Tips For Depositing Your Government

Government-issued checks requirespecial care when being deposited into a credit union account. Please followthese important instructions to ensure a successful deposit.

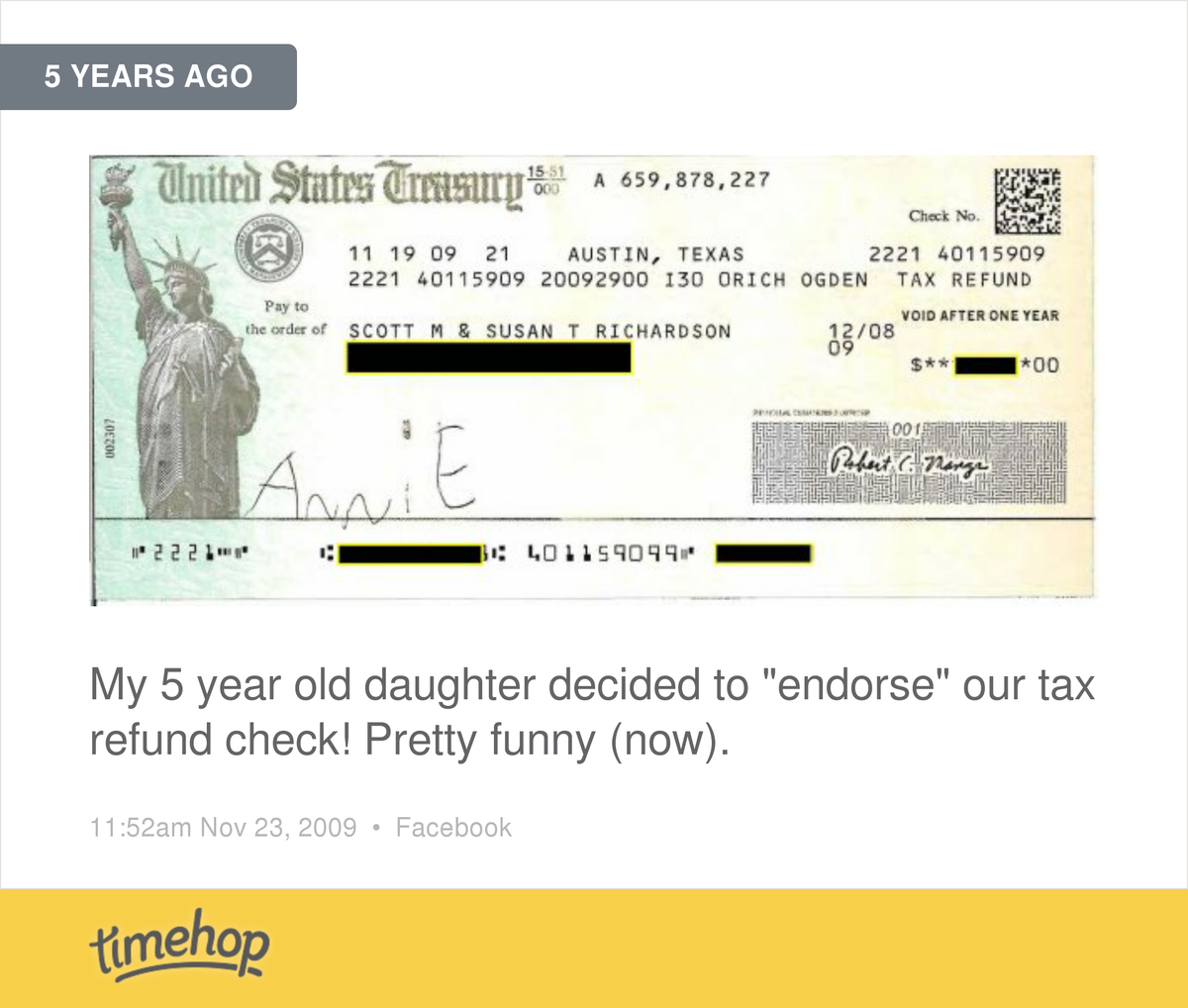

- Government-issued checks require all payees listed to endorse thecheck by signing each of their names on the back of the check.

