Why Are There Penalties And/or Interest On My Account

Title 8 Chapter 5 § 502 states that a penalty of $125.00 is assessed for failure to file the Annual Franchise Tax report by March 1st. Title 8 Chapter 5 § 504 states if the tax of any corporation remains unpaid after the due dates established by this section, the tax shall bear interest at the rate of 1.5 percent for each month or portion thereof until fully paid.

Filing Your Delaware Annual Report

The Delaware Annual Report and/or franchise tax must be filed online through the Delaware Corporations Information System.

- On the state website, youll need to enter your 7-digit Business Entity File Number. You can easily find your business file number by searching the Delaware Business Database.

- Then, click Continue. This will automatically begin the filing process.

Youll need to include, verify, and/or update the following information on your Delaware Annual Report.

All filing and franchise tax fees must be paid with a credit card OR electronic check.

Never worry about late fees, potential penalties, or forgetting to file. Hire Northwest Registered Agent to file your Delaware Annual Report for you!

What Is An Annual Report

Some of the information a corporation must provide in a Delaware Annual Report include:

- The corporations physical address

- The names and addresses of corporate officers

- The names and addresses of all directors on the corporations Board of Directors

Exempt domestic corporations pay $25 to file their annual reports. Non-Exempt domestic corporations pay $50 to file their annual reports.

The Annual Report filing fee is $125.00 for Foreign Corporations in Delaware.

Don’t Miss: Do You Get Taxed For Donating Plasma

Delaware Annual Report Information

Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

State agencies do not provide consistent reminders when annual reports are due. As a result, you may be tracking your companys annual report due dates on your own. Perhaps you received a letter from the state telling you an annual report is coming due, or worse, overdue.

This page provides information about how to file a Delaware annual report. Our handy reference table will provide you with the Delaware annual report due dates and filing fees for each entity type. We also offer Managed Annual Report Service to offload your annual reports entirely. We track your due dates and file on time, every time.

- Jump To:

Hi, Im John Beck, with Harbor Compliance, and today Im talking about annual reports. Annual reports are required filings to maintain a business entity’s good standing with the secretary of state.With a few exceptions, annual reports are not complex. They generally contain basic information about a company such as its principal address, registered agent, and officers and directors. Some states have more complex filings though. When annual reports are paired with another filing, such as a business license in Nevada, or a tax return in Maryland or Texas it becomes more complex.

When Is The Delaware Franchise Tax Due For Llcs

Franchise tax starts the year after you form your LLC. It is due on or before June 1 of every year. Failure to pay the tax will result in a $200 penalty in addition to the tax, plus interest and immediate loss of Good Standing status, so its important to pay the tax by the due date. You may also pay franchise tax for the year at any time before the tax is becomes due. If the LLC goes two years without paying state franchise tax, the company will automatically go void. The company will require a costly renewal/revival if the Members decide they want the business to continue under the same name. A renewal/revival is also the only way to keep the same formation date.

Recommended Reading: Is Donating Plasma Taxable Income

How Much Does The Delaware Llc Annual Franchise Tax Cost

If youre putting together a budget for all your LLCs costs like formation costs, name reservation fees, and initial operating expenses its important to include annual filings like this one, just so that there are no surprises.

