How To Store Financial Documents

You can cut down on clutter by creating a reliable system for storing your financial documents. Keeping your documents safe is equally important. When storing your documents, youll want a storage solution that is:

- Easily accessible

- Protected from the environment/weather/damage

- Well organized

Whether you have paper documents or electronic versions, here are options for storing your financial documents safely long term.

Why Should You Keep Tax Records

The IRS requires that have a detailed expense record, which makes proper bookkeeping very important to your big or small business.

Good records will help you do the following:

- Monitor the progress of your business

- Prepare your financial statements

- Identify sources of your taxable income

- Keep track of your tax deductible expenses and write offs

- Keep track of your basis in property

- Tax Preparation

- Support items reported on your tax returns

As a business owner you must always keep your records, including credit card statements available in case of an IRS audit. During the IRS examination of your tax returns, a detailed set of records will expedite the inspection process and protect you from penalties. Don’t get caught in an IRS audit without your receipts.

Paper Or Electronic Records

For most everything, I use Dropbox with FileThis as my online file cabinet. FileThis is a free service that automatically downloads your financial statements and bills as PDF files each month. I can log in any time and grab documents over one year old . When I needed statements for my recent mortgage refinance, I was able to find everything I need, download the files, and send them to the bank in minutes.

For older files, I scanned them and keep copies on both an external hard drive and my Dropbox. Dropbox is a free cloud storage service that I use every day to keep files I need regularly on multiple computers and for backups of my cell phone pictures. It is important to make sure electronic copies are safe from hackers and hard drive crashes.

So, what do you use for record keeping? What are you plans and strategies? Please share in the comments.

Originally

Don’t Miss: How To Buy Tax Lien Properties In California

Income Tax Return Filing Documents

The filing of income tax returns has become much simpler now as an individual can do it just by logging in to the official return filing portal. However, there are chances that an error might occur while filing the returns. It is always better and safer to take precautions to avoid such errors. One of the major precautions that an individual can take before filing his/her income tax returns is to make sure that he/she has ready access to all the required documents.

How Long To Keep Your Taxes And Bank Statements

Last Updated by Eric Rosenberg

Advertising disclosure: This article may contain affiliate links. If you sign up for an offer through such a link, the owner of this site receives a referral fee and is forever grateful for your support.

I have a file cabinet at home with bank statements dating back to when I opened my first checking account when I was sixteen years old. Nine years later, I wondered if I still need those bank statements. I also have every tax return I have filed, ever. Do I need those? I did some digging and found the answers.

Read Also: Do I Have To Report Roth Ira Contributions On My Taxes

The Irs Might Charge You Penalties And Interest

If the IRS finds out that youâve been late paying your taxes, you might be charged penalties for any number of reasons, including:

Missing a due date

Late filing comes with a . If you owe less than that, itâs 100 percent of your owed amount. For every subsequent month that you donât file taxes, you pay another 5 percent of the unpaid tax each month.

Youâll have to pay an additional 0.5 percent of unpaid tax every month until you pay your original tax bill, up to a maximum 25 percent of your total tax bill.

Thankfully, these two penalties donât stack. If you are late to both file and pay, you will only pay the 5 percent per month interest fine.

Undercalculating your taxes

If the IRS finds that you owe more in taxes than you originally calculated, you have 21 calendar days to pay the additional amount. Otherwise, 0.5 percent interest per month will begin to accumulate.

If you substantially under-report how much tax you owe, or the IRS finds you were intentionally negligent in any aspect of your taxes , the penalty is a 20-40 percent increase in taxes owed.

Submitting a specific tax form late

If youâre late returning a W2 or a 1099 , the fine is a maximum of $50. If youâre late returning a 1065 form or a 1120S form , the fine is a maximum of $195 a month per partner.

When You Need The Records

About two-thirds of Americans now use digital banking, either via a phone app or on a personal computer. More than half continue to get their bank and credit card statements by mail, though. Not surprisingly, older consumers are much more likely to prefer paper documents.