- If you receive a check made out to you and a joint filer, be sure to endorse the check with both of your names anddeposit it into an account you hold jointly. Checks from the governmentwritten to two parties cant be deposited into a single owners account.

- When depositing a government-issued check using Mobile Deposit,please have each payee endorse the check and write ForGFCU Mobile Deposit Only below the signature, otherwise, your mobiledeposit will be delayed until this is corrected.

Fbofor The Benefit Ofendorsement On A Check

Sometimes checks will be payable to a person or company for the benefit of another person. For example, someone might write a check to an assisted living facility for the benefit of an elderly or special needs family member. The Pay to the Order Of line may look like this:

- Assisted Living Facility FBO Jane Smith

- Assisted Living Facility for the Benefit Of Jane Smith

Writing a FBO check helps to ensure that the funds will be used for a specific purpose, but in this case, the assisted living facility is considered as the custodian of the funds. The custodian endorses the check.

Some banks will require both parties to endorse the check. Consult your bank and the organization receiving the check to find out how to write an FBO check for them. This can get tricky if the bank requires both signatures and the person receiving the benefit of the check is incapacitated and cannot endorse it.

More Technical Problems Have Emerged With The Irs Emergency Impact Payment System With Some Checks Being Deposited In The Wrong Back Account

While the majority of Americans have not experienced any problems receiving their secondstimulus checks, such a vast operation is impossible without a few technical glitches. Eligible citizens have received, or are about to receive, their payments of up to $600 per adult and an additional $600 for every dependent child but inevitably just like the first time around, some payments have gone missing.

Some, who have yet to receive their stimulus check have logged into the IRS Get My Payment portal only to discover that the payment has been made either to an old bank account which they no longer use or to another account, possibly someone elses.

Starting this week, approximately 8 million people will receive their 2nd Economic Impact Payments by prepaid debit card. #IRS urges you to check your mail: #COVIDreliefIRS

IRSnews

You May Like: Which Tax Return Did You Have From Last Year

What Might Delay My Refund

New Jersey processes individual tax returns every day beginning in January. The state uses automated processing systems, but its employees do check some returns for errors like income, deductions and tax credit mistakes. Sometimes, theyll send letters to New Jersey taxpayers for additional information needed in order to process their returns. Note that if you receive one of these letters and youre owed a refund, your refund wont be issued until you respond with the requested information. If you receive a notice, you may be able to respond online through the New Jersey Online Notice Response Service.

If youve looked online and the system shows a check issue date thats already passed, you may have provided the wrong banking details for a direct deposit or the incorrect mailing address for a paper check. You can check here to see if your refund was returned to the state. If thats the case, you can ask for the check to be reissued by submitting another form on the Division of Taxations website.

