If You Filed An Extension

I’ll get the most obvious situation out of the way first. If you filed for a tax extension before the April 18 deadline, you have an additional six months to file your taxes. For 2017, this is defined as an extended tax deadline of October 16.

It’s important to mention, however, that an extension does not give you extra time to pay. Any money you owe the IRS was due on the original tax deadline, or you can face interest and penalties, which I’ll discuss in more detail later on.

Your Online Efile Account

Use your EFILE number and password to:

- Maintain your account

Note: For an electronic record to be deemed a return of income filed with the Minister in prescribed form:

-

a confirmation number must be generated by the EFILE web service.

All returns filed with the Canada Revenue Agency are processed in cycles. Accepted returns are entered in the next available cycle. Cycle processing usually begins in mid-February and Notices of Assessment for returns processed in the first cycle should be issued by the end of that month.

Ways To File Back Taxes

If you miss Tax Day and need to file your taxes late for the current year, you can still e-file your return until November. The IRS announces in October when exactly it will stop accepting e-filed returns for that tax year. So if youâre filing 2020 taxes but miss filing by May 17, 2021, you still have until November 2021 to e-file.

If youâre filing a federal tax return from a previous year, you may need to mail a physical copy of your tax return to the IRS. You may be able to e-file your back taxes, but this is only available for certain tax years and through certain online tax-filing services.

There are three ways you can complete your back taxes.

Read Also: Reverse Ein Lookup Irs

Where Do I Send Back Taxes

If the IRS mailed you a notice about your late taxes, you should mail your return to the address listed in that notice. Otherwise, where you mail your old tax returns depends on where you live and whether or not youâre including a payment with your return. The IRS instructions for Form 1040 of the year youâre filing for should also include the proper mailing addresses.

What Happens If You Dont File Taxes For 3 Years

If you dont file within three years of the returns due date, the IRS will keep your refund money forever. However, the IRS wont know about your itemized deductions or business expense deductions until you file, so they could come after you if they think you should have sent them a check for taxes owed.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

File My Return With Taxact

To file a return in TaxAct®, you must complete the filing steps in the program. At the beginning of the filing steps you will choose to either file your return electronically or mail a paper return to the IRS/state agency. To begin the filing process, click the Filing tab from within your return. On smaller devices, click in the upper left-hand corner, then choose Filing.

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- That’s no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesn’t stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Don’t think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Don’t Miss: How To Buy Tax Forfeited Land

Can I Still File My 2017 Taxes

Non-filers can still file their 2017 taxes and get their unclaimed tax credits and returns through the updated May 17 deadline. Typically, if you skip your taxes one year, you can file for an extension and file late. The IRS gives a maximum window of three years before you lose out on your unclaimed return.

Collection And Enforcement Actions

The return we prepare for you will lead to a tax bill, which, if unpaid, will trigger the collection process. This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien.

If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Mailing Address For Back Taxes

| Your residence |

|---|

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Alaska, California, Hawaii, Washington | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 7704

San Francisco, CA 94120-7704 || Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, Nevada, New Mexico, Oregon, North Dakota, South Dakota, Utah, Wyoming | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Connecticut, District of Columbia, Maryland, Rhode Island, West Virginia | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000 || Delaware, Maine, Massachusetts, New Hampshire, New York, Vermont | Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999-0002 | Internal Revenue Service

P.O. Box 37008

Hartford, CT 06176-7008 || Florida, Louisiana, Mississippi, Texas | Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0002 | Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214 || Illinois, Michigan, Minnesota, Ohio, Wisconsin | Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0002 | Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501 || Pennsylvania | Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0002 | Internal Revenue Service

Can I Still Get My Tax Refund If Im Filing Back Taxes

Yes, if you file the return within three years of the original due date. This time limit also applies to claiming tax credits like the Earned Income Tax Credit . Tax credits and deductions can significantly reduce your tax liability, so its in your best interest to file within this three-year window to get the tax breaks and the refund you deserve. If you have a prior year return that you still need to file, you can get started for free today with TaxSlayer.

The information in this article is current through tax year 2020 (returns filed in 2021.

You May Like: How Can I Make Payments For My Taxes

Filing A Paper Return:

To file a paper return, you must choose Mail Paper Return during the filing steps. Continue through the filing screens and you will be prompted to print a paper copy of your tax return. Additionally, you’ll be prompted to print the filing instructions . To complete the paper filing process, simply mail your return to the address specified in the filing instructions.

Note: If you have not completed the steps above for either Filing Electronically or Filing a Paper Return, your return has NOT been filed.

TaxAct does NOT have the capability to check the status of mailed paper returns. To check the status of your paper return, please call the IRS at 1-800-829-1040.

City Of Detroit Income Tax E

City of Detroit tax returns for 2015, 2016 and 2017 including amended 2017 tax returns will be accepted during the 2018 processing year.

Michigan, along with many other state revenue agencies, is requesting additional information in an effort to combat stolen-identity tax fraud to protect you and your tax refund. If you have a driver’s license or state issued identification card, please provide the requested information from it. Your return will not be rejected if you do not have a driver’s license or state-issued identification. Providing the information could help process your return more quickly. View more information regarding identity theft.

