Wheres My State Tax Refund Montana

Visit the Department of Revenues TransAction Portal and click the Wheres My Refund link toward the top of the page. From there you will need to enter your SSN and the amount of your refund.

The processing time for your tax return and refund will depend on when you file. The Montana Department of Revenue says that if you file your return in January, it may process your refund within a week. However, you may wait up to eight weeks if you file in April, which is generally when states receive the majority of returns.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Recommended Reading: 1040paytax Review

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

You May Like: Does Doordash Send You A 1099

How Long Will It Take To Get My State Tax Refund

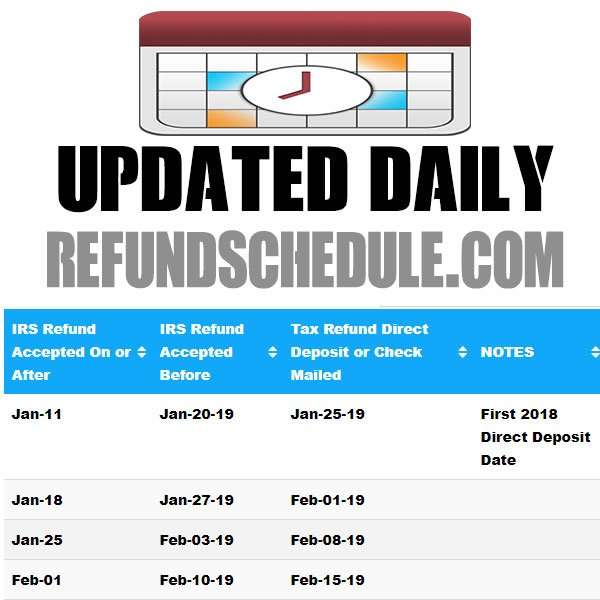

While there are a few exceptions, most states have state income taxes. If you are looking for information about your state income tax refund, use the chart below. It gives the average time it takes to get your refund processed in each state.

Also, if you click on the states name, youll find more detailed information about the states tax refund policies and timeframes. Youll also find links to your states department of revenue web page and automated phone number. Those will be the best options to check the status of your refund.

For most states, youll need your social security number, the tax year and your expected refund amount to check your state refund status.

Can Someone Take Your Property By Paying The Taxes In Mississippi

In Mississippi, a tax sale will eventually take place if you don’t pay the property taxes on your home. At the sale, the winning bidder buys the tax debt and gets a lien on the property. The purchaser receives a receipt along with the right to eventually get ownership of your property if you don’t pay off the debt.

You May Like: Stripe Doordash 1099

Need A State Tax Exemption Form

Per OMB Circular A-123, federal travelers “…must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills.” GSA’s SmartPay team maintains the most current state tax information, including any applicable forms.

Last Reviewed: 2021-09-30

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you’ve entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense.

Rates for foreign countries are set by the State Department.

How Can I Avoid Paying Nppr

There were exemptions to the NPPR charge. A person is not liable for the NPPR charge in the following circumstances: You owned only one property and you reside in it as your principal private residence. You were renting out a room in your house and you can avail of the tax relief for renting this room.

Read Also: Www.1040paytax

Can You Pay Ms State Taxes Online

Pay your taxes online at The Mississippi Department of Revenue’s Taxpayer Access Point, TAP!. You can also pay your taxes online at Official Payments Corporation. Visa, MasterCard, Discover Network, and American Express credit and debit cards, and other forms of payment, such as Bill Me Later® are accepted.

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

Read Also: How Much Should I Set Aside For Taxes Doordash

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once you return to the processing stage, your return may be selected for additional review before completing processing.