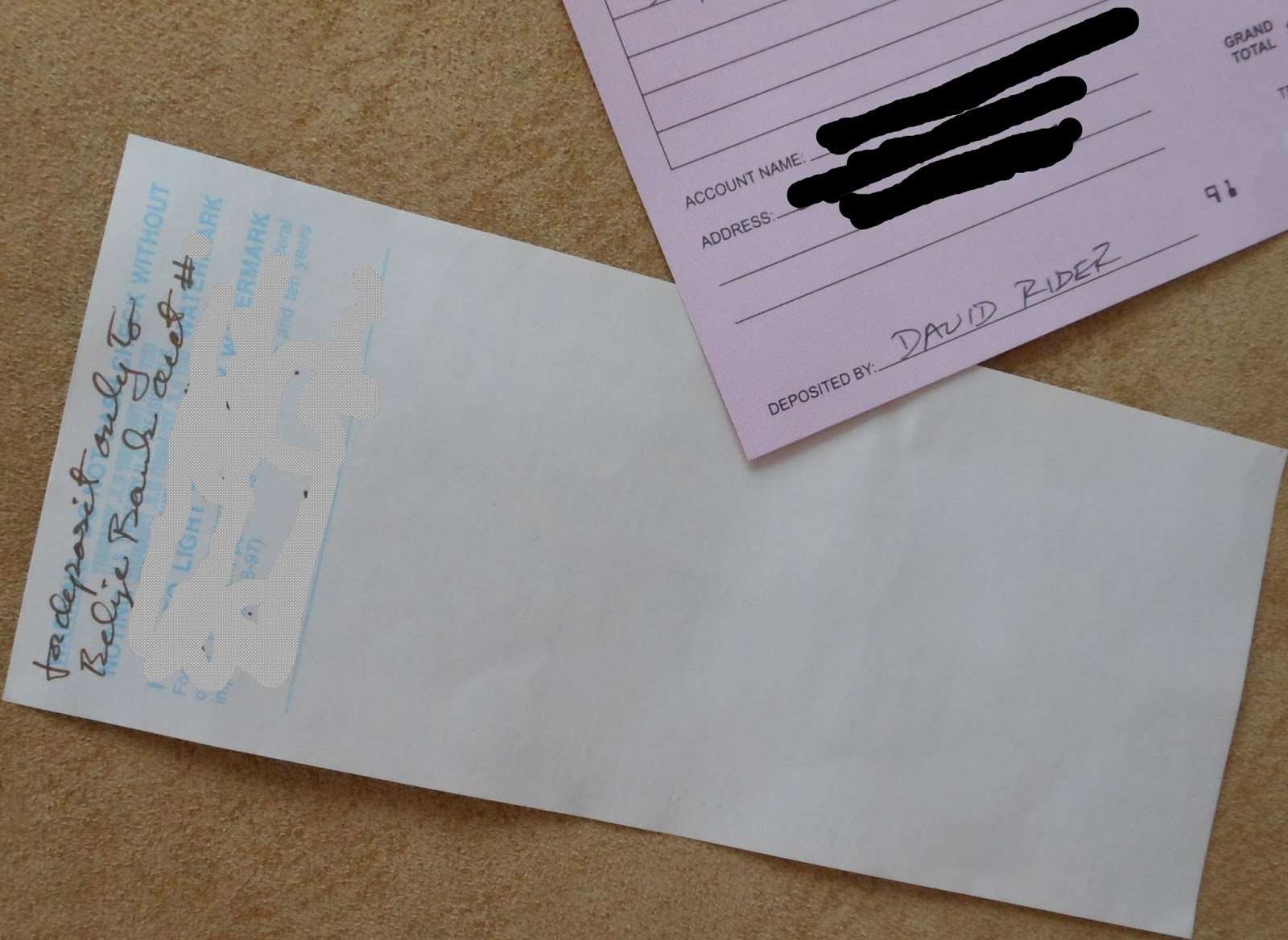

Blank Endorsement For A Check

This is the least secure way to endorse a check, but its the most common. You do a blank endorsement by simply signing your name on the back of the check. Then, when youre at the bank, you tell the teller if you want to cash it or deposit it. People will also do a blank endorsement when theyre depositing a check through an ATM or using mobile deposit. If youre doing a blank endorsement, sign the check just before you deposit the check.

Don’t Miss: How To Find Tax Id

Can I Direct Part Or All Of My Refund To My Prior Year Individual Retirement Account

IRS will deposit your refund to any of your checking or savings accounts with U.S. financial institutions per the account and routing numbers you provide, but you should ensure your financial institution will accept direct deposits to prior year IRA accounts.As with all IRA deposits, the account owner is responsible for informing their IRA trustee of the year for which the deposit is intended and for ensuring their contributions do not exceed their annual contribution limitations. IRS direct deposits of federal tax refunds will not indicate a contribution year for IRA accounts.If you fail to notify your IRA trustee of the intended year for the deposit, your trustee can assume the deposit is for a prior year.

IRS is not responsible for the timeliness or contribution amounts related to an IRA direct deposit. Since an error on your return or an offset to your refund could change the amount of refund available for deposit you must verify the deposit was actually made to the account by the due date of the return . If the deposit is not made into your account by the due date of the return , the deposit is not a contribution for that year. You must file an amended return and reduce any IRA deduction and any retirement savings contributions credit you claimed.

Keep An Eye On Your Credit Score And Reports

If someone has enough of your personal information to file a tax return in your name, they also could be opening fraudulent credit accounts with your data. Check your credit score regularly in case there’s a sudden, unexplained drop. If this happens, it could be a sign that you’re a victim of identity theft.

Also, get a copy of your credit report at least once a year to look for fraudulent accounts. If you find something, your Social Security number could be compromised.