E-file is a safe, fast, and easy way to file your tax return. This filing option is now available for City of Detroit Individual Income Tax Returns.

E-File with Commercial Tax Software Do it yourself. Buy tax preparation software either over-the-counter or online, and prepare your own return.

E-File through a Paid Tax Preparer Find a tax professional you trust to prepare and e-file your return. Most tax preparers use e-file and many are required to do so. To find an e-file provider in your area, search the IRS Authorized e-file Provider Locator.

Where’s My RefundE-Service is the quickest way to check the status of your refund. Please allow 14 days before checking the status of your e-filed return.

If submitting payment by mail, send a completed form 5122 City Income Tax e-File payment voucher , with payment to:

You May Like: How To Buy Tax Lien Properties In California

Tax Return Filing Dates In 2022

Below are the estimated dates for key tax filing activities and deadlines. These will be updated as the IRS provides more information and you can subscribe to get notified of the latest updates.

Stay In the Know:or follow us on , and

An important point to note is that while you can file your taxes anytime after the beginning of the year, the IRS will not process any returns until IRS e-File goes live. This includes returns filed via the main tax software providers or directly via the IRS website for lower income filers. The IRS also reiterated that filing your taxes electronically is the most accurate way to file a tax return and the fastest way to get a refund. It is expected that more than over 80% of tax returns will be e-filed in the latest tax year.

Once your return is accepted the IRS processes your refund based on the IRS E-file Refund Cycle Chart. Exact refund dates are based on IRS processing times and can be found in IRS Publication 2043 and IRS Topic 152 for both e-filed and mailed returns. After filing and assuming your tax return is on order you should receive your federal refund between 8 and 21 days. If you did not select the electronic deposit option, getting a paper check mailed to you adds about a week. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date.

How To Prepare And Paper File Your 2015 Tax Return Online

Sure, the e-file season for 2015 is over. Youre not completely out of luck. You can still prepare your tax return as you normally would. Youll just need to send it into the IRS instead of submitting it online.

For example, if you typucally use RapidTax each year, you can also use us for your late returns. Heres how it works:

Also Check: How Much Does H& r Block Charge To Do Taxes

How Many Years Can You File Back Taxes

You can file returns up to three years old with TaxSlayer. If needed, you can file back further using paper filing. You can typically find the forms for earlier years on the IRS website.

The IRS typically does not investigate returns that are more than six years overdue. In other words, if your taxes are in question, your past six years of tax returns are usually the only ones that would be considered for auditing.

You can find more information about preparing a prior year return with TaxSlayer here.

If You Owe More Than You Can Pay

If you cannot pay what you owe, you can request an additional 60-120 days to pay your account in full through the Online Payment Agreement application or by calling 800-829-1040 no user fee will be charged. If you need more time to pay, you can request an installment agreement or you may qualify for an offer in compromise.

Recommended Reading: How Can I Make Payments For My Taxes

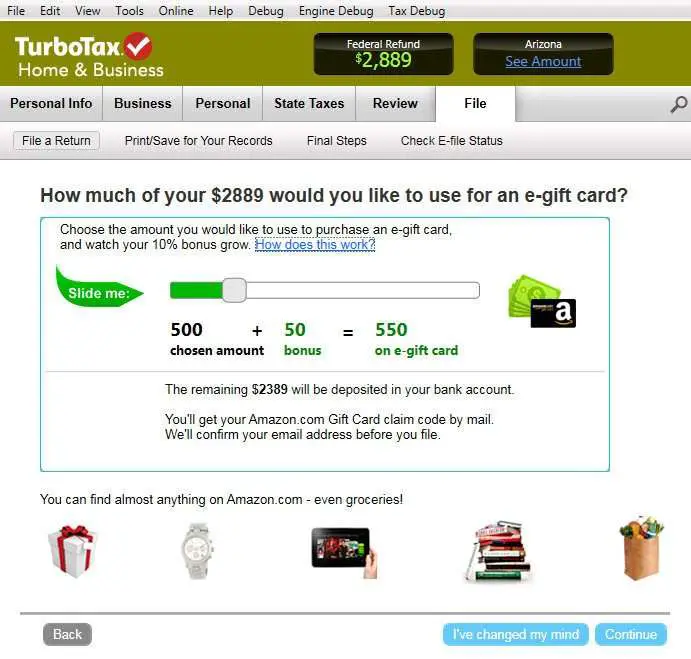

Filing Back Taxes With Tax

Using an online tax-filing service will cost money, but it will offer more guidance and information about which forms you need and how to complete them. However, some online products only allow you to access a few years of prior-year tax forms. Select services do allow you to e-file back taxes for certain tax years, but itâs likely that you will need to print your tax return after filling it out and then mail it to the IRS.

Plan Ahead For Your 2016 Tax Return

Although its simple enough to file late with RapidTax, its always more beneficial for you to file on time. Heres how you can get on the right track for next year.