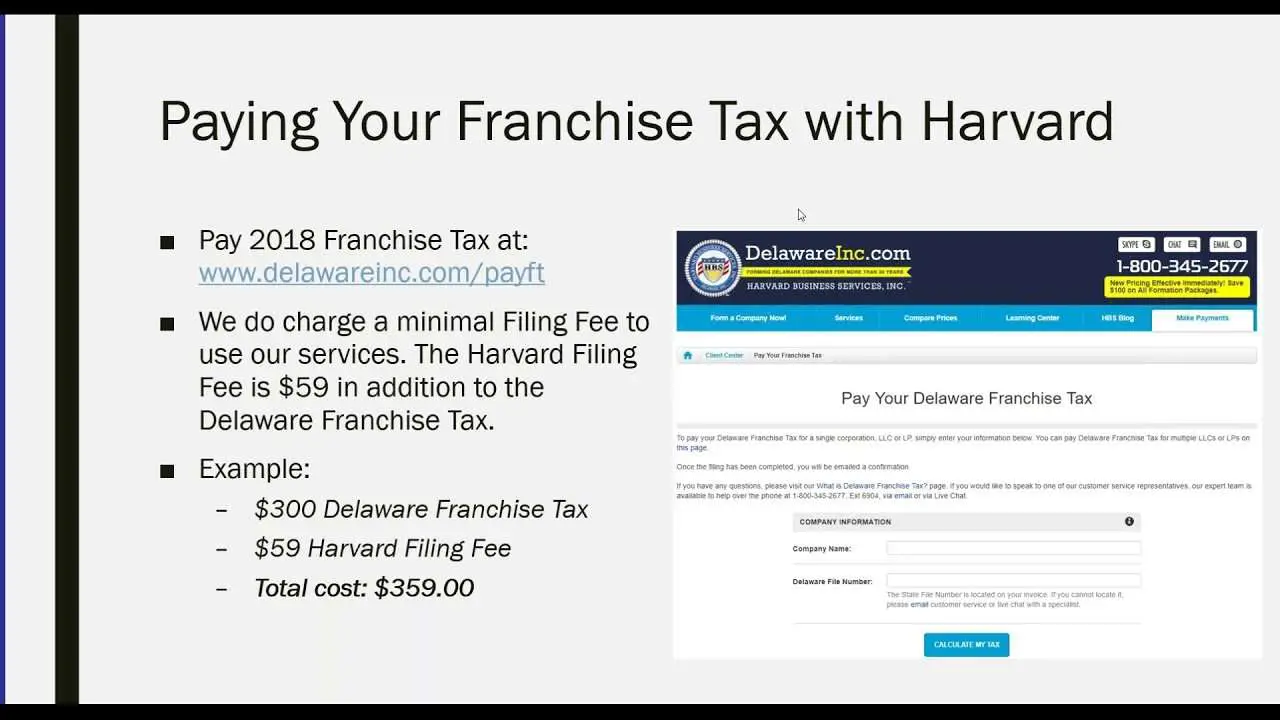

Costs vary from state to state. Some franchise taxes are $50 while others can be several hundred dollars. At $300, Delawares Annual Franchise Tax isnt exactly cheap, so youll want to include it in your budget for each year. This does not take the place of your other state taxes. You will still need to pay any other applicable state business taxes by April 15 each year. If you need tax help, it might be prudent to consult a CPA or other tax professional.

The Authorized Share Method

When you create a Delaware company, one of the pieces of information youre required to list in your Articles of Organization is the number of shares that the company is authorized to issue to shareholders. This is the maximum number of shares that a corporation is legally permitted to issue. These shares should not be confused with the outstanding shares, which are the number of shares the corporation has issued that are held by founders or other investors. A lot of companies these days, particularly startups, seems to want to authorize millions and millions of shares in the anticipation of large rounds of funding. If your company has 20 million authorized shares, this will ensure a large franchise tax notice from the state of Delaware, using the authorized shares method of calculation is:Using the authorized shares method, Delaware will calculate your franchise tax by charging you:

- $175.00 flat fee if you have 5k shares or less or

- $250.00 flat fee for your first 10k shares, AND

- $75.00 fee for every additional 10k shares, up to a total tax of $200,000.00

So, if youve authorized 20 million shares, youd be charged under the authorized shares method:

- $250.00 , plus

- $149,925.00 , for the remaining 19.9mm shares

- Total Tax Bill: $150,175.00

This can be quite the shock, especially if your business is pre-revenue, which is why they have the assumed par value method as well.

Don’t Miss: Csl Plasma Taxable

Delaware Llc Annual Franchise Tax: What It Is And How To File

You did it. Your Delaware LLC is officially up and running, ready to take on challenges, roll in the profits, and change the world.

Theres no doubt that this is an exciting time in your business journey. After starting your LLC, its easy to get carried away in all the excitement and expectations. After all, as a new business owner, youve got a lot on your plate.

But the state does too. They need to keep updated records on thousands of businesses so that they can effectively reach out with any important tax or legal communications down the road. How do they do it? With your cooperation, of course.

In Delaware, LLCs are not required to file annual reports. The only annual filing youll need to take care of is your franchise tax payment, which has the same due date and fee every year. Unsure how to go about it? Never even heard of it? No worries at all. Thats why were here. Keep reading for everything you need to know.

Important Consumer Alert About Corporate Records Service Scam

The Delaware Secretary of States Office and the Delaware Division of Corporations recently learned of a deceptive solicitation that has been mailed to numerous Delaware corporations from a company named Corporate Records Service. These solicitations urge corporations to file information and send payment in the amount of $125.00 by a certain date in order to complete corporate meeting minutes on behalf of the corporation. More information.