There may be some satisfaction in seeing the actual piece of paper that you signed, although such documentation doesn’t exist for electronic purchases.

In any case, whether you have a paper filing system or access your records online, there may come a time when you’ll need your old statements for any of several reasons.

Recommended Reading: How To Buy Tax Lien Properties In California

What Records Should You Keep

You should keep copies of your tax returns, and all supporting documentation. The list below includes some of the tax records you should maintain.

- Income: Keep forms W-2 , Forms 1099, financial statements, bank statements, contacts, and other documents to verify income reported on your returns.

- Deductions and credits: Keep cancelled checks, bank statements, paid invoices, sales receipts, Forms 1098 , loan documents, financial and legal documents, mileage logs, appointment books, credit card statements, tax credit certificates, and other documents to verify expenses and credits claimed on your returns.

What Are Your Chances Of Being Audited

The CRA regularly audits a certain number of income tax and GST/HST accounts each year to monitor compliance and serve as a quality check on the tax system, which means that your small business could be selected to be audited just by the luck of the draw.

However, your chances of being audited are especially high if you are:

- Self-employed or a sole proprietor

- Running a construction, retail, accommodation, or food sector business

These businesses are more likely to be audited, as the CRA considers them a higher risk for participating in the underground economy by taking cash payments from customers and not reporting the income. And each year, the CRA chooses certain types of businesses to investigate more closely, upping the possibility of audit for any business in that sector.

In other words, your chance of being audited may be quite a bit higher than you think. And if and when your business is selected to be audited, you will certainly want to have all your records in order.

Recommended Reading: How Much H And R Block Charge For Taxes

What Documents Will I Require To File Itr

If you are a salaried employee, these are the documents you would need before you sit down to file your I-T Return:

- If you are paying tax, you surely have a Permanent Account Number with the I-T Department. One of the first documents you need is a copy of the PAN Card.

- For salaried individuals, tax is deducted from your salary before it is credited to your account. The employer, at the end of the fiscal year, will provide you with your Form-16, which contains your salary details, the tax exemptions under various heads based on the documents you have provided to your employer, and your personal information. This Form 16 in two documents: Form 16A and Form 16B is mandatory to file your ITR.

- If you are eligible for an income tax refund that is, if more tax has been deducted from your salary than is required then you also need to submit a cancelled cheque to the I-T Department to confirm your bank account number.

Companies that deduct tax at source also ask employees to furnish all documents relevant to additional income and documents proving your investments under various provisions of the I-T Act for tax exemption. Since all this is included in the Form 16, you need not produce any more documents. However, if there are proofs of investments and income that you have not submitted to the company, you can add them to the ITR. These include:

What Investments will give me Tax Exemption?