- Stay Organized: Have all your documents, receipts and income statements in order before you start preparing your tax return.

- E-File: Electronically filing your tax return is safer, easier and MUCH faster than paper filing.

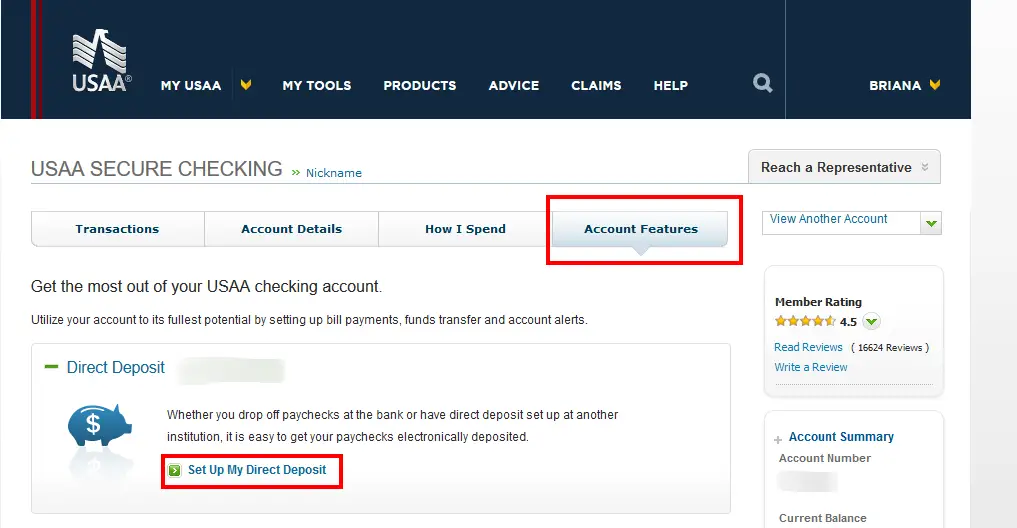

- Choose Direct Deposit: Why wait months for your tax refund when you can have it within 21 days? Having your refund direct deposited into your bank account means youll receive your tax refund much faster than choosing to receive a check.

- Get Help: Use a tax service who can answer the tax questions you have. Dont file your tax return without having your questions answered.

Also Check: How Much Does H& r Block Charge To Do Taxes

The Canada Revenue Agency

We permit only approved participants to electronically file income tax returns.

Personal and financial information must be transmitted to us in an encrypted format. Encryption is a way of encoding information before it is transmitted over the Internet. This ensures that no unauthorized party can alter or view the data.

We also ensure that all personal and financial information is stored securely in our computers. We use state-of-the-art encryption technology and sophisticated security techniques to protect this site at all times.

We have made every possible effort to ensure the safety and integrity of transactions on our Web site. However, the Internet is a public network and, as a result, is outside our control.

General Information About Individual Income Tax Electronic Filing

Filing electronically is a fast growing alternative to mailing paper returns. The Missouri Department of Revenue received more than 2.7 million electronically filed returns in 2019. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Read Also: How To Correct State Tax Return

How Do I File Back Tax Returns

You can use TaxSlayer to file a return for up to three years after it is due. So for example, in 2021, you can file back taxes for years 2017, 2018, and 2019.

Simply log into your account or create a new account to begin. Then click on the Prior Years tab in the middle of the My Account page. Select the year you wish to create and click Start a New Tax Return. From there, youll enter the income and expense information for the year you are filing.

Once your return is complete, you will need to print out and mail in the paper copies of your forms. This is because the IRS does not support filing prior year returns electronically. The mailing address for the IRS can be found here based on the state where you live.

When you file back taxes with TaxSlayer, you get all the correct forms and instructions for the specific year you are completing.

How Late Can You File

The IRS prefers that you file all back tax returns for years you have not yet filed. That said, the IRS usually only requires you to file the last six years of tax returns to be considered in good standing. Even so, the IRS can go back more than six years in certain instances.

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return’s original due date. By not filing within three years of the due date, you might end up owing even more taxes because you can no longer claim the lucrative tax credits you might have otherwise qualified for.

You May Like: How Much Does H& r Block Charge To Do Taxes

Time Matters With Tax Refunds

May 17, 2021 is the last day to file your original 2017 tax return to claim a refund. If you received an extension for the 2017 return then your deadline is October 15, 2021.

If you miss the deadline, any excess in the amount of tax you paid every paycheck or sent as quarterly estimated payments in 2017 goes to the U.S. Treasury instead of to you. You also lose the opportunity to apply any refund dollars to another tax year in which you owe income tax.

Under certain conditions the IRS will withhold your refund check. It can be used to pay:

- past-due student loans,

- child support and

- federal tax debt you owe.

The IRS can also hold refund checks when the two subsequent annual returns are missing. That means you should file returns for 2018 and 2019 as soon as possible. For the 2018 tax year, with a filing deadline in April of 2019, the three-year grace period ends April 15, 2022.