Also Check: Csl Plasma Taxable

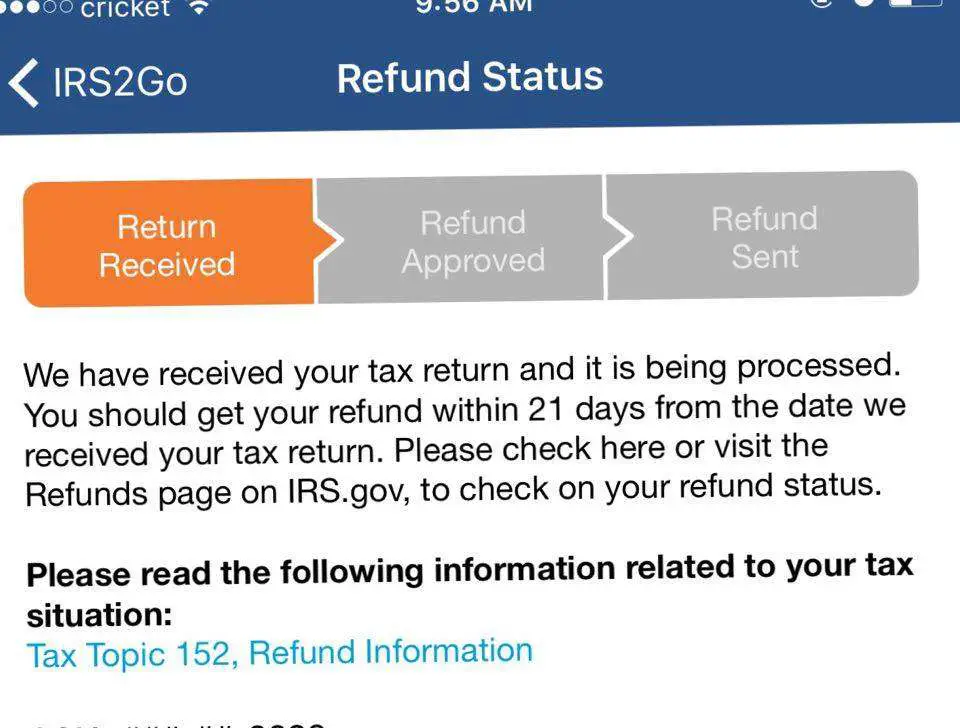

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Vies Vat Number Validation

Important Disclaimer:

As of 01/01/2021, the VoW service to validate UK VAT numbers ceased to exist while a new service to validate VAT numbers of businesses operating under the Protocol on Ireland and Northern Ireland appeared. These VAT numbers are starting with the XI prefix, which may be found in the Member State / Northern Ireland drop down under the new entry XI-Northern Ireland.Moreover, any quote of Member State is replaced by Member State / Northern Ireland and any quote of MS is replaced by MS / XI.All traders seeking to validate UK VAT numbers may address their request to the UK Tax Administration.

You can verify the validity of a VAT number issued by any Member State / Northern Ireland by selecting that Member State / Northern Ireland from the drop-down menu provided, and entering the number to be validated.

Recommended Reading: Efstatus.taxact.com.

What Can Cause A Delay In My Mississippi Refund

There are a number of things that could cause a delay in your Mississippi refund. Here are a few of them:

- Mailing a paper return

- Having an error on your return

- Returns identified for additional review

- Additional procedures to protect taxpayers from identity theft may cause a delay in refund processing.

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their return after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get e refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

You May Like: Do You Have To Pay Taxes On Donating Plasma

Main Causes Of A Delay In Your State Tax Refund

Although each state handles things a little differently, there are some common things that can delay your state tax refund. The main ones are:

- If you file a paper return, it can greatly slow down the processing of your refund vs. filing electronically. To get your refund as soon as possible, youll want to file your state income tax return online.

- Similarly, if you get your refund checked mailed to you, it will take longer to get your refund vs. if you choose direct deposit.

- Any errors, incomplete information, adjustments, etc. on your return will usually cause delays.

- Errors in your direct deposit information can cause issues that can delay things weeks or months. Be sure to double check your banking information.