Also Check: What Is New York State Sales Tax Rate

Depositing The Check Yourself

Provided you have your relative’s full name and full account number, you can go to his bank yourself and deposit the check. Anyone can deposit money into a bank account although withdrawing money is not an option. You should not sign the back of the check until you are in front of the teller. If the check is already signed, you may be asked to sign it again.

Going to an ATM to deposit a check could be an option, provided you know your relative’s bank card PIN number. For example, if your relative has given you power of attorney to do his banking, you may be allowed to access his bank account with an ATM. However, in most cases your relative should deposit it himself.

Read More:The Alternatives for Cashing Checks If My Bank Account Is Frozen

What Happens If Someone Steals Your Tax Refund

If someone uses your personal information to file a tax return in your name, you typically won’t know until you try to file yourself or receive some form of communication from the IRS.

Fortunately, tax identity theft isn’t as common as it used to be. Between 2015 and 2017, reports of fraudulent tax returns from identity theft victims dropped by 65% due to efforts by the IRS, state tax agencies and the tax community, according to the IRS.

But while the IRS and other agencies are getting better at foiling tax identity theft, there were still 242,000 reported cases in 2017, according to the IRS, which means you’re still at risk. Here are some warning signs that could indicate a fraudulent tax return:

- You get a letter from the IRS about a suspicious tax return, and you haven’t filed one yet.

- Your e-filed tax return is rejected because of a duplicate Social Security number.

- You get a tax transcript in the mail that you didn’t request.

- You get a notice from the IRS that an online account has been created in your name or your existing account has been accessed or disabled, and you haven’t taken these actions.

- You get a notice from the IRS that you owe additional tax, your refund is offset or collection actions are taken against you regarding a tax year for which you didn’t file.

- IRS records show you received income from an employer you don’t recognize and for whom you didn’t work.

Don’t Miss: How To Do Llc Taxes Yourself

Now That Im Done With My Taxes When Should I Start Next Years

The IRS usually accepts electronically filed returns as early as mid-January. Its always a good idea to start preparing your return early in case you run into a problem. You might also find youre missing a form from a financial institution or an employer. It can take time to gather these forms.

Online Statements require Adobe® Acrobat® PDF reader. The length of time Online Statements are available to view and download varies depending on the product: up to 12 months for auto loans and student loans up to 2 years for credit cards, home equity lines of credit, and personal loans and lines of credit and up to 7 years for deposit accounts, home mortgage accounts, and trust and managed investment accounts. The length of time the specific product statements are available online can be found in Wells Fargo Online® in Statements & Documents. Availability may be affected by your mobile carrier’s coverage area. Your mobile carriers message and data rates may apply.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

LRC-0121

How To Sign/endorse A Check Over To Someone Else

You have a check payable to you, but you find yourself in a situation where you are unable to deposit the check, and/or you dont want to cash it yourself. Now what?

One of your options is to sign the check over to someone else. Because the check is currently payable to you, youll need to ensure that the third party and their bank can accept a signed-over check, also known as a third-party check, and endorse the check by signing the back of it.

The following steps detail the process of signing over a check to a third party:

You May Like: How To Find Out Your Tax Rate

When Might I Want To Sign Over A Check

There are a few reasons why you may want to sign a check over to someone else. You may not live close enough to a bank branch or be physically able to visit your bank in person. Its also possible you dont have a smartphone or your bank doesnt currently offer mobile deposits.

And signing a check over to someone else could be a convenient time-saver. If you owe money to an individual or company, it might seem easier to bypass your bank account and pay them sooner.

Are You Missing A Cheque Or Do You Have An Uncashed Cheque From The Canada Revenue Agency

There are many reasons Canadians may be missing a cheque, or have not cashed their cheque from the Canada Revenue Agency . For example, people might have moved and not updated their address, the recipient might have died or believed the payment was issued to them in error, or the cheque might have been lost, stolen.

Don’t Miss: Do I Charge Sales Tax On Services

Signing For Your Spouse

The color of ink you use isn’t the only potential legal pitfall signatures can bring. Let’s say your spouse is out of town and you want to deposit an expense check or rebate made out to your mate. You could find yourself in legal trouble.