Corporate Annual Report and Franchise Tax Payments

Don’t Miss: Do You Pay Taxes On Donating Plasma

Delaware Annual Report And Franchise Tax Overview

Domestic Delaware corporations have a franchise tax and annual report due every March 1st. The only way to file your Delaware corporate annual report for a domestic corporation is to file online. Or you can pay a Delaware registered agent to do it for you, but theres no need to waste your money paying someone else to turn around and just enter the same info you give them into the Delaware Division of Corporations website.

How To Calculate It

There are 2 methods to calculate the tax, both are accepted by the state of Delaware. We recommend calculating using both and then using the method that results in the lower tax. Almost always for startups, that will be the Par Value Capital Method, but both are quick and simple to check.

You only need four pieces of information to do both methods:

- Number of authorized shares

- Par value of the shares

- Gross assets of the company

Your initial number of authorized shares and the par value were set at incorporation. Unless you have authorized more then check your incorporation documents for this info. Issued shares are those which have been issued to shareholders. Gross assets should be the number on your federal tax return, you can ask your accountant for this, but its usually your cash balances plus other assets like intercompany loans or machinery.

The two methods are:

You May Like: Www Aztaxes Net

What Information Does Delaware Require

Delaware requires basic information regarding the company, such as its location, and its directors and/or officers. Delaware also requires information needed to compute the franchise taxauthorized shares, issued shares, and total assets. CT Corporation will file your annual report using the method that results in the lowest tax due.

What are the typical fees?

The state of Delaware charges corporate entities a franchise taxamounts range between $175 and $250,000. For late filings, additional fees and interest are added to the amount owed. Each LLC or LP must pay a $300 annual tax.

CT Corporations efiling fee is $75.

Corporate Annual Report Information And Franchise Tax Fees

Corporate Annual Report

All active Domestic Corporation Annual Reports and Franchise Taxes for the prior year are due annually on or before March 1st and are required to be filed online. Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

Annual Report Filing Fees:

Effective September 1, 2019, the fees for filing an Annual Report or an Amended Annual Report are below:

- Non-Exempt Domestic Corporations $50.00.

Franchise Tax Rates:The minimum tax is currently $175.00, using the Authorized Shares Method and the Minimum Tax using the Assumed Par Value Capital Method is $400.00 with a maximum tax of $200,000.00 for both methods unless it has been identified as a Large Corporate Filer, then their tax will be $250,000.00. Taxes are assessed if the corporation is active in the records of the Division of Corporations anytime during January 1st through December 31st of the current tax year.

Don’t Miss: How To File Uber Taxes On Taxact

How Do I Pay My Delaware Franchise Taxes

Your Delaware franchise taxes are due by March 1 every year. Use the instructions below to file them.

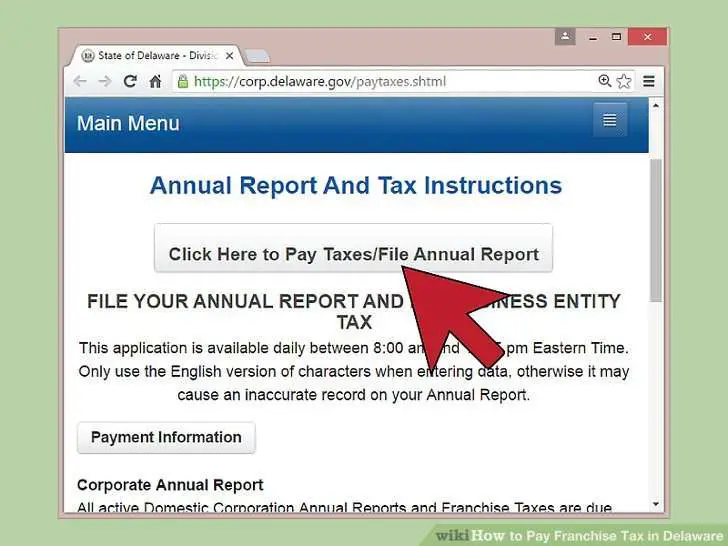

Go to the State of Delaware – Division of Corporations franchise tax filing page.

Enter your Business Entity File Number and click Continue. You can find your File Number on your Gust Launch Company Information page .