- 40% to 80% disability Rs. 75,000

- More than 80% disability Rs. 1,25,000

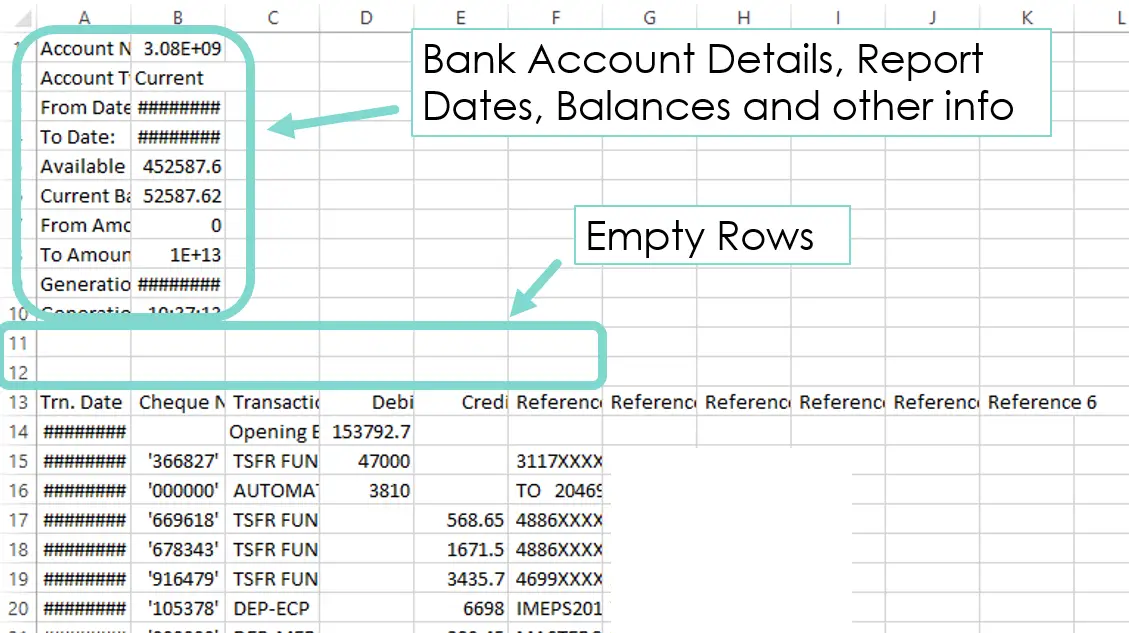

Our Number One Bank Reconciliation Tip

Itâs a good idea to use a dedicated bank account just for your business. That way you know all the transactions on your bank statement are business related, and should appear in your business accounts.

If they donât sync up, you need to figure out why. Itâs most likely because you mistyped some information into your business accounts, entered it at the wrong time, or missed a transaction altogether. Bank reconciliation gets much trickier if you use the same account for business and personal transactions.

Don’t Miss: Do You Have To Report Roth Ira On Taxes

Adjustments To Your Income:

The following can help reduce the amount of your income that is taxed, which can increase your tax refund or lower the amount you owe.

- Student loan interest

- Medical Savings Account contributions

- Moving expenses

- Keogh, SEP, SIMPLE and other self-employed pension plans

- Alimony paid that is tax deductible

- Educator expenses

The Irs Period Of Limitations And Other Considerations

If youve got a mountain of paper bills and statements piling up at home, you may be wondering what you need to keep and what can go in the shredder. When it comes to bank statements, you typically need to have access to them for at least three years. However, in some cases, youll need them for up to seven years.

Learn more about why its necessary to keep bank statements, for how long, and what happens if you dont.

Read Also: How Can I Make Payments For My Taxes

More Health Care Statements

If you or someone in your family had health coverage in 2016, you will get a 1095 form. There are three versions.

Form 1095-A If you, your spouse or a dependent enrolled in health insurance through a state or federal exchange, also referred to as the marketplace, you should receive Form 1095-A, Health Insurance Marketplace Statement. The information on this new form is needed to complete Form 8962 and calculate your correct premium tax credit amount.

Only individuals who bought medical insurance through the marketplace will receive this new form. If you do not get your Form 1095-A, contact the marketplace from which you purchased your coverage.

Form 1095-B This form confirms that you, your spouse and your dependents had at least minimum qualifying health insurance coverage for some or all months of the prior tax year. Form 1095-B is sent by your health care insurer and/or your employer if the company has fewer than 50 full-time employees. Individuals who dont have minimum essential coverage may have to make an individual shared responsibility payment.

Form 1095-C This form is the version used by large employers to notify employees that they, their spouses and dependents had minimum essential coverage for all or part of the prior tax year. This verification will help taxpayers avoid the penalty for not having coverage, known as the shared responsibility payment.

How To Dispose Of Old Financial Documents

Clearing your home of piles of old, useless paperwork is a wonderful feeling, but dont scrap it with your weekly garbage collection. Most of these documents contain personal information you dont want to have exposed.

