals from conventional savings, money market accounts, or tax-sheltered accounts.

Read Also: How Can I Make Payments For My Taxes

Can You Claim Someone On Your Taxes If They Get An Ssi Check Each Month

Supplemental Security Income, or SSI, is a program administered by the Social Security Administration to provide benefits to a select group of Americans: those who are blind, disabled or age 65 and older. These individuals must additionally have little or no income and limited other financial resources. If this sounds like someone who’s close to you, you might wonder if you can claim her as a dependent on your tax return. Can you claim someone as a dependent whos on SSI? Yes, if you and your dependent meet some rules.