- Complex returns that have multiple forms also tend to take longer to process.

- Filing your return too late or too early

Also keep in mind that new state fraud prevention measures are leading to delays in some states.

Good luck!

How To Check On Your State Tax Refund

Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Also Check: Tax Deductions Doordash

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Do I Have To File Mississippi Tax Return

2020MississippiTax Return RefundfilewillfilingclaimMississippiTax Return RefunddoesTaxes

Do you have to file state taxes in mississippi?

Mississippi Residents As a resident you are required to file a state income tax return if you had any income withheld for tax purposes, earned more than $8,300 or earned more than $16,600 . To file a Mississippi resident return use Form 80-105.

does Mississippi tax gambling winnings?Gambling winningsMississippiincome taxMississippi gambling winningsMississippi tax

Contents

Also Check: When Does Doordash Send 1099

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To the check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

Wheres My Refund Mississippi

To check the status of your Mississippi state refund online, go to .

In order to view status information, you will be prompted to enter:

- ID Type

- Social Security number

For specific telephone numbers, refer to the Mississippi Department of Revenue Contact Us page.

If you e-filed your tax return, allow ten business days before calling about your refund. All other returns which are filed early are processed before and usually more quickly than returns filed closer to the due date.

Ordinarily, within ten weeks after receiving your completed return, your refund check will be mailed. Allow at least ten weeks for your refund to arrive before contacting department of revenue.

Also Check: Where Can I Amend My Taxes For Free

Do I Need To File Multiple State Tax Returns

You may need to file multiple state tax returns if you have moved within the last year, work in multiple states, or live and work in different states.

In 2015, the U.S. Supreme Court ruled against double taxation meaning two or more states are no longer allowed to tax someone for the same income. If you work in a state that has a reciprocal tax agreement with your home state, you may be able to submit a document to your employer and avoid having taxes withheld from your paycheck. If the two states do not have a reciprocal agreement, you may need to prepare multiple state returns, but you will be refunded for unnecessary withholdings from your paychecks.

For more details about these special circumstances, read Living in One State, Working in Another.

Wheres My Mississippi Tax Refund

Check the status of your tax refund using these resources.

State: MississippiRefund Status Phone Support: 1-601-923-7801 Hours: 8 a.m. 5 p.m.General Tax Information: 1-601-923-7089, 1-601-923-7700Online Contact Form: 2020 State Tax Filing Deadline: May 17, 2021

Note: Please wait at least eight to 10 weeks before checking the status of your refund.

You May Like: Www..1040paytax.com

Contact Us Using The Intime Customer Portal

Secure Messaging | Request Refunds | Make Payments | View Balances | Respond to Correspondence & Upload Documents

Payments, Billing, General Questions, Refunds, Liability Status 232-2240 Monday Friday 8:00 a.m. 4:30 p.m. EST

Taxpayer Advocate Office Monday Friday 8:00 a.m. 4:30 p.m. EST Check eligibility for Taxpayer Advocate Office assistance here.

Wheres My State Tax Refund North Dakota

North Dakotas Income Tax Refund Status page is the place to go to check on your tax refund. Click the link in the center of the page and then enter your SSN, filing status and exact tax refund. The refund status page also has information on how the state handles refunds.

The state advises not to call unless you check your refund status and it says to call.

Don’t Miss: 1099 Nec Doordash

The Income Tax Refund Is Processed By State Bank Of India And Is Directly Credited To The Bank Account Nominated By The Taxpayer In His/her Itr At The Time Of Filing It

CBDT issues refunds of over Rs. 1,50,407 crore to more than 1.48 crore taxpayers from 1st Apr,2021 to 3rd January,2 https://t.co/wzNR4nId6o

Income Tax India 1641368709000

How to track status of income tax refund on the new income tax portalHow to track status of Income tax refund on TIN NSDL website

- Refund is credited

- Adjusted against outstanding demand of previous year

- Refund re-issue request