According to a Federal Trade Commission report, over 3.2 million consumer reports were filed with the Consumer Sentinel Network in 2019, and 20% of them involved identity theft. Throwing away documents with your trash exposes your information to anyone willing to do a little dirty work to steal your identity. You might not realize how much information is present on your old bills, statements, voided and canceled checks and other financial documents.

Heres what could be present on the documents you want to throw away:

- Full names

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Types Of Canadian Property

As a non-resident of Canada, you have to follow certain procedures if you have disposed of, or are planning to dispose of, the following types of property:

- a Canadian timber resource property

Taxable Canadian property

For the procedures explained in the following section, taxable Canadian property includes:

- real or immovable property located in Canada

- property used or held in a business carried on in Canada

- designated insurance property belonging to an insurer

- real or immovable property located in Canada

- Canadian resource property

- Canadian timber resource property

- options or interests in any of the above

For more information, go to Disposing of or acquiring certain Canadian property or contact the CRA.

Budgeting For Your Business

When you go over your bank statements, some spending habits might jump out. You might realize you are spending a lot of money at certain places. Or, you might discover an overlooked source of steady income.

Streamline the process of creating your business budget by taking advantage of the data on your bank statements. You can estimate your future transactions based on your past transactions.

Recommended Reading: How Much Taxes Do You Pay On Slot Machine Winnings

How Long Should You Keep Bank Statements

In most cases, youll need access to your bank statements for at least three years as proof in audit situations. Bank statements of the past year should be kept for tax-filing purposes, but you may also need them to get a loan or rent a home.

Banks are required by federal law to keep most records on file for at least five years, and many keep members account statements available for up to seven. Check with your bank to see how long it will keep your records. If anaudit or another need for a statement comes up within that time period, you can order them from your bank rather than keeping them on handalthough you may need to pay a small fee for older statements.

Are you wondering about statements from your business bank account? Here’s how long to keep business records.

Calculating Your Taxes Payable

If you are reporting income from employment in Canada or from a business with a permanent establishment in Canada, you will pay federal tax on that income plus tax to the province or territory where you earned the income.

If you are also reporting other types of Canadian-source income , you will pay federal tax on that income plus the surtax for non-residents and deemed residents of Canada. If this is the case, complete Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions, to calculate your taxes payable.

Also Check: How Does H& r Block Charge

How Long Should You Keep Your Statements

If you haven’t opted out of monthly bank statements by mail, keep them for a minimum of one year. If your account is online-only, review the deposits and withdrawals monthly to make sure they’re correct.

Alternatively, if you’re great at data entry, you can record your income and expenses in a bookkeeping program or a spreadsheet.

After one year, it’s safe to shred and discard the paper with one big exception: Anything that documents a tax deduction should be kept for at least three years. The IRS says it rarely goes back farther than that in audits, although it reserves the option to do so.

If your account is online, the records will be either archived online or available by special order from the bank or financial institution. American Express, for example, keeps three years worth of account transactions online and searchable. Chase Bank users can access seven years of account activity.

Do You Need A Social Insurance Number

A SIN is a nine-digit number issued by Service Canada. You are usually required to have a SIN to work in Canada, and your SIN is used for income tax purposes under section 237 of the Income Tax Act. You must give your SIN to anyone who prepares information slips for you.

For more information, or to get an application for a SIN, visit Service Canada or call 1-800-206-7218 ).

If you are outside Canada and the U.S., you can write to:

Service Canada CANADA

or call 506-548-7961.

If you are not eligible to get a SIN, you can apply for an individual tax number by completing Form T1261, Application for a Canada Revenue Agency Individual Tax Number for Non-Residents. Send it to the CRA as soon as possible. Donot complete this form if you already have a SIN, an individual tax number, or a temporary tax number.

If you have requested but not yet received a SIN or an ITN, and the deadline for filing your return is near, file your return without your SIN or ITN to avoid any possible late-filing penalty and interest charges. Attach a note to your return to let the CRA know.

Also Check: How Can I Make Payments For My Taxes