4. Most Gust Launch customers will want to Recalculate their franchise taxes using the Assumed Par Value method at this point so that their tax bill is as low as possible. To do so, underneath the Stock Information section of the page enter your company’s Issued Shares, Gross Assets, and for Asset Date enter the last day of the year you are filing taxes for . After you have entered this information, click the “Recalculate Tax” button.

Enter your Federal Employer Id Number at the top of the page. Again, you can get this from the Gust Launch Company Information page.

Enter your Principal Place of Business. This should be the same as the physical address that you have listed on your Gust Launch Company Information page. If the information on Gust Launch is inaccurate, update it now.

Enter the information of one of your Company Officers .

How Do I Pay My Franchise Taxes And File The Annual Report

Companies based in the United States must pay their franchise tax and file their annual report electronically. You can do so by following these steps:

Recommended Reading: Doordash Tax Forms

How Do I File A Delaware Annual Report

There are two ways to file a Delaware annual report.

- If you plan to file your Delaware Alternative Entity Tax / Annual Franchise Tax Report / Annual Report on your own, view the table below for the available filing methods for your type of legal entity. We also provide links to forms and agency filing portals.

- . Simply provide your information one time and update it with us when it changes. Our software tracks your due dates and automatically files your annual reports throughout the year.

What Is Delaware Annual Report

A Delaware annual report is a document that contains specific business information. The Delaware annual report is a form that is submitted at the time of payment of the Delaware franchise tax.

The information required by a Delaware annual report is:

-

The address of the corporation’s physical location

-

The name and address of one officer

-

The names and addresses of all corporation directors

These details must be submitted each year, even if no changes were made since the previous year.

All businesses that are incorporated in Delaware must submit an annual report. The report is due on March 1. This is the same due date as the Delaware franchise tax.

LLCs are not required to fill an annual report. LLCs are required to file the Delaware franchise tax.

The annual reports are filed and stored with the Delaware Secretary of State’s office.

If a change happens mid-year that affects the information listed on your annual report, an update must be filed. The amendment must be fully filled out when submitted. The amendments are accepted for up to a year after the original filing.

Recommended Reading: Csl Plasma Taxes

Who Is Authorized To The File The Annual Report

Title 8 Chapter 5 § 502 states that the report shall be made on a form designated by the Secretary of State and shall be signed by the corporation’s president, secretary, treasurer or other proper officer duly authorized so to act, or by any of its directors, or by any incorporator in the event its board of directors shall not have been elected.

Where Are My Notices Sent And How Do I Get A Duplicate

All tax notices are printed in December of the year that tax is due and sent to the Registered Agent. The Registered Agent is designated by the corporation through the initial formation or a filing submitted by the corporation that designates another Delaware Registered Agent. Please contact Delaware Business Incorporators, Inc. if you require another copy of your notice.

Also Check: What Does It Mean To Grieve Taxes

How To Pay The Delaware Franchise Tax

If you have a tax preparer, they might do this for youâ â itâs a good idea to ask, and many will handle it free of charge .

If you donât have a tax preparer , hereâs how to handle it yourself. The process might look intimidating, but itâs actually pretty straightforward, and weâll walk you through the trickiest parts.

Step 1Visit Delawareâs website for paying the tax:

Step 2Click on Pay Taxes / File Annual Report and enter your information as prompted . Then, click on âfile annual report.â

You will most likely see a very large âamount due,â possibly in the tens of thousands of dollars. Donât panic! There are two methods to calculate the amount of tax you owe, and you can use whichever one is lower. Those methods are:

- â This bases your tax obligation amount on the total number of shares authorized in your company charter, regardless of the number of actual shares outstanding. For startups, this method tends to result in much higher numbers than using the assumed par value method.

- Assumed par value â This bases your tax obligation amount on a mix of issued shares and gross assets. For startups and small companies, this method usually results in a much lower tax value. The minimum tax using this method is $400. This is almost certainly the method youâll want to use.

You can learn more about the calculation methods on Delawareâs franchise tax website.

Frequently Asked Tax Questions

I am not a Franchise why do I owe Franchise Tax?

I havent started doing business yet do I still have to file a report and pay taxes?

I am going out of business or my business is closed do I still owe taxes?

What if I dont have Federal ID #?

Where do I get my total gross assets?

Where are my notices sent and how do I get a duplicate?

What is a PDF? How would I attach one?

Who is authorized to file the report?

What is a session ID?

Why are there penalties and/or interest on my account?

What Qualifies a Corporation as a Large Corporate Filer?

Also Check: Efstatus.taxact.com