Even if you’re legally married and have a joint bank account, its illegal to endorse your spouses name on the back of a check, says Charles R. Gallagher III, an attorney at Gallagher & Associates in St. Petersburg, Florida. Technically, signing someone elses name is fraud. And that could lead to the check being denied for payment and even to your arrest if your spouse were to press charges.

Can Somebody Else Cash An Irs Refund Check

You can have someone else cash your refund check if you follow regular banking policies. The process is not complex and is the same for all types of checks written to you. However, anyone can attempt to duplicate these steps if your check falls into the wrong hands. Its important to guard your information carefully to avoid losing your refund.

Tips

-

You can select a third-part individual to cash your IRS refund check for you if this is your preference.

You May Like: Do You Pay Income Tax On Unemployment

Deposit A Check Made Out To Two People

Now that tax season has officially begun, some Advantis members may receive tax refund checks from the IRS made out to two names. If you receive such a check, you can tell how to deposit it at Advantis by noting how both names are written in the “Payable To” line:

- If the names are separated by the words “or” or “and/or”, or by a comma, or if each name is on a separate line, then the check can be deposited in person at an Advantis branch if it’s endorsed by either individual. In this case, the check can also be endorsed by either individual and deposited via ATM or Mobile Deposit.

- If the names are only separated by the word “and”, then the check must be endorsed and deposited by both individuals in person at an Advantis branch. In this case, the check can be endorsed by both individuals and deposited via ATM or Mobile Deposit into a joint account that both individuals own.

Related to this: per Federal regulations, Advantis members may not sign over state and federal government checks to a third party for cashing, deposit or payment. A member would need to deposit the check, and then either transfer funds or issue a cashier’s check to the third party.

Are There Special Endorsement Requirements For Us Government Checks To Two Parties

At a bank where I have a checking account in my name only, I regularly cash a dividend check made out to my wife AND me. My wife endorses the check at home and then I stroll down to the bank and add my endorsement. I submit the check and the bank gives me the cash.

Last year I attempted the same procedure with our Federal tax refund check, also made out to my wife AND me. The bank refused to cash the check and would not deposit the check, citing some rule that the US Government requires her to be present to endorse the check. My response beyond, expletive deleted, was to point out that feds would not know whether she was present when the endorsement was made and that this makes no sense.

As it turns out I have another sole account at a different bank down the street from the first. I took the check to it and successfully deposited the check to my account.

Was the first bank following statutory procedures or were they making up rules on the fly? Was the second bank somehow remiss in depositing the check?

My credit union is normally very lenient when depositing checks into my wife and my joint account. My wife or I can deposit checks made out to either of us, and as long as we are depositing the entire amount into our account , the checks don’t even need to be endorsed.

However, when it comes to government checks , they insist that the check be signed by both my wife and I, even though we are simply depositing it into a joint account.

Recommended Reading: Why Does It Cost So Much To File Taxes

Bank Of America Us Online Privacy Notice

Your privacy is important to us. We conduct regular assessment reviews to ensure personal information we collect, use and share is protected. This U.S. Online Privacy Notice describes how Bank of America and our affiliates manage personal information about you when you interact with us online through our websites, mobile applications and social sites .

How To Fill Out Form 2848

In order for Form 2848 to be effective, you have to specify the tax form and year for which you are granting authority. This includes:

- The description of the matter .

- The tax form number. For example, if you want to authorize your agent to deal with your standard tax return form with the IRS, you would denote Form 1040. Keep in mind that saying “all forms” is not sufficient.

- The year or period of applicability. Saying “all years” or “all periods” is not sufficient.

You also have to provide information about your agent/representative. This includes:

- Name, address, telephone number, and fax number.

- Preparer Tax Identification Number , which is a preparer tax identification number that must be renewed by CPAs, attorneys, enrolled agents, and paid preparers annually.

- Centralized Authorization File number, which the IRS uses to identify the representative. This is a nine-digit number assigned by the IRS the first time a third-party authorization such as Form 2848 is submitted. If this is your agents first designation as a representative, there wont be any CAF number to enter.

You have to sign the form. If you filed jointly and each spouse wants to grant authority, each must file a separate Form 2848 to designate a representative. Although you may have filed jointly, this doesn’t mean that you have to use the same representative.

All pages of Form 2848 are available on the IRS website.

Don’t Miss: How To Find Property Tax Information